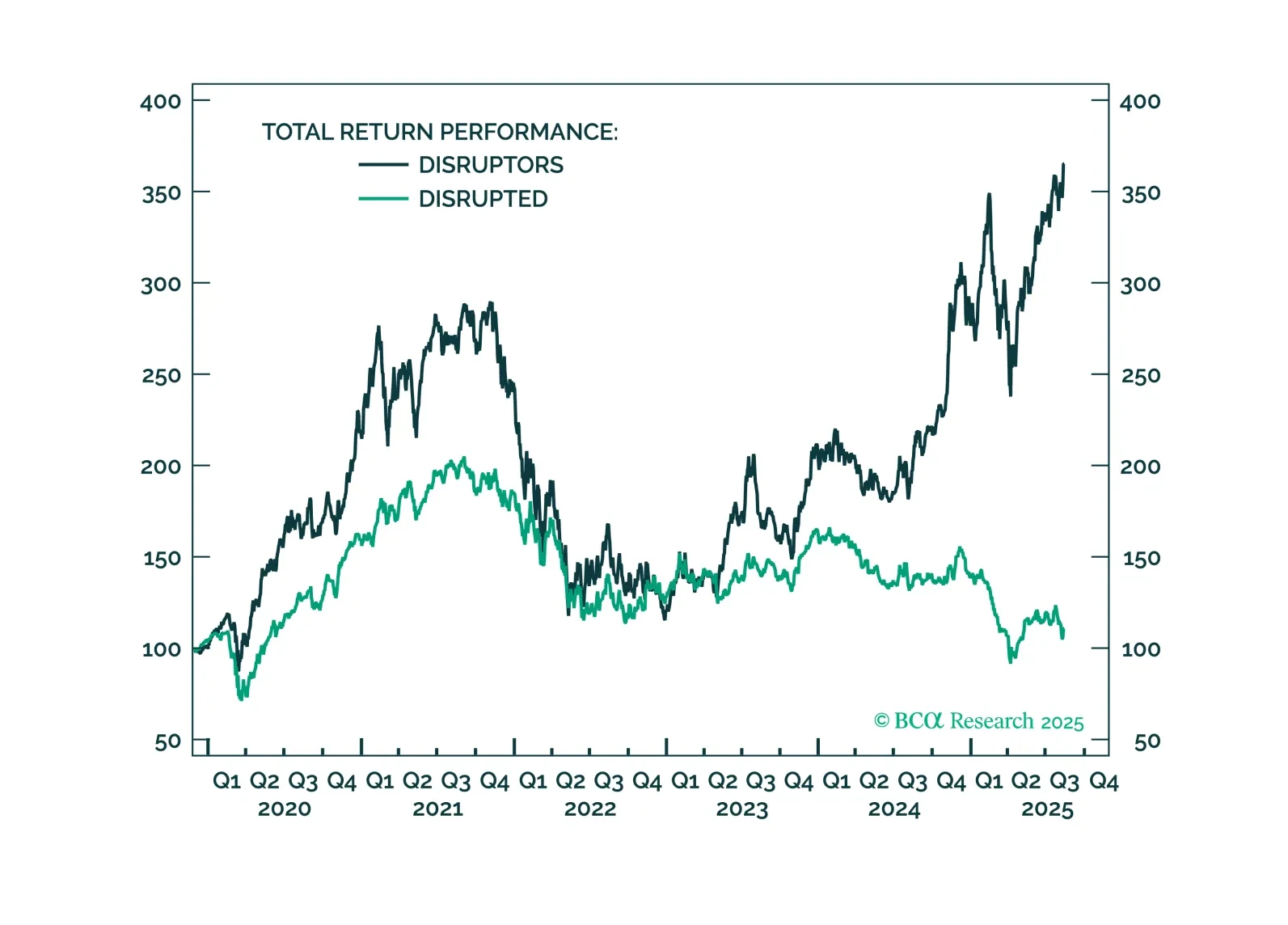

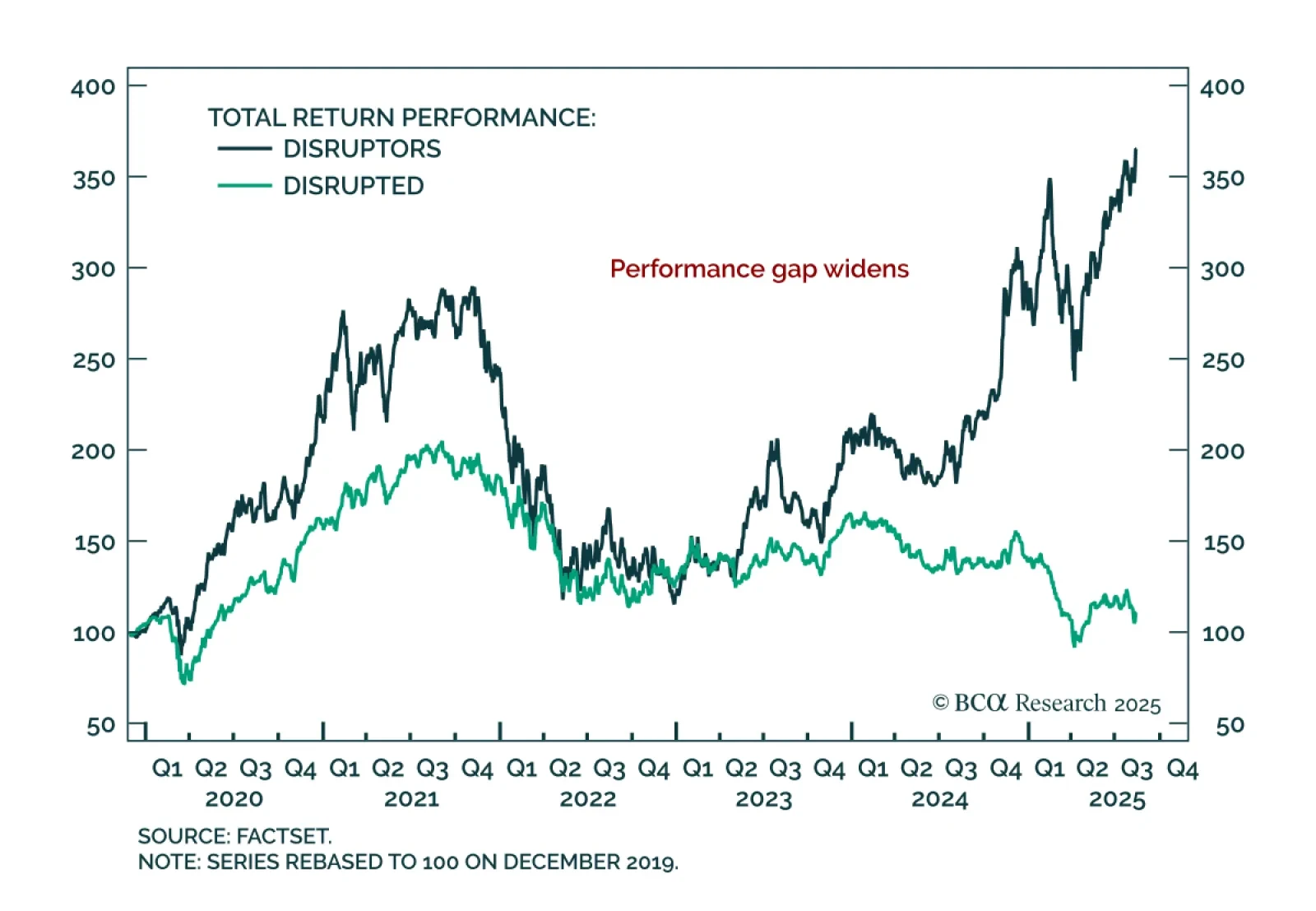

Our US Equity strategists recommend favoring their “disruptors” over the “disrupted” stock basket as GenAI momentum builds across industries. Adoption remains in the early stages but is set to accelerate as foundational models…

GenAI momentum is building. Many companies are already reaping benefits from the technology. GenAI is disrupting entire industries, such as education, image generation, and staffing. Investors should prefer our “disruptors” basket…

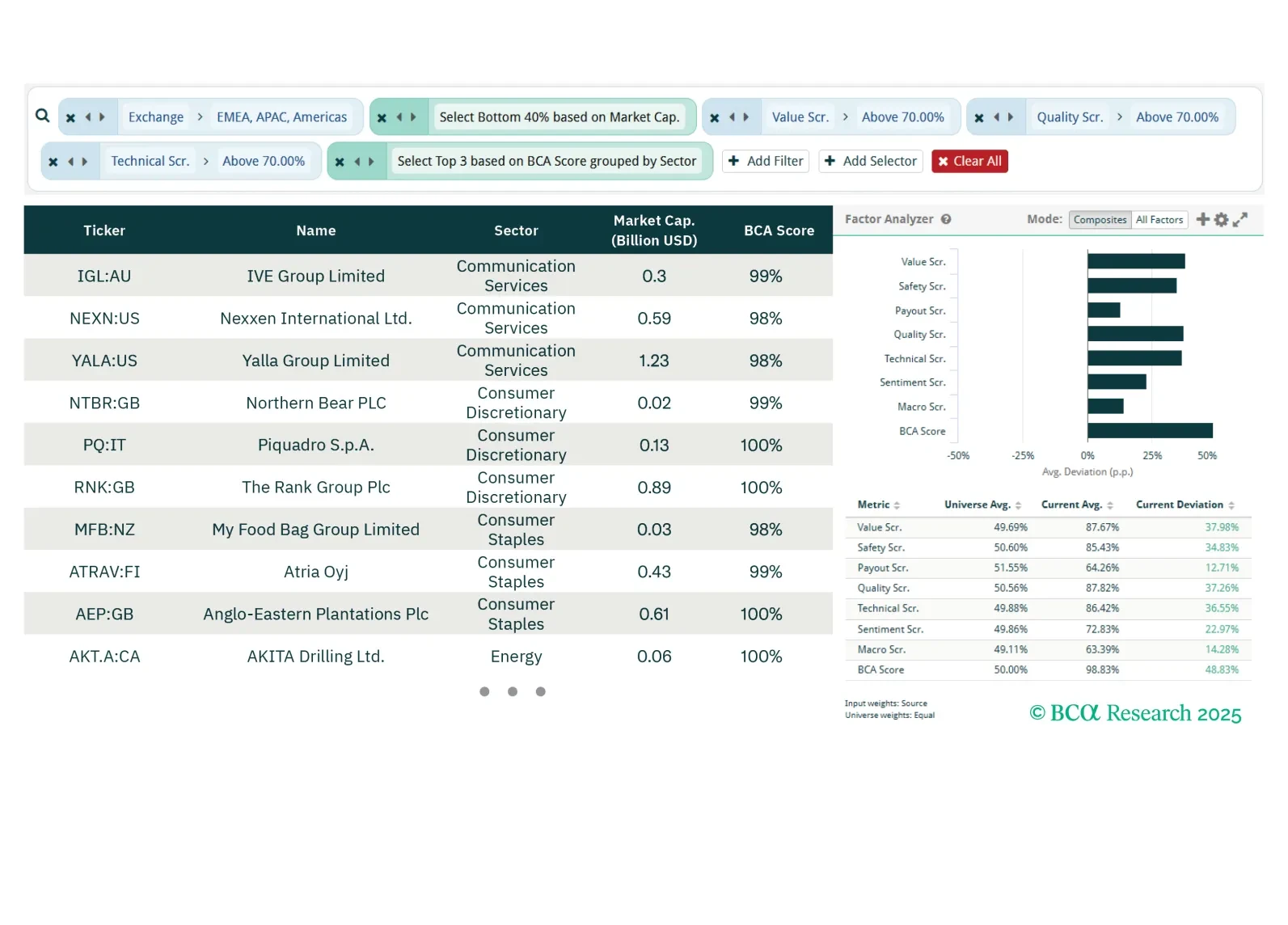

This week our three screeners highlight plays in global small-cap value stocks, gold miners, and stocks exposed to an exciting structural investment theme: Space.

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

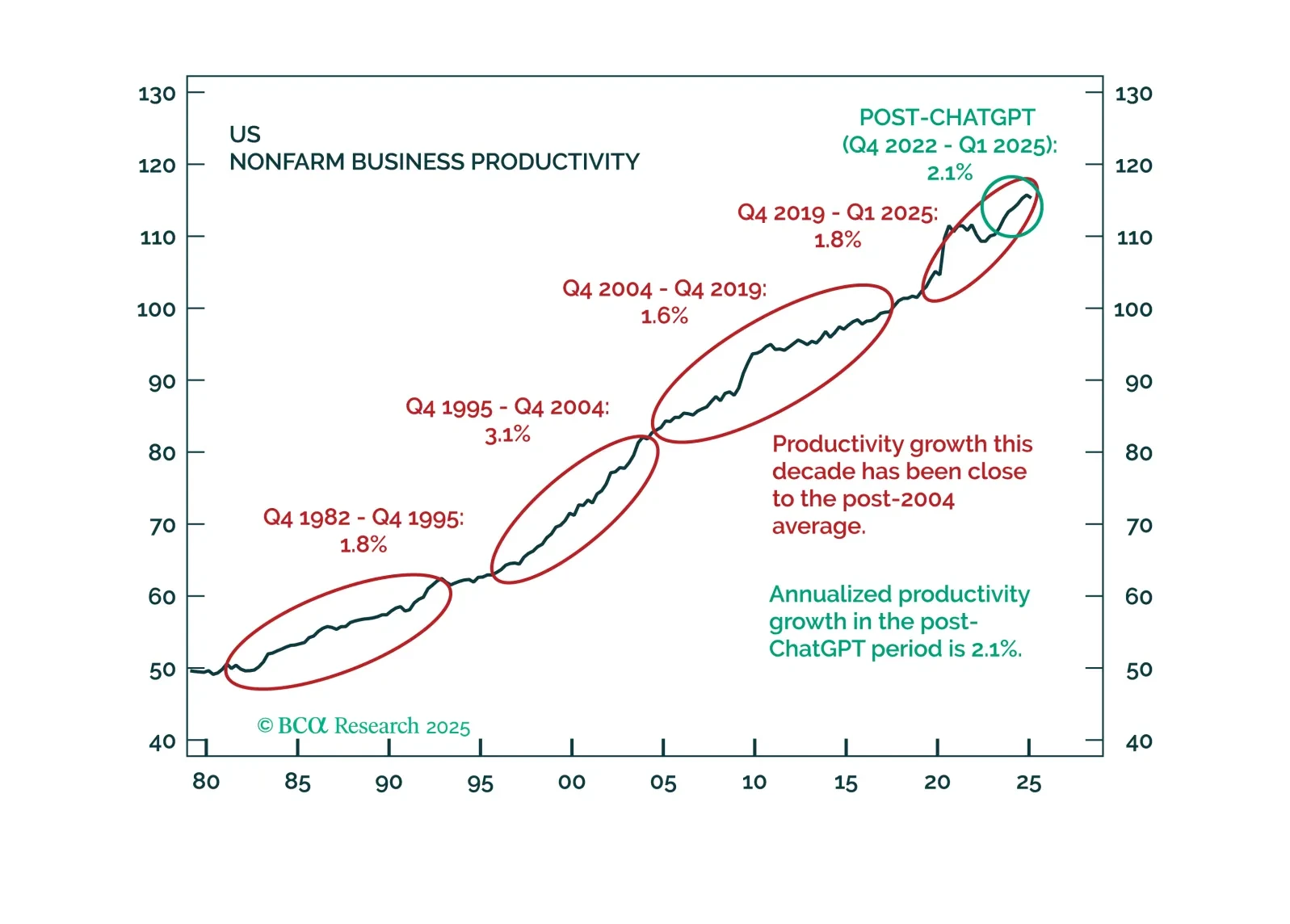

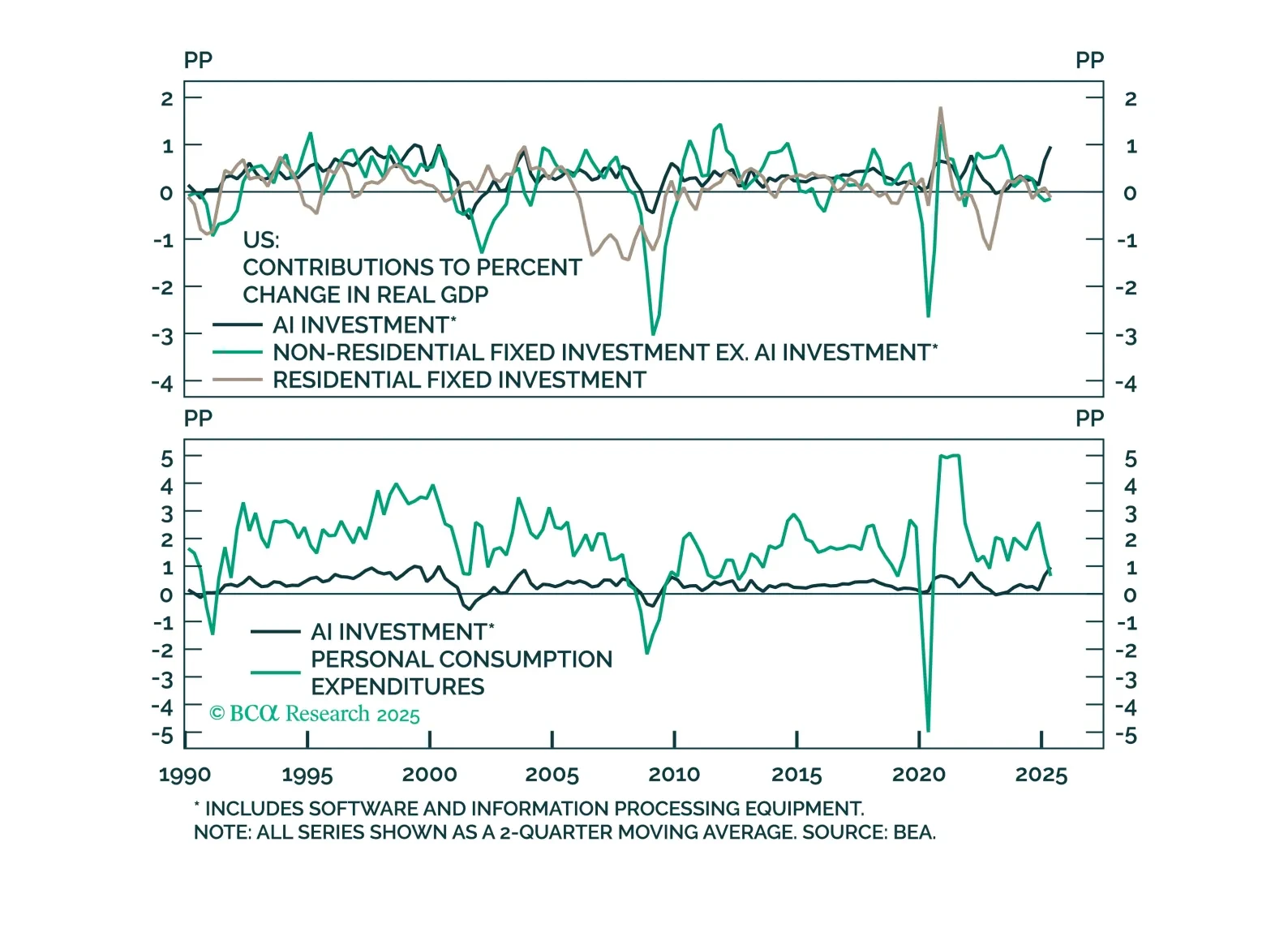

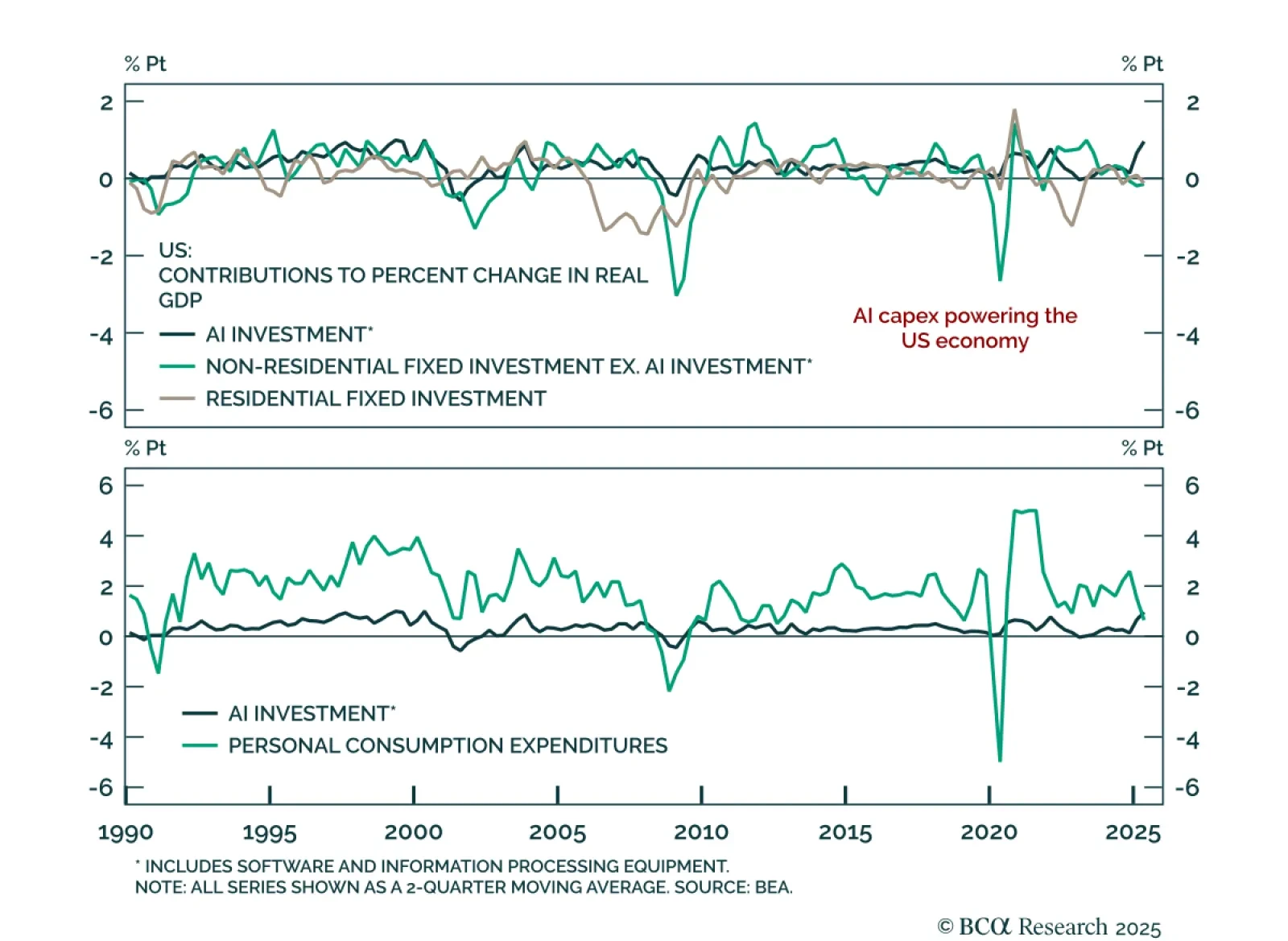

AI capex has emerged as the dominant driver of US growth in 2025, reshaping both macro dynamics and equity strategy. Our Chart Of The Week comes from Juan Correa, Chief Strategist for Global Asset Allocation.Over the first half of…

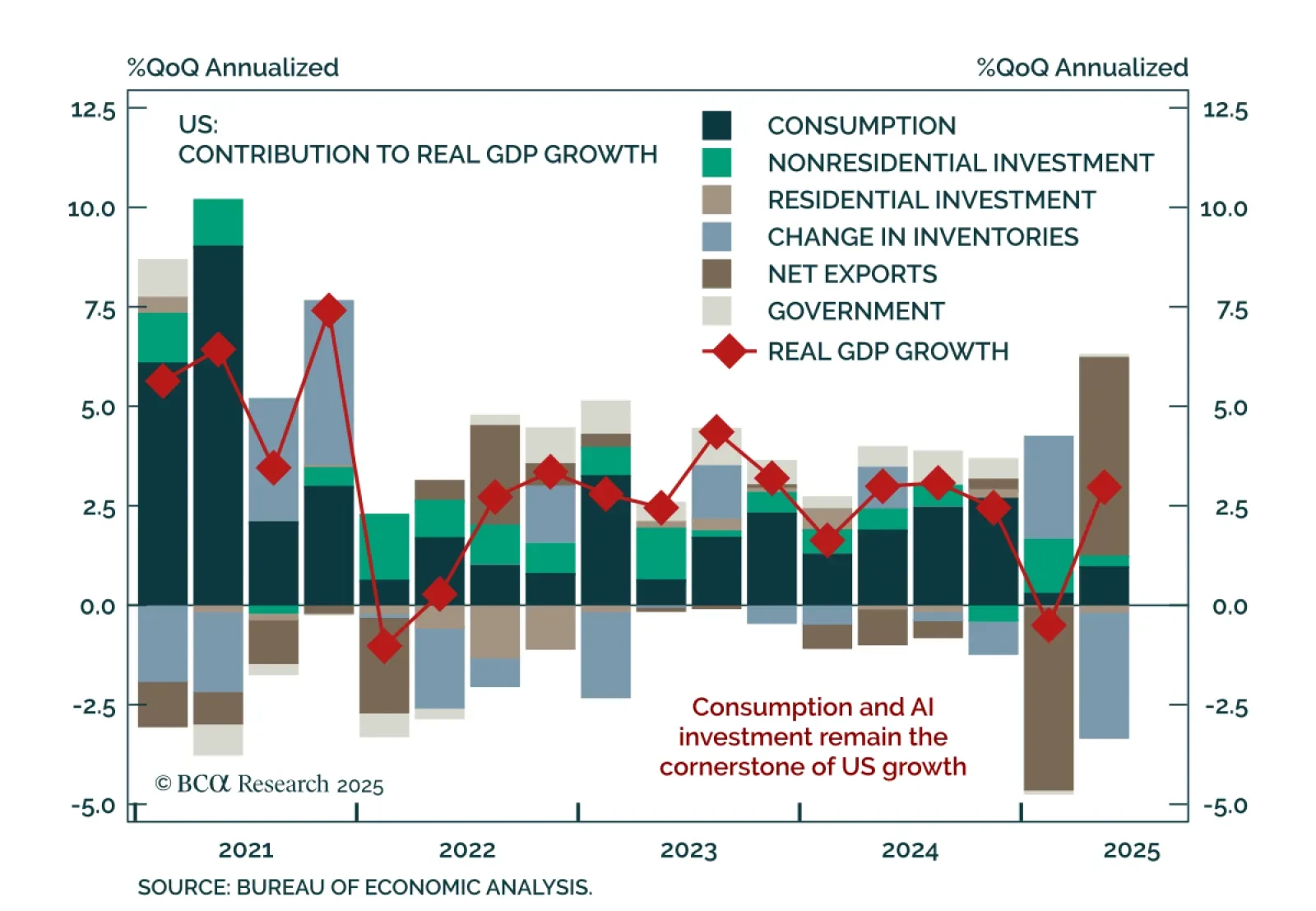

Over the first half of 2025, AI capex outpaced both consumption and all other investments in its contribution to US growth. Like all other capex cycles this one will end in tears. However, the indicators we track suggest that AI…

Q2 US GDP beat expectations at 3.0% annualized, but the underlying data confirm that growth momentum is fading, reinforcing our defensive stance. Consumption rebounded, but disappointed at 1.4%. The quarter was heavily distorted by…

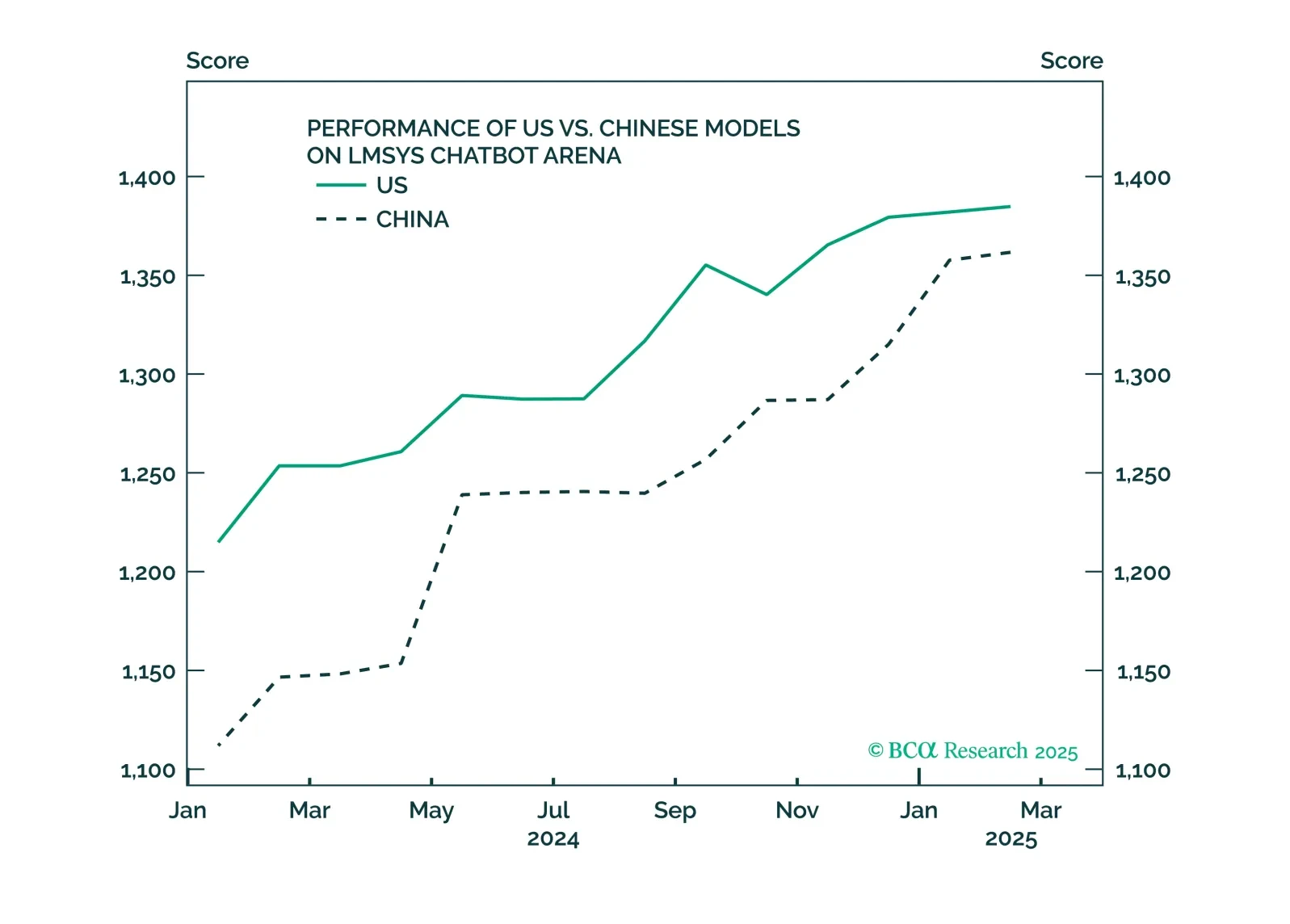

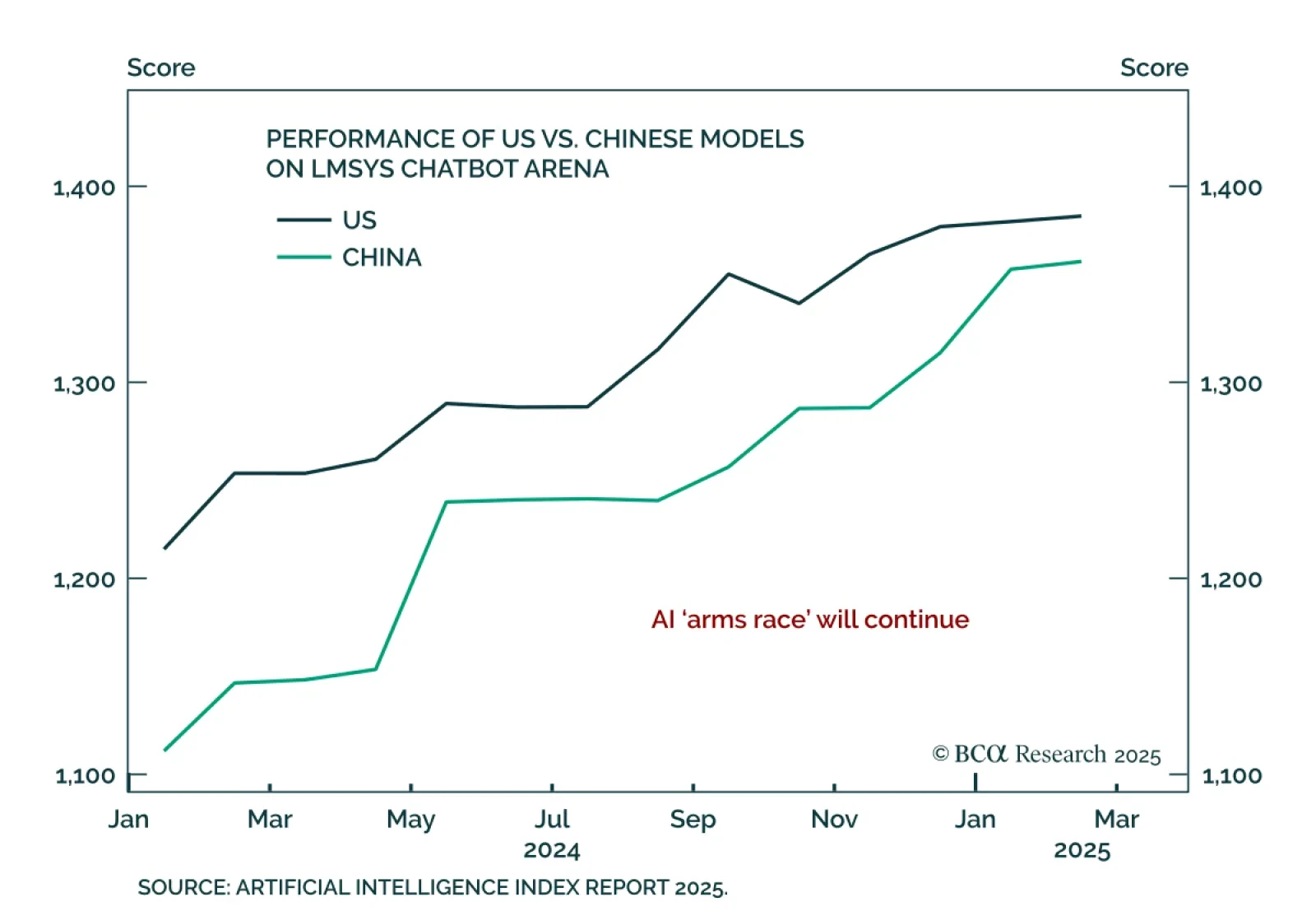

BCA’s Geopolitical strategists argue that artificial intelligence will destabilize both domestic politics and international security, prompting more aggressive fiscal responses. President Trump’s July 23 executive orders to…

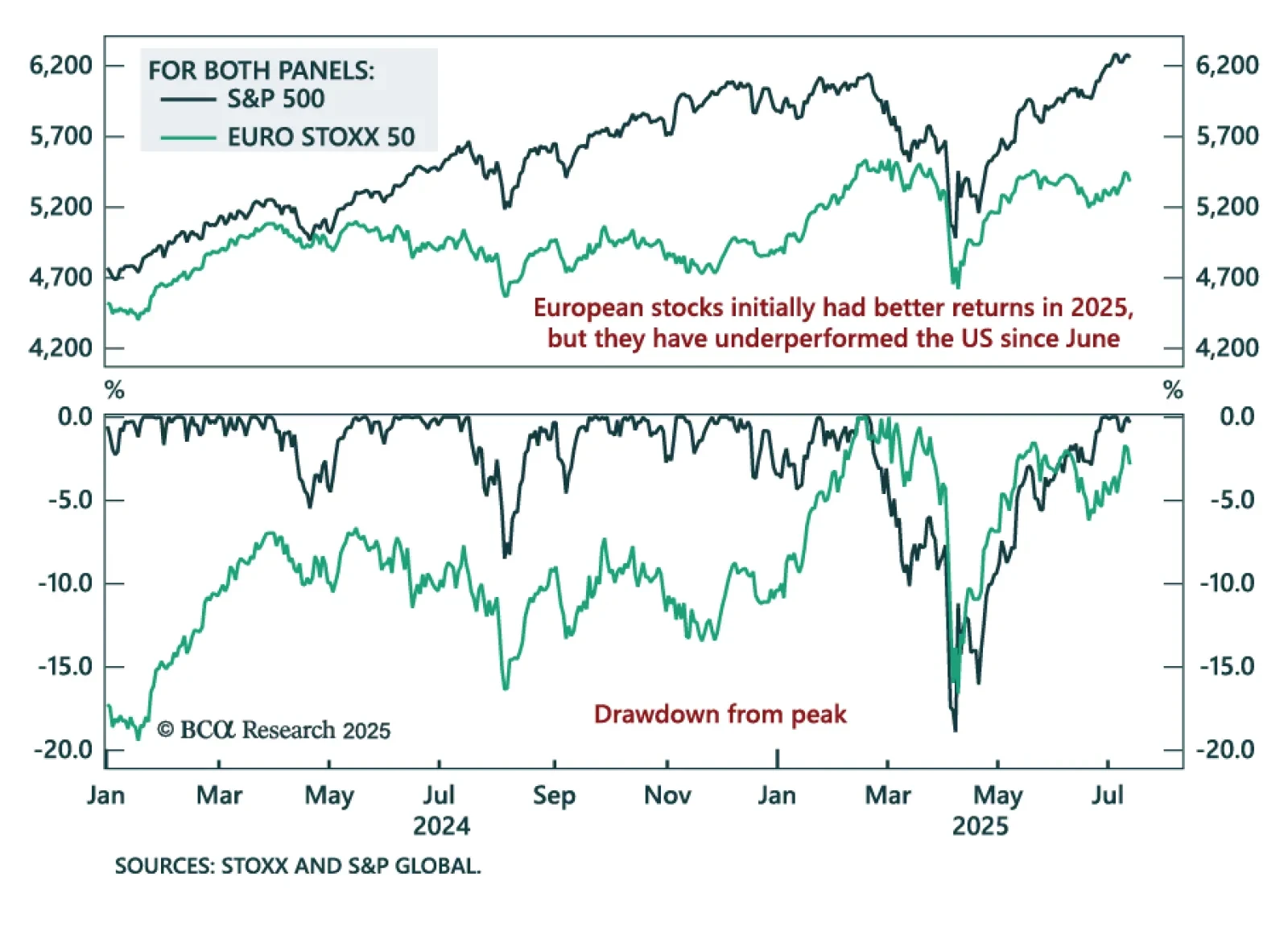

European equities have recently lagged the S&P 500, with short-term risks building despite a constructive long-term outlook. After reaching all-time highs in February, the EURO STOXX 50 began to stall as US markets sold off on…