Soft Data Contradict Strong Growth Forecasts

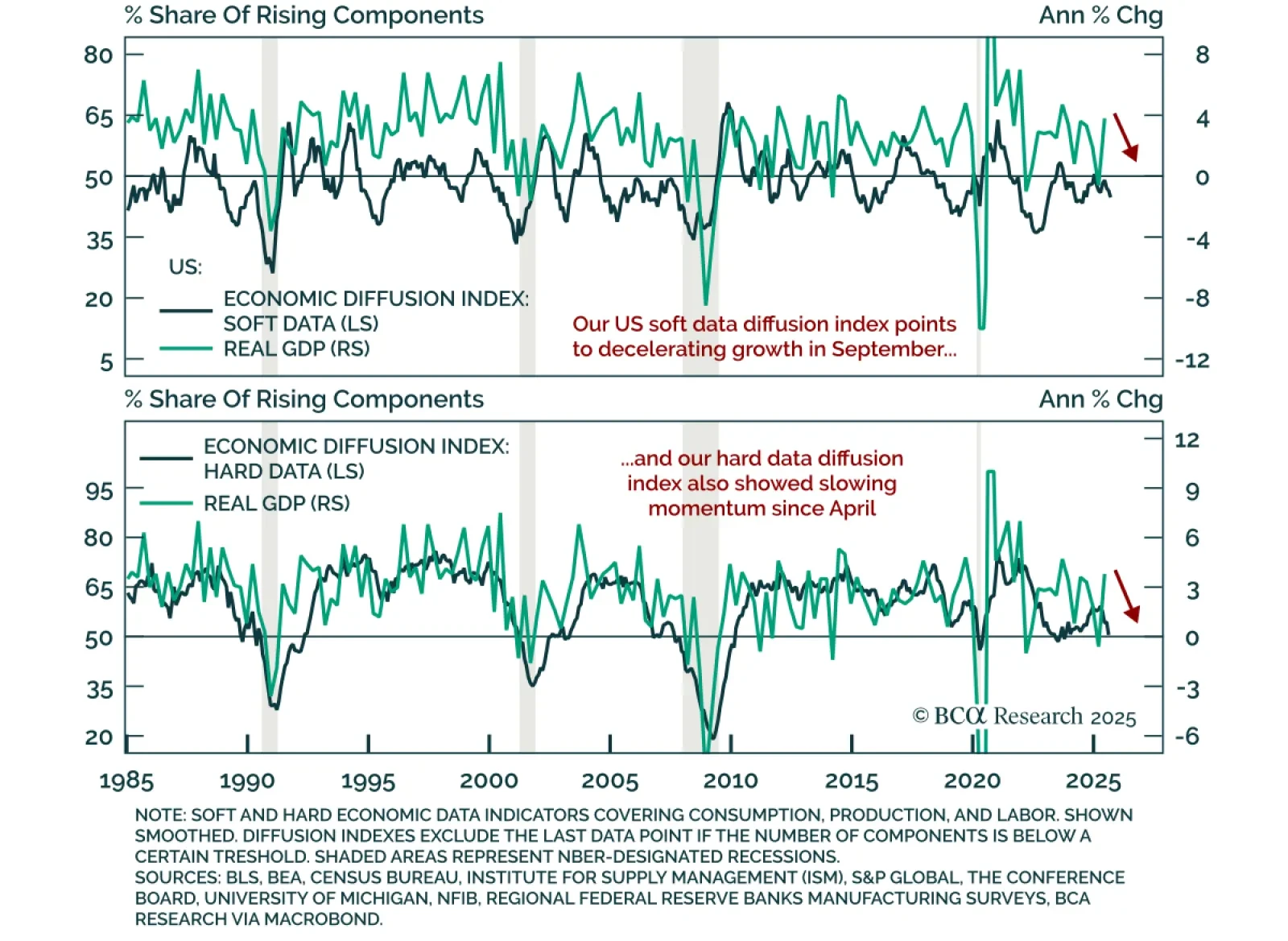

Survey-based data available for September show weakening US growth momentum, supporting modest defensiveness. While the government shutdown may delay official releases, soft data provide a timely view. Our US economic diffusion index, combining more than 80 indicators, points to slowing momentum. Of the 51 soft indicators tracked, 45 are available for September, and less than a quarter increased on the month. The data is volatile; our smoothed version shows about 45% of indicators rising, extending the downtrend that began at the start of the year.

Hard data for September is still limited, but our hard data subindex has also been losing momentum from April to August. This stands in contrast to the Atlanta Fed GDPNow estimate of 3.8% annualized Q3 growth, similar to Q2. Despite hard data releases being delayed due to the government shutdown, the broader evidence suggests growth is weakening enough to allow the Fed to keep easing at its October meeting.

This backdrop supports modest defensiveness: Neutral equities, overweight government bonds, and underweight credit. With elevated inflation, slow growth deterioration is needed to preserve easing and sustain the expansion, and paradoxically the S&P 500. Our data tracking does not show collapse or accelerating weakness. However, downside growth risks remain too high for an overweight in risk assets as the labor market hovers near neutral estimates.