Thoughts On The Bitcoin Selloff

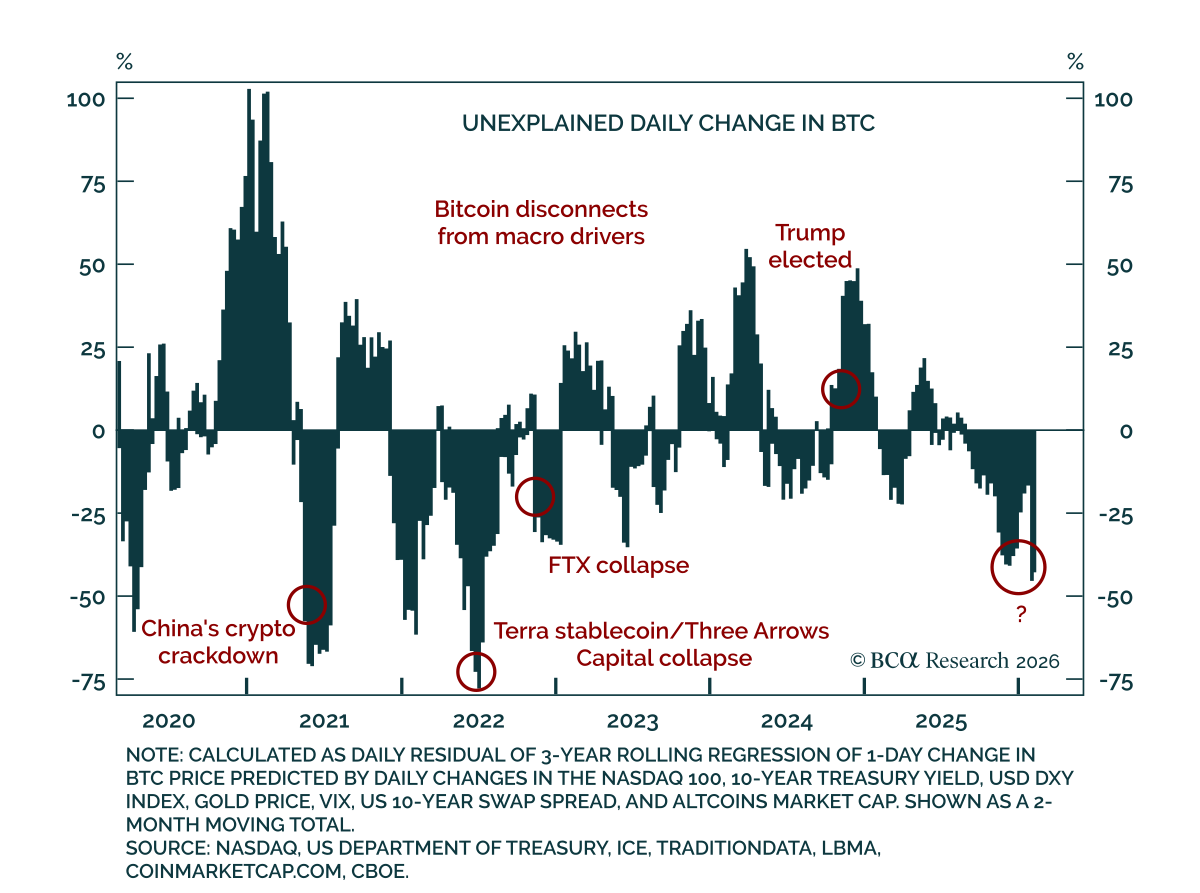

The recent Bitcoin selloff is lacking a clear macro driver. Our Chart Of The Week comes from Artem Sakhbiev, from our FX strategy team. Bitcoin is down roughly 45% since its October peak, erasing all gains since the 2024 US presidential election.

While large drawdowns are common in crypto, the latest selloff lacks a clear driver. Notably, Bitcoin has not benefited from USD weakness or the debasement trade. The “digital gold” thesis has faltered as precious metals hit new highs earlier this year. Its correlation with risk assets has weakened as equities remain near records. Bitcoin’s decoupling from typical macro drivers is now the widest since the 2022 crypto winter. However, back then, identifiable crypto-specific shocks explained the downturn. Today, no such dominant catalyst exists. Liquidations of leveraged positions and concerns about potential quantum risks may have contributed to the selloff, but they do not fully account for the scale of the correction. Only software stocks have been similarly battered in the past few weeks.

More fundamentally, Bitcoin has historically traded as a narrative-driven asset, with rallies fueled by dominant bullish themes that attract new capital. Price action is no longer following those narratives, and ETF inflows or regulatory progress are failing to generate incremental demand. What remains unchanged is Bitcoin’s underlying technology and its role as the first “unconfiscatable” digital bearer asset, which continues to appeal to investors seeking insurance against monetary debasement and state expropriation, despite persistent volatility.