No Improvement In Chinese Inflation

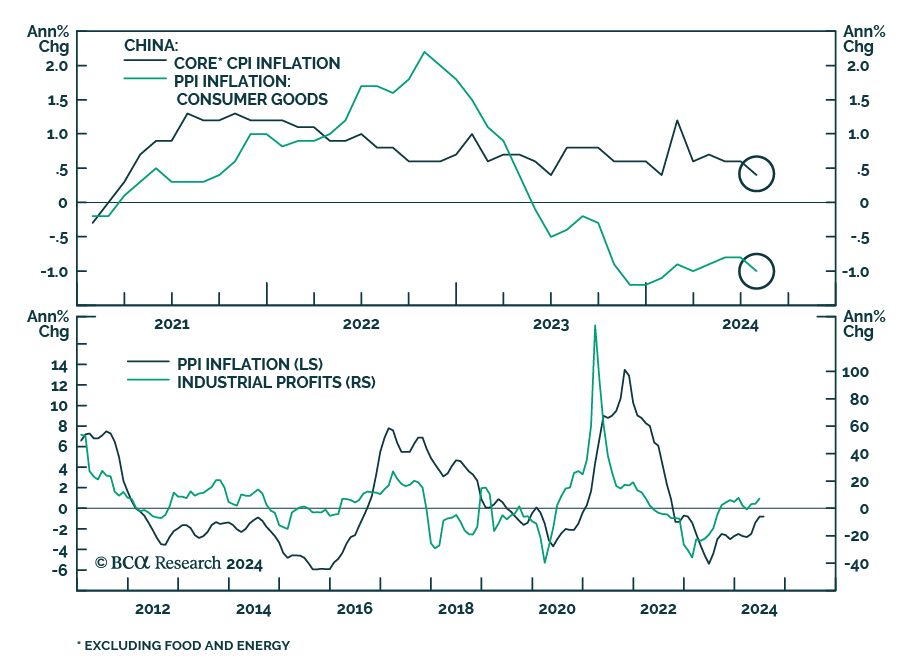

China’s CPI and PPI prints surprised to the upside on Friday. Producer prices contracted -0.8%y/y, unchanged from June, compared to expectations of a -0.9% contraction. Consumer prices increased 0.5%y/y, above 0.3% expectations.

The consumer price index hit its highest rate of change since February, while producer prices have been contracting at the slowest pace since December 2022 for two consecutive months. This begs the question: is China recovering?

As BCA’s China Investment Strategist Jing Sima noted in Friday’s BCA Live & Unfiltered discussion, the answer is likely ‘no’. Most of the acceleration in CPI can be attributed to fluctuations in food and energy prices. Core CPI and Consumer Goods PPI both decelerated in July, which is further evidence that Chinese households are still downbeat.

On the other hand, exports and the relatively slow contraction in producer prices drove the upside in industrial profits. However, this tailwind will fade due to waning global demand and an ever-stagnant domestic economy. In addition, a potential second Trump presidency would come with heavy tariffs, hamstringing exports to the US and potentially the EU.

However, our China Investment strategists recently upgraded onshore stocks to overweight and offshore stocks to neutral within a global equity portfolio on the basis that Chinese equities are already oversold and have scope to outperform global equities in the context of a global equity sell-off.