Tariff Distortions Mask Underlying US Growth Weakness

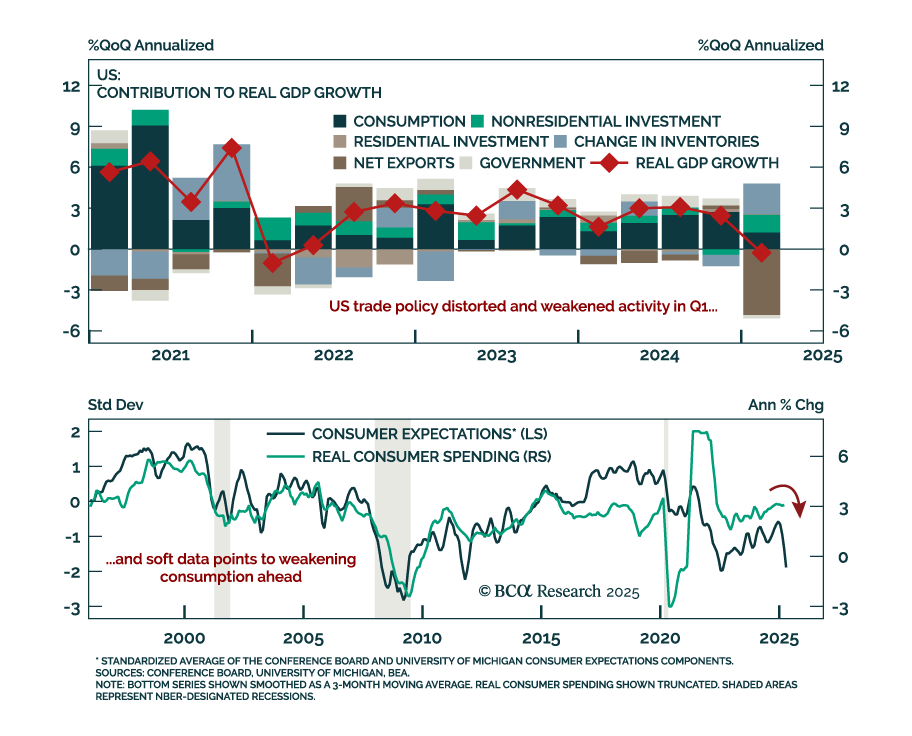

The Q1 US GDP contraction and inflation dynamics reinforce our defensive asset allocation. GDP missed estimates and contracted -0.3% annualized, led by a sharp slowdown in net exports. Consumption slid to 1.8% from 4.0%, reflecting falling consumer confidence. Business investment rose modestly, likely due to tariff-driven frontloading, evidenced by a spike in inventories and falling capex intentions. Residential investment slightly detracted from growth. Frontloaded demand and inventory accumulation will weigh on Q2 growth as new orders fade.

March personal consumption was decent, driven by autos, but spending outpaced income, pushing the saving rate down to 3.9%. Given weakening employment indicators, the saving rate has limited downside. Input costs are rising due to tariffs, especially in goods, yet delivery times remain stable, a key difference from the COVID inflation shock, when supply chains were strained. The Fed will focus on anchoring short-term inflation expectations. The result is a restrictive policy stance that will persist despite softening growth, supporting our preference for long duration exposure.