Still Too Early to Chase Risk

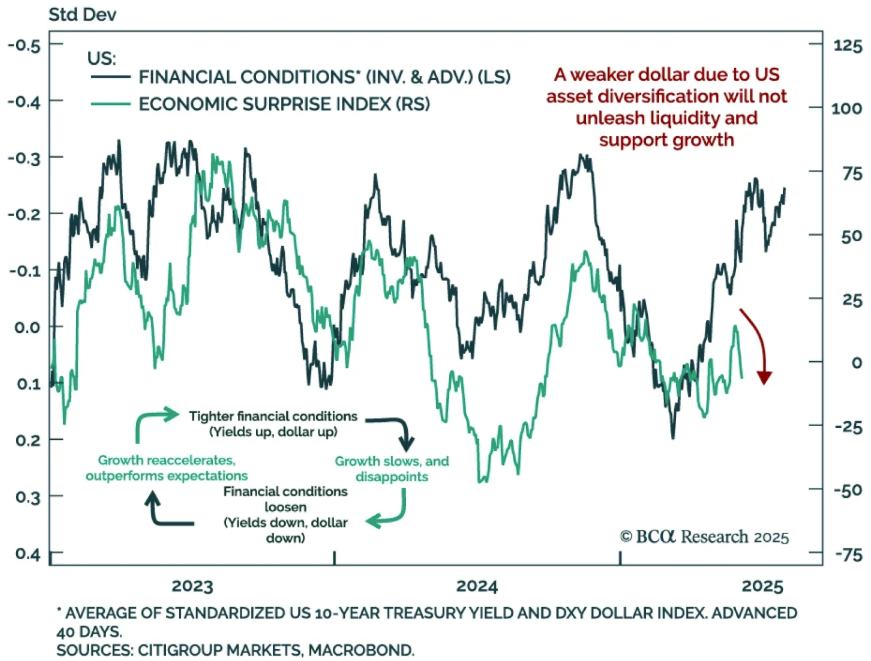

A falling dollar usually eases financial conditions, but recent dollar weakness is unlikely to reverse negative growth surprises, reinforcing our call to sell risk assets on strength. Our tactical framework tracks the reflexive loop between financial conditions and economic surprises: data surprises move markets, but bond yields and the USD in turn shape growth outcomes by tightening or loosening conditions. This feedback loop means growth strength often plants the seeds of its own reversal, and vice versa.

While recent dollar softness might suggest easier financial conditions, context matters. Yields remain sticky, and USD weakness reflects diversification out of US assets rather than a broad liquidity impulse. As a result, the move is unlikely to support growth or risk sentiment.

US economic surprises remain negative, and that momentum is unlikely to shift near term. Risk assets have decoupled from fundamentals, pricing in optimistic policy outcomes. Even if trade de-escalation provides a short-term boost, a global baseline tariff rate near 10% will weigh on growth and likely trigger a recession. We recommend fading strength in risk assets as recession risks remain underpriced.