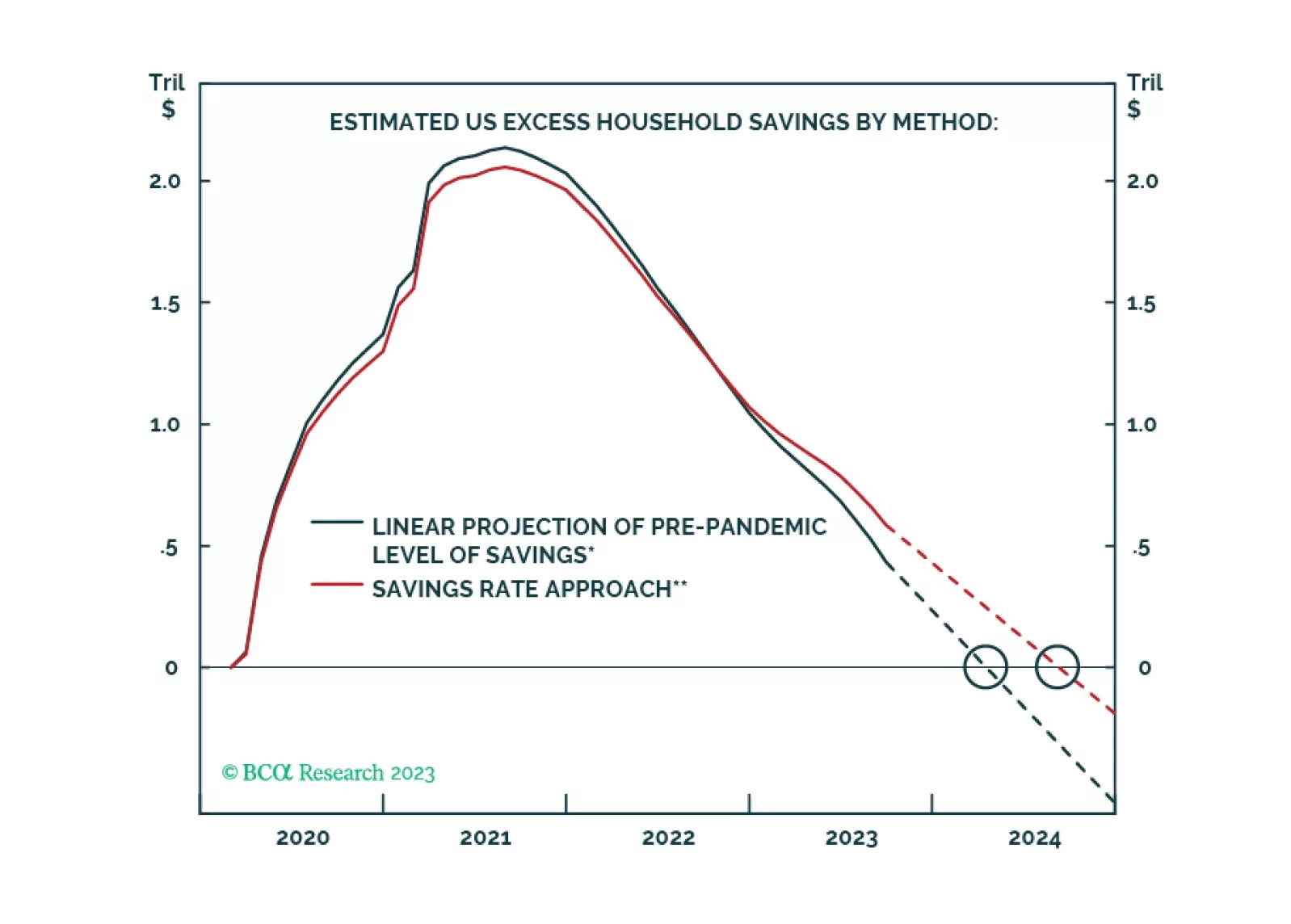

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

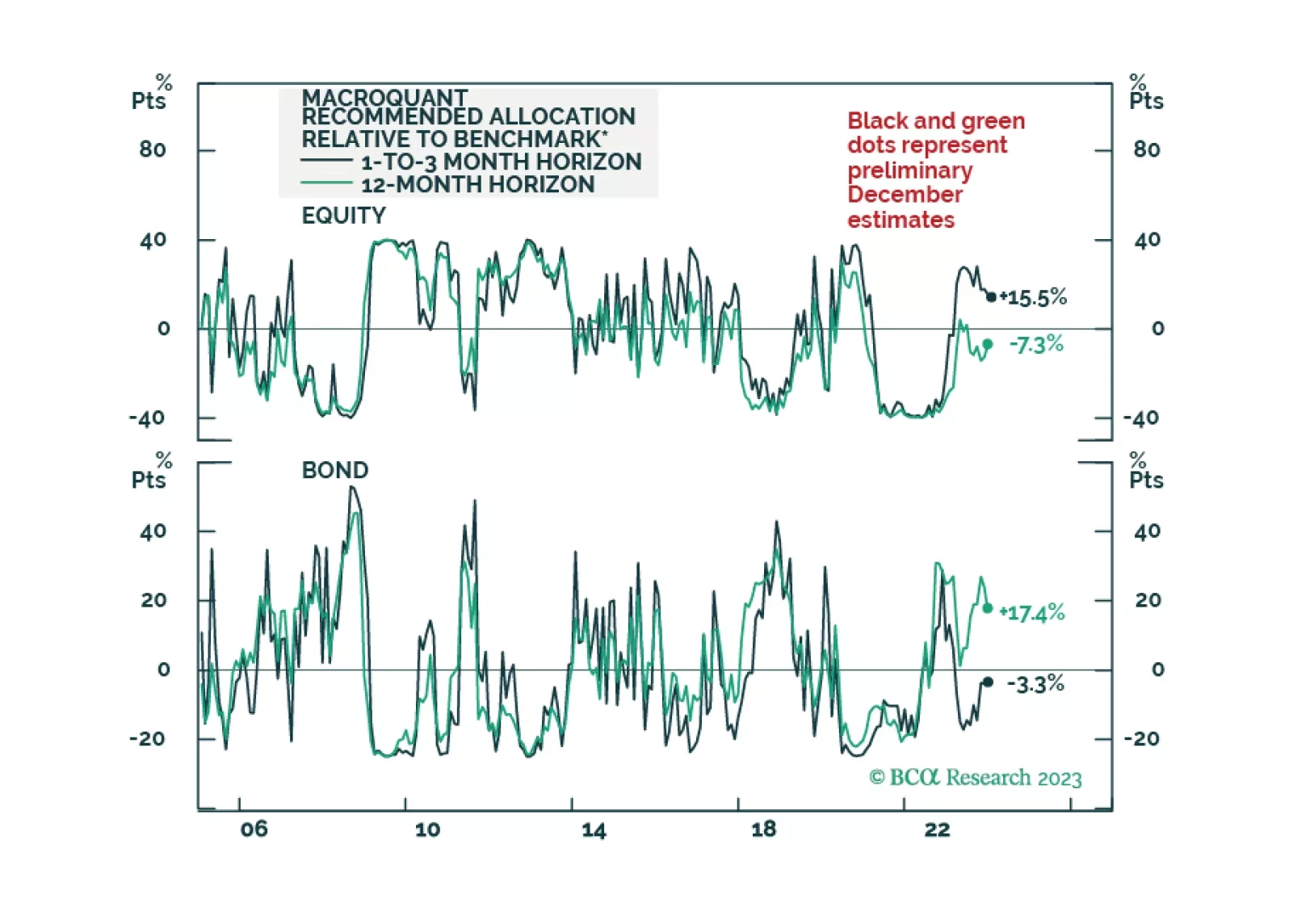

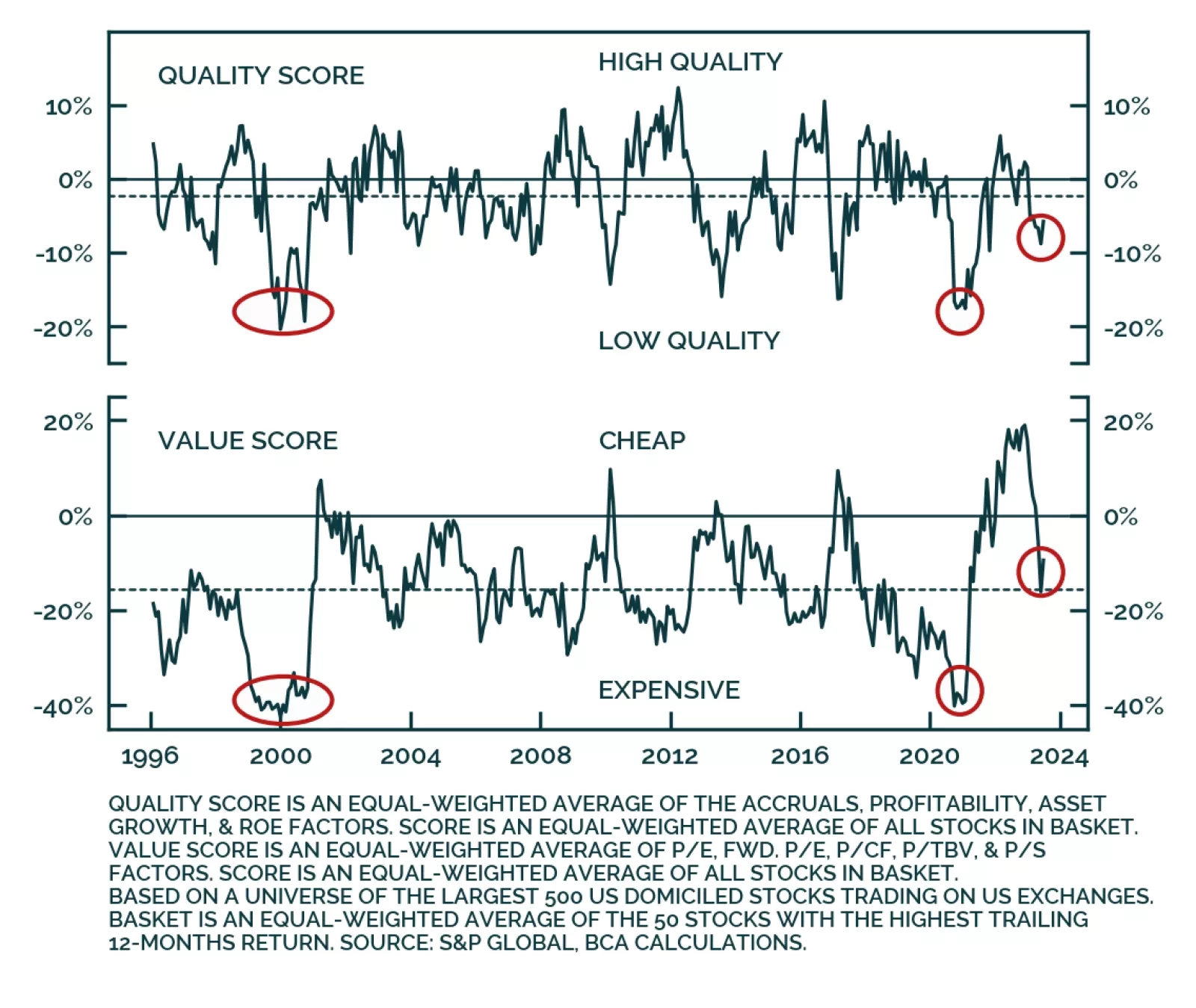

Outperformance of Growth sectors most likely has run its course. It is time to shift Growth vs. Value allocation to neutral, downgrade Semis, and upgrade Energy to overweight.

Investors remain cautious about the US economy and still have significant cash that needs to be put to work which could extend the rally further. Earnings rebound later in the year will be supported by rising sales growth and surging…

The stratospheric valuation of this year’s AI mania is likely to deflate, just as it did after the Web 1.0 mania of the late 90s. We go through some long-term and short-term investment implications.

This chart breaks down the factor exposure of the top performers in the US large cap space relative to the largest 500 stocks in the US to see how the current market leaders compare to history relative to their peers. The values…