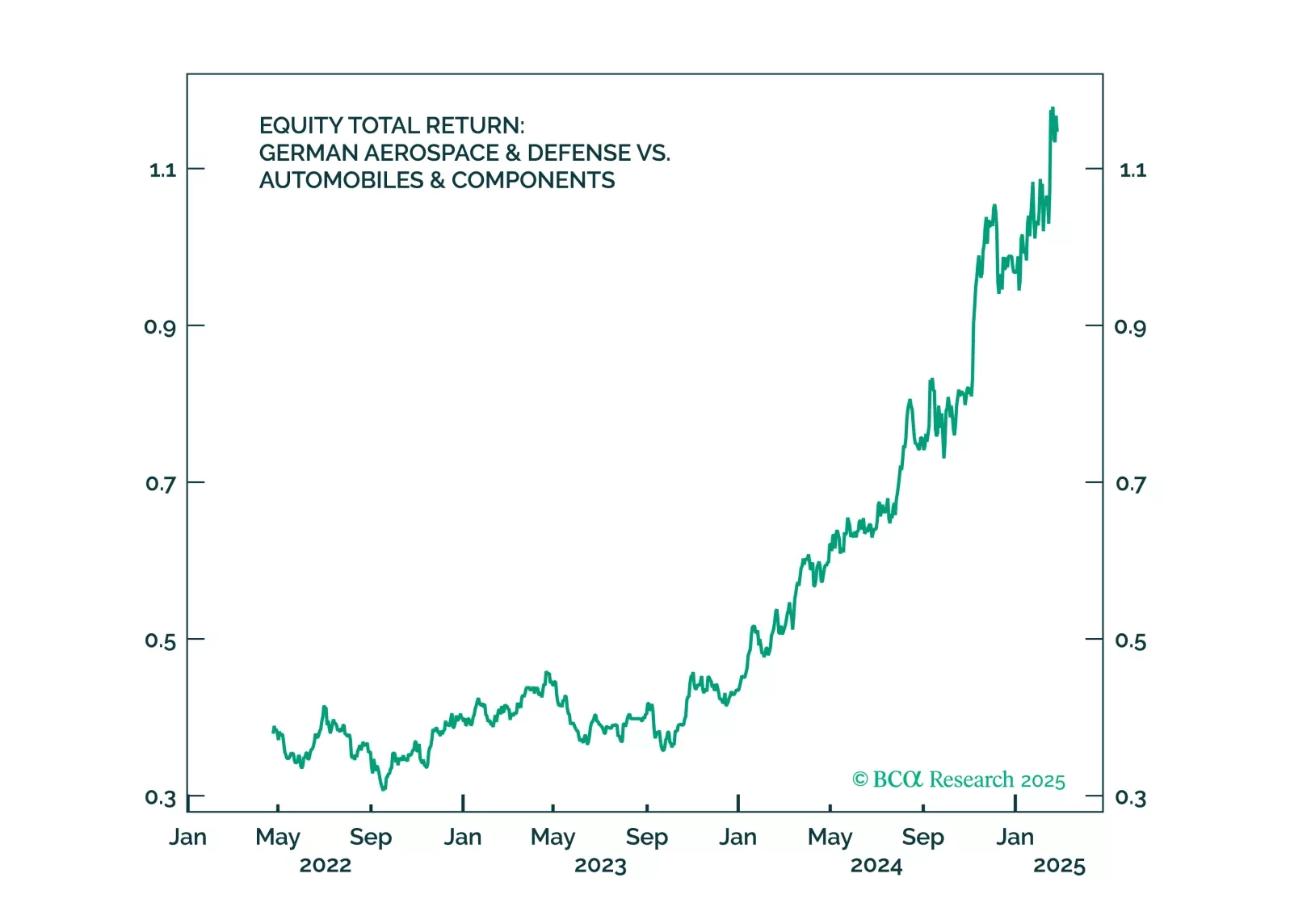

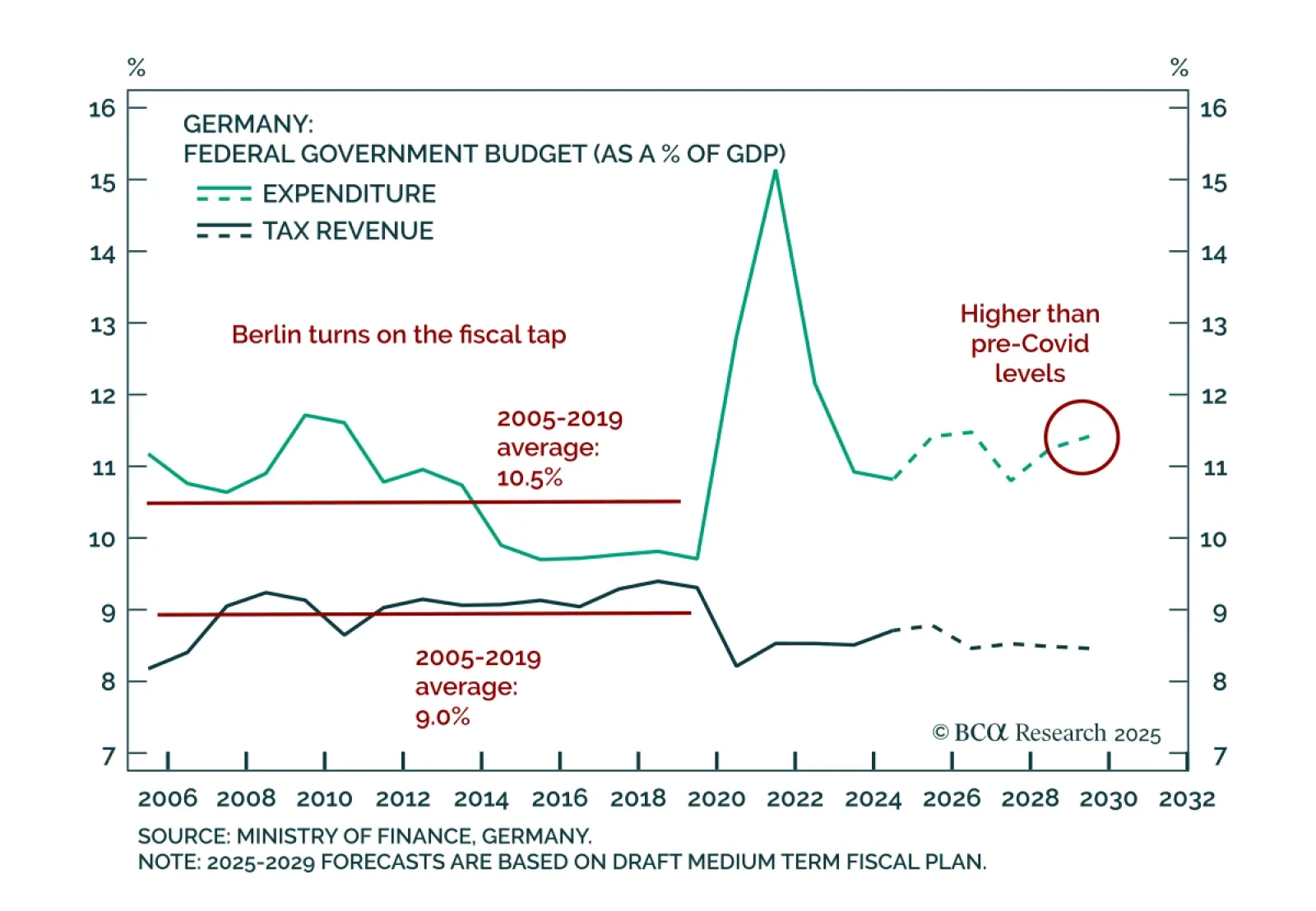

Our Geopolitical strategists see Germany advancing its fiscal and defense agenda, with defense stocks set to benefit. The country is moving ahead with its investment program, providing a tailwind for growth. A historic military build…

This insight gives life to four high-conviction views on European small caps, aero¬space & defense, banks, and telecoms by harnessing the power of BCA’s Equity Analyzer (EA).

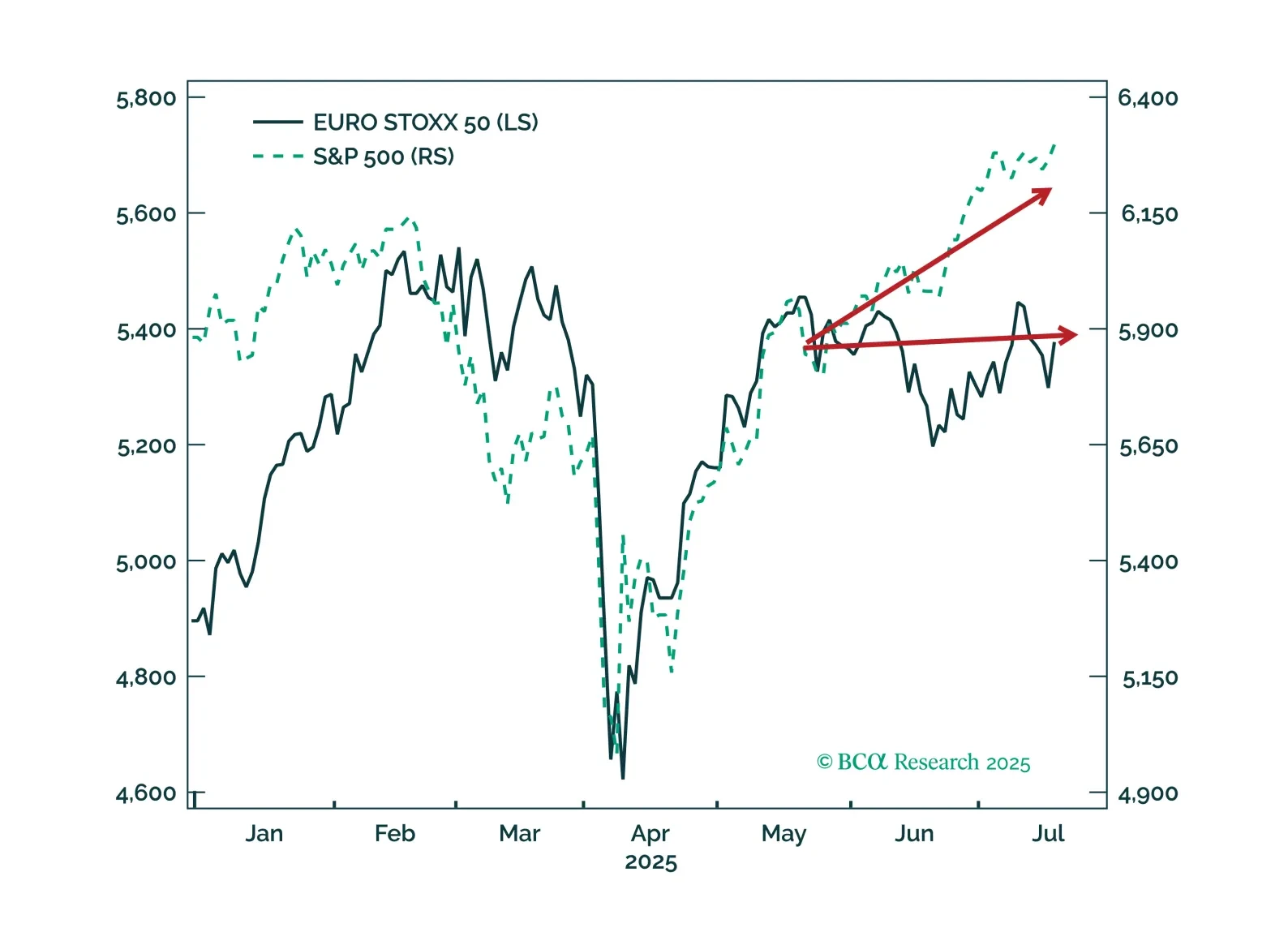

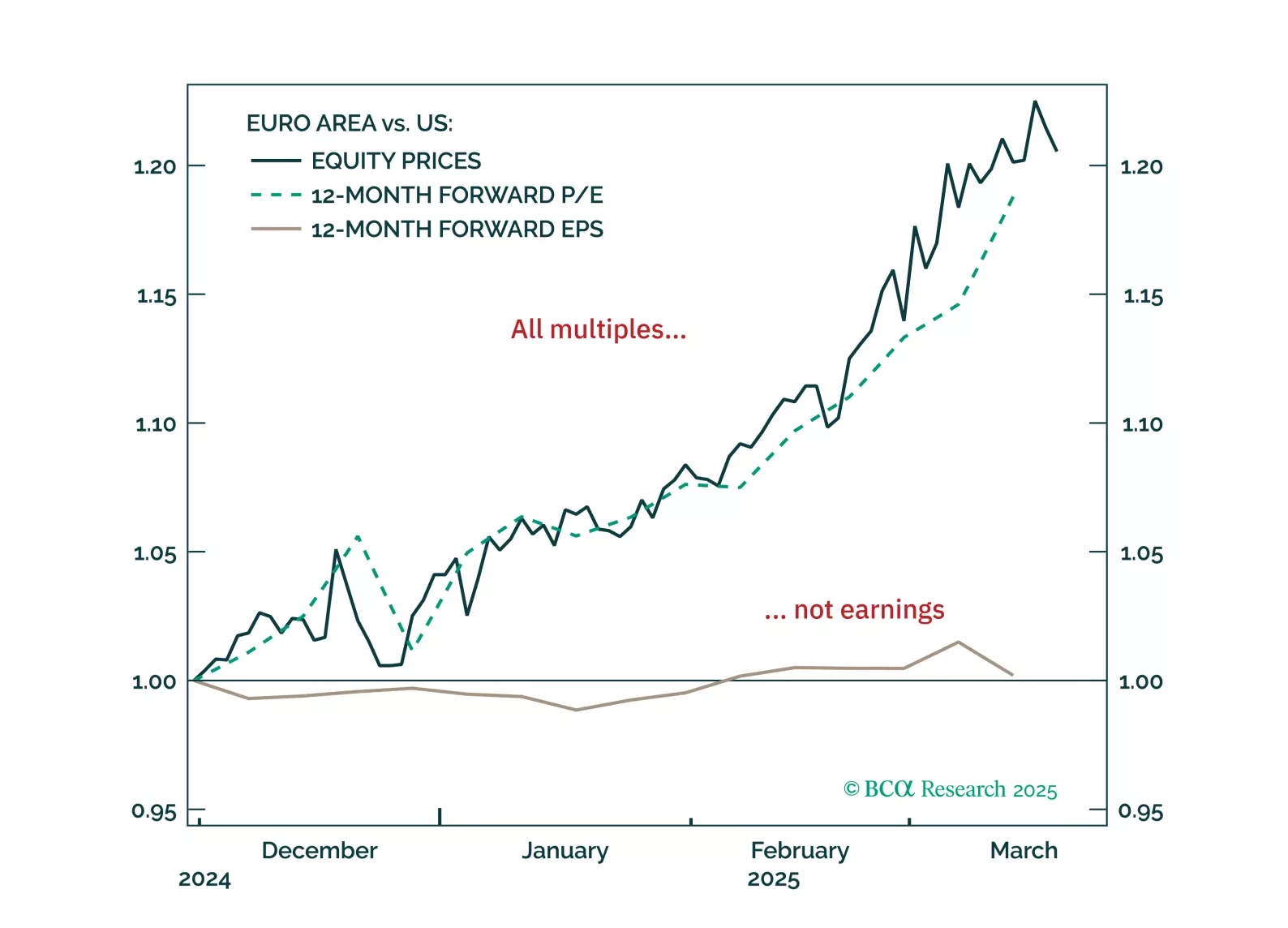

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

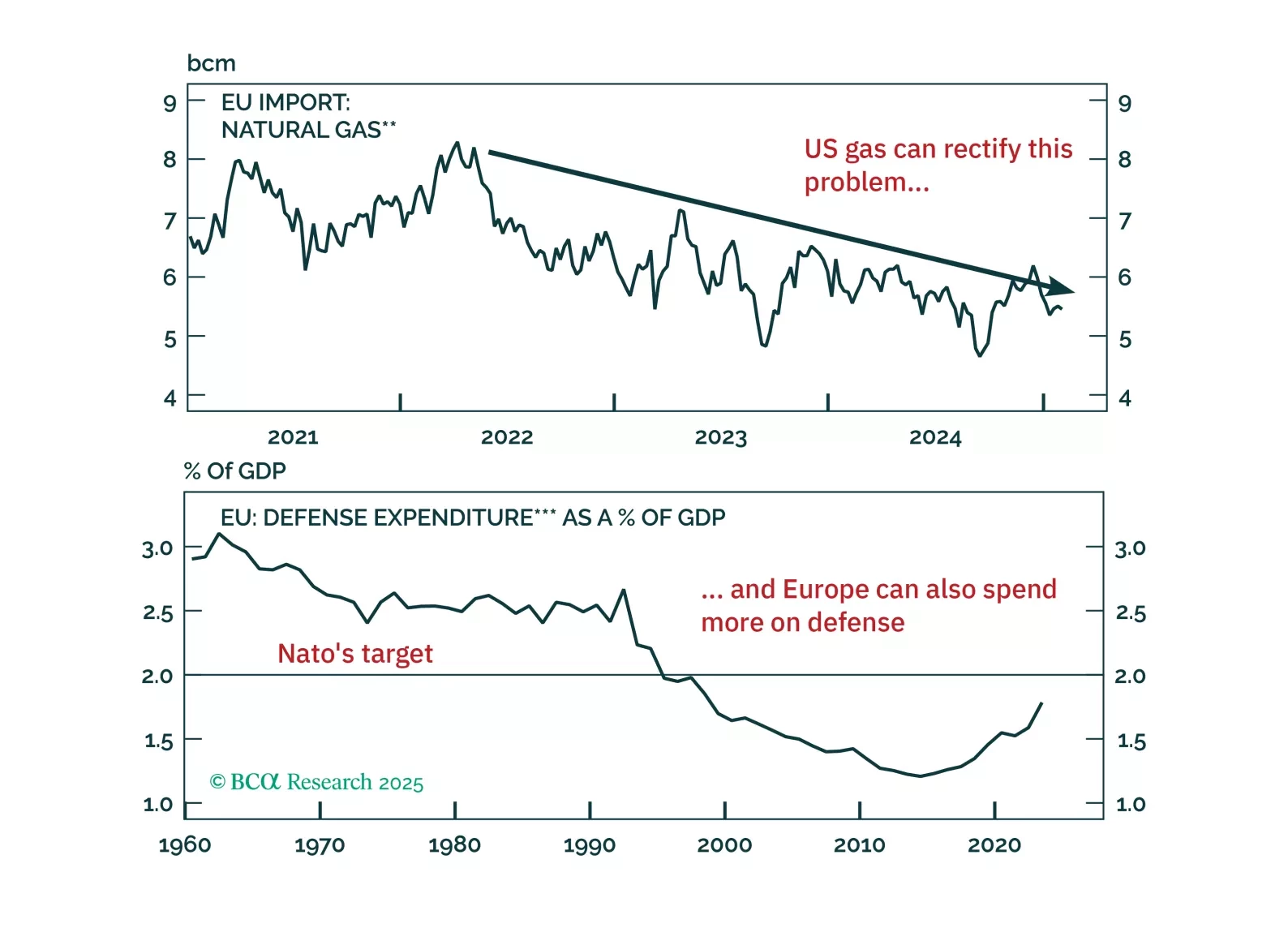

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

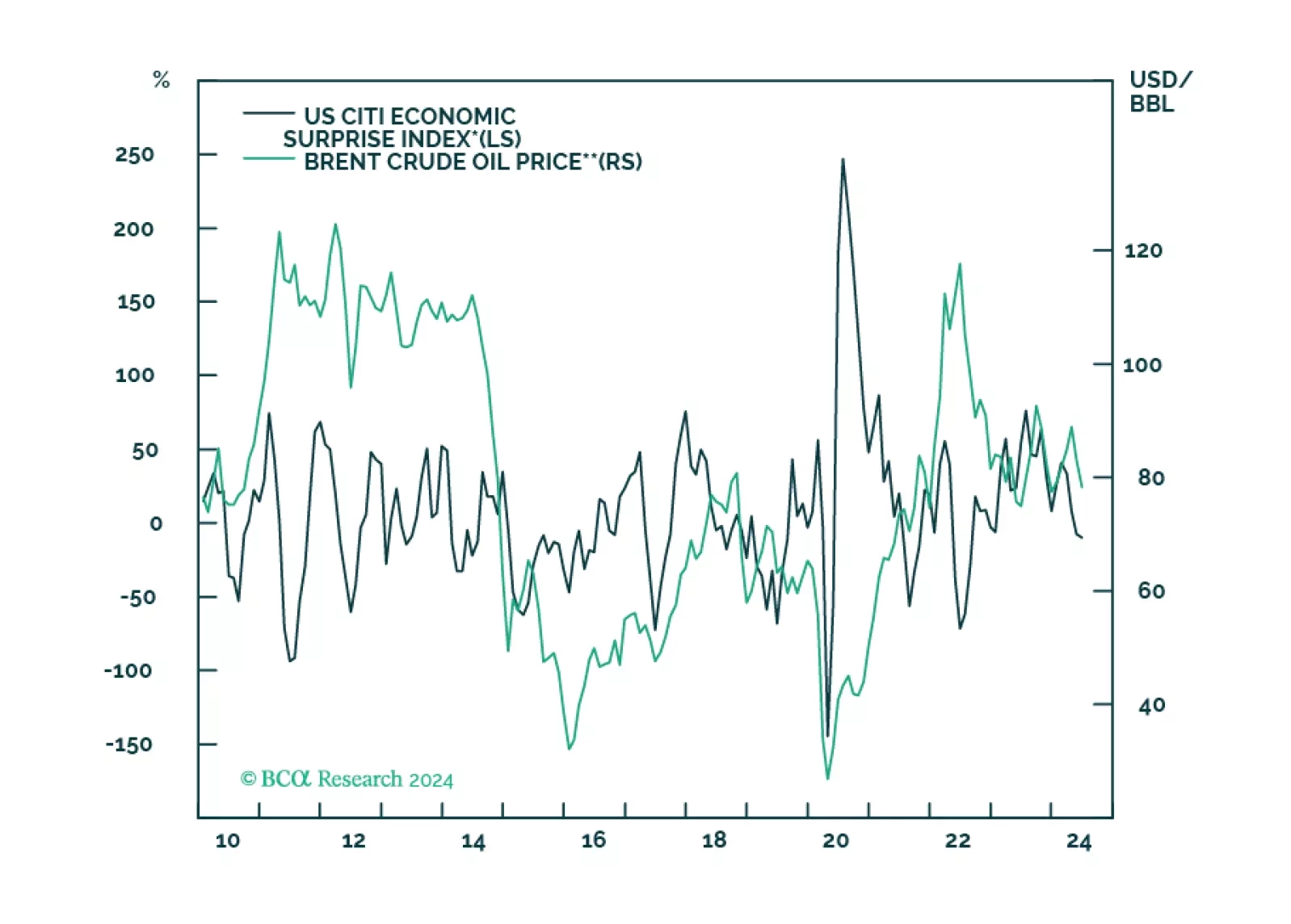

We close our overweights to Energy and Aerospace & Defense. The macroeconomic backdrop is deteriorating for Energy. As for A&D, the good news is already priced in.

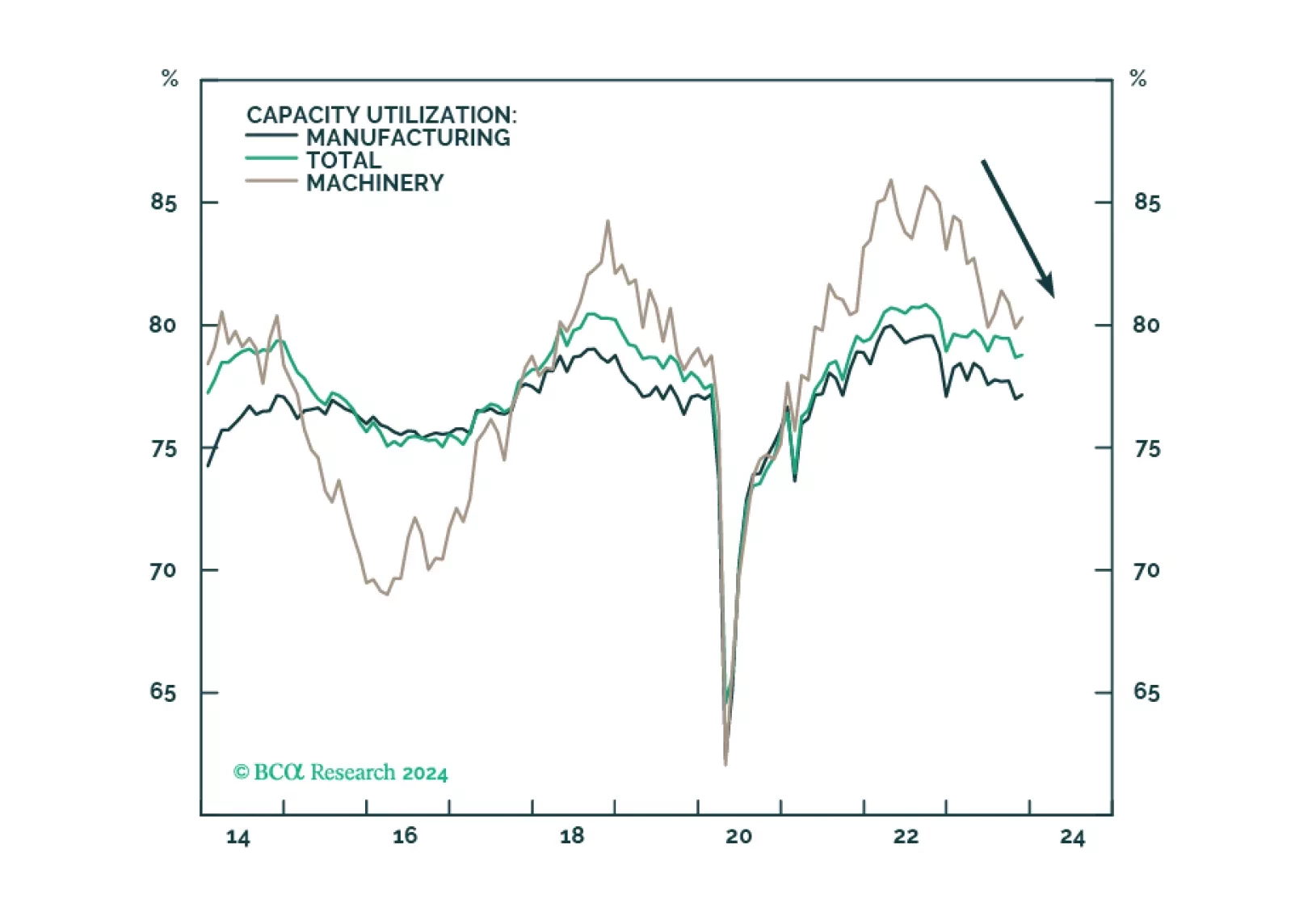

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

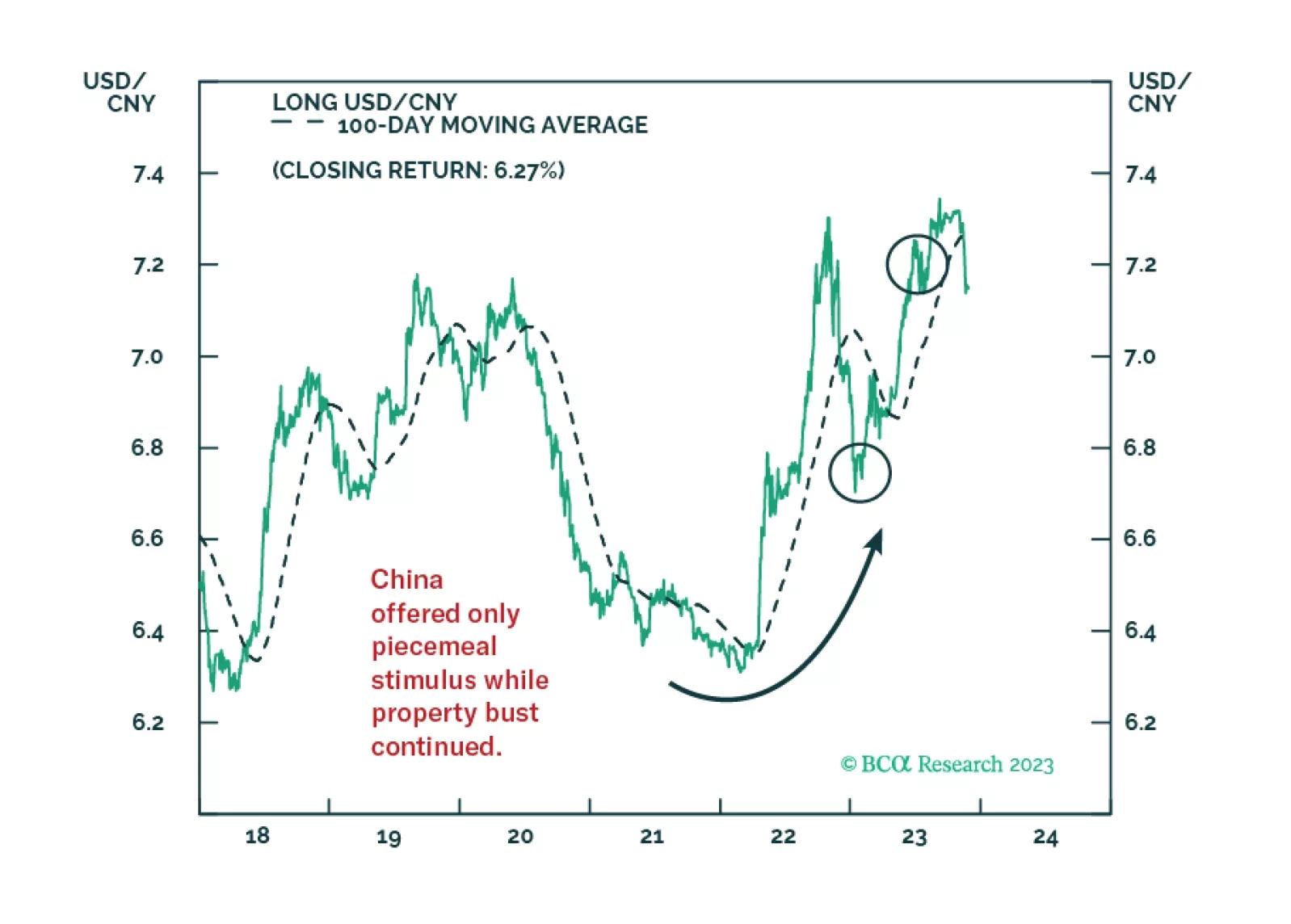

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.