Inflation Crosscurrents Point To Further Fed Easing

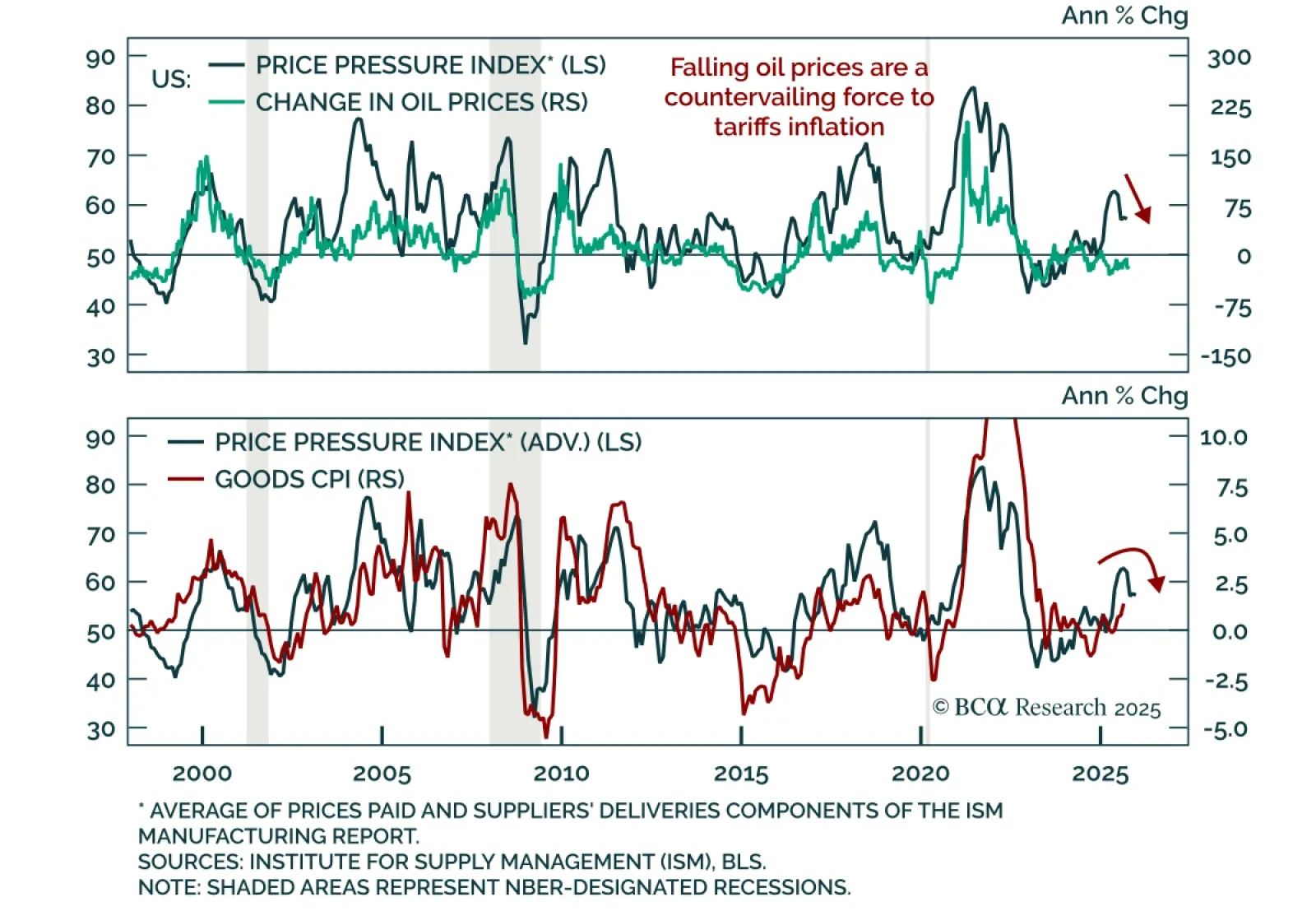

Falling oil prices are countering tariff-driven inflation which, along with a weakening labor market, is reinforcing a long duration stance. Brent crude broke below the $65/bbl support level held since June and WTI is now down 16% from a year ago. Falling oil prices are significant at this stage of the cycle, as inflation is being shaped by crosscurrents: A weakening labor market will weigh on wage growth and services inflation. Goods inflation remains supported by tariffs, but oil acts as a countervailing force.

This mix has important policy implications. Until the Jackson Hole pivot, the Fed prioritized inflation risks over growth, but successive weak employment reports and downward revisions revealed a stalling labor market. Tariff-driven cost-push inflation is still a concern, though long-term inflation expectations remain stable. Falling oil prices alter the picture by strengthening the Fed’s case for easing. The Fed resumed cutting rates as demand-pull inflation, which it can influence, began outweighing supply-side and tariff-driven pressures. With oil prices (another factor outside the Fed’s control) now moving in a disinflationary direction, the balance of risks shifts further toward easing.

The September CPI release on Friday will clarify the trend, but inflation remains a lagging indicator. Our leading indicators point to only a limited tariff-related impulse. Our Commodity strategists remain defensive within commodities, favoring precious metals over energy and industrial metals, and stay short Brent with a stop loss at $73/bbl. The moderating inflation picture supports long duration and curve steepeners in global bond portfolios.