The Fed Has Not Surrendered On Inflation

Powell’s “risk management cut” underscores the Fed’s shift toward growth risks, reinforcing long duration with steepeners.

Risk management is central to monetary policy. It determines how policymakers balance uncertainty and decide which mistake is less costly: Cutting too soon and risking inflation, or waiting too long and deepening a slowdown. Powell’s Jackson Hole speech signaled the Fed’s focus has shifted toward growth risks, a stance reflected in Wednesday’s decision.

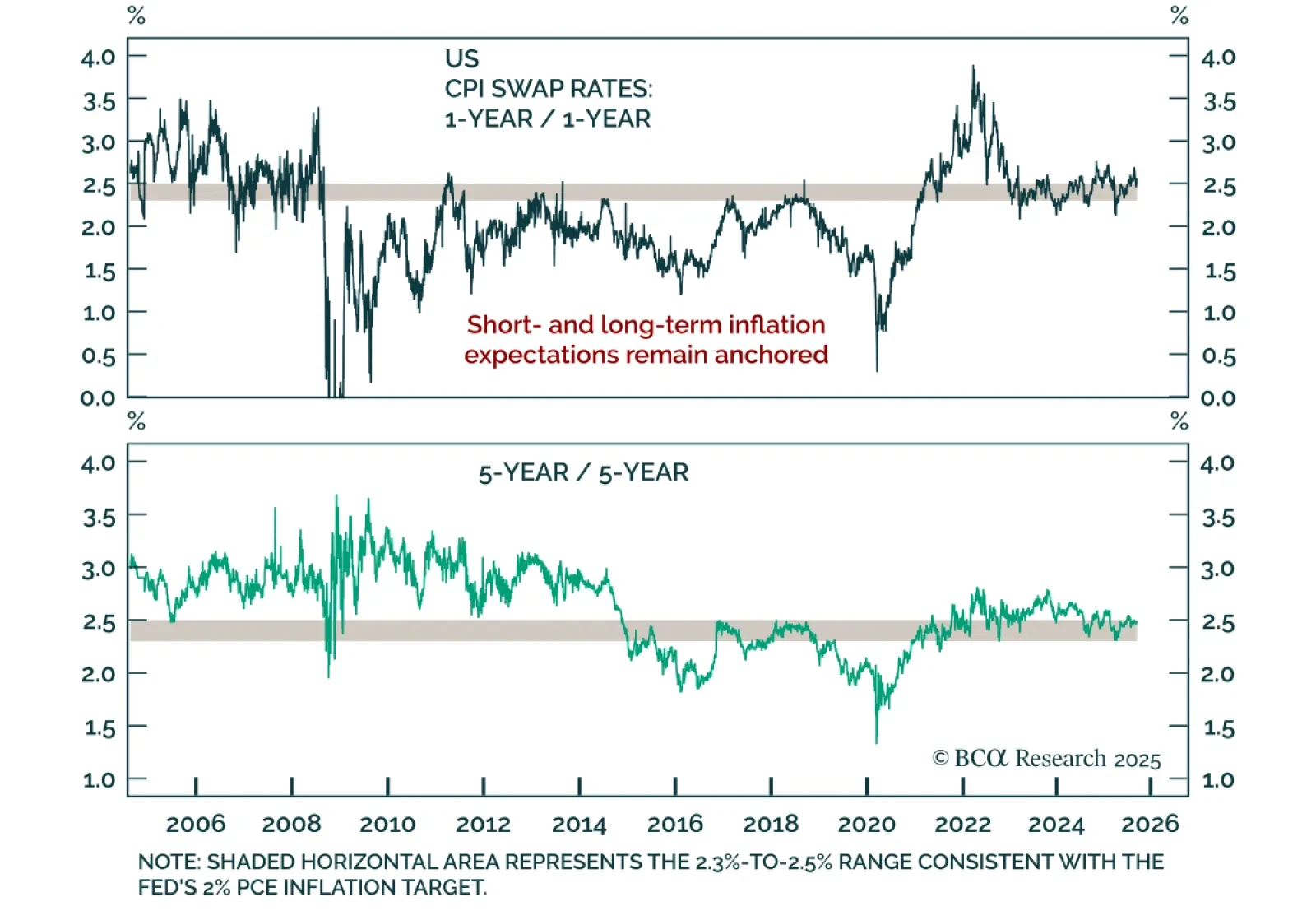

A cut while inflation is above target does not mark a retreat from the 2% mandate. The fed funds rate remains above the Fed’s 3% neutral estimate, keeping conditions restrictive, not easy. Recent inflation has been driven by tariffs-induced goods prices, largely beyond the Fed’s control, while services inflation hinges on the labor market, which has loosened significantly this year. Supply-side shocks such as tariffs are typically “looked through” so long as inflation expectations remain stable.

Central banks face a volatile mix of growth and inflation shocks, making stable expectations and flexible policy critical. For now, expectations remain anchored, with the 5y/5y and 1y/1y inflation swaps within the Fed’s 2.3%-2.5% PCE-equivalent target range. We recommend global bond investors maintain long duration and steepeners. In the US, the easing path is well priced, so our US Bond strategists tactically hedge duration with a short Jan 2026/long Dec 2026 fed funds futures trade.