What To Do About Small Caps

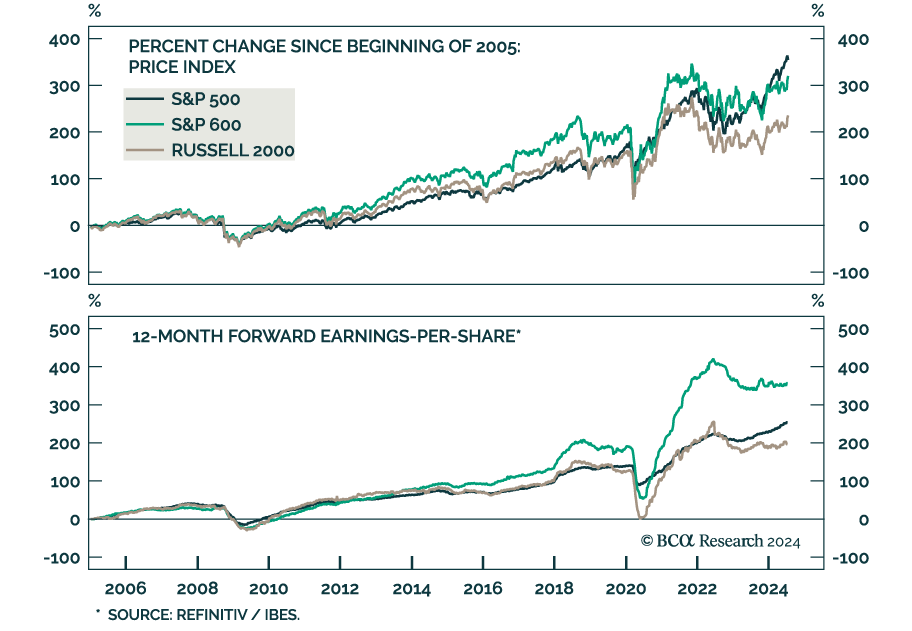

The S&P 600 and Russell 2000 have outperformed the S&P 500 by close to 10% since July 9. Small caps typically outperform in the early stages of economic expansions when growth is accelerating, demand-driven inflation is rising and lending standards are easing. Why are they rallying now that economic conditions are at polar opposites?

Small caps are relatively more exposed to domestic economic conditions since their large-cap peers derive a larger share of their revenues from abroad. Periods of US growth leadership are therefore auspicious for small caps’ relative performance. Although the US has been leading global growth for longer than a couple of weeks, the recent broadening of what had previously been an extremely narrow equity rally has lifted small cap indices relative to Mag7 stocks and other non-tech large caps.

Moreover, the soft-landing/no-landing view still dominates markets. Even if one anticipates an upcoming end to the business cycle, our US Investment strategists have shown that the (first and) last deciles of expansions typically post the strongest equity returns. With small-cap valuations more than two standard deviations below their mean, investors may be turning to smaller-sized firms as a means of staying invested at a relative bargain.

That said, we caution against chasing these gains at such a late stage of the cycle, even though cheap valuations may offer some cushion. Small caps are high beta and our conviction that a recession looms is strong. More attractive entry points await at the other end of the recession tunnel.

Our Global Investment strategists recommend investors who are looking to maintain exposure nevertheless to favor the S&P 600. Its companies score higher on most quality measures and their earnings have grown at a faster rate than their Russell 2000 peers.