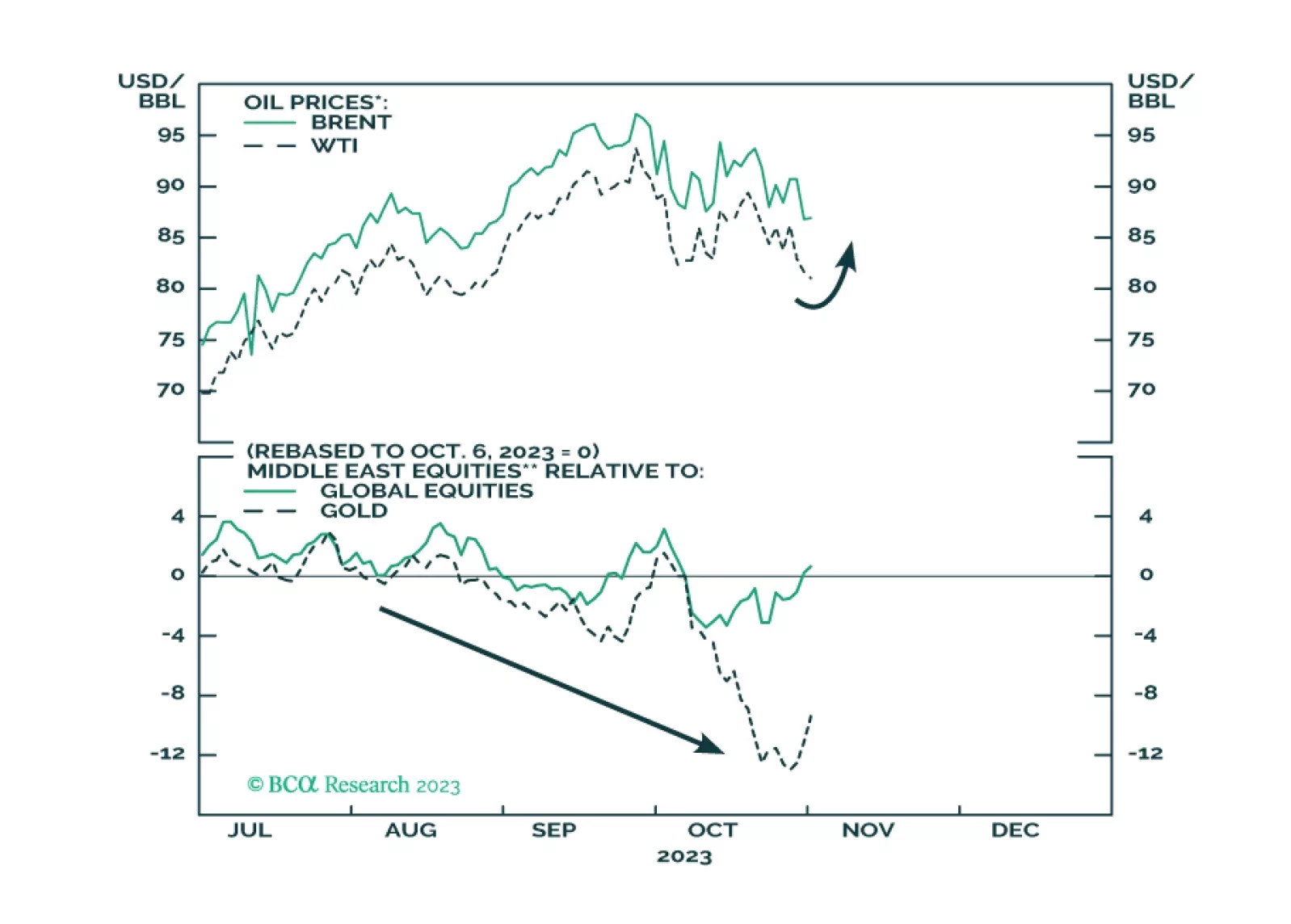

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.

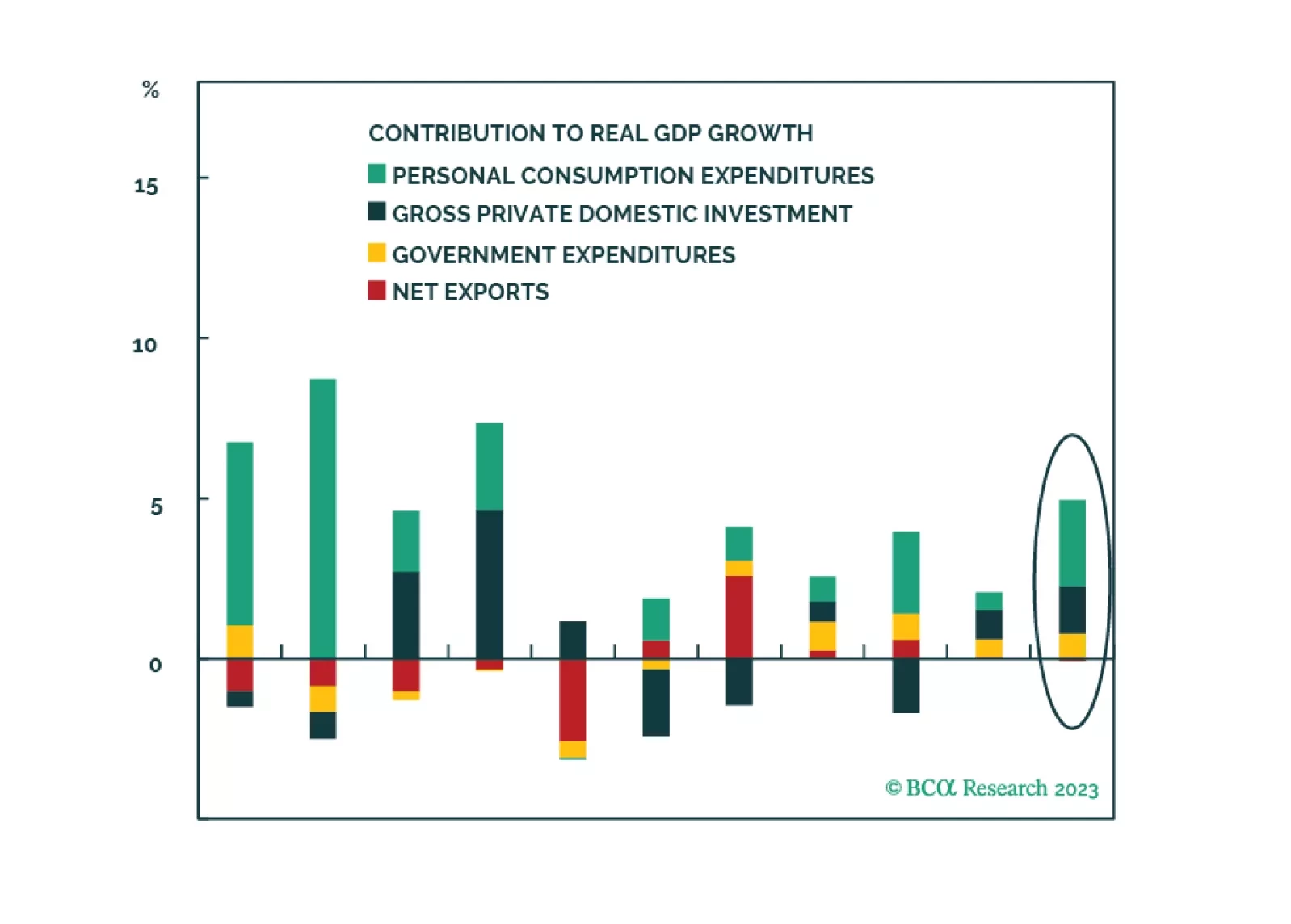

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…

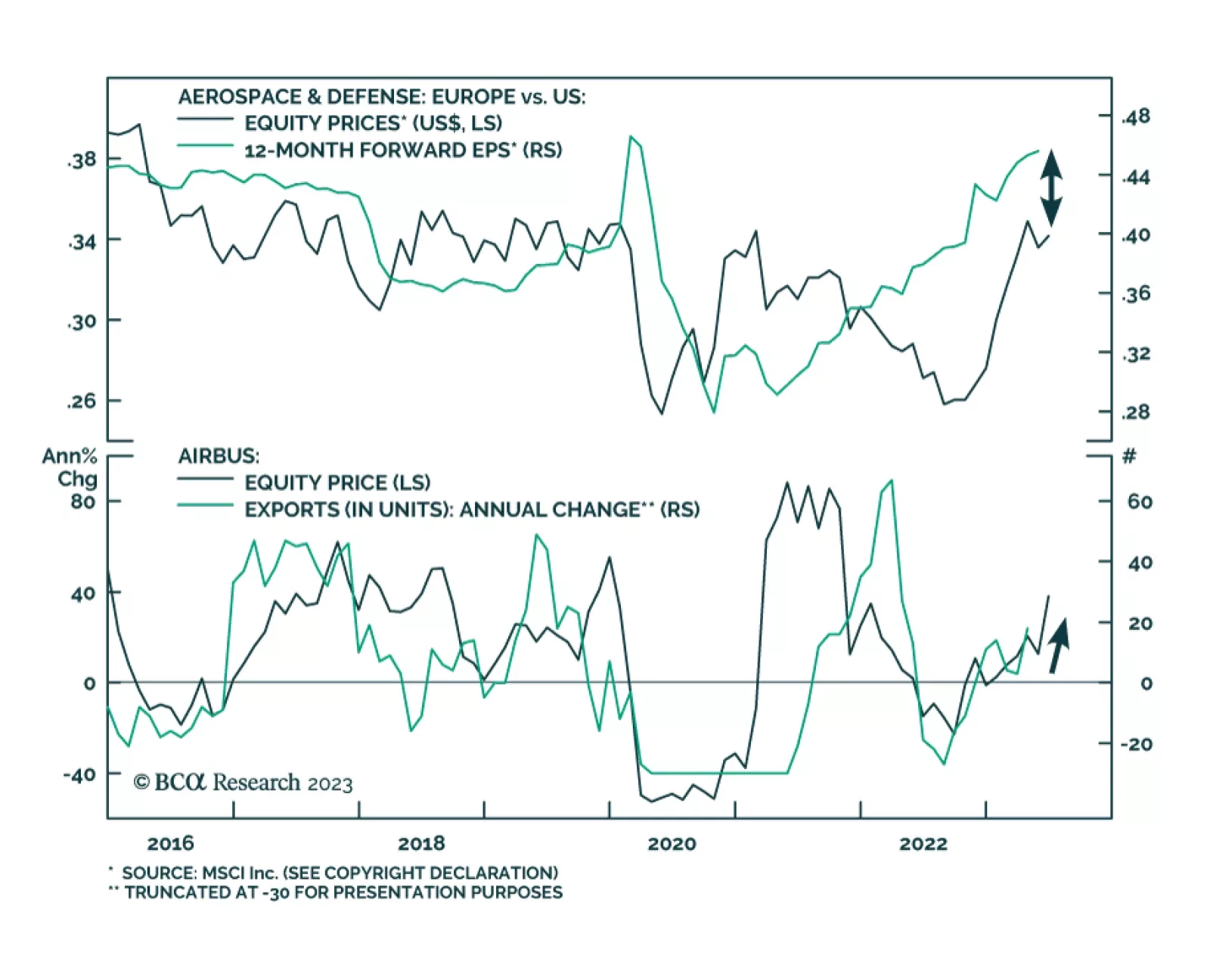

European aerospace and defense stocks are on the offense. Year-to-date, they are up 20% in absolute terms and 24% relative to their US counterparts, both in US dollar terms. The relative 12-month forward earnings suggest that…

US defense stocks have been on a tear of late (outperforming SPX by 10% since late November), benefiting from both macro and geopolitical trends. From a macro standpoint, the Defense industry has been neglected…

Highlights Geopolitical risk is trickling back into financial markets. China’s fiscal-and-credit impulse collapsed again. The Global Economic Policy Uncertainty Index is ticking back up after the sharp drop from 2020. All of our…