CPI Cools, But Fed Still On Hold

January US CPI cooled slightly, with leading indicators pointing to further disinflation later this year. Headline inflation fell to 2.4% y/y in January from 2.7%. Similarly, core also cooled to 2.5% from 2.6%, in line with estimates. Core goods inflation declined from 1.4% y/y to 1.1%, while core services was roughly unchanged at 3.0%.

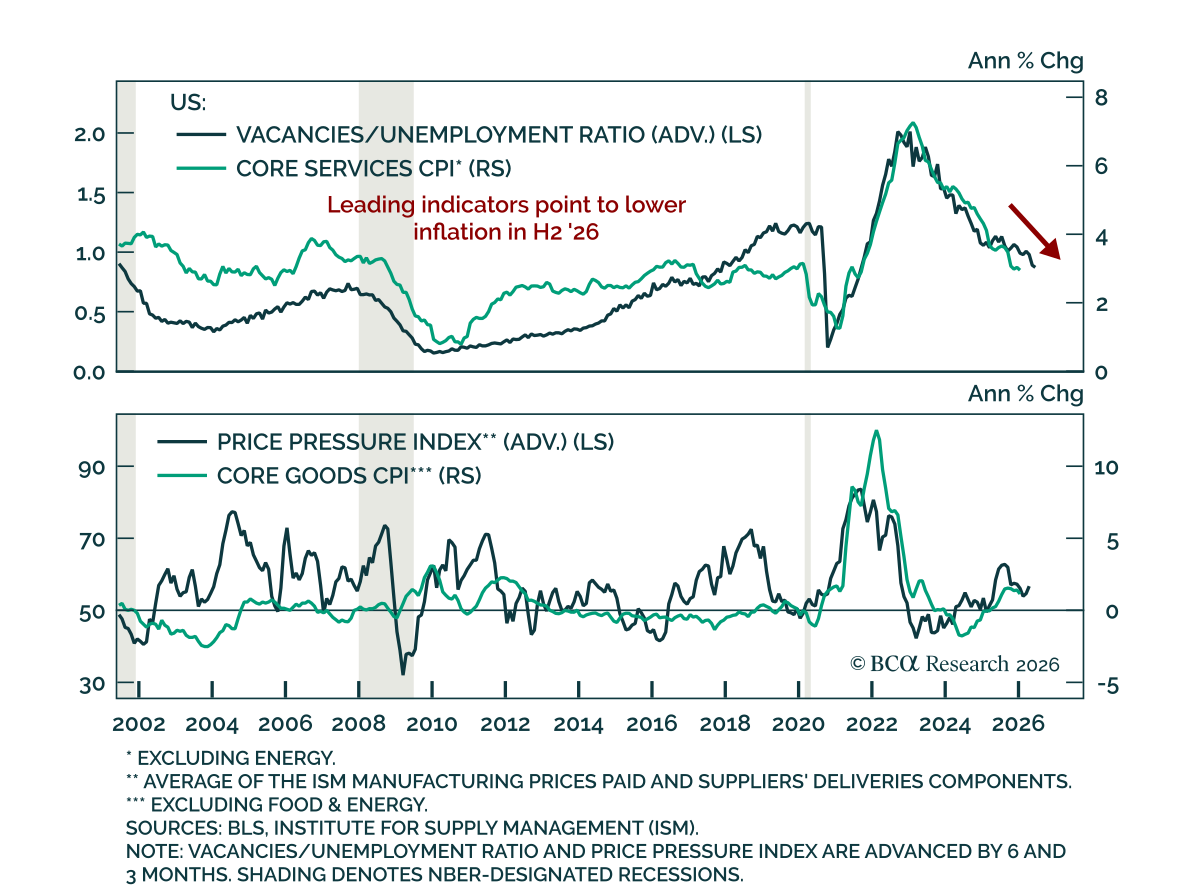

Importantly, leading indicators point to further disinflation in the second half of this year. Services disinflation will stem from a labor market that has cooled and stabilized near NAIRU. Despite the strong January employment report, labor demand remains weak, as evidenced by slower wage growth, lower quits, and low job openings. Meanwhile, leading indicators for goods inflation also suggest tariff pressures have crested. Markets are not signaling concern, with CPI swaps implying inflation around 2.5% over the next year.

Although our US Bond strategists expect inflation to remain too high for the Fed to cut in the first half of the year, they expect a more meaningful drop in core in the second half to allow for disinflationary cuts. Upside and downside risks to our base case include a rise in unemployment that would bring cuts forward, and a labor-market-driven rebound in inflation that would result in fewer cuts. A rebounding labor market would warrant less duration exposure, and the curve would flatten, as the front end is not priced for growth and inflation reacceleration. Our colleagues remain positioned for dovish surprises, with above-benchmark portfolio duration, curve steepeners, and a tactical long December 2026 fed funds futures position.