Highlights Chart 1Will Fed Purchases Mark The Top? Policymakers can’t do much to boost economic activity when the entire population is under quarantine, but they can take steps to contain the ongoing credit shock and…

Highlights Chart 1Making New Lows While the number of daily new COVID-19 cases is falling in China, the virus is spreading rapidly to the rest of the world. It is now clear that the outbreak will not be contained, though…

Highlights Chart 1The 2003 SARS Roadmap The bond market impact from the coronavirus has already been substantial. The 10-year Treasury yield has fallen back to 1.51%, below the fed funds rate. Meanwhile, the investment grade…

Highlights Chart 1Softer PMIs In December A bond bear market looked to be underway in December, with the 10-year Treasury yield reaching as high as 1.93% just before Christmas. But two developments during the past week drove…

Highlights Chart 1Manufacturing PMIs Track Bond Yields November’s manufacturing PMI data were released yesterday, giving us an update for two of our preferred global growth indicators: the Global Manufacturing PMI and…

Highlights Chart 1The Fed Must Remain Dovish Many were quick to label last week’s FOMC decision a “hawkish cut”. This is somewhat true in the near-term. The Fed lowered rates by 25 basis points while…

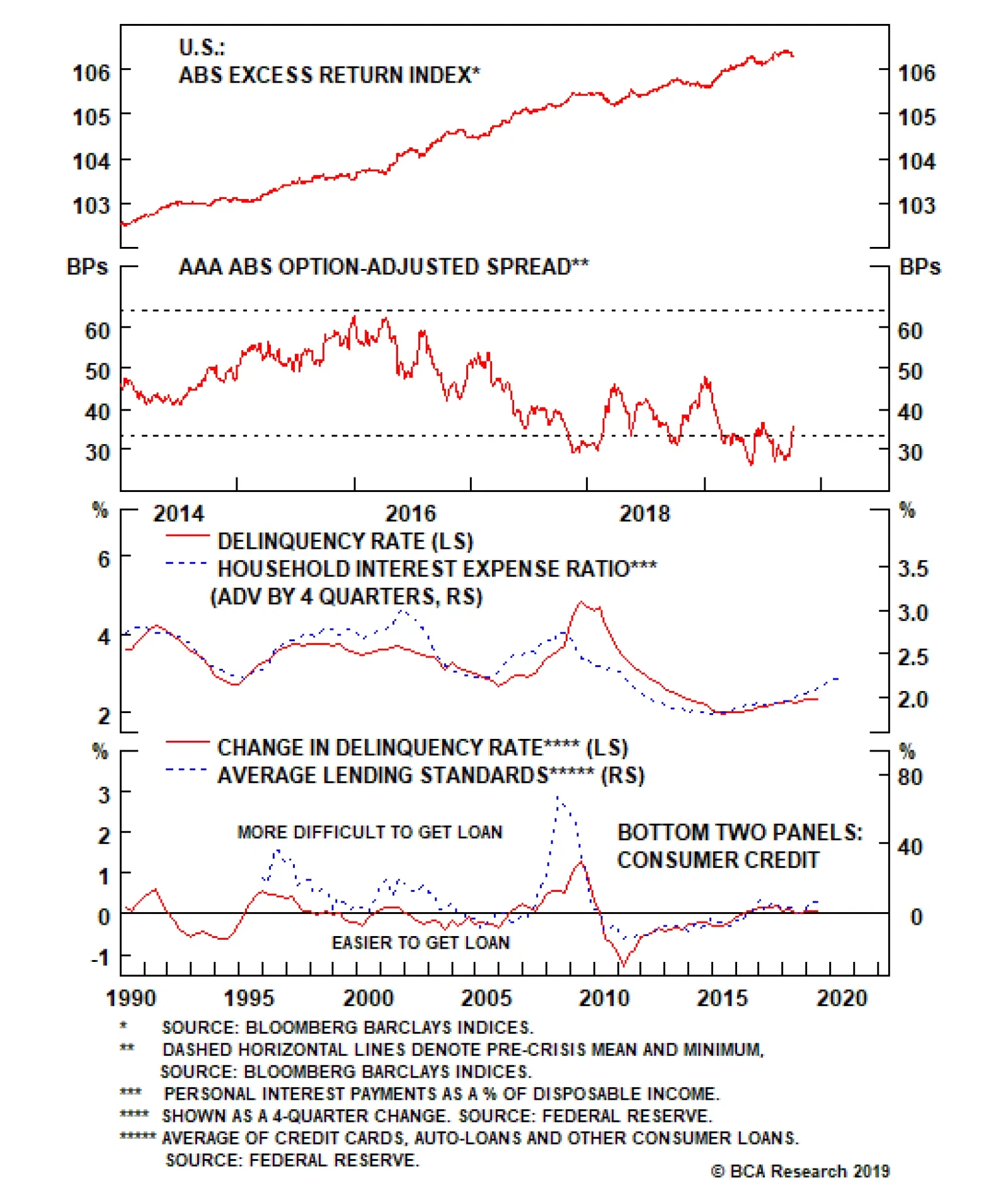

Asset-Backed Securities underperformed the duration-equivalent Treasury index by 2 basis points in September, dragging year-to-date excess returns down to +72 bps. The index option-adjusted spread for Aaa-rated ABS widened 2…

Highlights Chart 1Contagion? Until last week, global growth weakness had been wholly confined to the manufacturing sector. But the drop to 52.6 in September’s Non-Manufacturing PMI (from 56.4 in August) raises the…

Highlights Chart 1Waiting For A Manufacturing Rebound The 2015/16 roadmap is holding. As in that period, the ISM Manufacturing PMI has fallen into recessionary territory, but the Services PMI remains strong (Chart 1). As is…

Highlights Chart 1Keep Tracking The CRB / Gold Ratio The Fed cut rates by 25 basis points last week, a move that Chairman Powell described as an “insurance” cut meant to counter the risks from trade tensions and…