Download Report

Please complete form to access this report

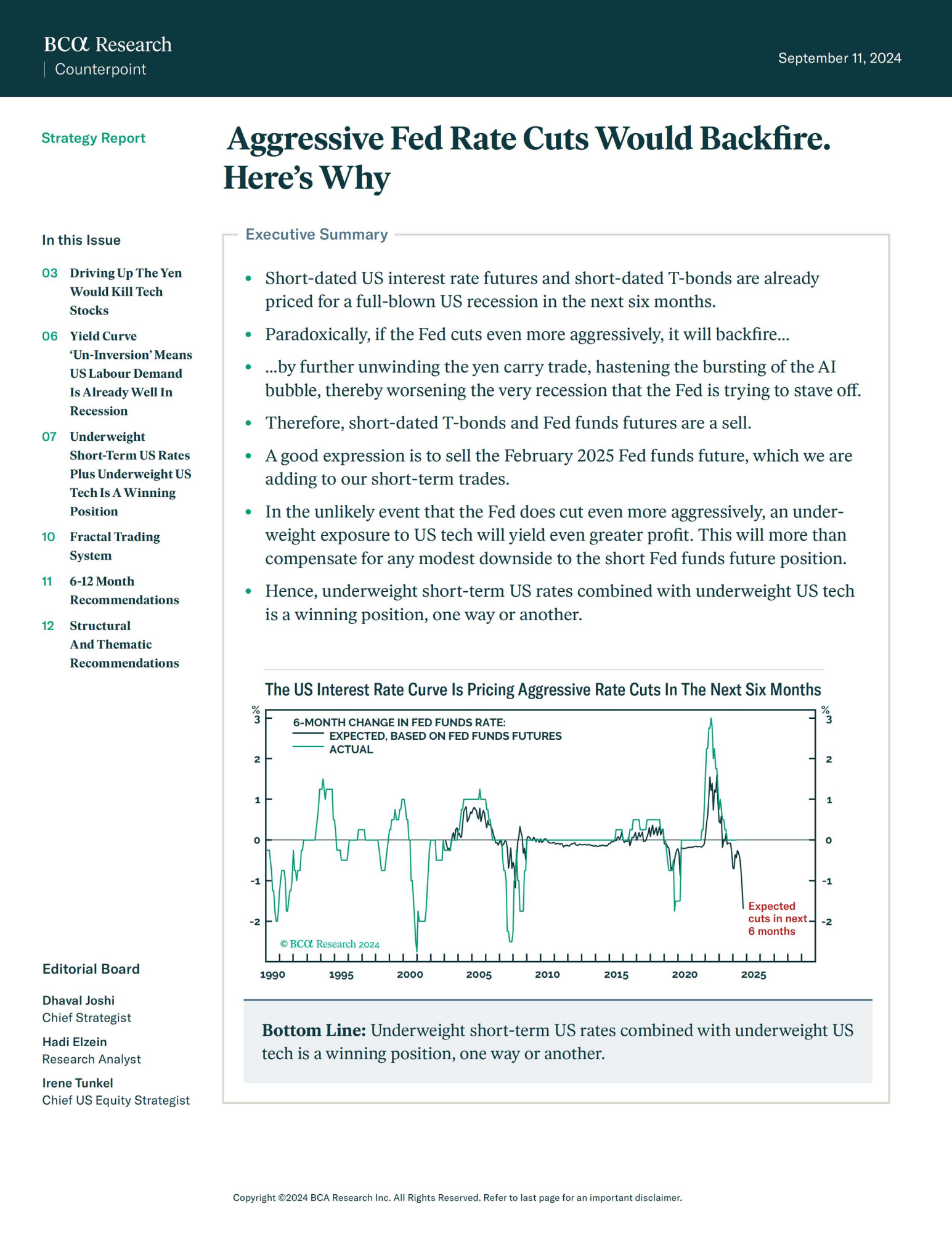

Short-dated US interest rate futures and short-dated T-bonds are already priced for a full-blown US recession in the next six months. Paradoxically, if the Fed cuts even more aggressively, it will backfire by further unwinding the yen carry trade, hastening the bursting of the AI bubble, thereby worsening the very recession that the Fed is trying to stave off. Therefore, short-dated T-bonds and Fed funds futures are a sell.