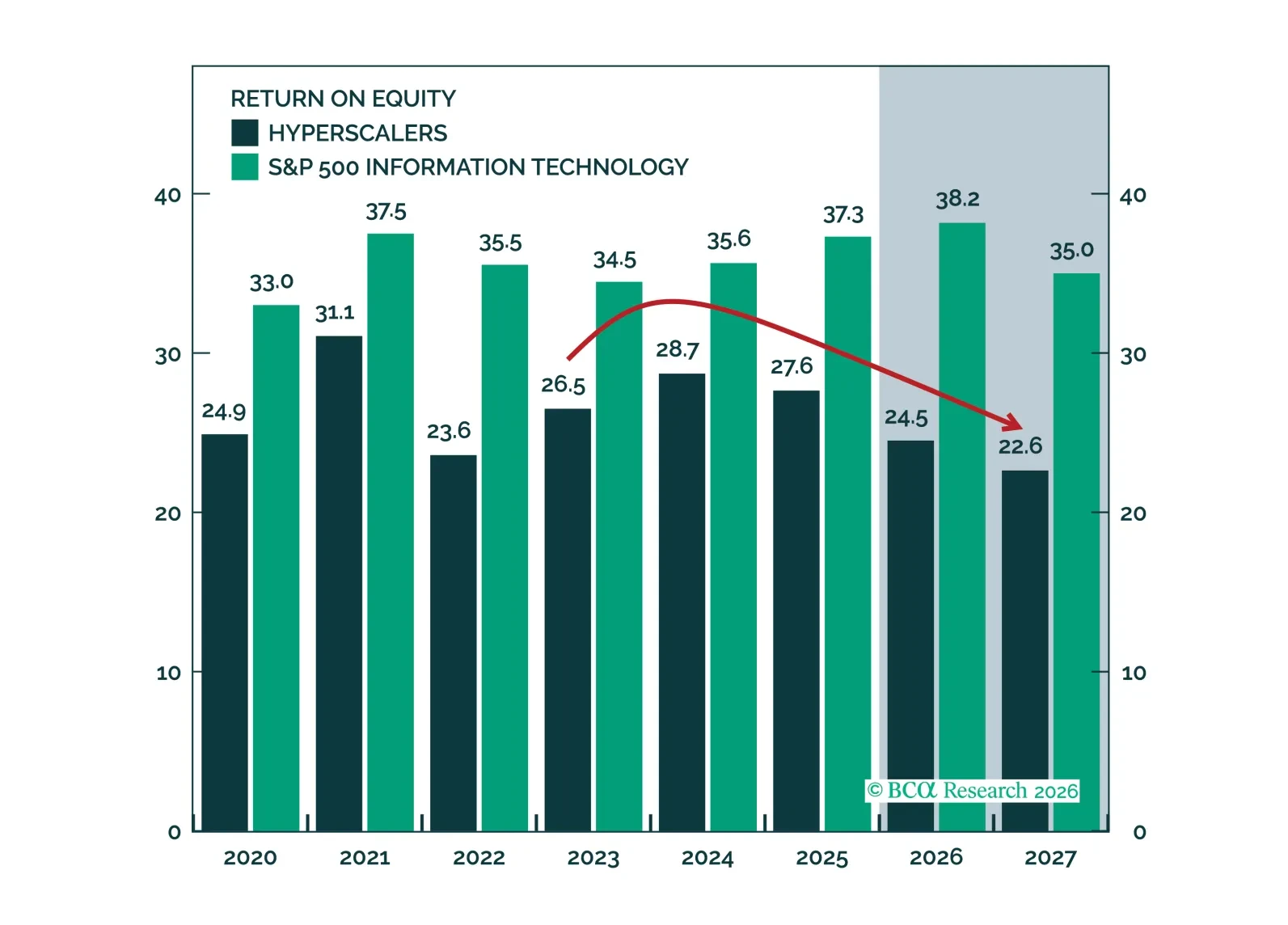

The capex debate is better framed not as boom versus bubble, but as around capacity, leverage, and cash conversion. ROEs have compressed, but revenue growth and margin expansion offer a credible path back. Spenders likely have time…

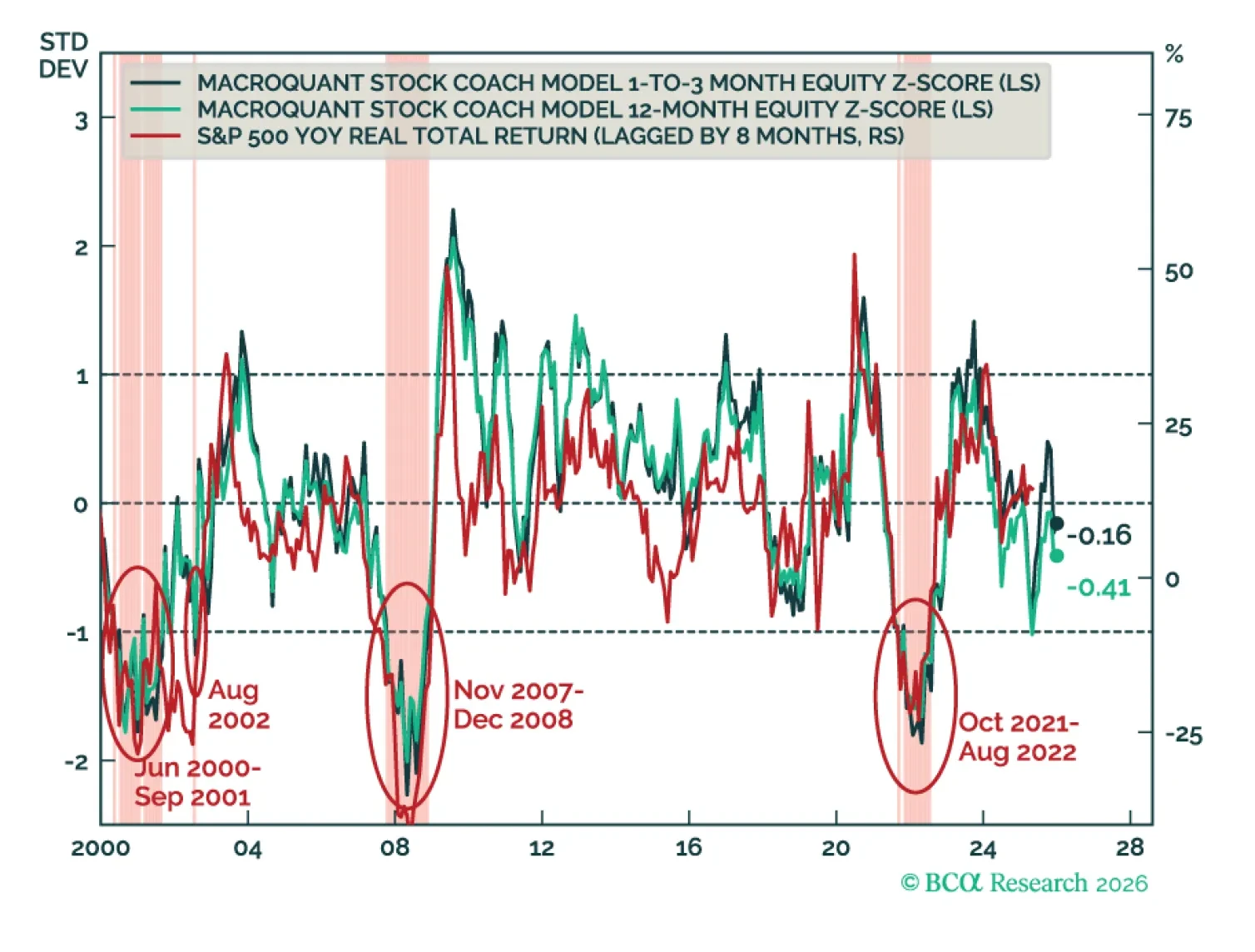

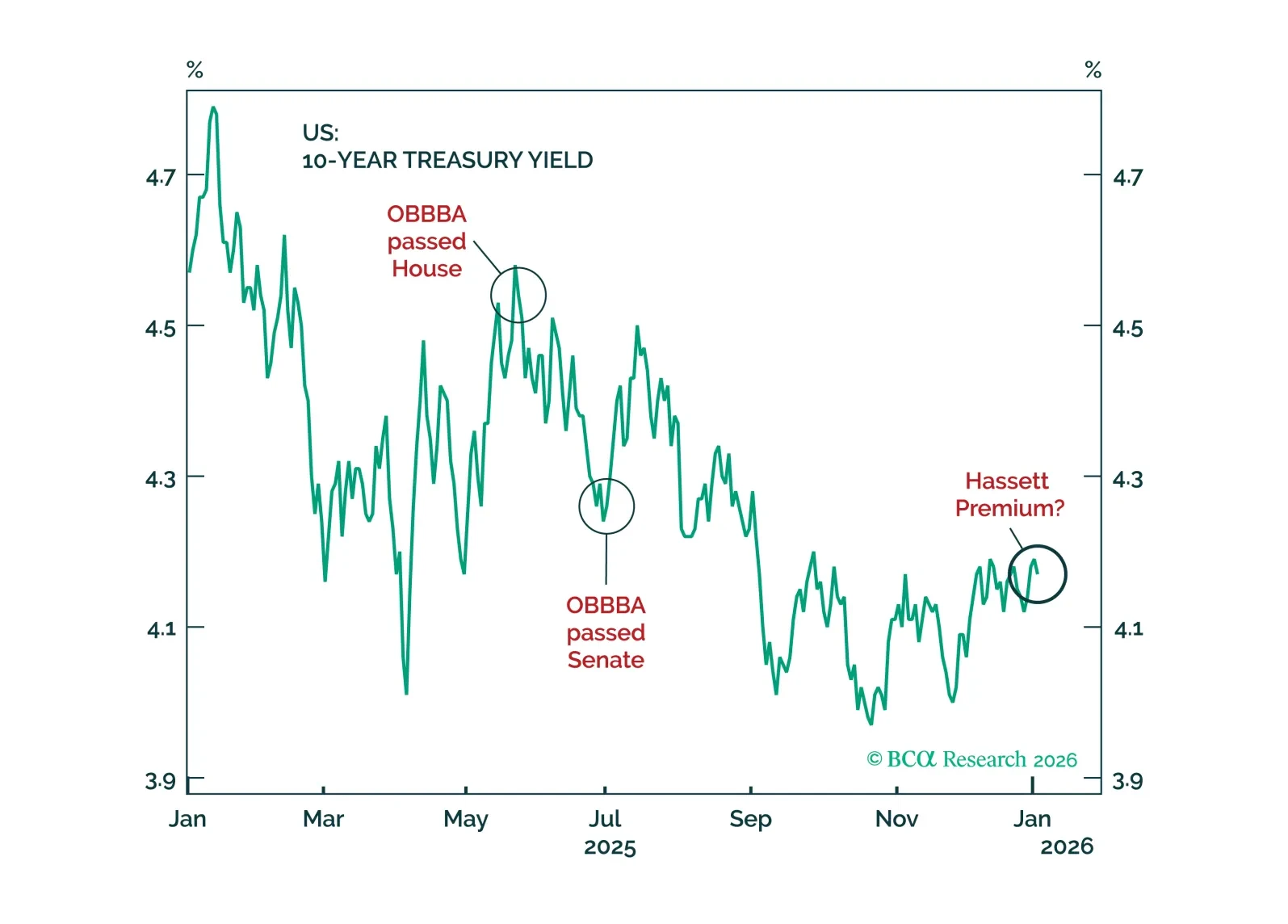

MacroQuant recommends a slight underweight in equities, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, has upgraded oil and copper to overweight, and is bullish on gold.

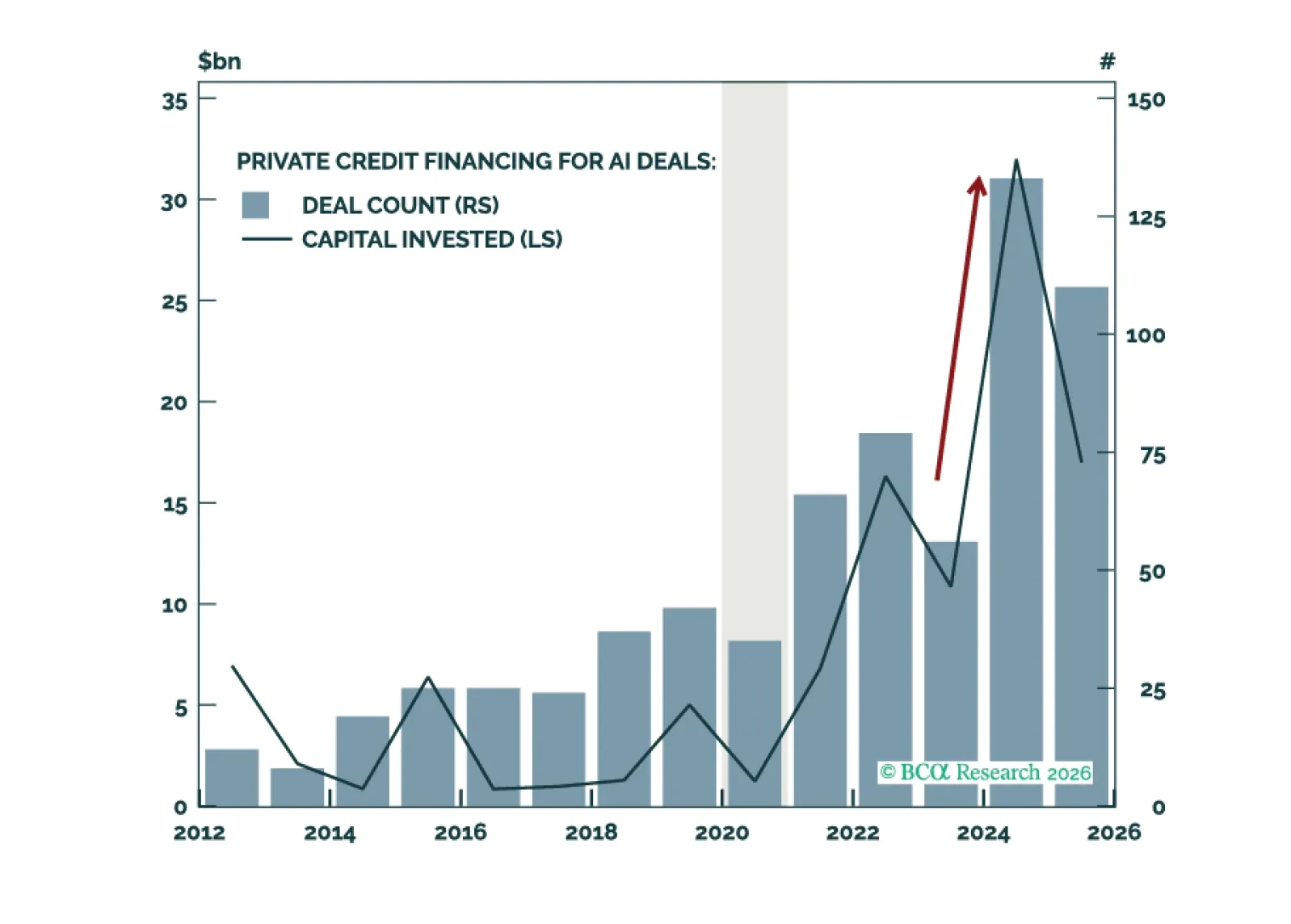

The AI trade has broadened beyond Public Markets, pulling Private Credit deeper into the ecosystem. Investors are right to understand their overlapping exposures between Public Equities, Venture Capital, Data Centers, and now Private…

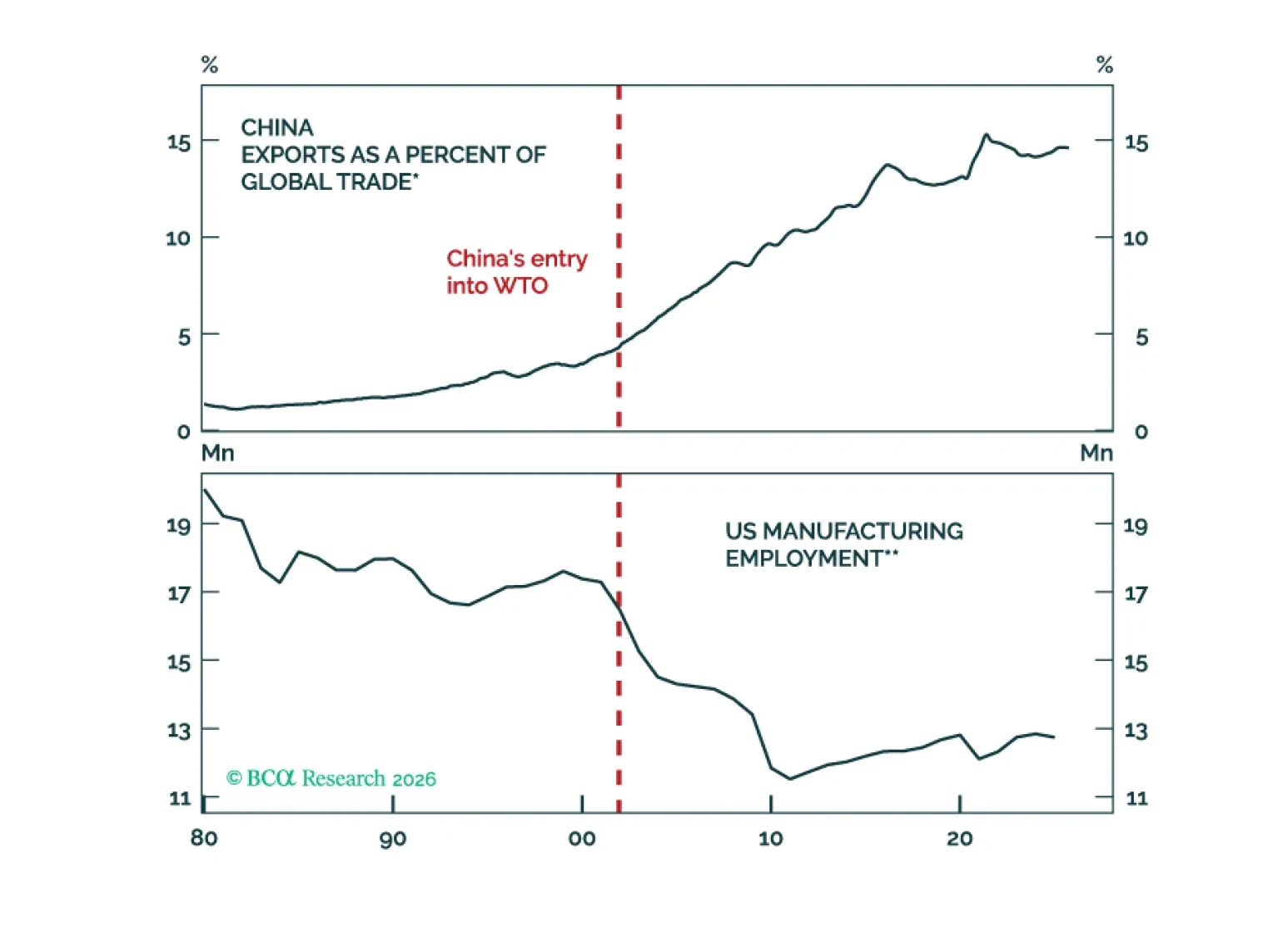

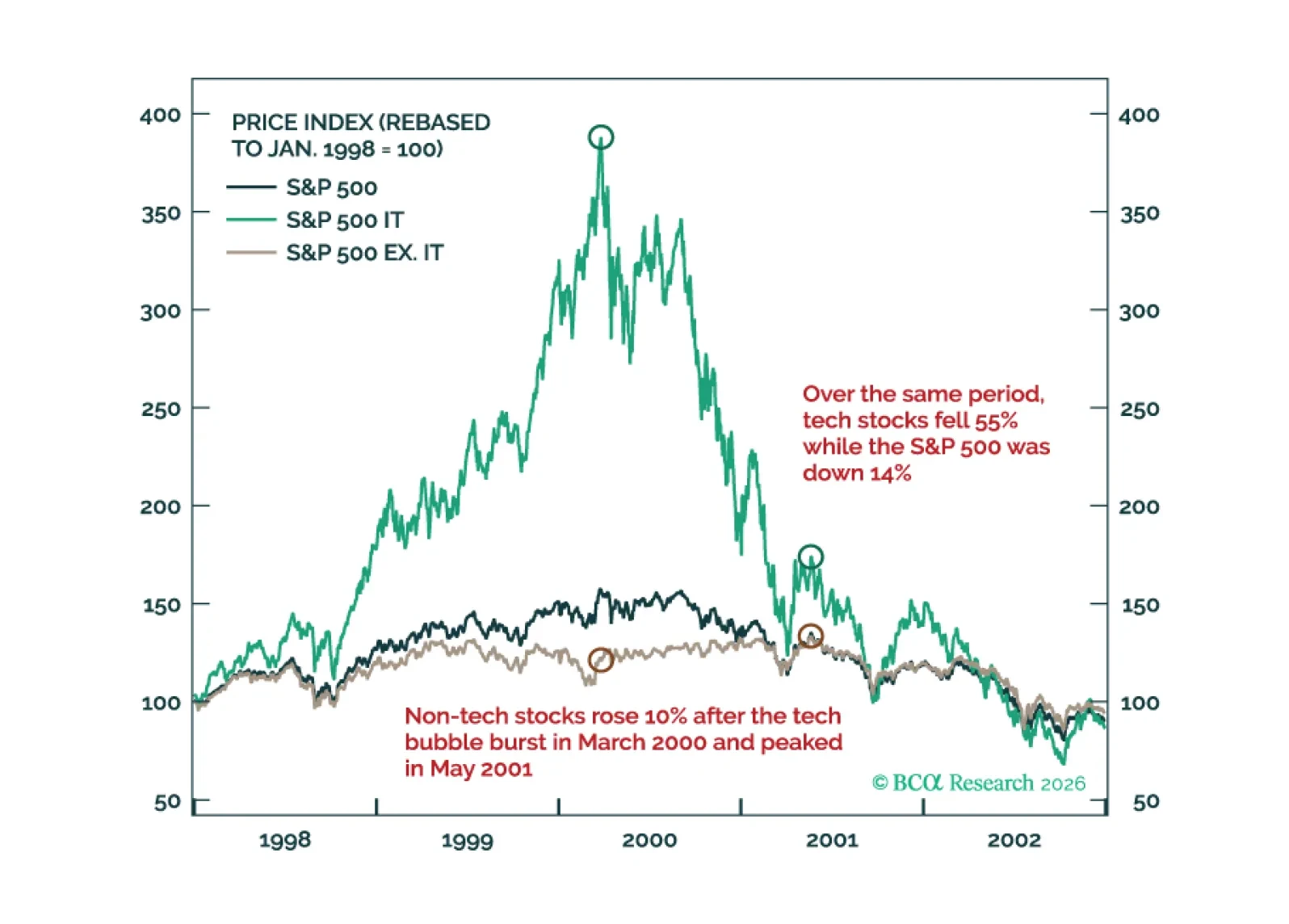

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

The first week of January is always the most difficult for investment strategists. The annual outlook is usually penned in early December. Ours went to your inbox on December 2, perhaps too early to get a read on the next 12 (really 13!)…

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

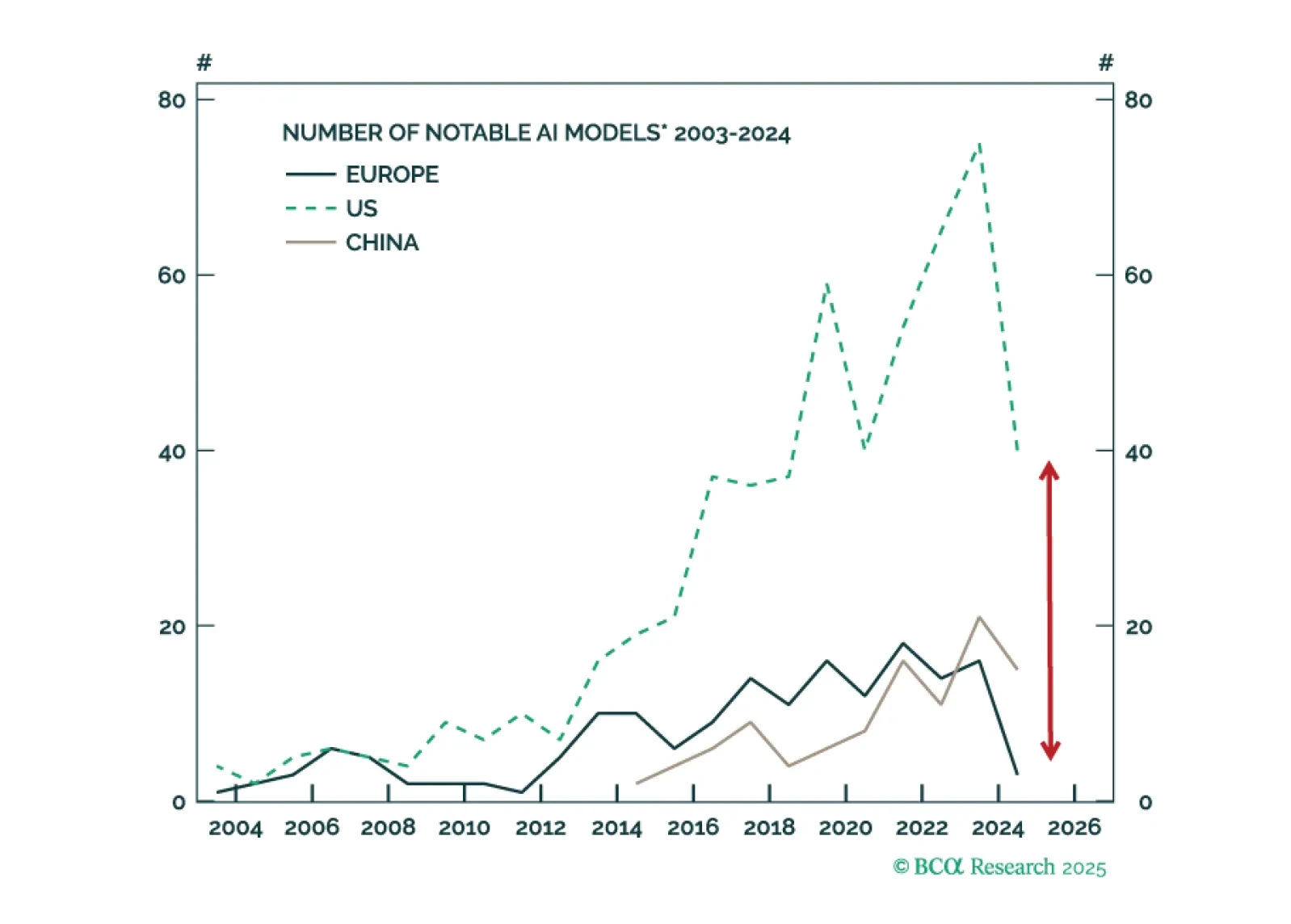

Europe is not left out of the AI race. Despite lagging US and China in LLMs and AI capex, Europe is quietly making progress where it matters, including industrial adoption. European capitals and the EU seem committed to not let that…

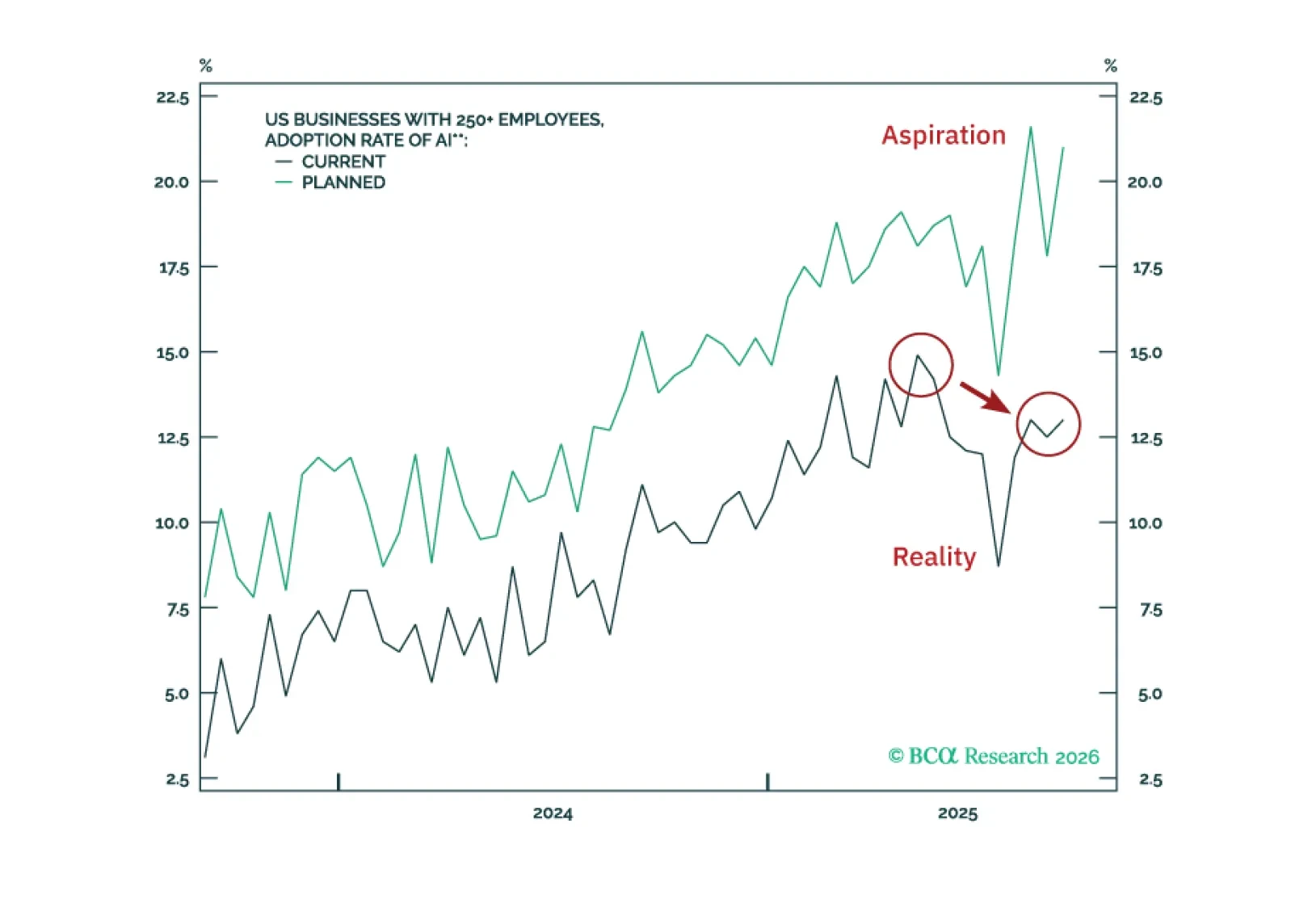

The odds have risen that we have reached a “Metaverse Moment” – a situation where investors punish AI companies for increasing capex. This warrants greater caution towards AI stocks specifically, and the broader S&P 500 more…