To start 2026, we answer what we believe are the most important questions facing investors surrounding the labor market, monetary and fiscal policy, and AI stocks. Overall, we reiterate our overweight views on risk assets and…

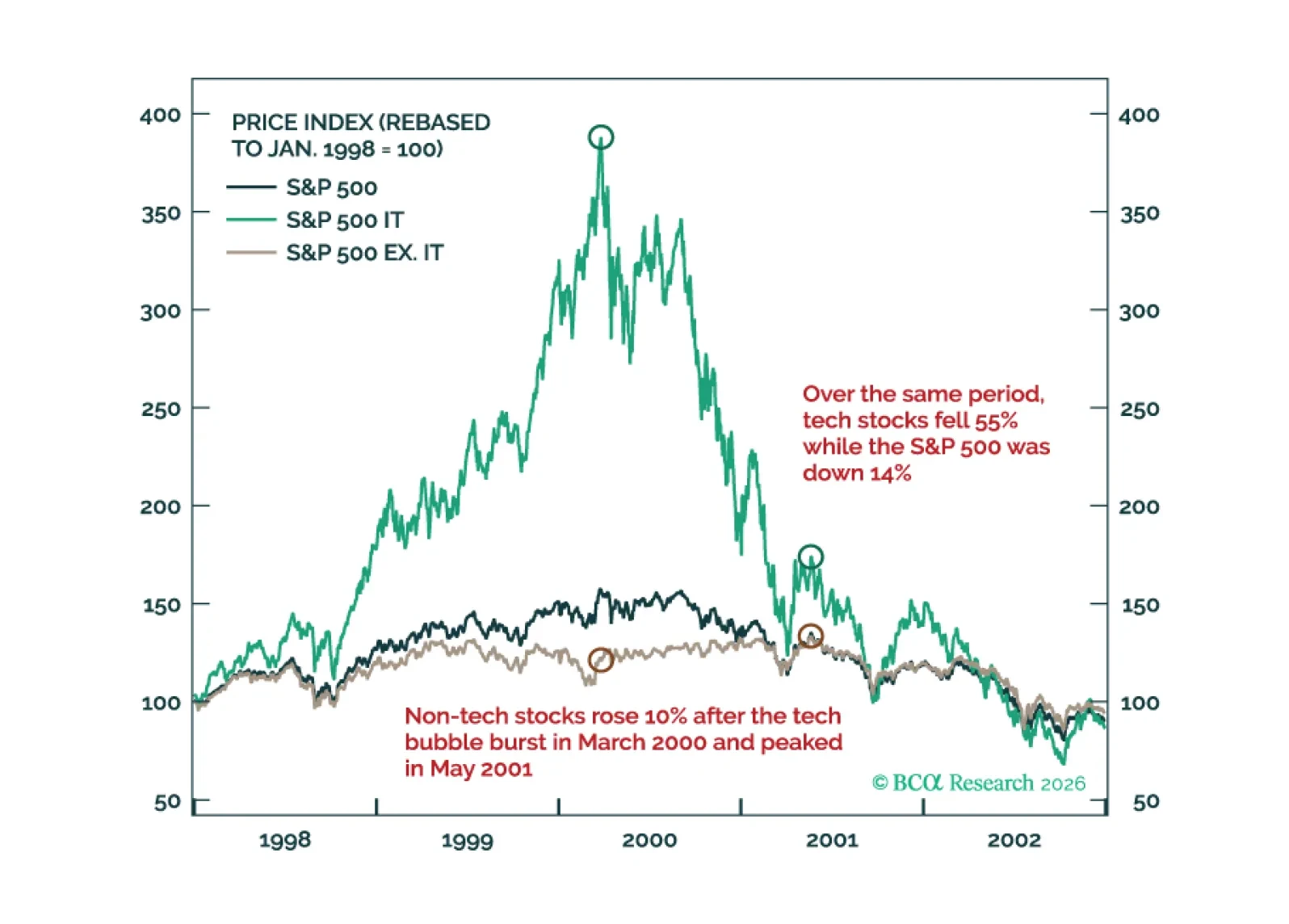

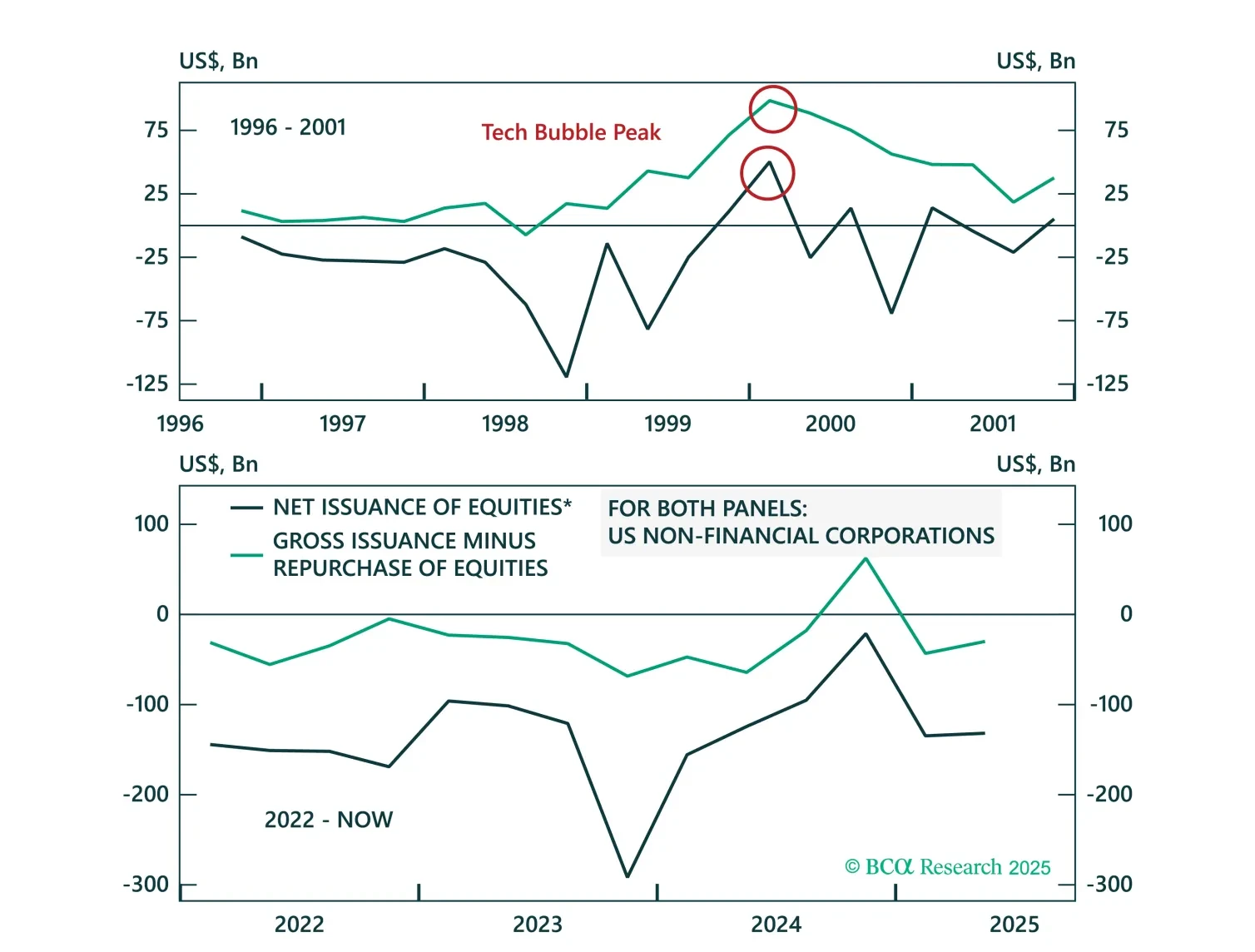

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

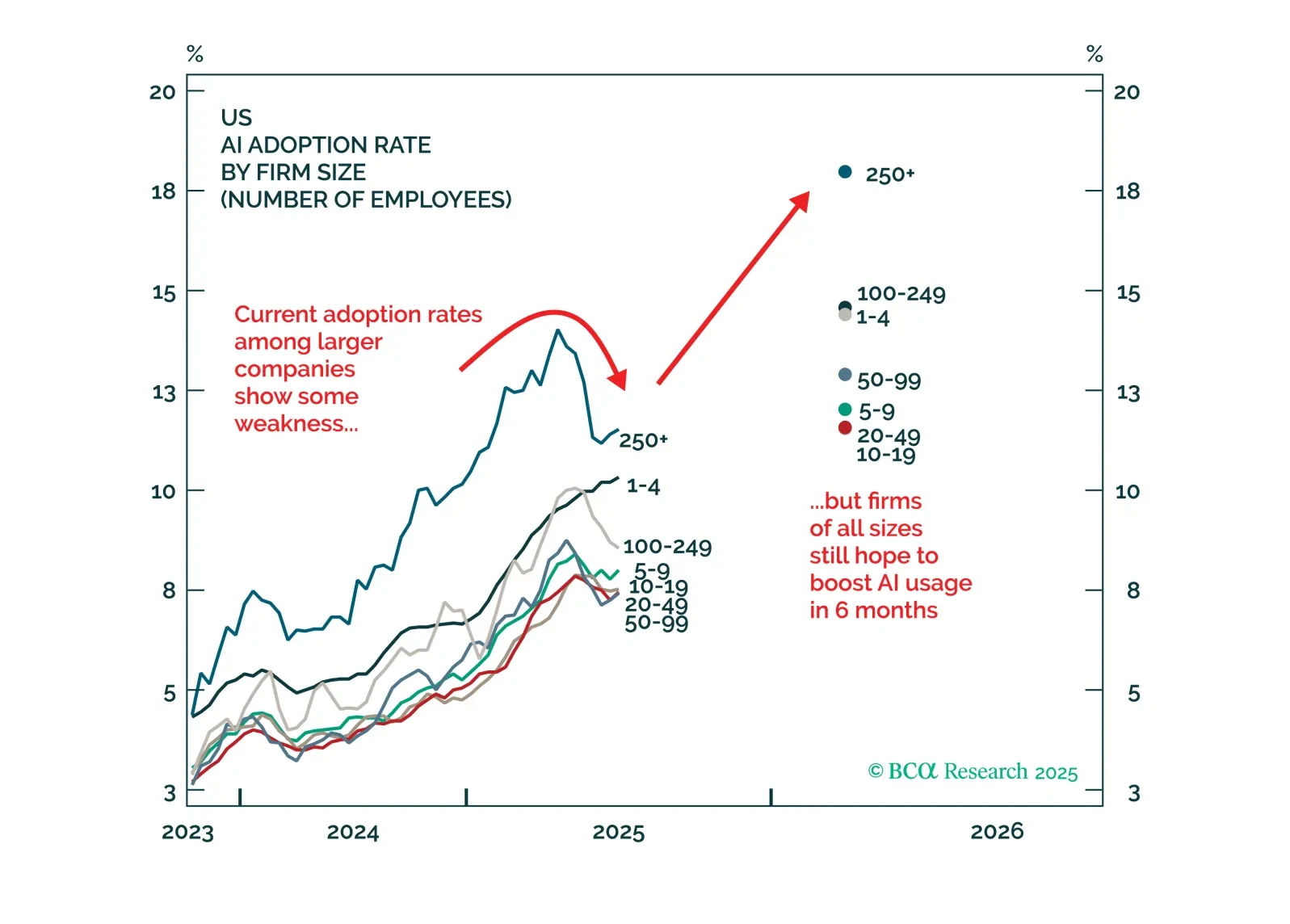

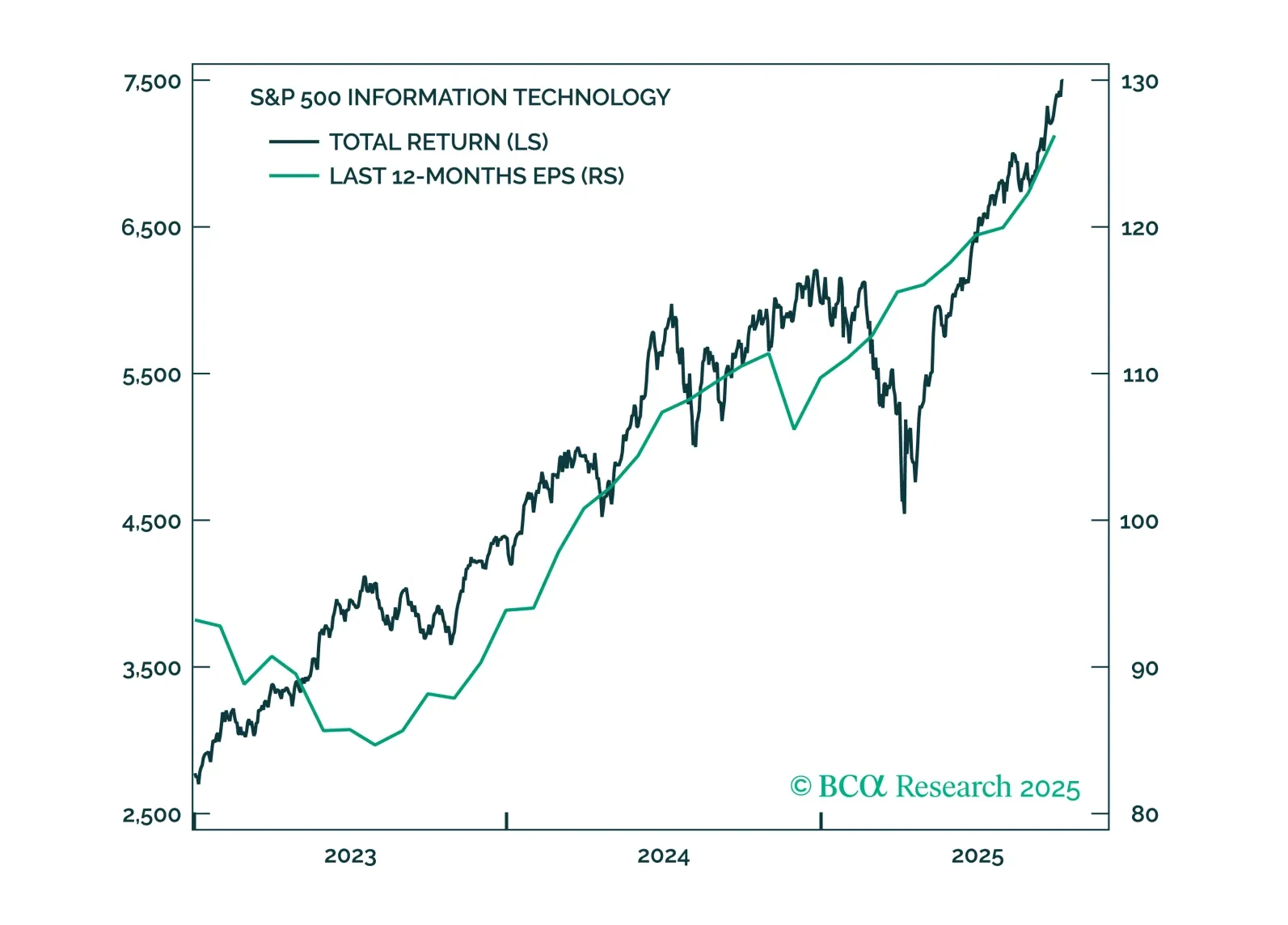

The odds have risen that we have reached a “Metaverse Moment” – a situation where investors punish AI companies for increasing capex. This warrants greater caution towards AI stocks specifically, and the broader S&P 500 more…

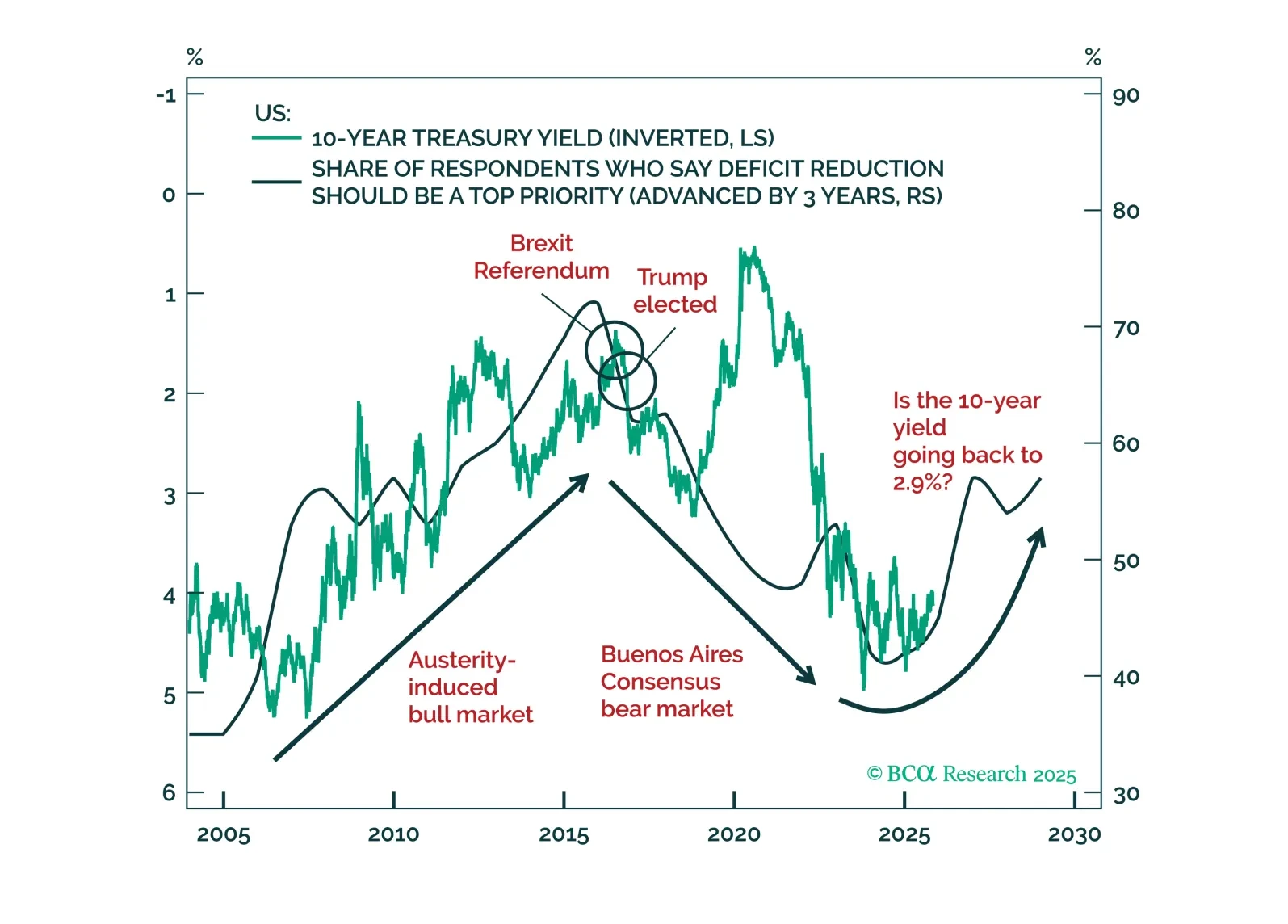

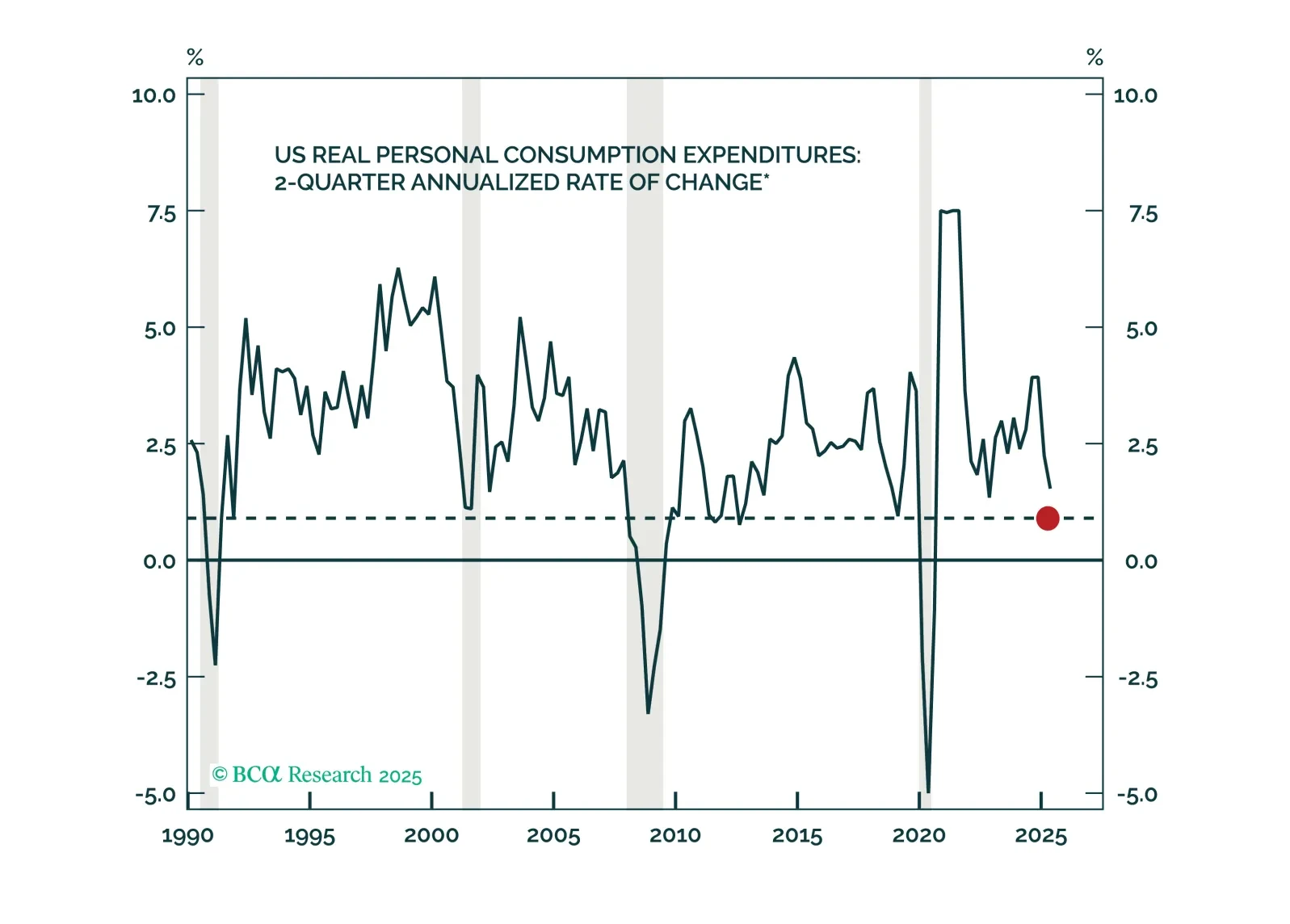

Détente between China and the US is a big deal. Economic data continues to give the Fed reasons to cut. What is there to be worried about? Very little. But we chew on some bearish thoughts as we start thinking about 2026.

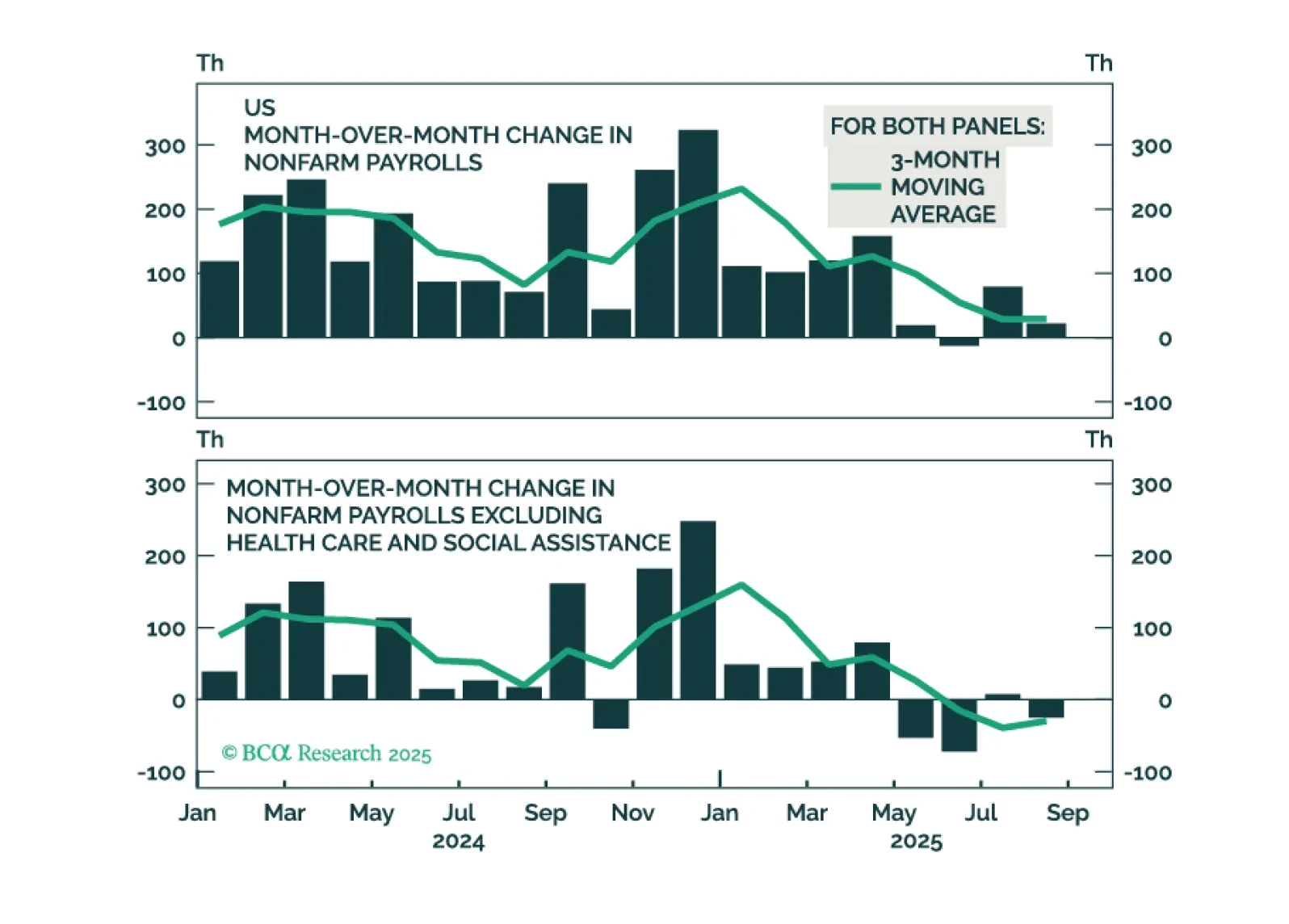

We discuss which variables we are tracking to assess the risks to the bull market in the absence of government data. So far, we do not see any obvious red flags. Remain overweight on equities and fixed income.

The rush to build AI infrastructure is based on a false premise: that there are significant advantages to being the first to come to market.

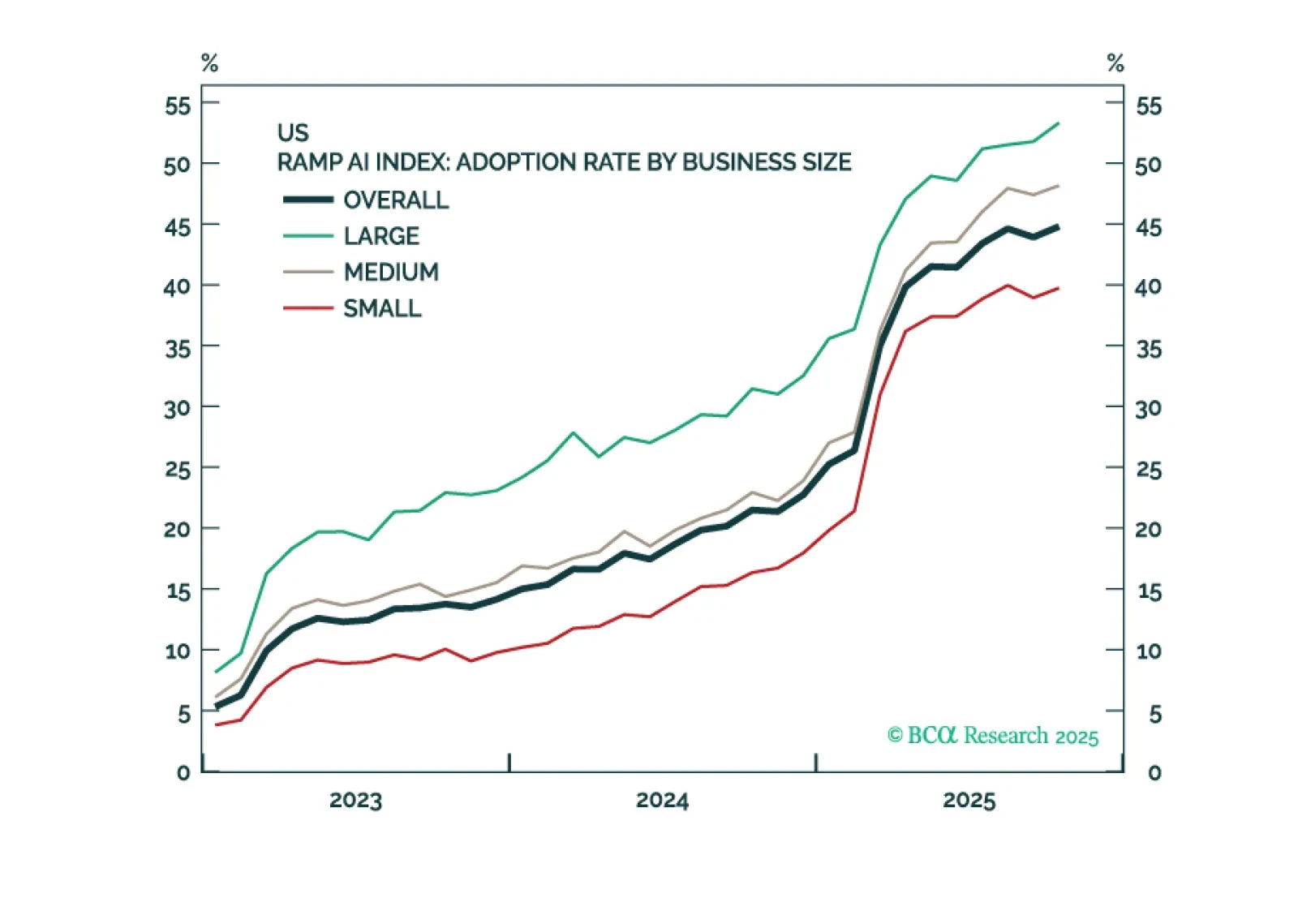

The most significant divide in the stock market and the economy is the gap between companies positioned to benefit from the AI boom and companies without a link to it. The former are surging while many of the latter are struggling.

Broad GenAI adoption and monetization, alongside falling inference costs, should make hyperscalers’ and enterprise investments worthwhile. While the GenAI boom echoes the dot-com era, it differs in key ways: Valuations are elevated…

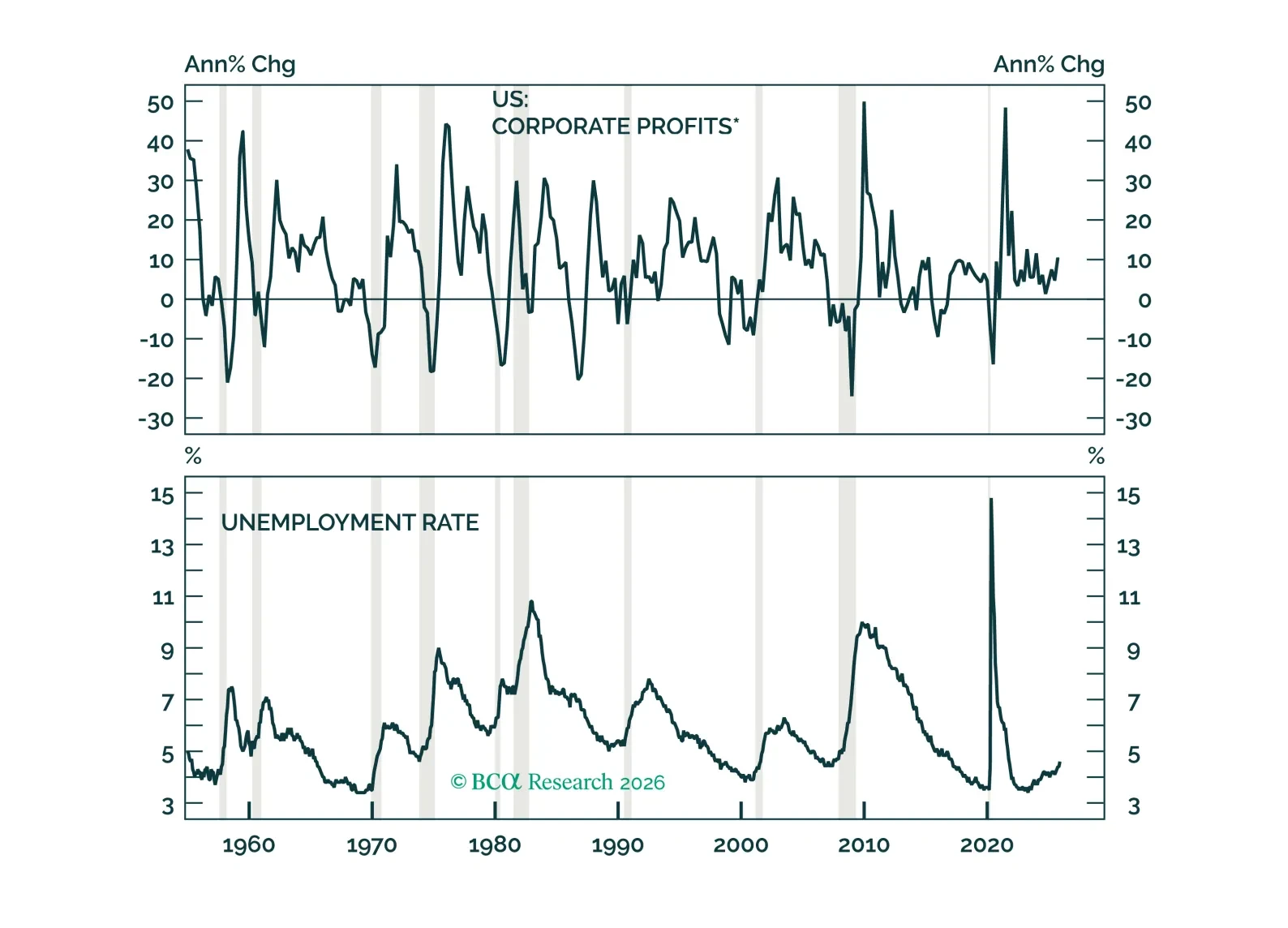

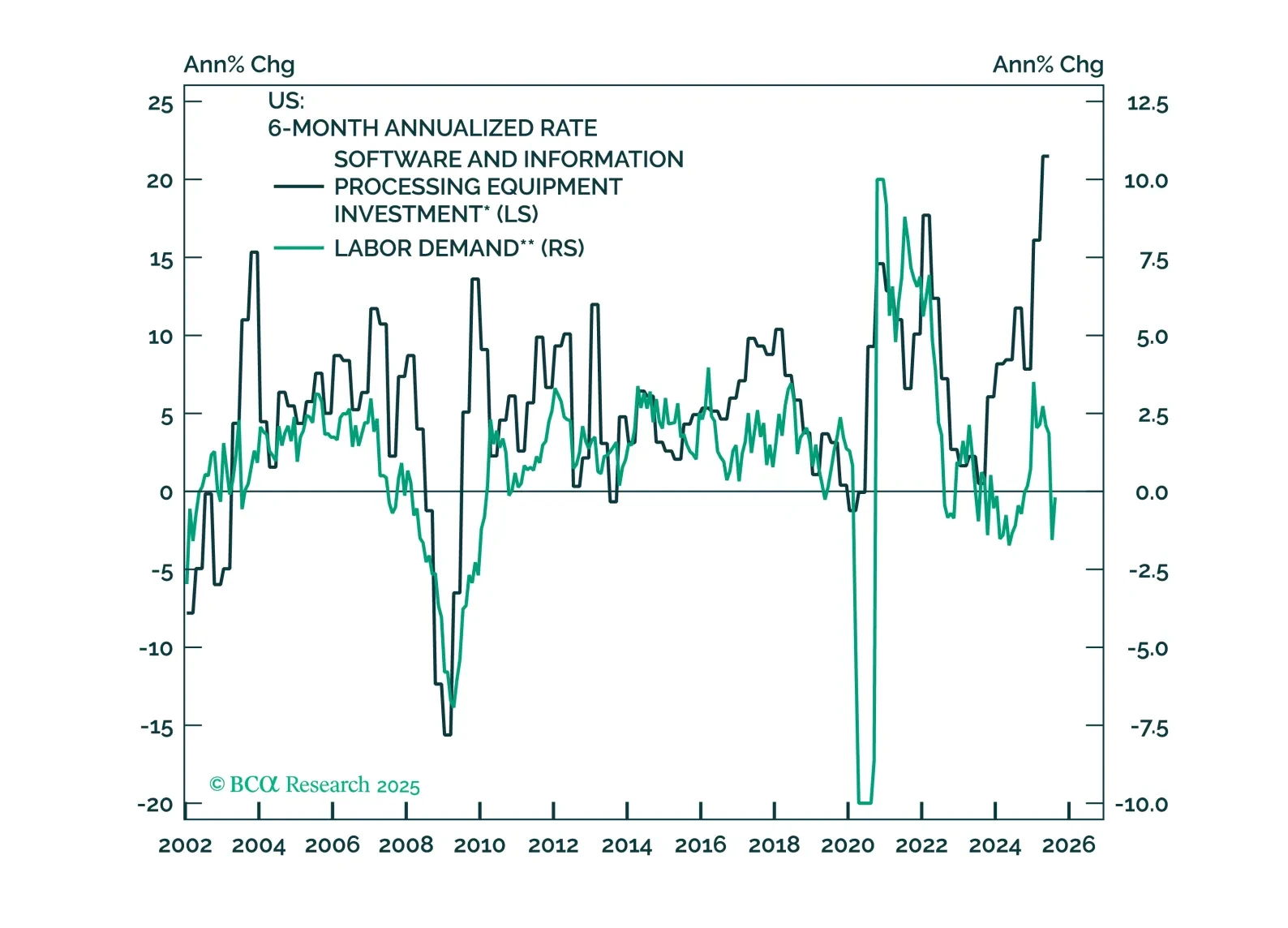

Big Tech and the Trump administration are engineering an industrial boom that favors American hardware over American workers. Economic growth will be robust in the US but the labor market will stay relatively sluggish. Adopt an…

While it is impossible to know exactly when global equities will peak, there are now enough vulnerabilities to justify keeping one’s finger near the eject button.