Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

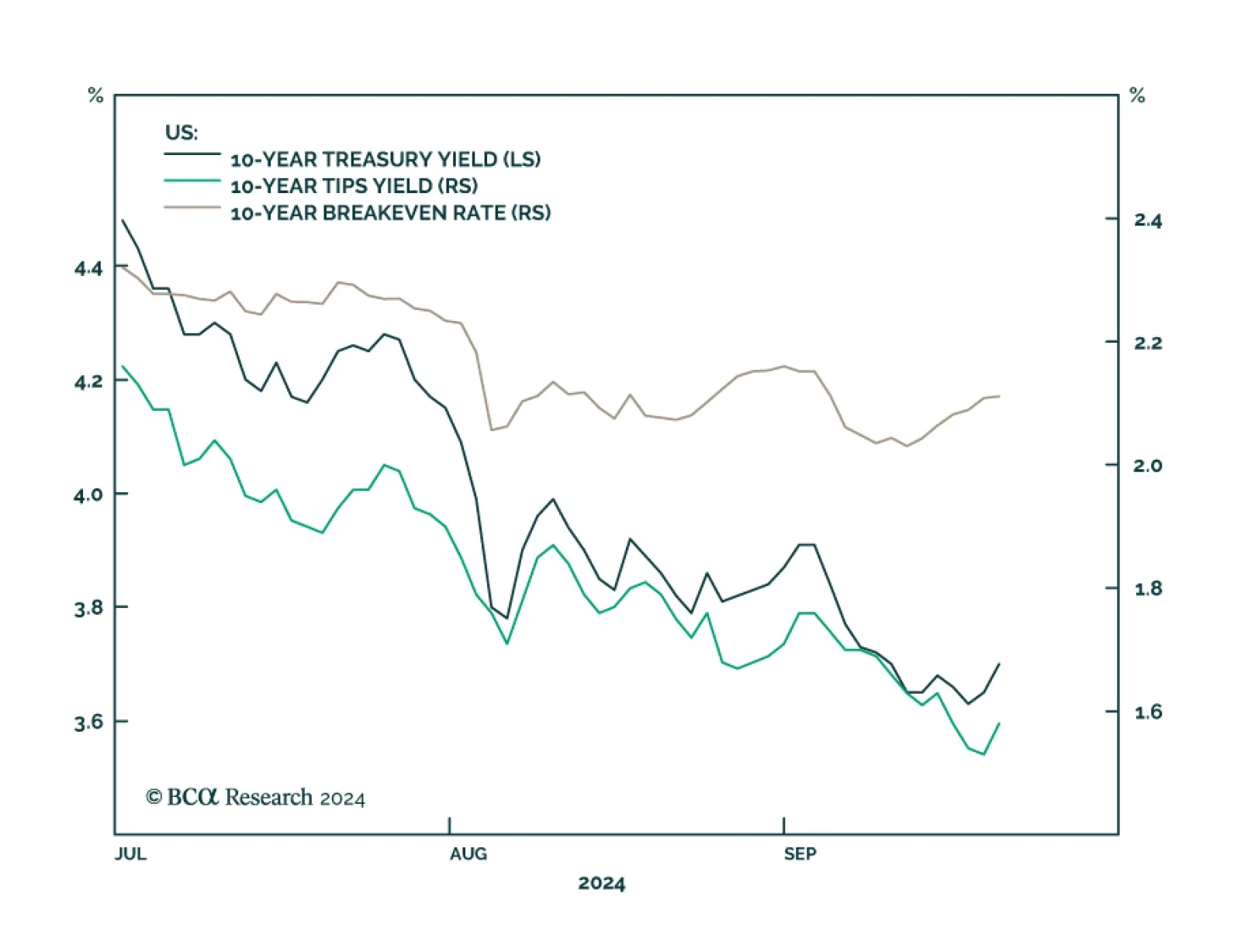

The 10-year Treasury yield rose in the aftermath of the Fed’s jumbo rate cut on Wednesday. Our US Bond strategists noted that this move reflects the fact that the downward revisions to the dots still fall short of the…

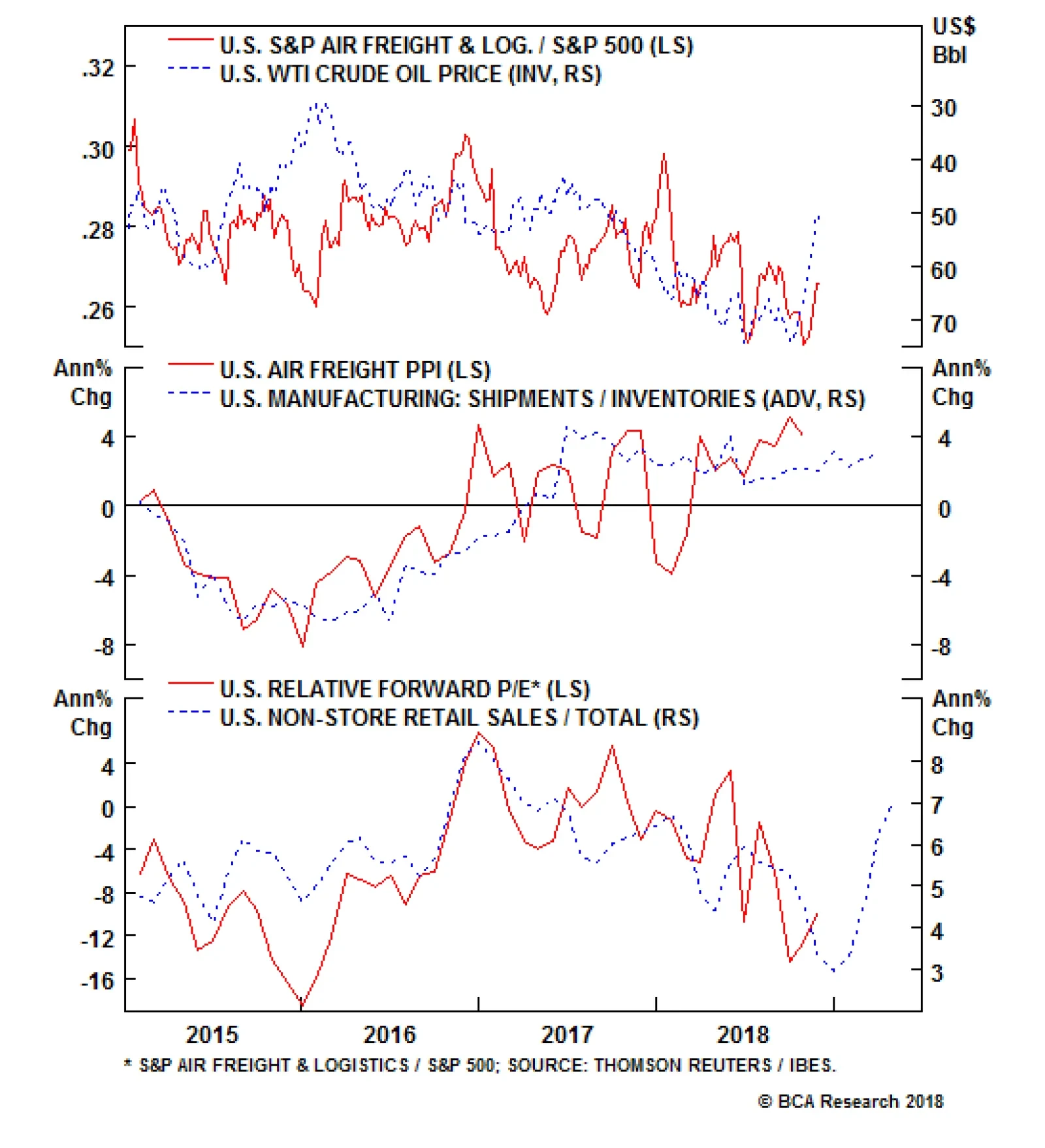

Neutral - Downgrade Alert The transportation industry is a bellwether for the economy as rising freight hauling services demand is synonymous with firming economic activity and vice versa. The recent FedEx earnings report…

Highlights Portfolio Strategy Corporate sector selling price inflation is nil while leading wage inflation indicators signal additional labor cost increases in the coming months. The risk is that profit margins have already peaked for…

Neutral We have been offside on the high-conviction overweight call on the S&P air freight & logistics index and the recent FedEx warning suggests that profits will come under pressure for this index for the rest of…

Highlights Portfolio Strategy Higher interest rates, with the Federal Reserve tightening monetary policy three more times in the next seven months, will be the dominant theme next year. All four of our high-conviction underweight…

Energy costs comprise a large chunk of the input costs for freight service firms. The recent drubbing oil suffered will boost margins for airfreight & logistics companies, especially as it materialized on the eve of the…

Overweight (High-conviction) Air freight & logistics stocks have been bouncing along the bottom for the better part of the past year and have formed a base that should serve as a launch board higher in the coming months. Energy…

Dear Client, Next week on November 26th instead of our regular weekly publication you will receive our flagship publication “The Bank Credit Analyst” with our annual investment outlook. Our regular publication service will…