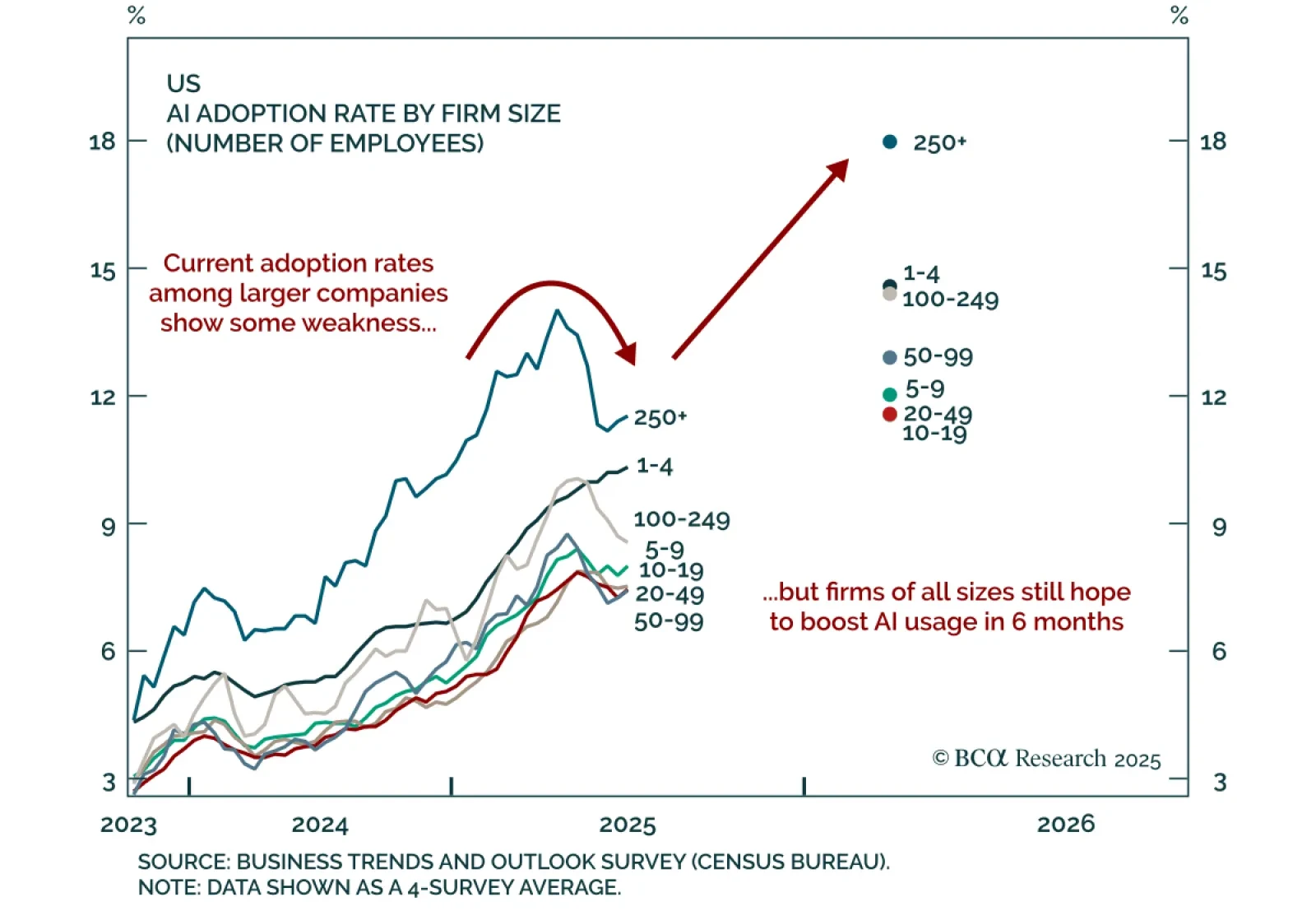

AI adoption momentum has cooled recently among the largest US companies, although firms of all sizes still expect to increase their usage over the next six months. Our Chart Of The Week comes from Miroslav Aradski of BCA…

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

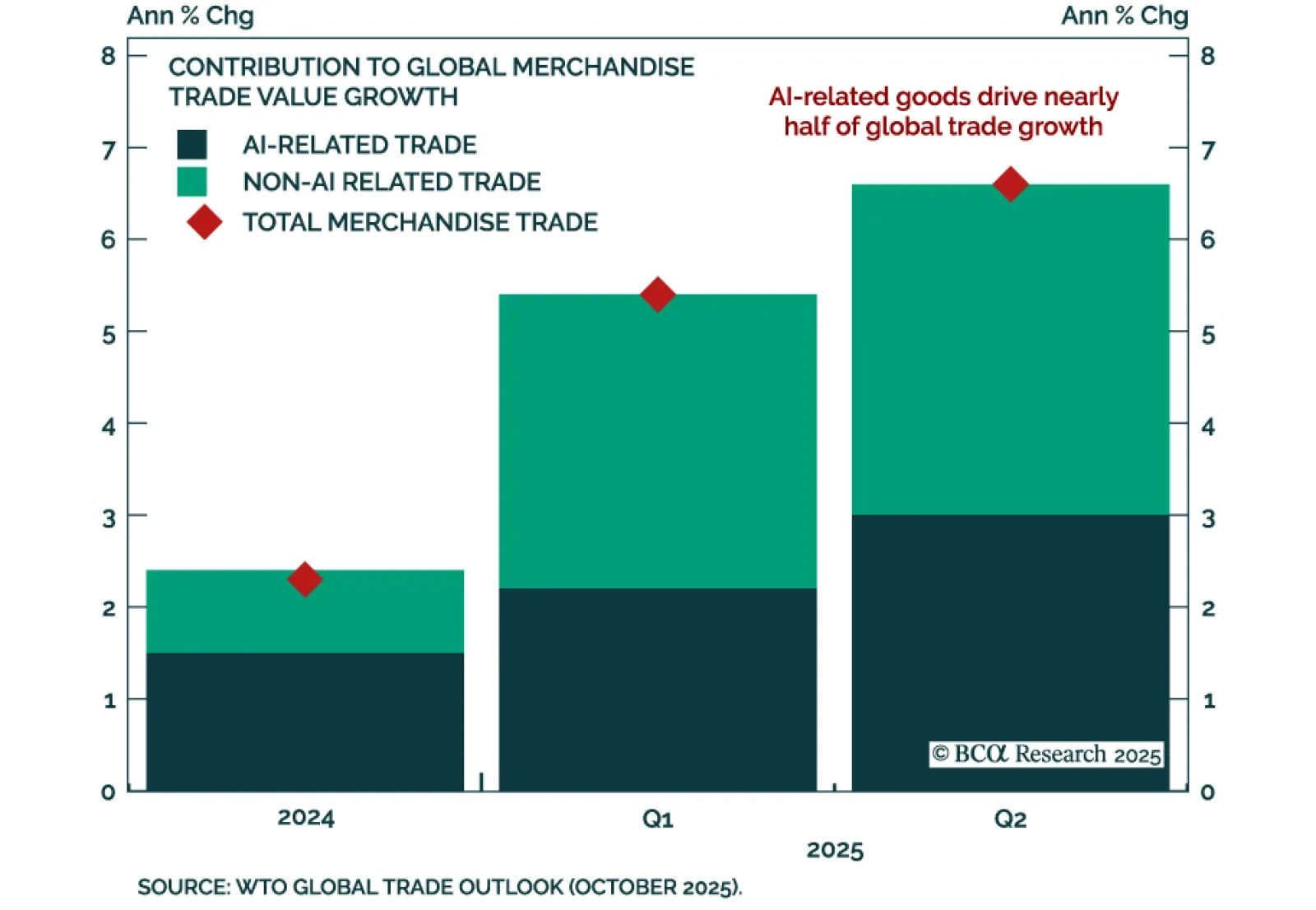

AI-related trade and frontloading lifted global trade growth in 2025 but also increased the risk of a slowdown next year, according to the WTO’s latest Global Trade Outlook. The organization sharply revised up its forecast for 2025…

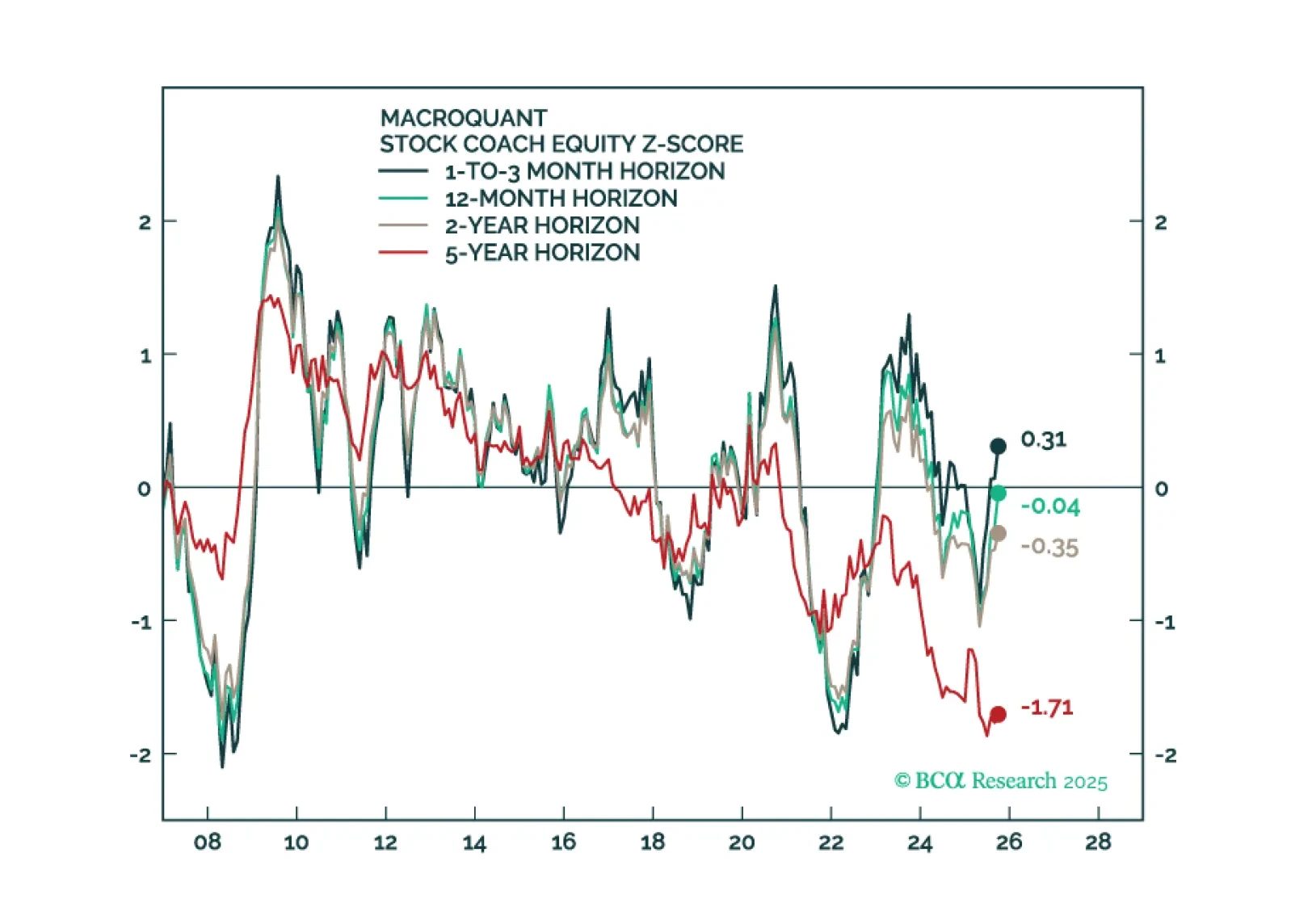

We remain bullish both bonds and equities, but conviction is falling. We are Luddites when it comes to the AI theme, but we have followed it regardless. A bubble is a bubble, not to be shorted. Yet Europe’s weak AI returns reveal…

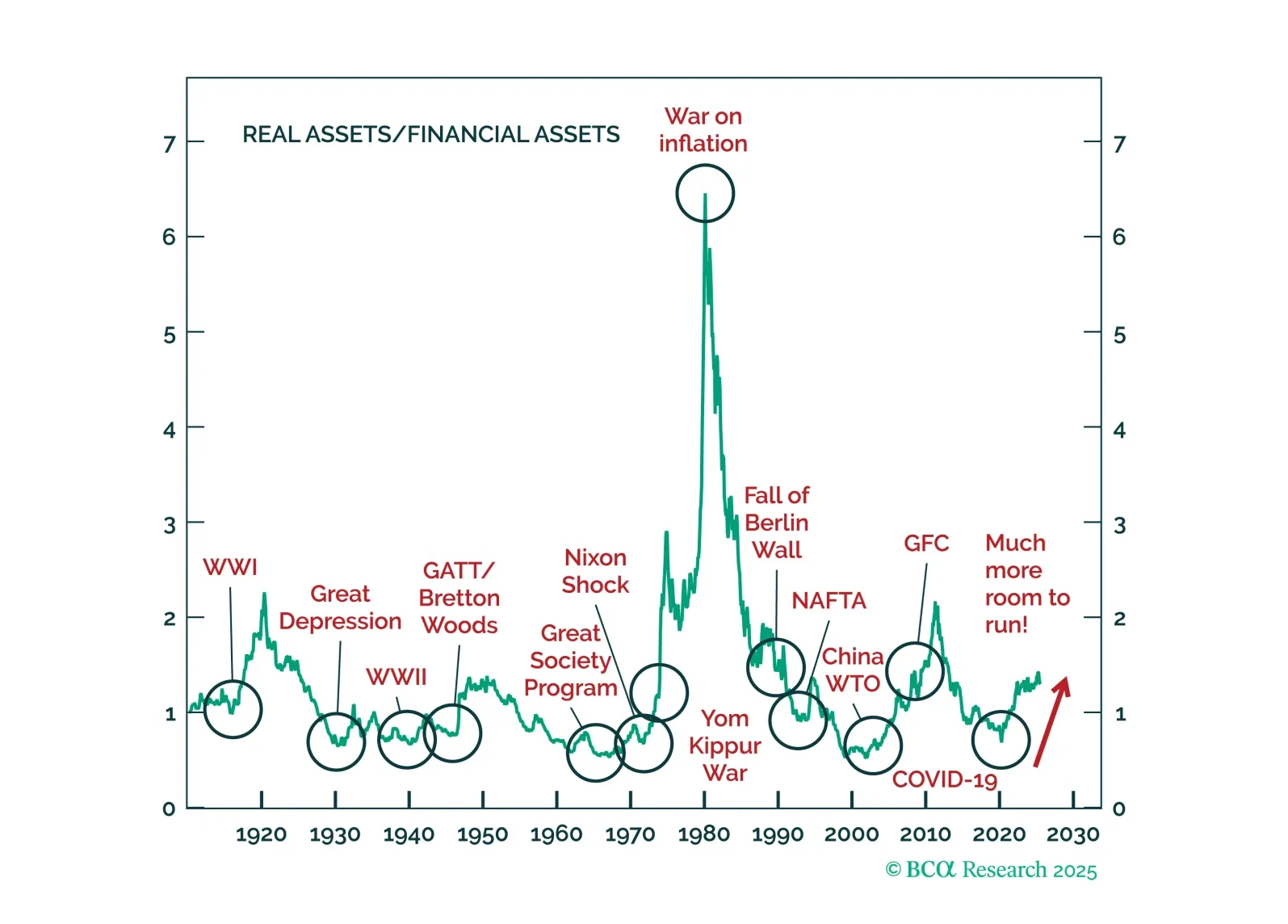

Our Global Asset Allocation strategists recommend overweights in both equities and fixed income, underweight cash, and get exposure to the AI-driven US boom through Industrials. Big Tech and the Trump administration are driving a…

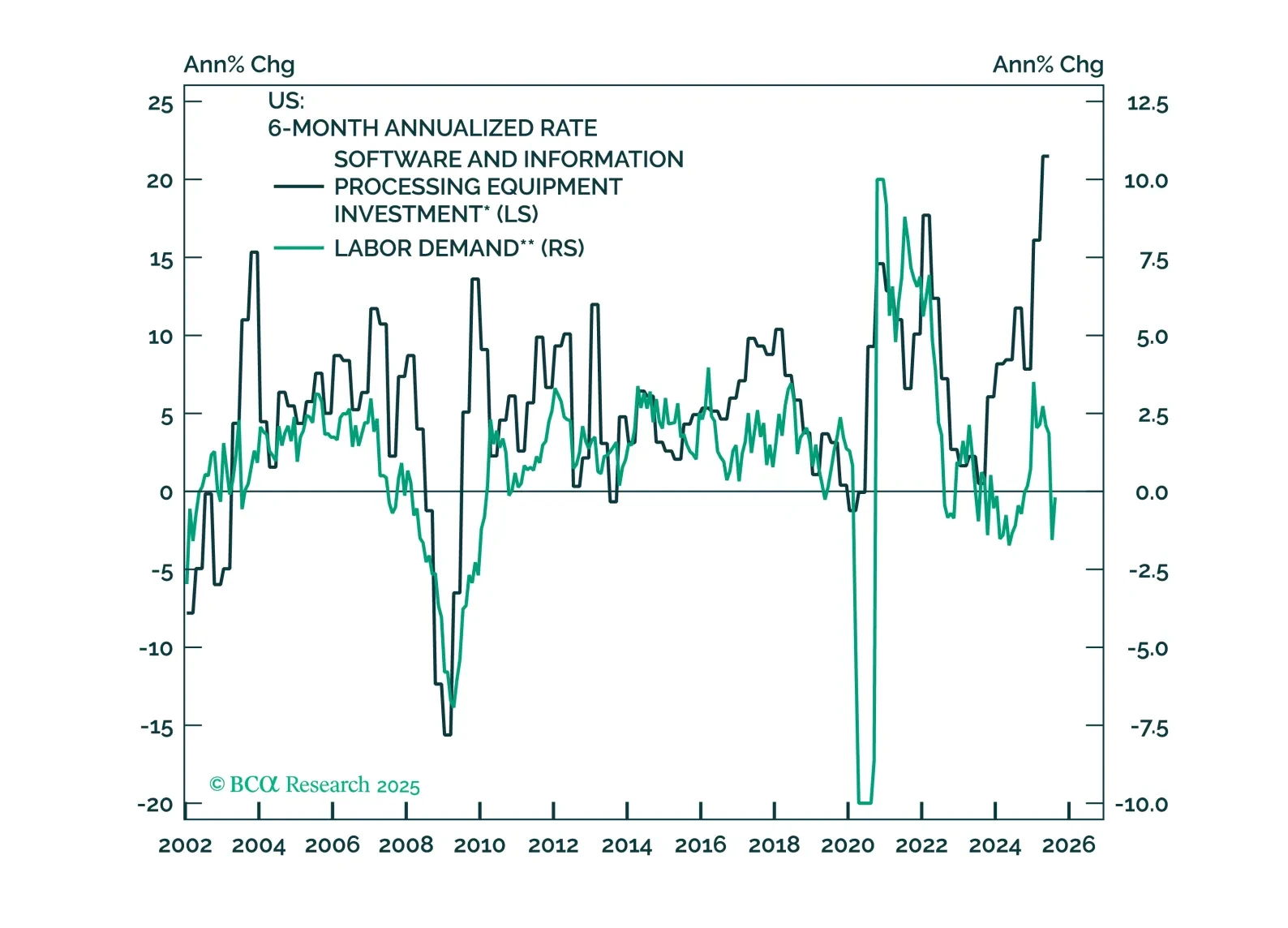

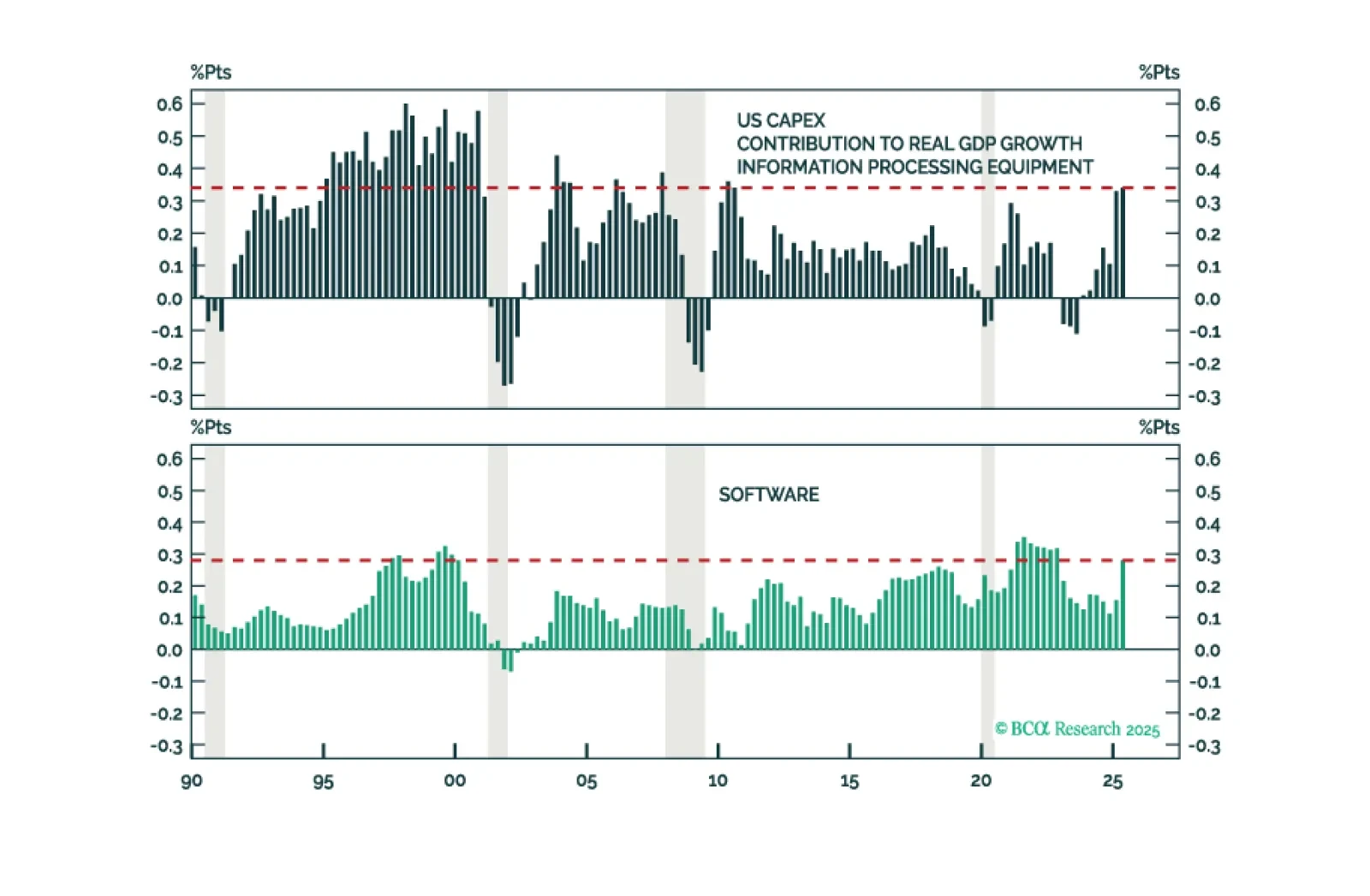

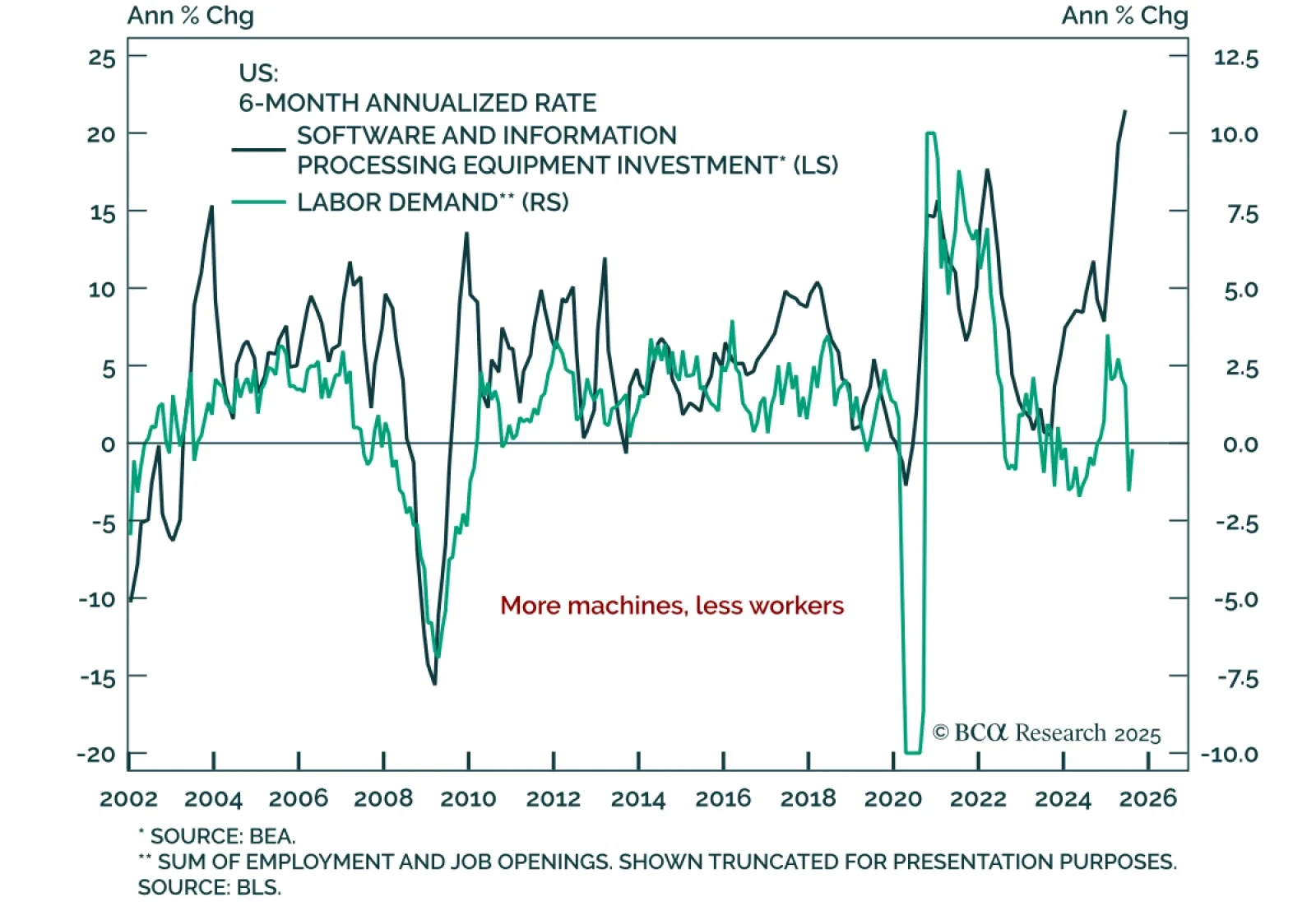

Big Tech and the Trump administration are engineering an industrial boom that favors American hardware over American workers. Economic growth will be robust in the US but the labor market will stay relatively sluggish. Adopt an…

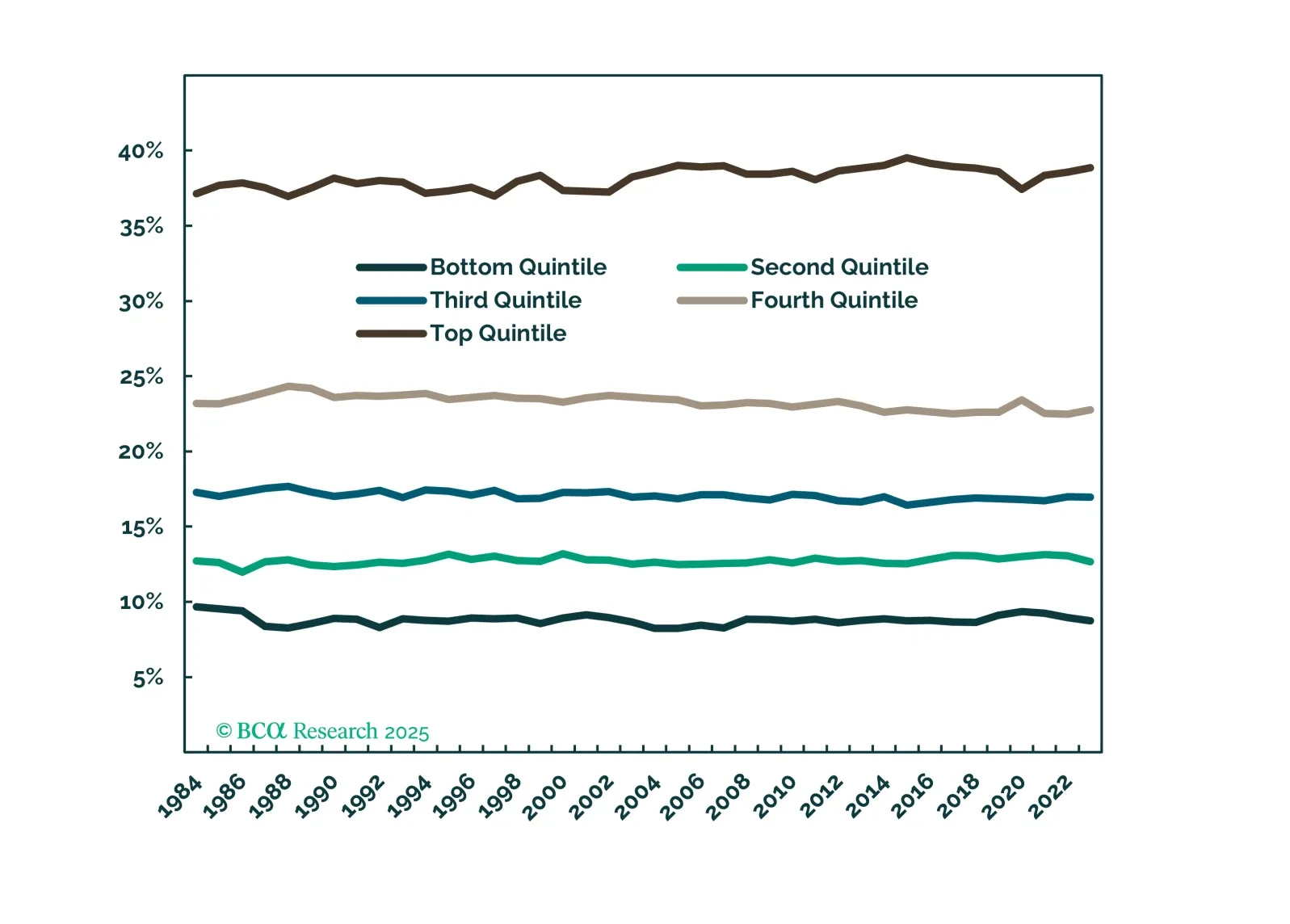

While it is not yet time to bet against risk assets, we push back on the increasingly popular ideas that the wealthiest households and/or AI-related capex can keep the expansion going despite the wobbling labor market.

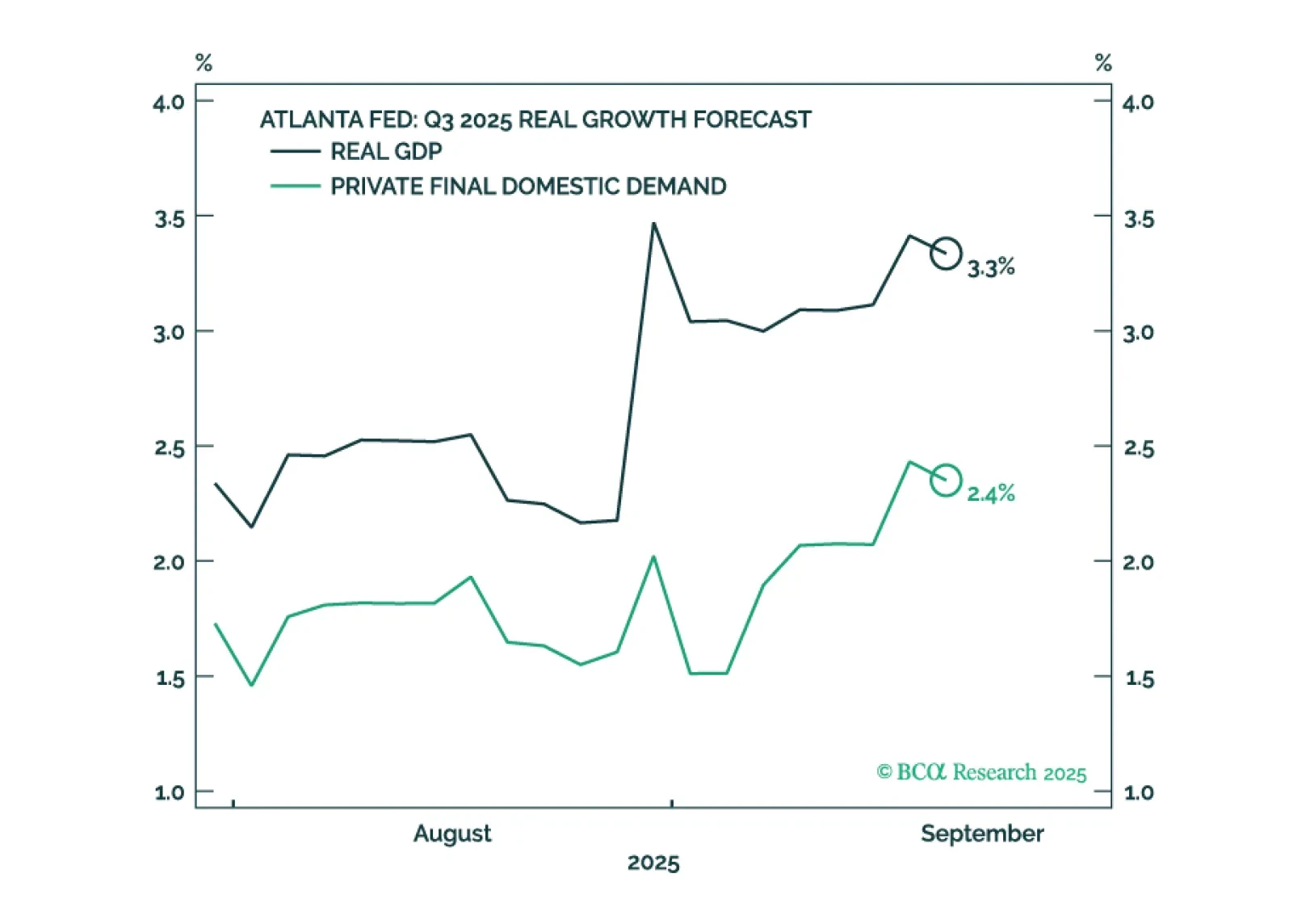

US GDP growth appears to have accelerated even as employment growth has faltered. We will make a final decision in early October when we publish our next Strategy Outlook, but most likely, we will cut our 12-month US recession…

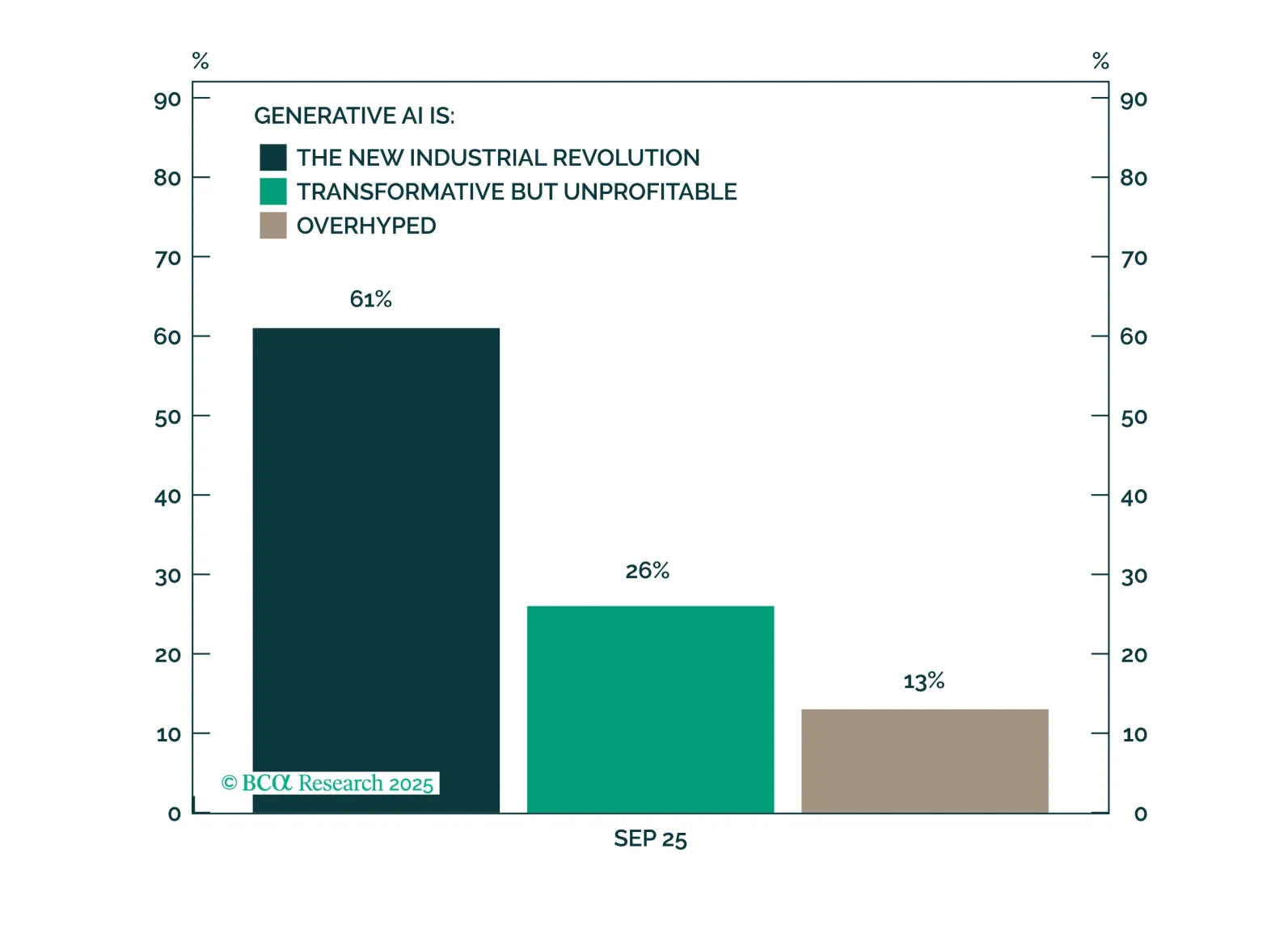

According to our latest client poll, most respondents are optimistic about the Generative AI's potential. Investors remain divided on whether current equity valuations reflect a bubble. Economic concerns continue to center on bond…