How Will The Growth-Employment Split Resolve?

We expect the divergence between resilient growth and weakening employment to be resolved by lower growth estimates, supporting long duration and steepeners. Economic activity and employment usually move together in a circular relationship: spending drives income and jobs, with income driving subsequent spending. This link explains why unemployment spikes coincide with higher saving rates. However, recent data, even before the government shutdown, show a split between strong GDP estimates and a stalled labor market.

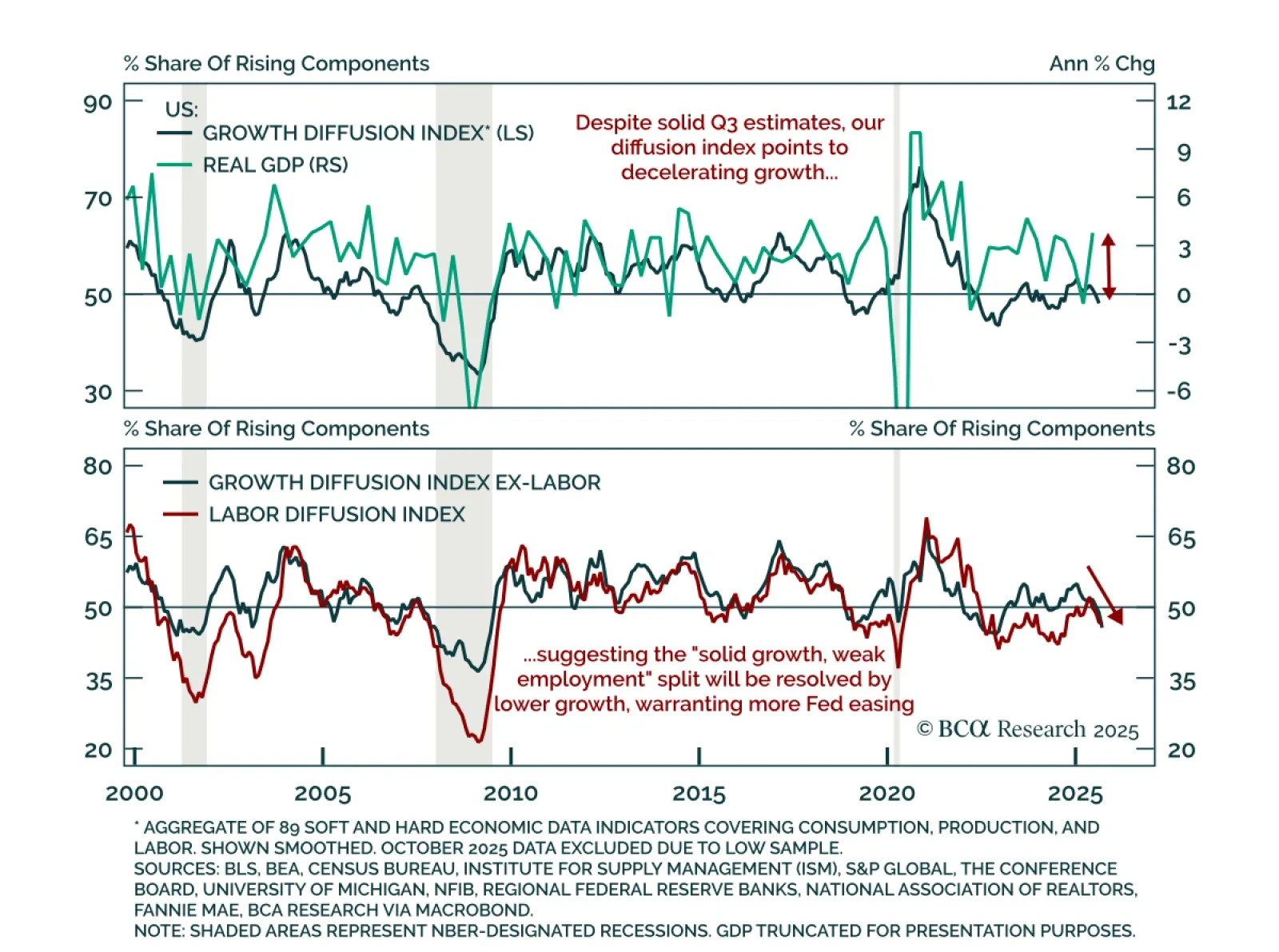

The Atlanta Fed’s Q3 GDPNow estimate of 3.9% implies growth above potential (1.7–2.0%), which should correspond to accelerating employment, not deceleration. Our US diffusion index, which combines 89 hard and soft indicators and has historically led GDP turning points, instead shows clear growth deceleration. Soft data reliability has weakened post-COVID, but our hard data subindex peaked in April and has slowed since, confirming the trend. “Objective” soft data measures also continue to show deceleration in October. Excluding labor variables does not alter the signal.

Fed Governor Waller recently emphasized that resolving the growth-employment split will guide policy. We believe the resolution will come through lower growth estimates. This supports maintaining a long duration stance in bond portfolios and positioning for curve steepening as growth slows. We do not see regional banking weakness as a major drag for now but note it adds to downside risks as growth and employment soften.