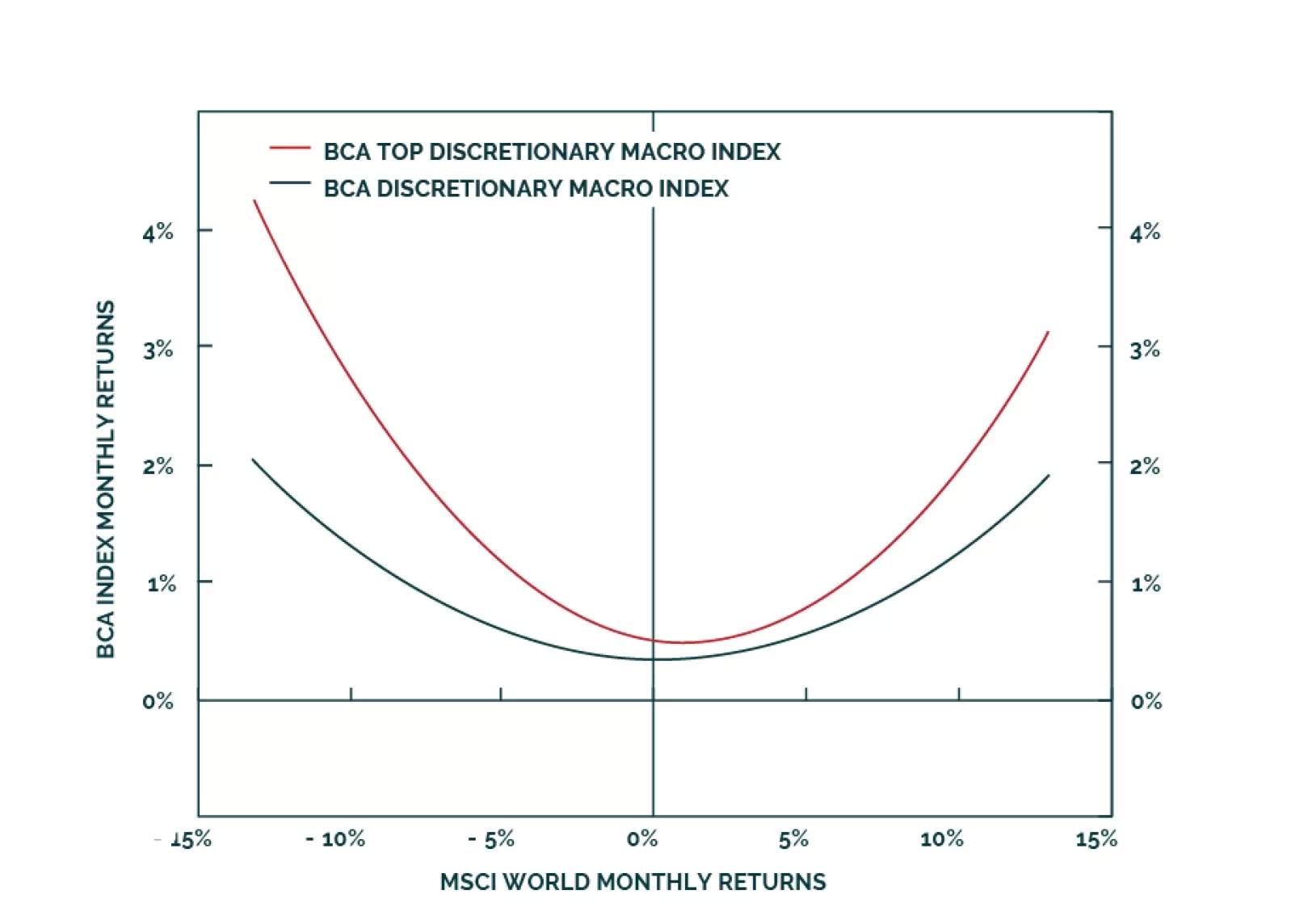

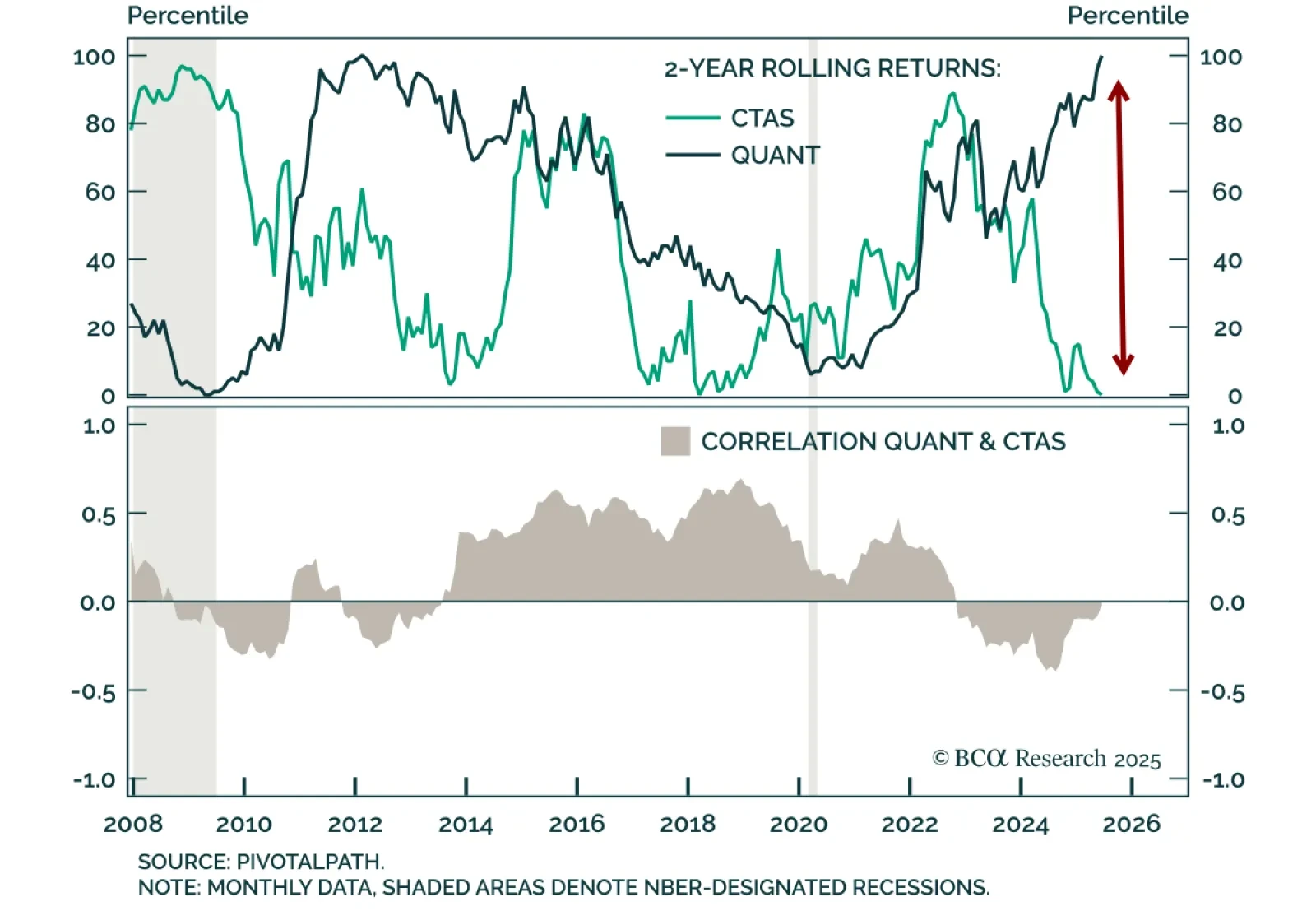

A historic divergence between systematic strategies is creating a compelling entry point into Managed Futures. Our Chart Of The Week comes from Brian Payne, Chief Strategist for our Private Markets & Alternatives team.…

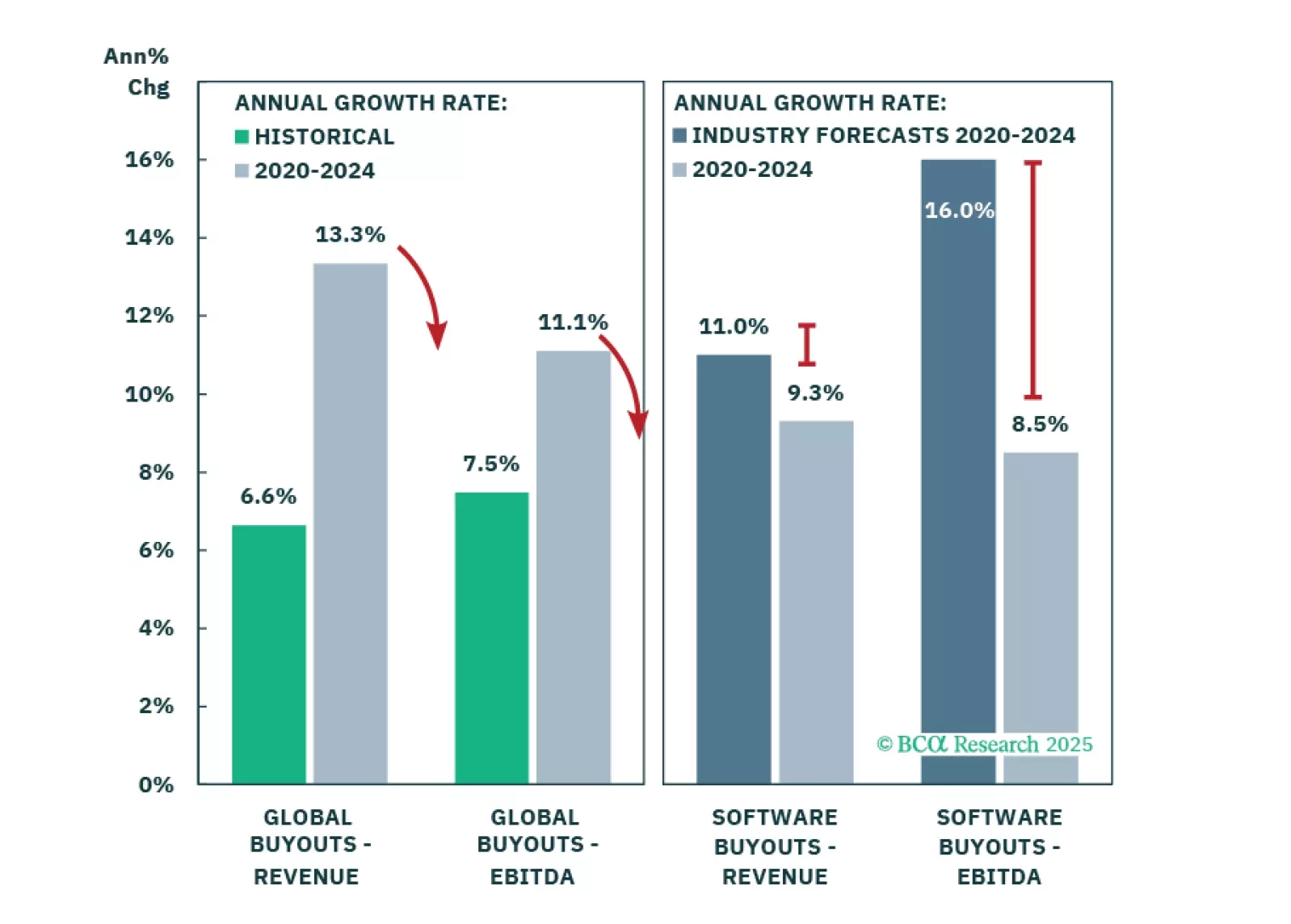

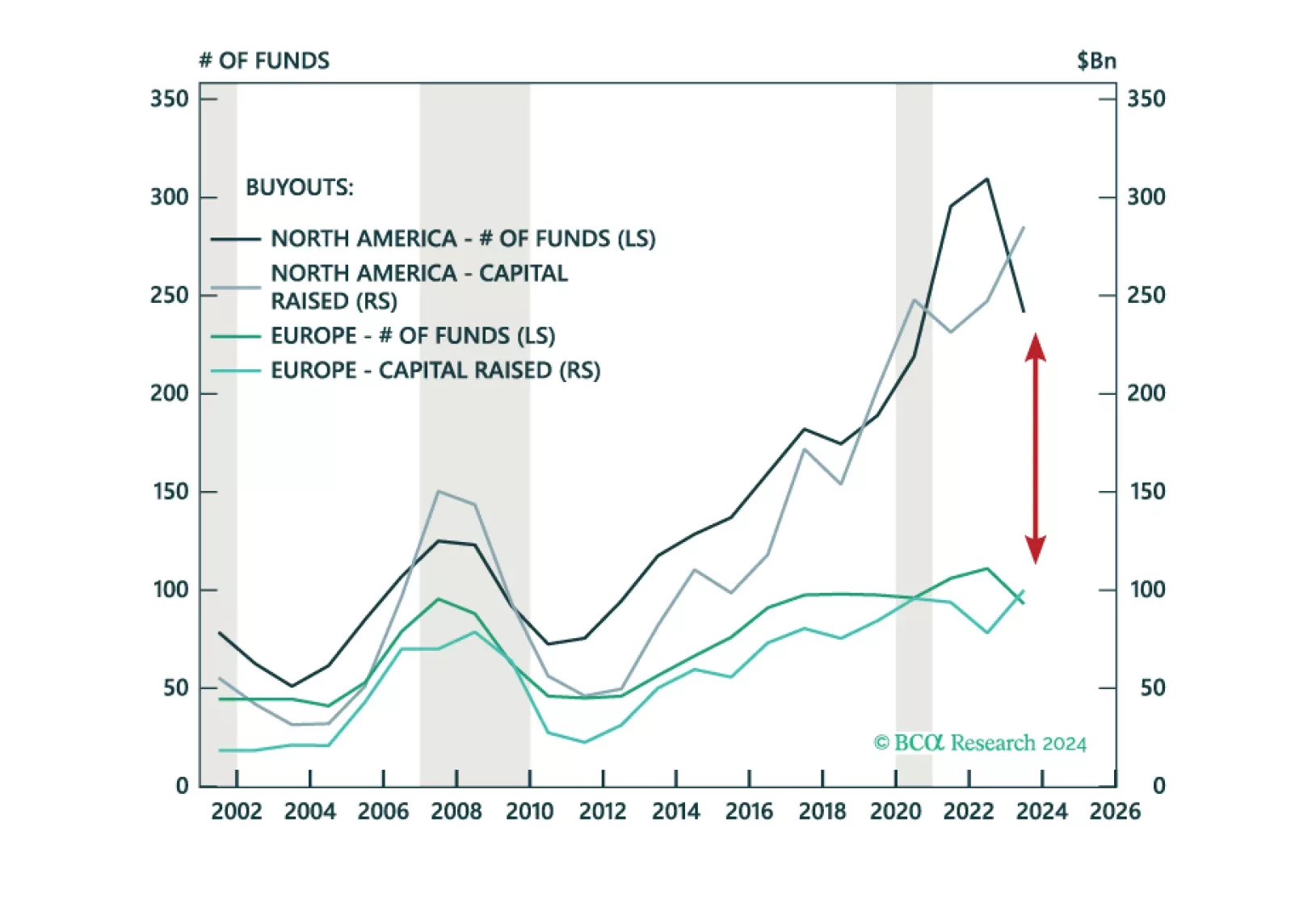

Tariffs may trigger the recession, but the economy was already vulnerable from unsustainable growth and inflated expectations. Private Equity is most exposed, though this situation neither emerged suddenly nor will it unfold…

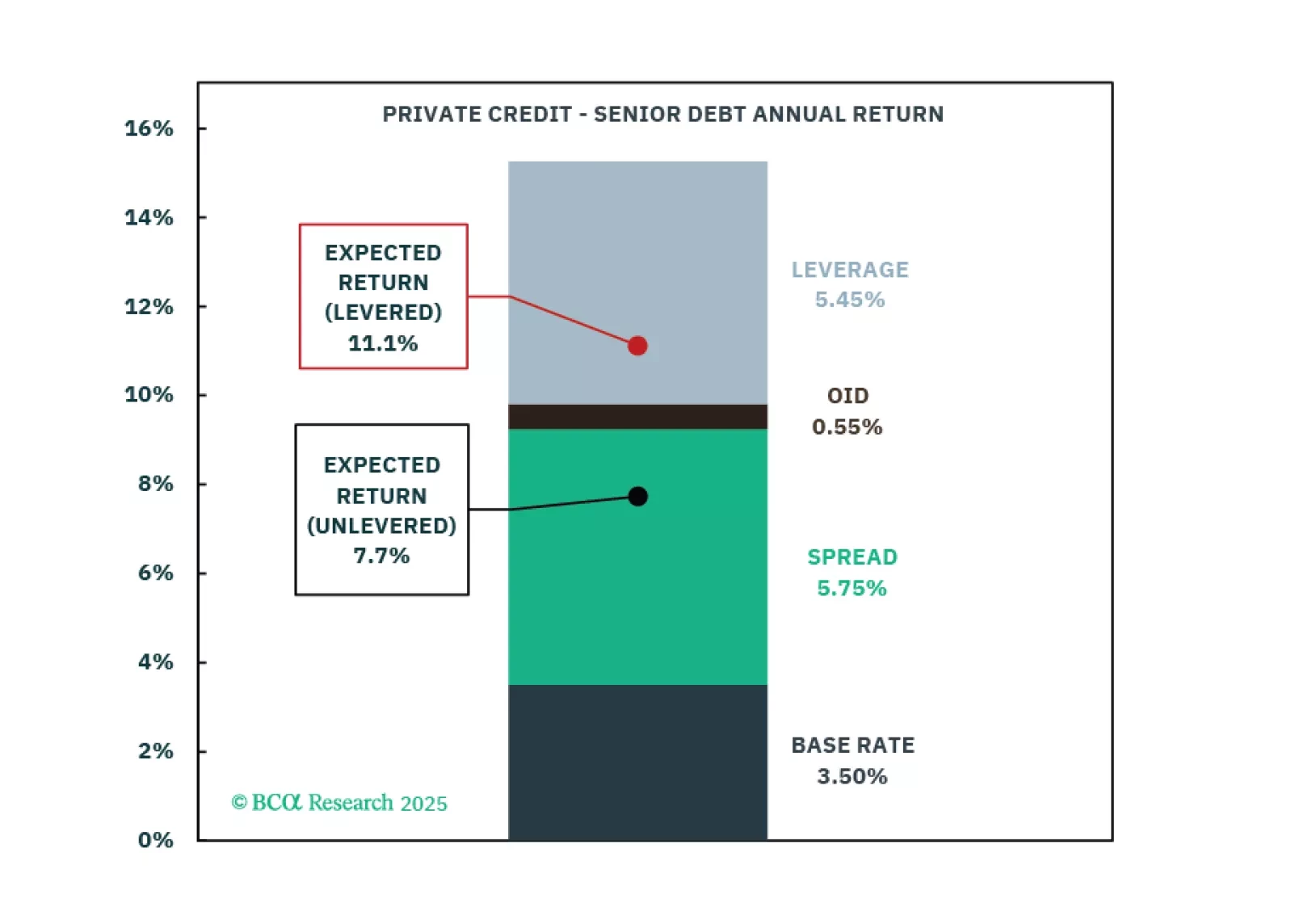

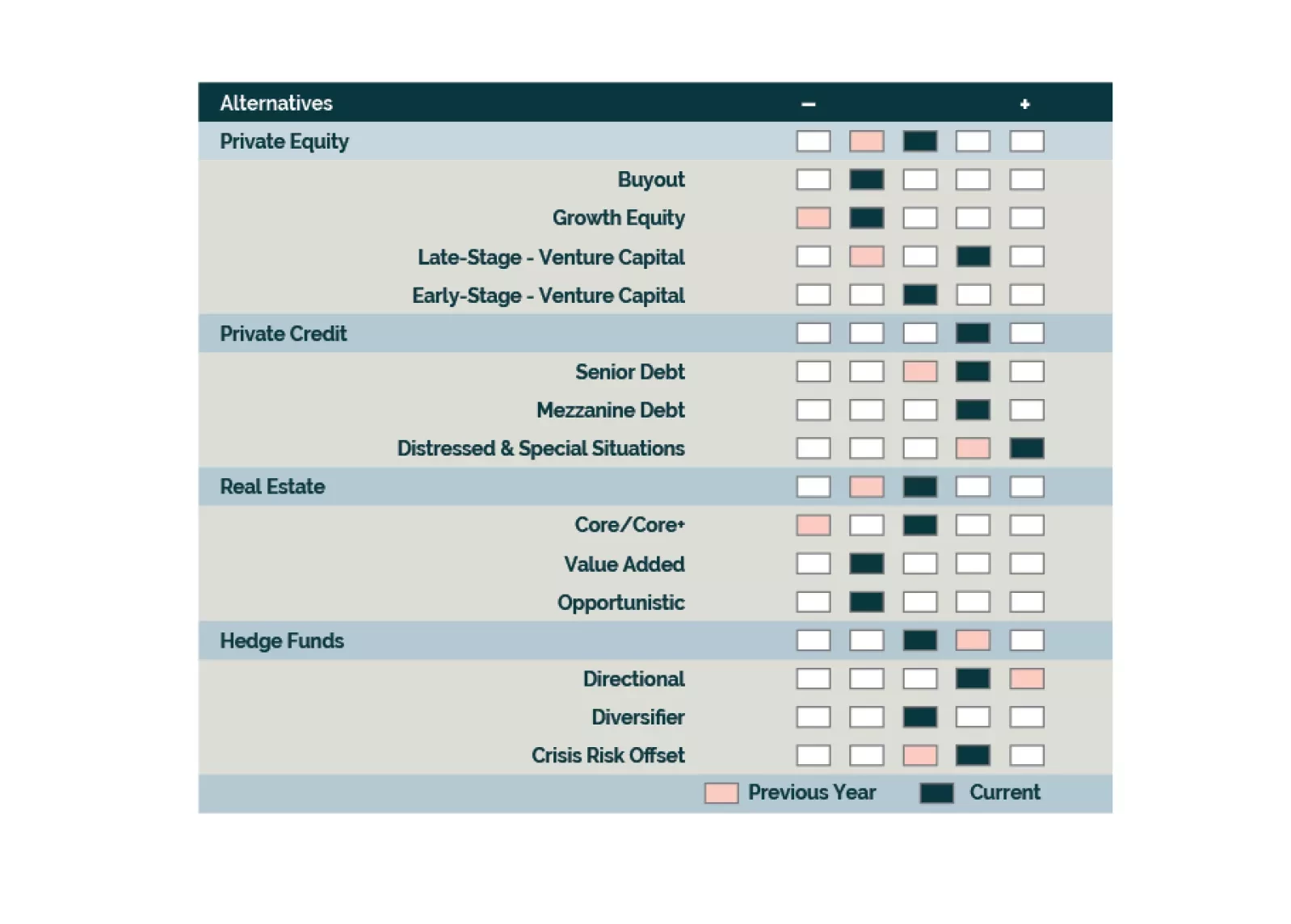

Asset class expectations show mixed shifts from 2024, with Real Estate seeing substantial upgrades and Private Equity benefiting from Venture Capital improvements. Private Credit return expectations decline from 2024 but remain…

We are growing positive on Growth assets with recession expectations increasing our optimism on entry points. Equities are led by APAC Private Equity, North America Venture Capital, and Europe Buyouts. Our outlook continues to…

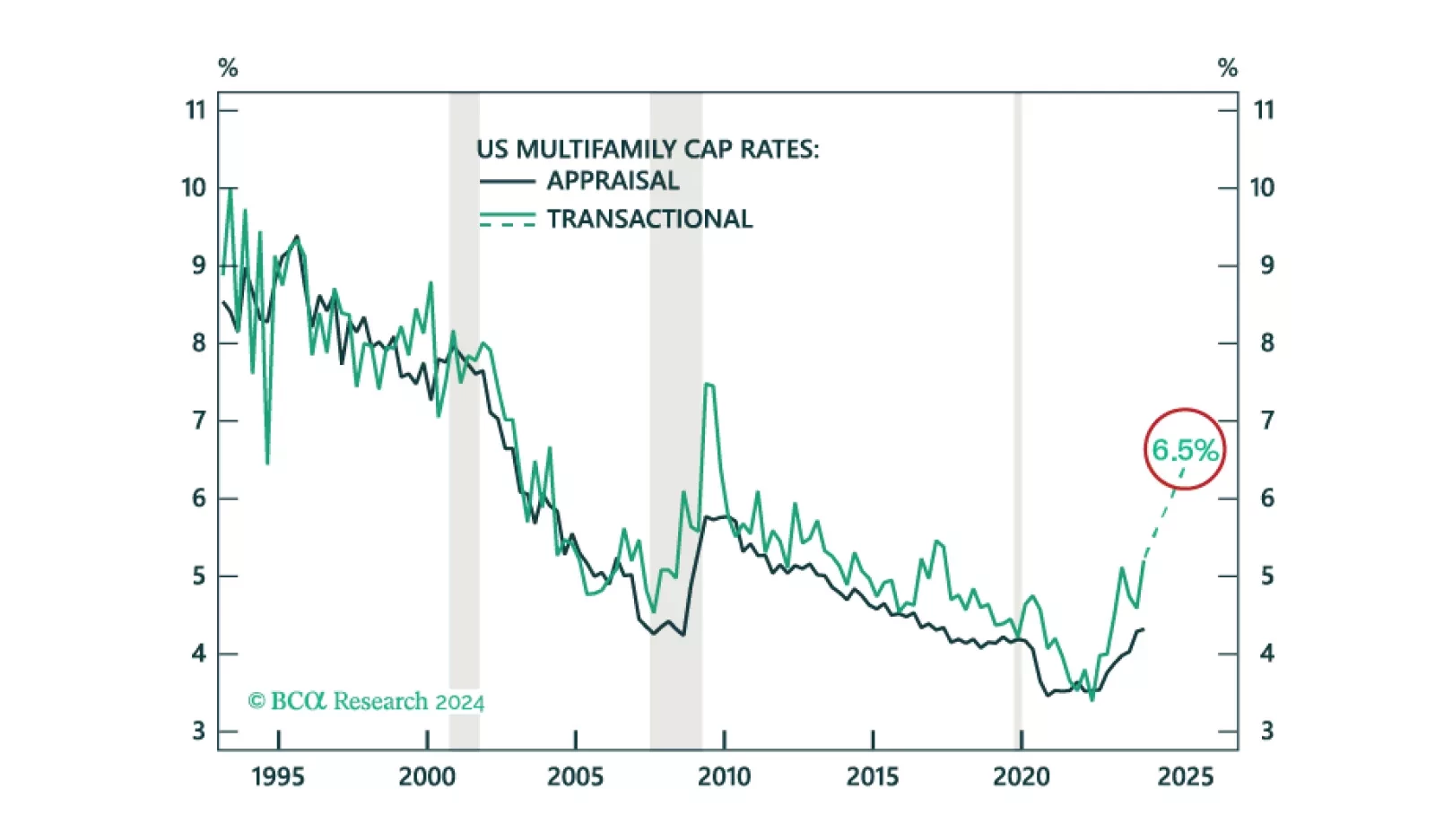

We project US Multifamily cap rates to increase from 5.2% to 6.5%. While we find an unfavorable risk-adjusted return on the asset, especially relative to other opportunities in CRE, cap rates are moving closer to peak.

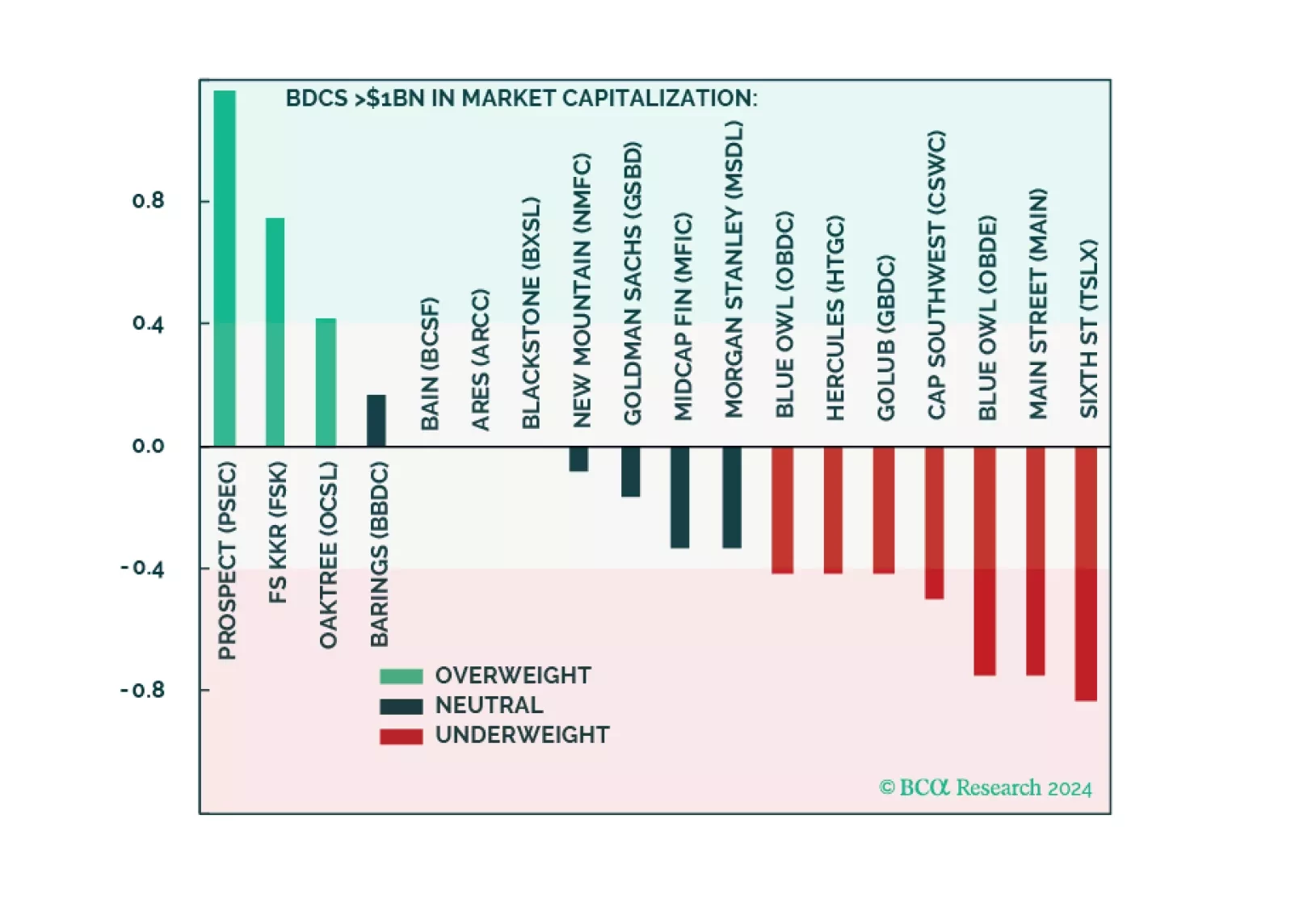

We are positive Private Credit but currently underweight Public BDCs. Today’s market pricing and sentiment in BDCs are excessively optimistic. Long-term investors should await a better entry point. Traders may find an attractive…

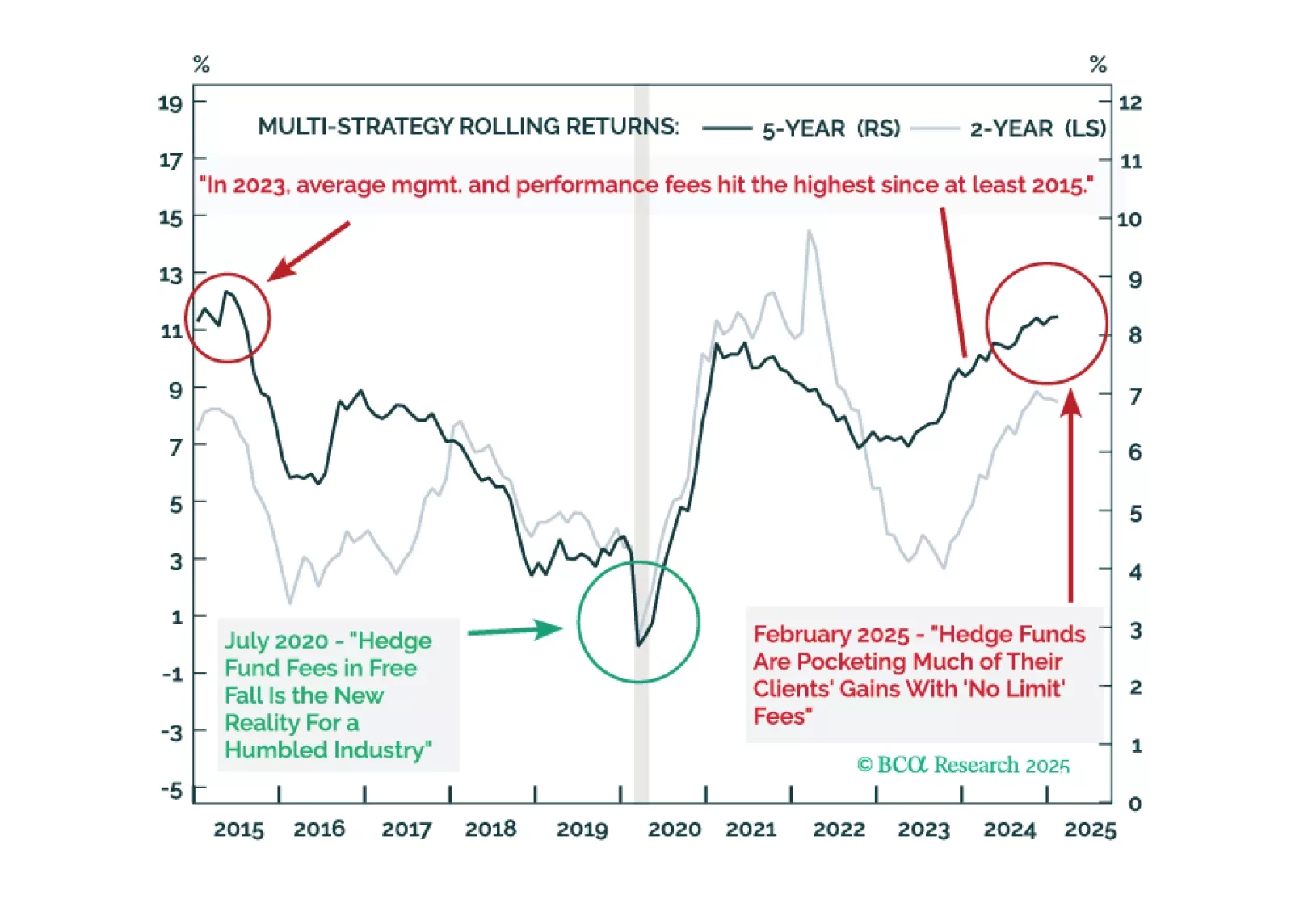

We go overweight Late-Stage Venture Capital and APAC Private Equity but remain underweight North America Buyouts. We maintain our neutral outlook towards Hedge Funds and are positive on Long-Short Equity, Event Driven, and CRO…

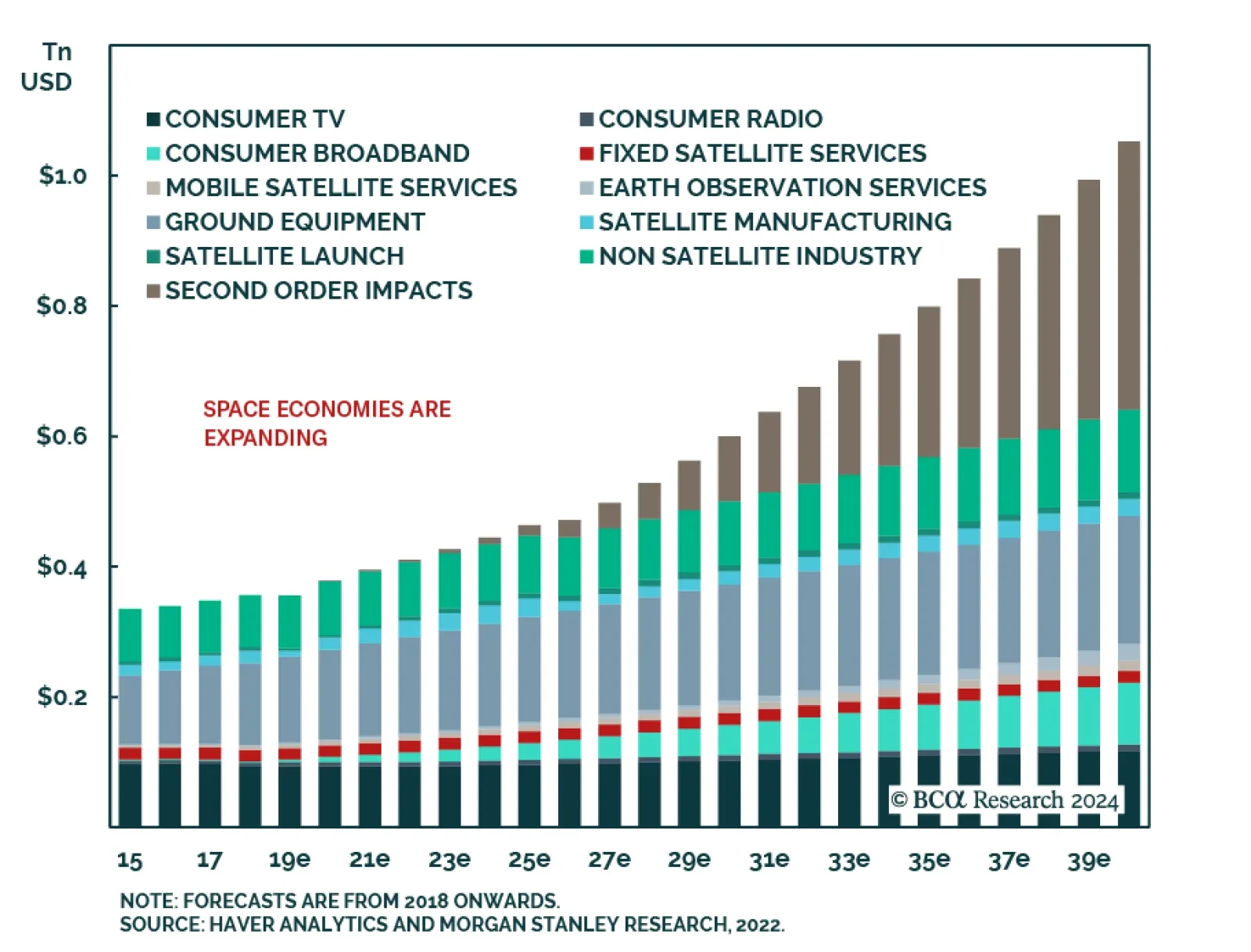

According to BCA Research’s Private Markets & Alternatives service, Artificial Intelligence is old news. Given such, it is not prime for Early-Stage Venture Capital (VC) investing. While everyone is distracted with…