Irrespective of the outcome of this deal, our U.S. Equity Strategy team remains overweight the pure-play BCA Defense Index on a structural basis and also reiterates its high-conviction overweight bet for this industry. Three…

Highlights Portfolio Strategy Business sector selling price inflation is sinking like a stone following the bond market’s melting inflation expectations, at a time when wage inflation continues to expand smartly. There are good…

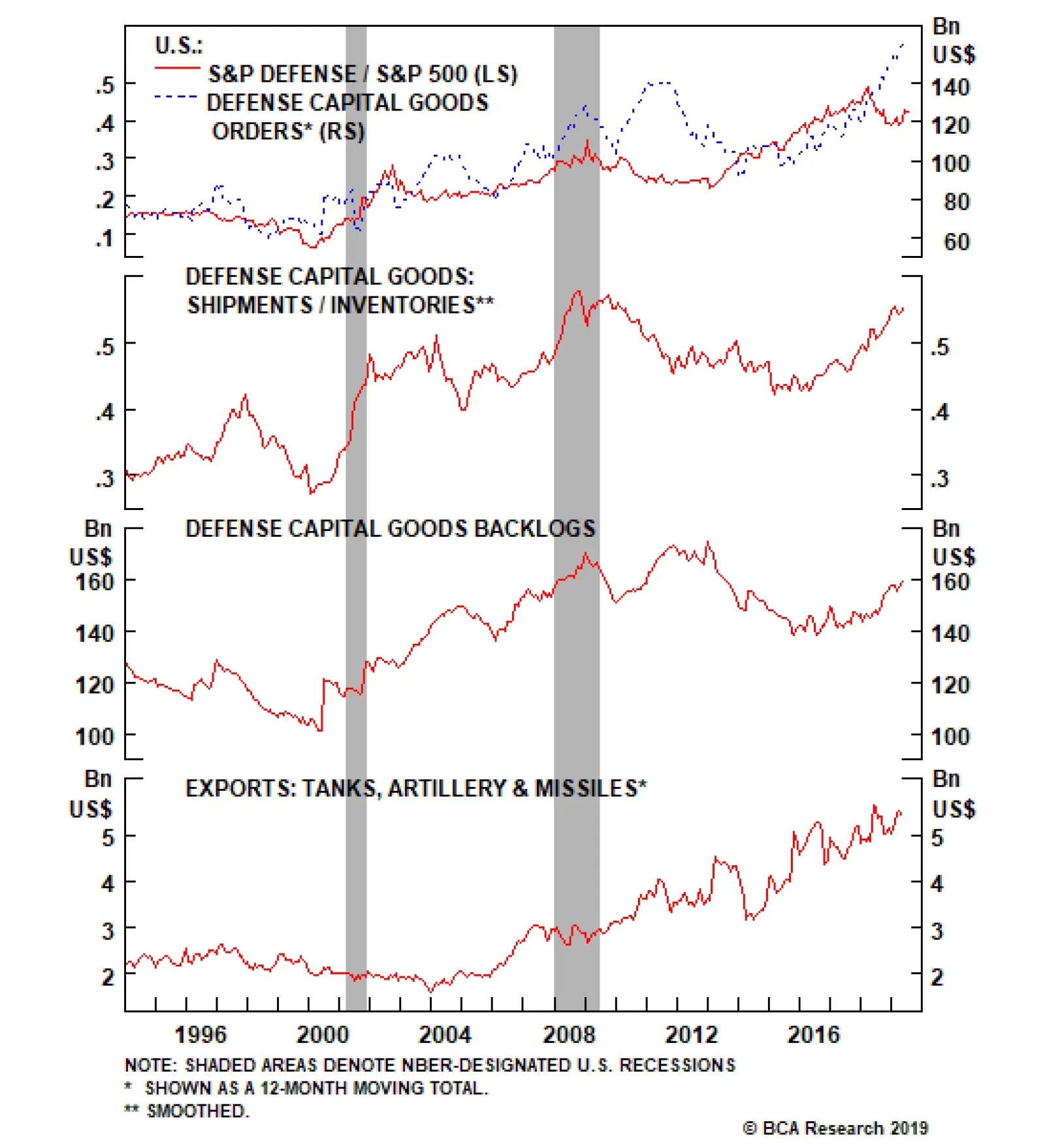

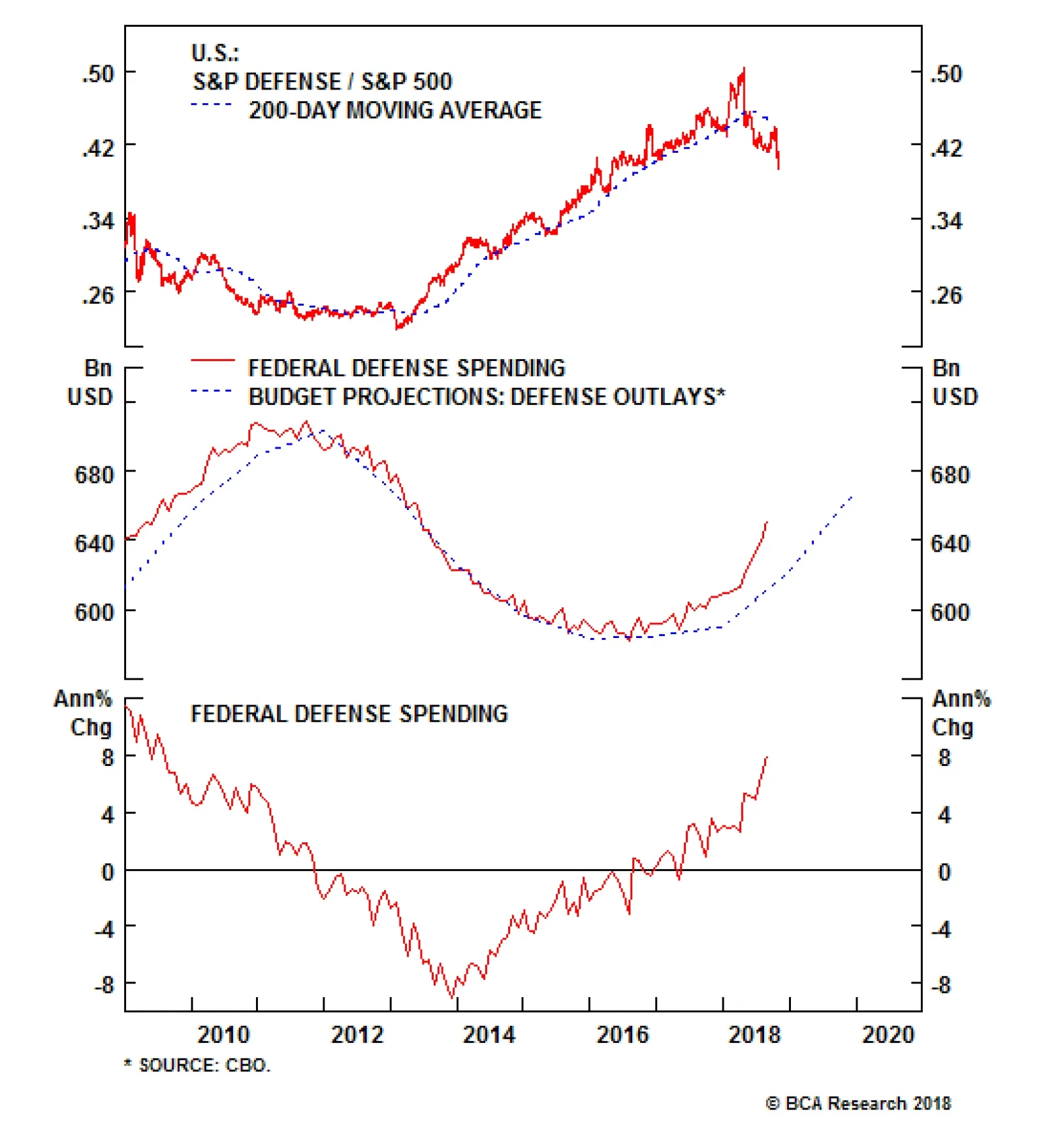

Overweight Though the pure-play BCA defense index has retreated somewhat from the mid-2018 highs, our thesis remains solidly on the offensive. As a reminder, we have been overweight the pure-play BCA defense index since late-…

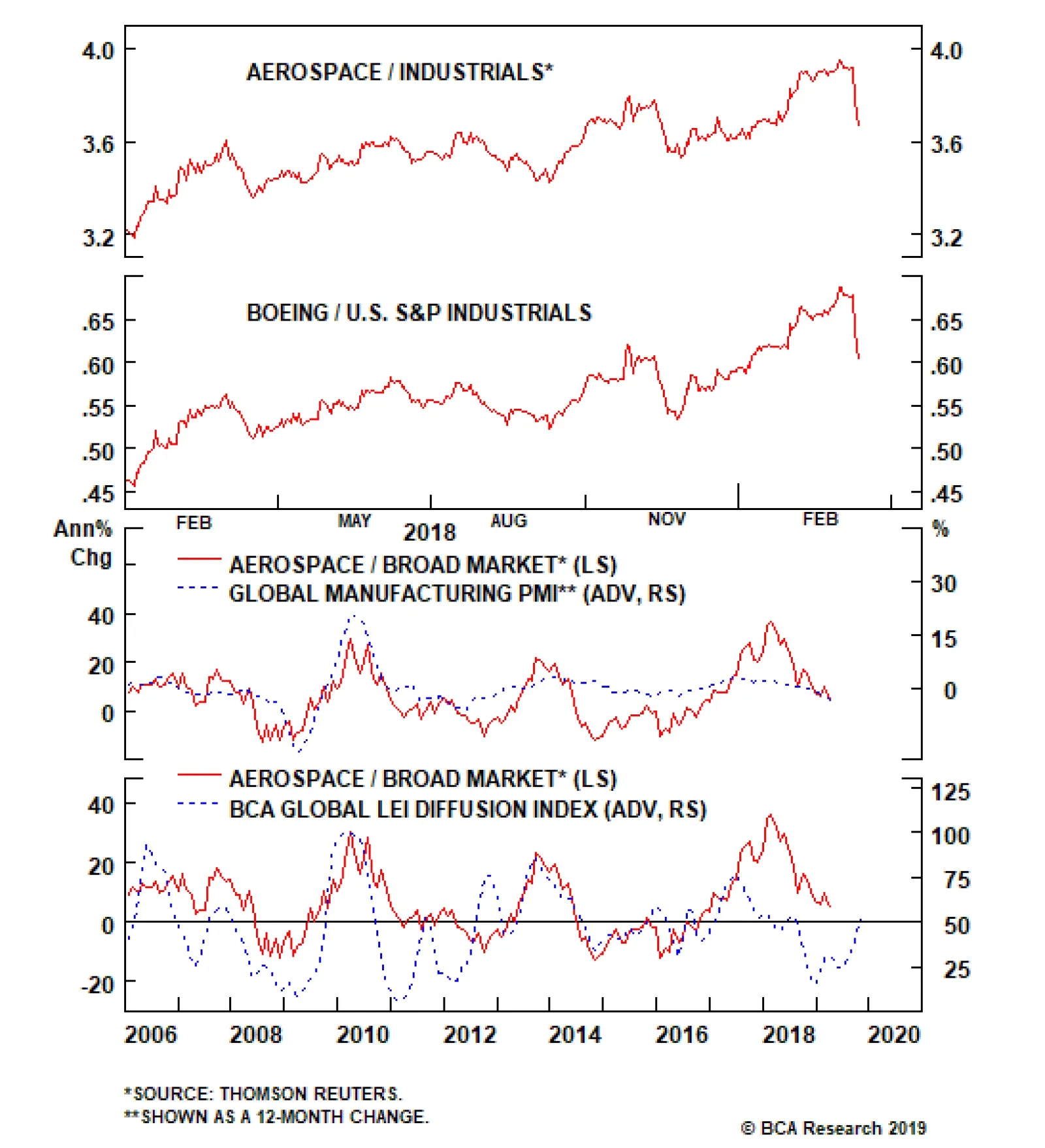

This performance is due in large part to Boeing taking on the mantle of a global trade bellwether and also dominating our BCA aerospace index. Considering the global nature of the firm, this role seems appropriate. In the…

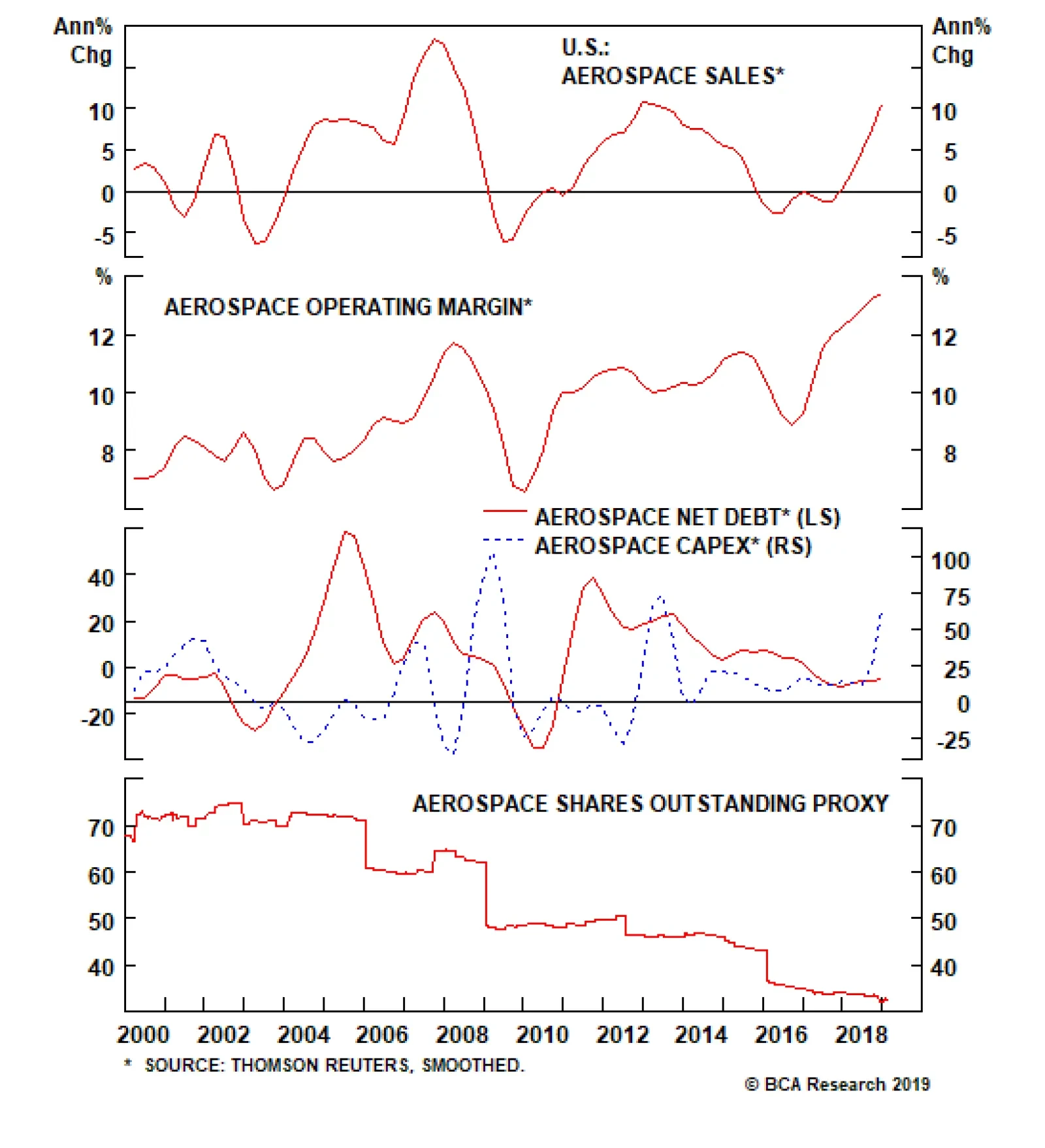

Industry sales have pushed into double-digit growth territory, while margins are hitting record levels. Our U.S. Equity Strategy team thinks the reason why earnings are so elevated has much to do with the age of the order…

Neutral In this week’s Special Report, we moved to a neutral recommendation on the BCA aerospace index. The report highlights the two pillars supporting the aerospace index and its relative performance: global trade sentiment and…

Highlights Portfolio Strategy Higher interest rates, with the Federal Reserve tightening monetary policy three more times in the next seven months, will be the dominant theme next year. All four of our high-conviction underweight…

In the U.S., defense spending and investment have bottomed and will continue to accelerate. The Congressional Budget Office (CBO) continues to project that defense outlays will jump further next year. We expect that this…