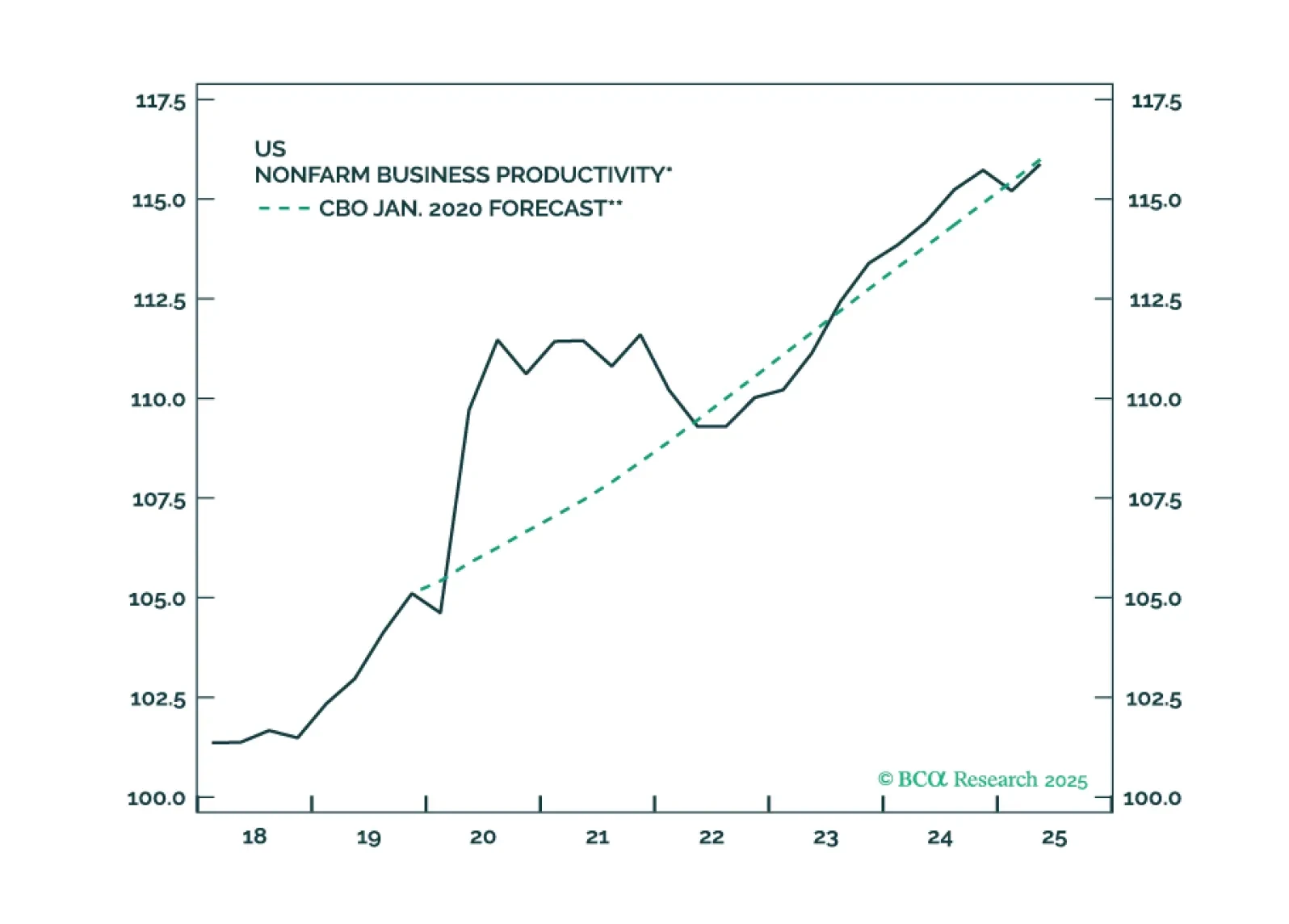

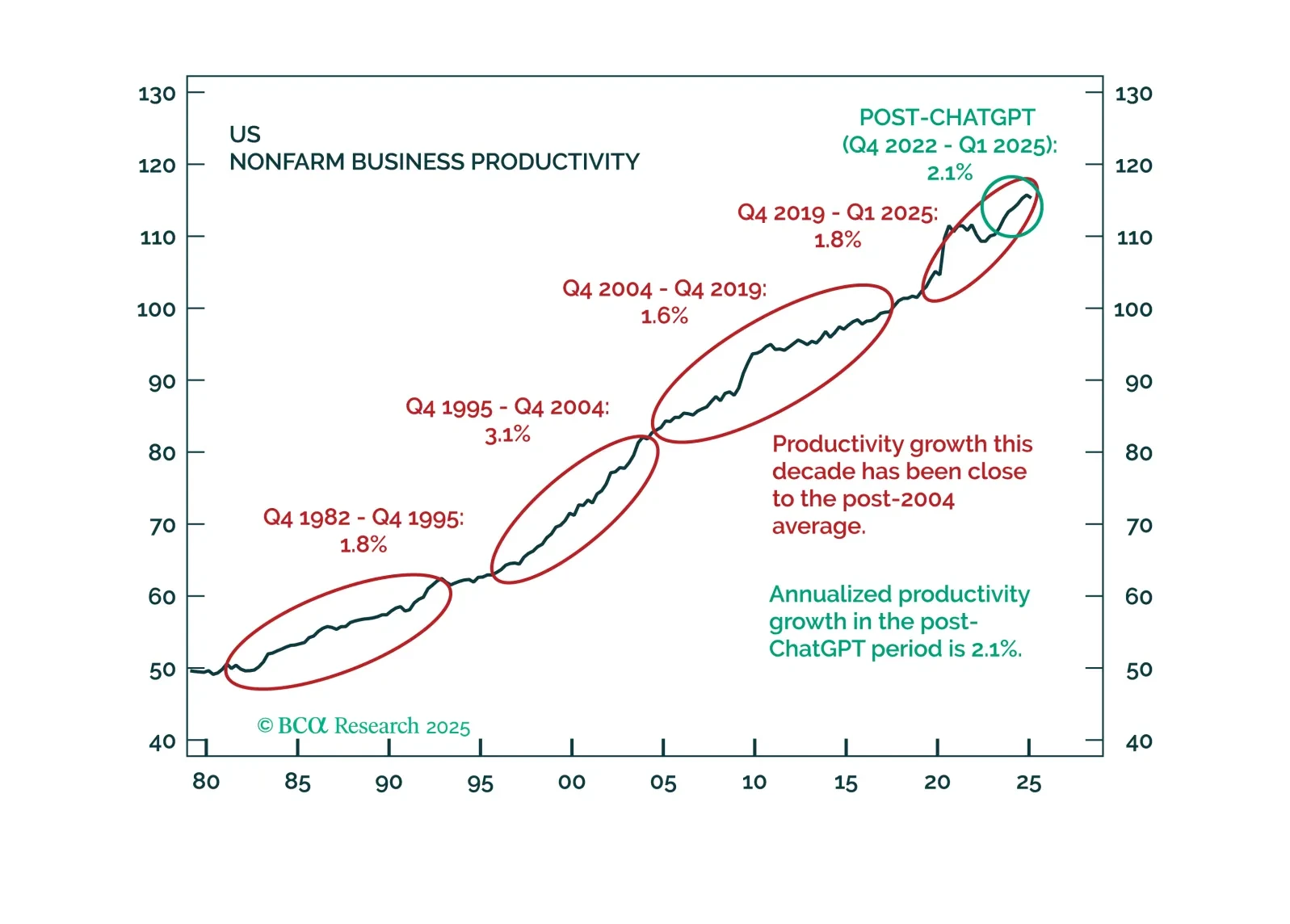

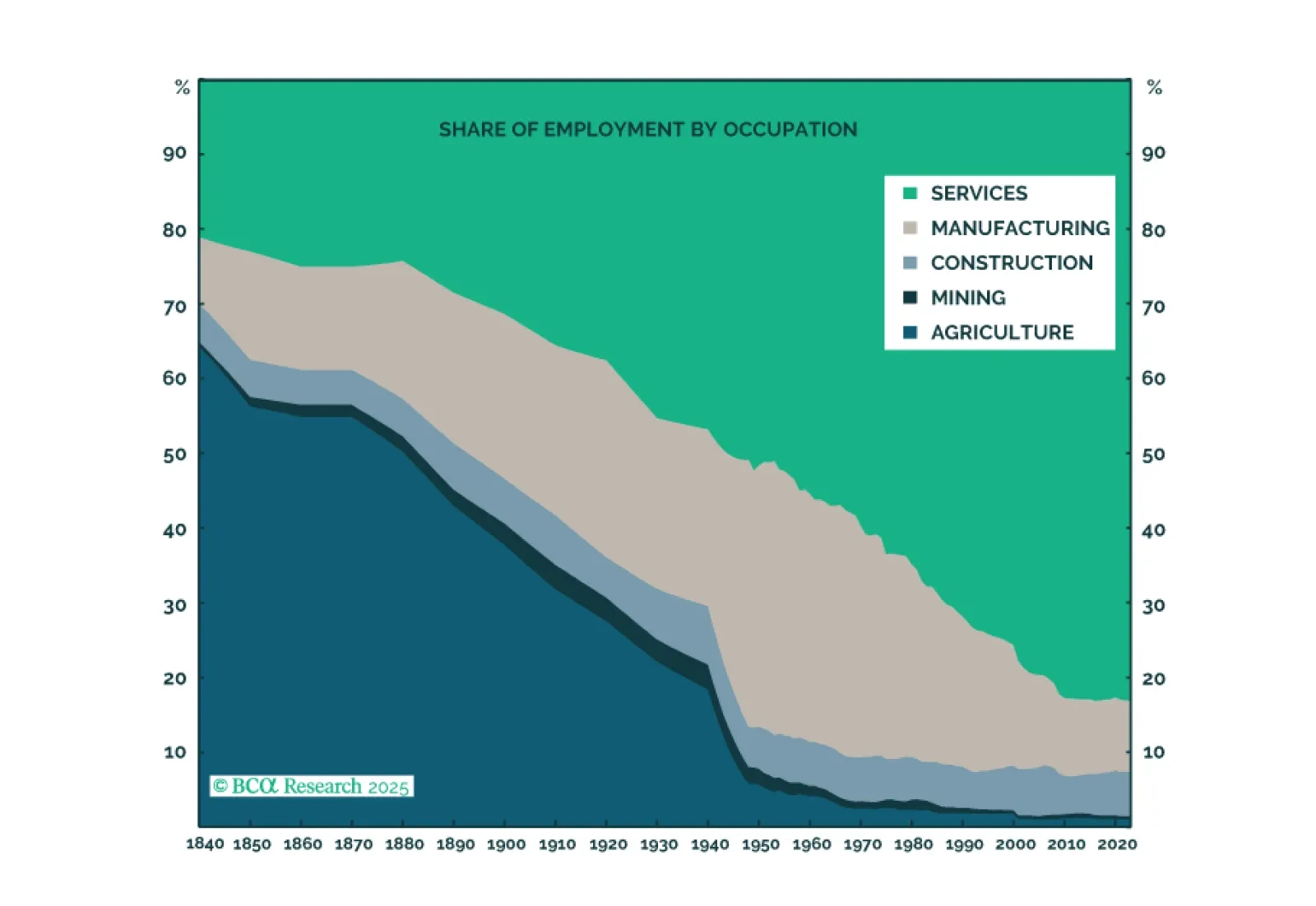

The AI boom has had less of an impact on the economy than widely believed. This may eventually change, but the risk is that investors grow impatient before it does.

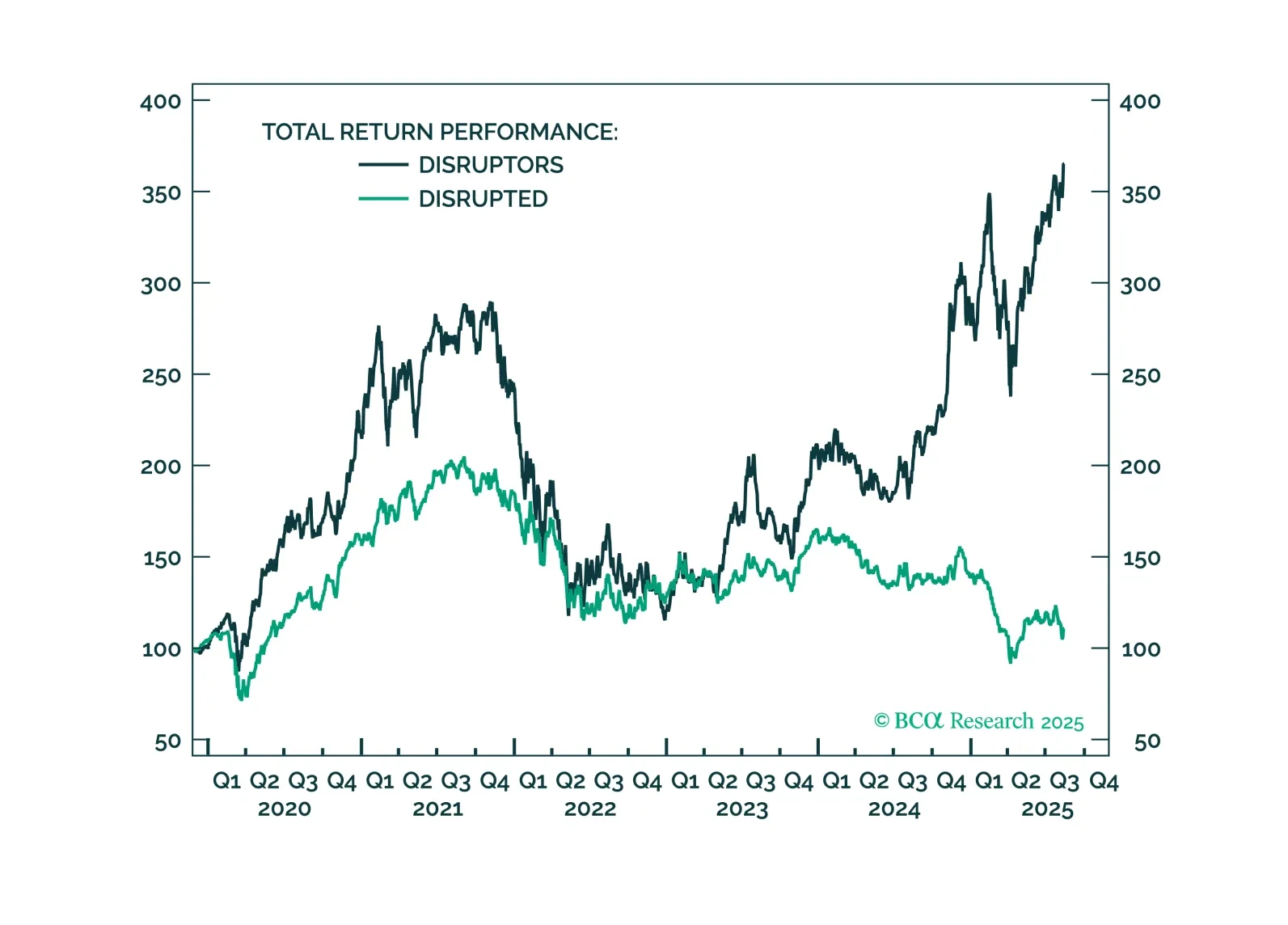

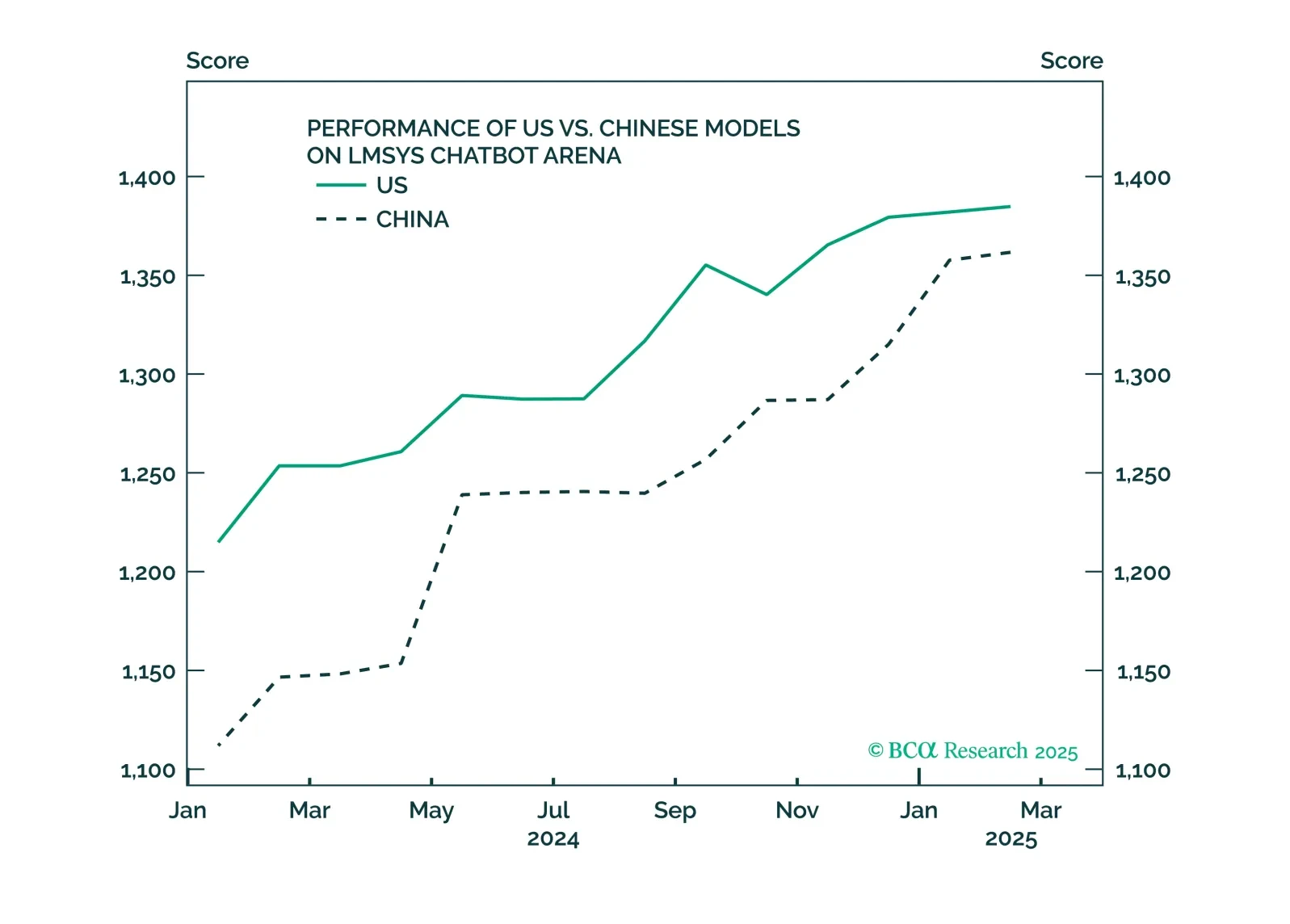

GenAI momentum is building. Many companies are already reaping benefits from the technology. GenAI is disrupting entire industries, such as education, image generation, and staffing. Investors should prefer our “disruptors” basket…

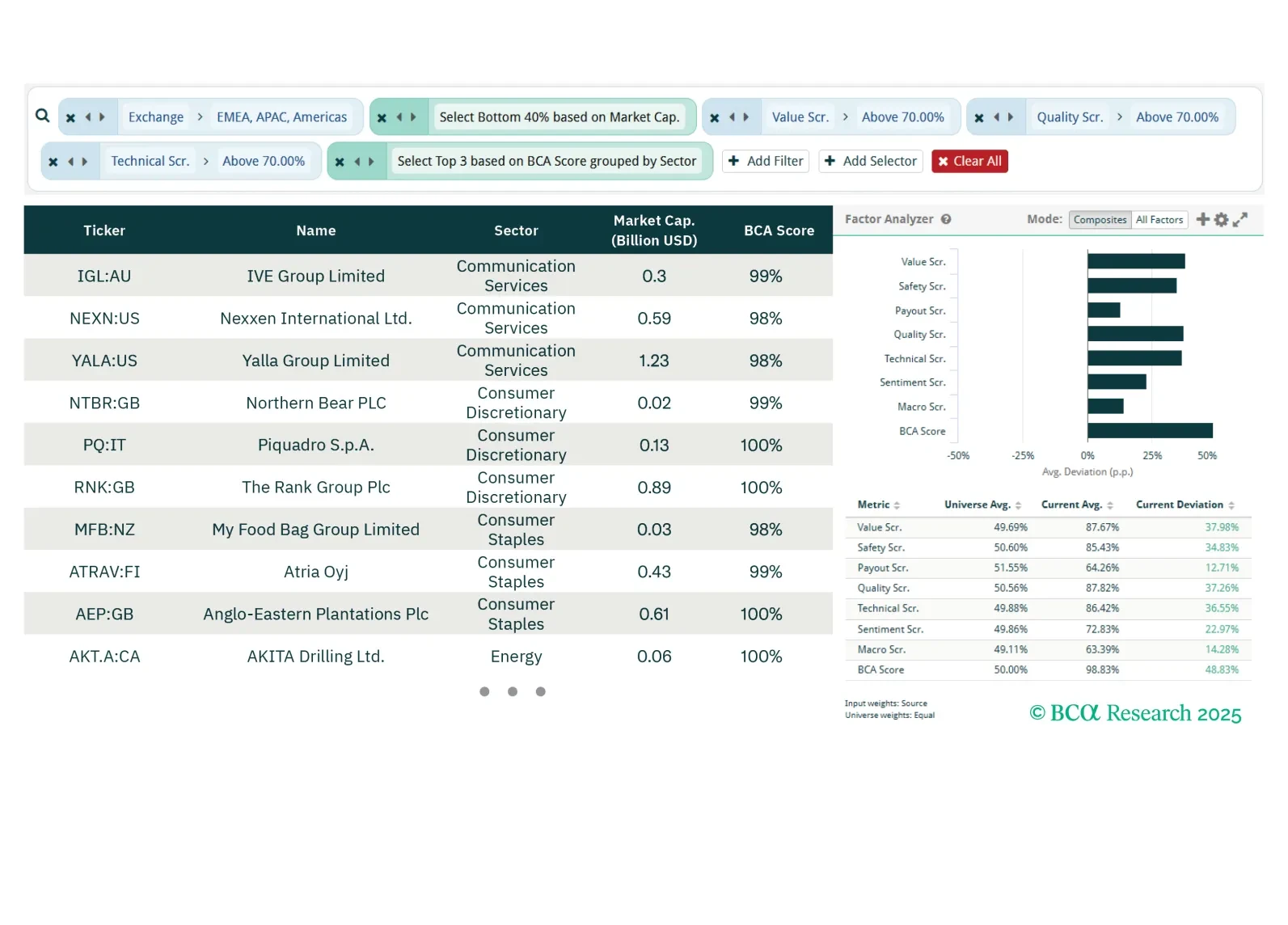

This week our three screeners highlight plays in global small-cap value stocks, gold miners, and stocks exposed to an exciting structural investment theme: Space.

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

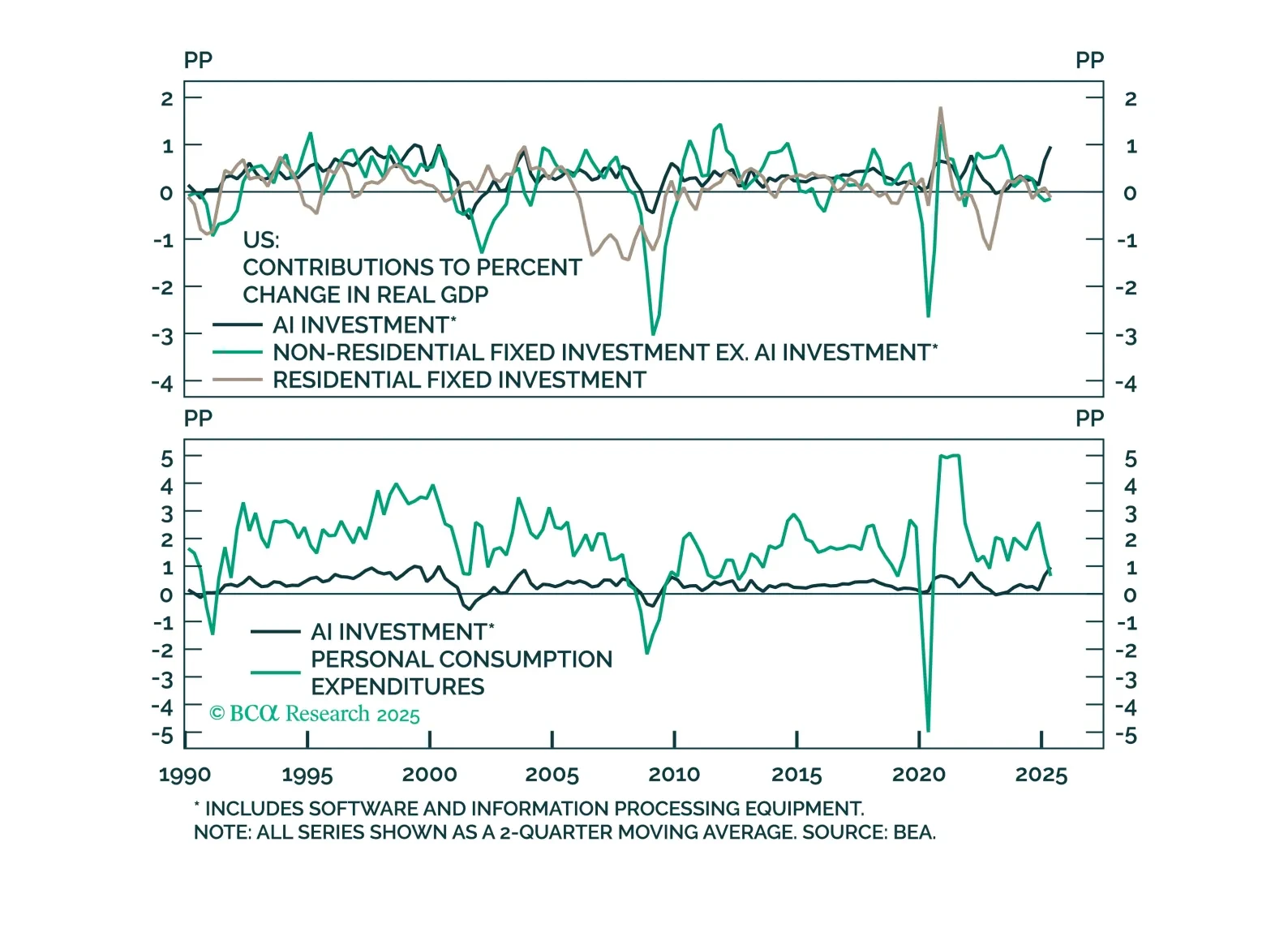

Over the first half of 2025, AI capex outpaced both consumption and all other investments in its contribution to US growth. Like all other capex cycles this one will end in tears. However, the indicators we track suggest that AI…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

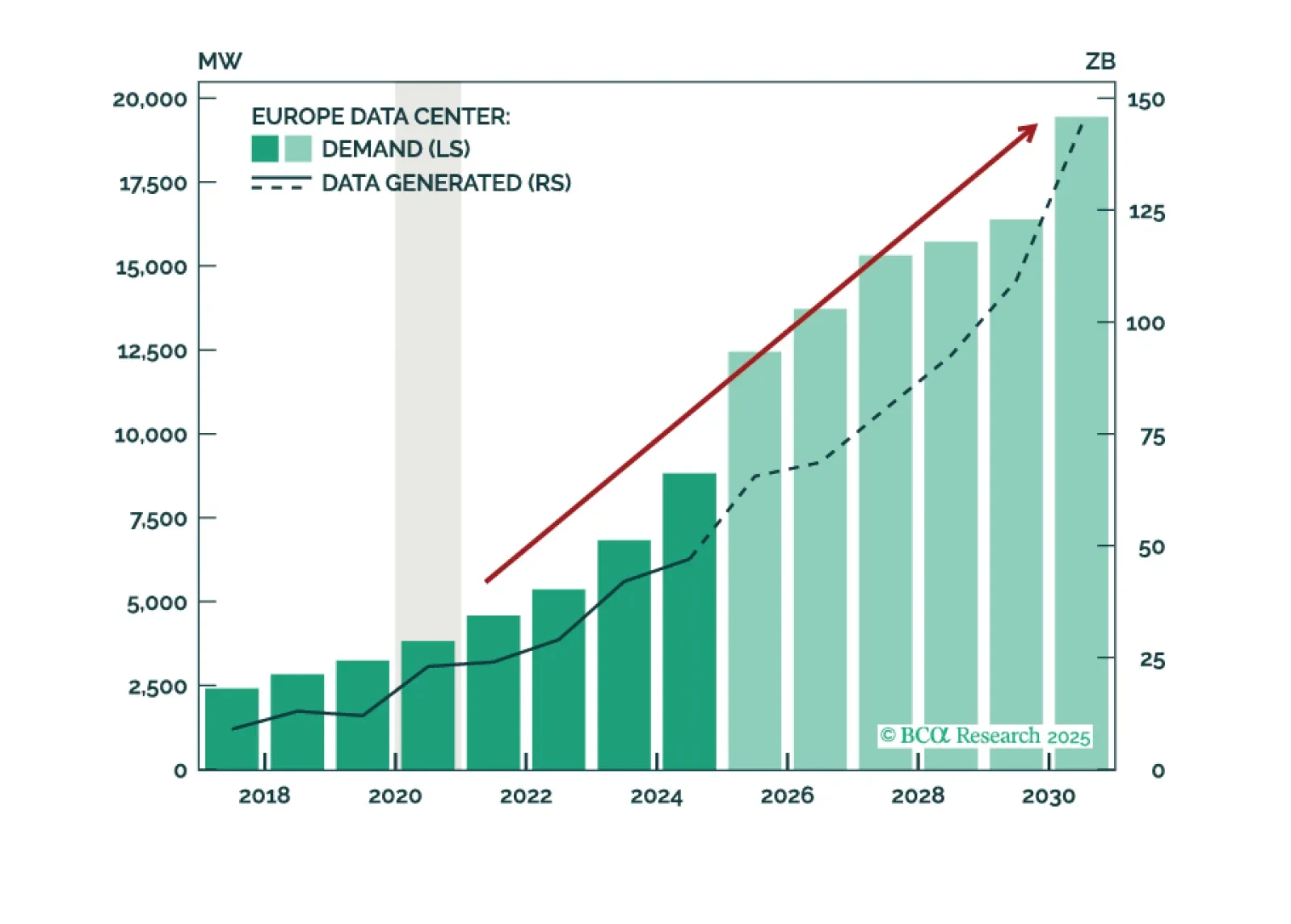

While the US is the pioneer, Europe will follow suit—more rapidly than expected. It is not a question of if GenAI will boom in Europe, but when. Europe’s Data Center growth is already strong today, but a US-style boom is just around…

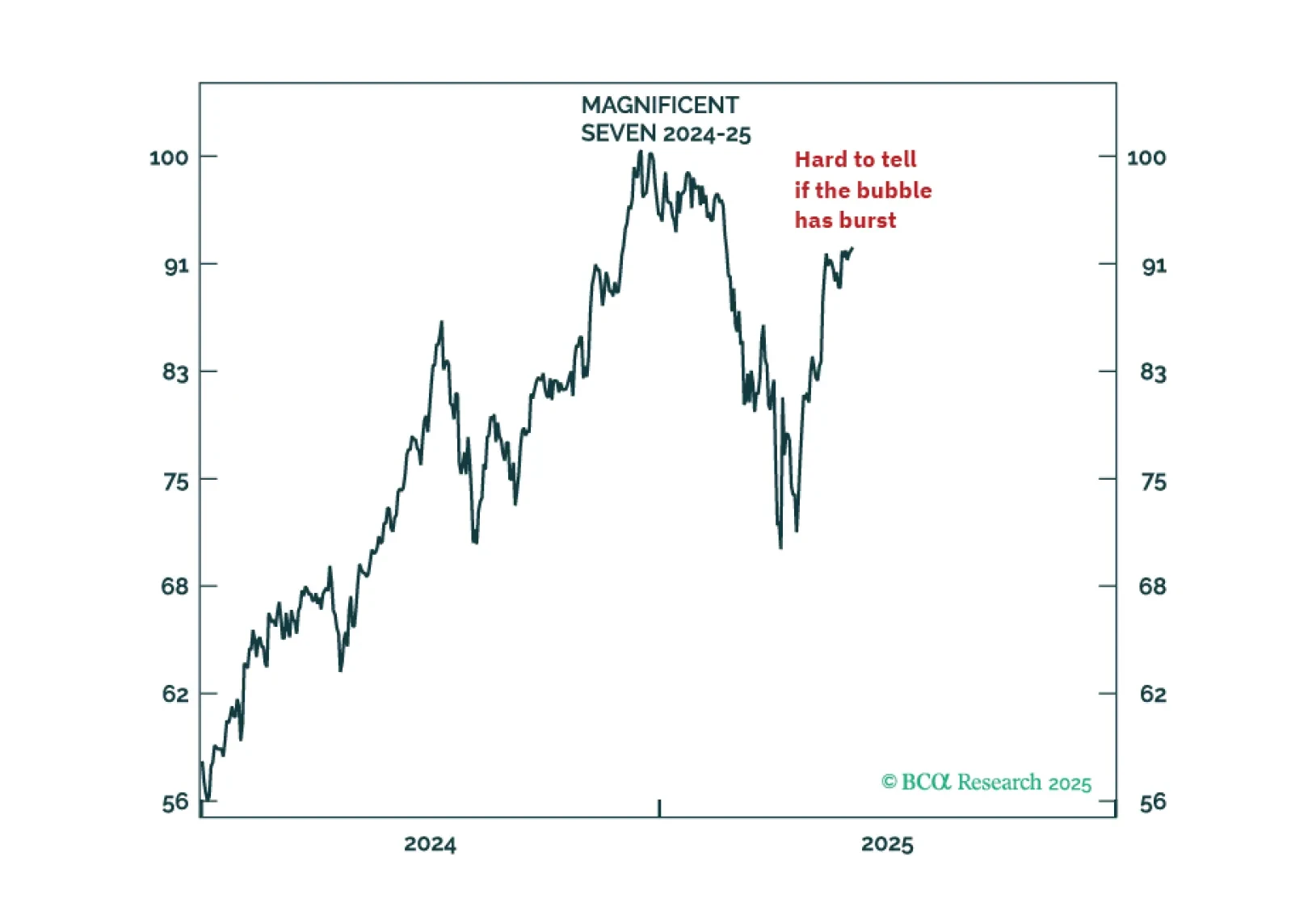

I am a structural disbeliever in the US superstar stocks because these winners of the previous technology, Web 2.0, are unlikely all to be the winners of the latest technology, AI. But I would suspend my disbelief if the Magnificent-…