Labor Market On A Knife’s Edge As Hiring Slows In Cyclical Sectors

May JOLTS data suggest labor market softening beneath the surface, reinforcing a defensive stance across portfolios. Job openings rose to 7.7m from 7.4m, beating estimates, while quits ticked up to 3.3m and layoffs fell to 1.6m. However, hiring edged lower to 5.5m, and openings in cyclical sectors remain in a downtrend, pointing to fragility in the more economically-sensitive areas of the labor market.

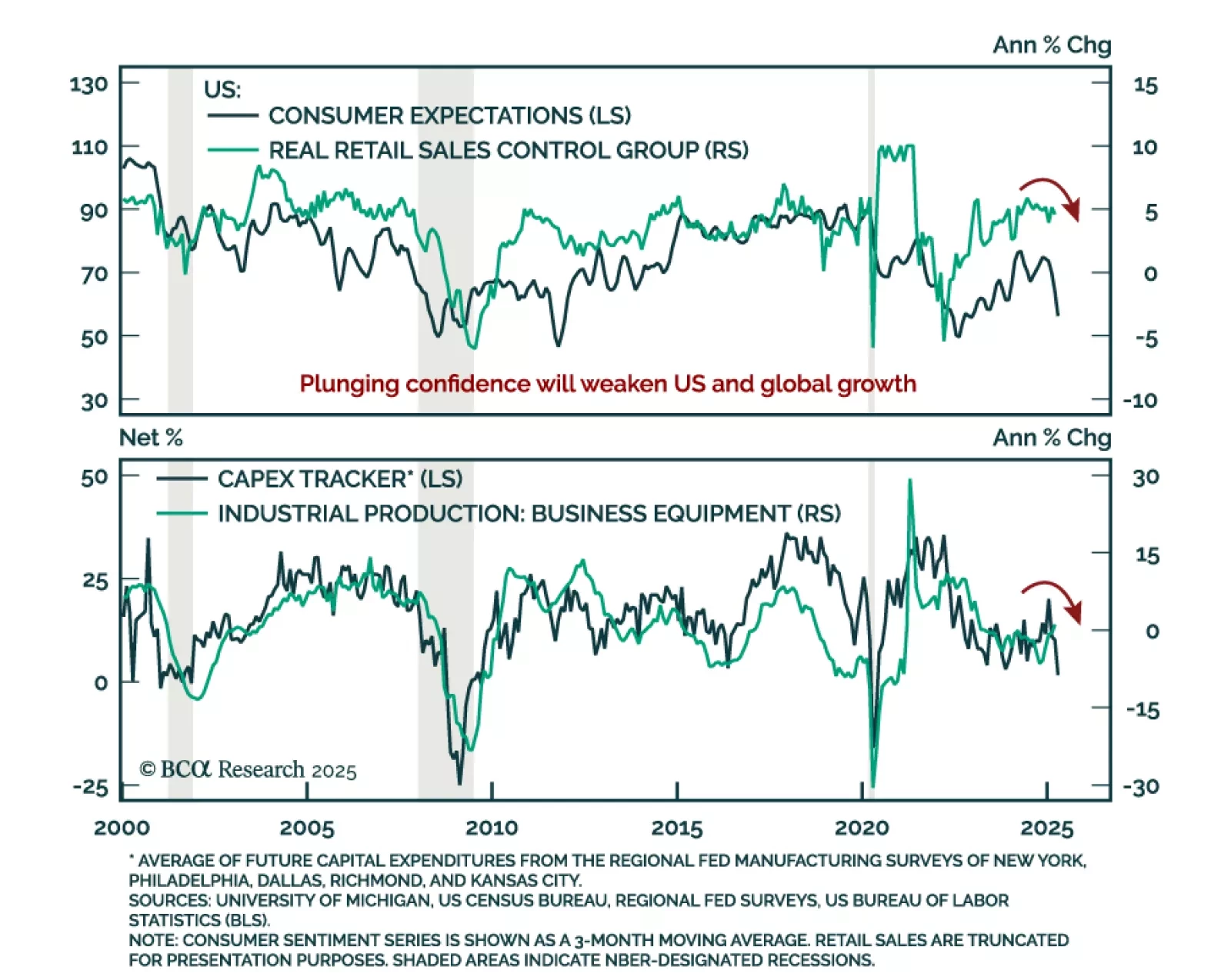

Despite apparent resilience, the JOLTS report lags by a month and contrasts with weakening leading indicators of employment. Consumers are turning more cautious, and hiring remains soft in sectors most exposed to growth fluctuations. Moreover, jobs are reportedly getting harder to get. Historically, recessions begin not with a spike in layoffs, but as hiring slows and labor market slack gradually builds. With current conditions roughly balanced, it will not take much of a slowdown for slack to emerge.

We remain underweight risk assets and overweight government bonds within a global portfolio. BCA’s US Equity strategists recommend lowering beta and reducing exposure to cyclical sectors.