Consumer Credit Increases The Most In Three Months

Total consumer credit rose by USD 11.4 billion in May (to USD 5,065 billion outstanding) from a slightly upwardly revised USD 6.5 billion increase in April, surpassing expectations of a smaller increase. Notably, revolving credit (which includes credit cards) accounted for nearly two-thirds of the rise in May and credit’s advances in May were the highest in three months.

The SIFI banks’ latest round of quarterly earnings calls also underscored that credit card lending continued to grow -- albeit at a modest pace. They reported that their retail customers otherwise evinced little appetite for credit.

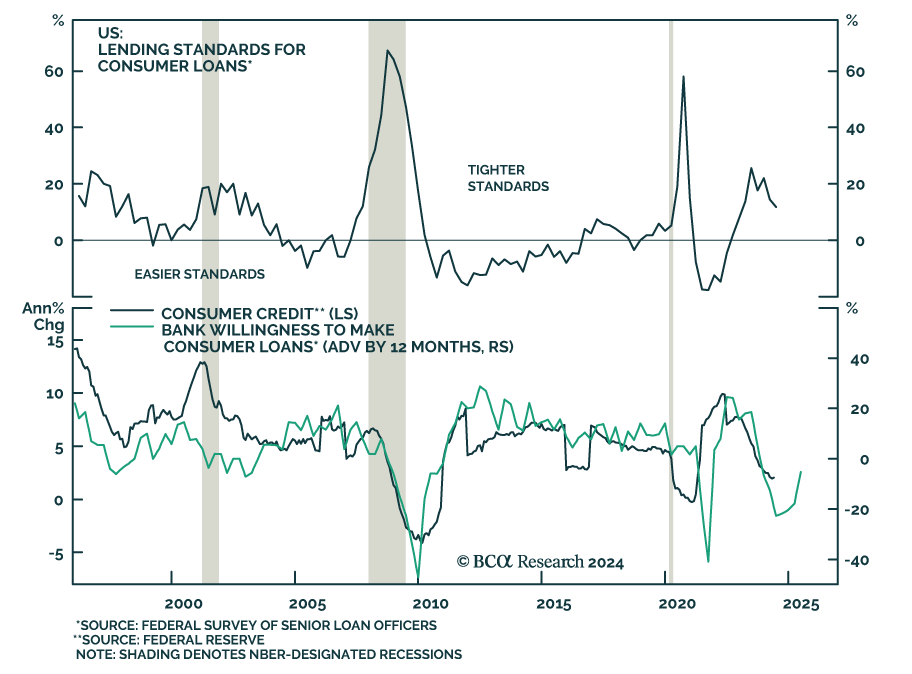

A rise in consumer credit is noteworthy in an environment of a softening labor market and dwindling excess savings, given that it may contribute more to consumption growth than we expect. However, we continue to anticipate that a low willingness to lend will cap that contribution.

Lending standards respond to credit performance. Although credit card delinquencies remain low relative to history, they have been steadily rising. The soft-landing/no-landing narrative may still be dominating economic agents’ psyche and this optimism may still support lending. However, compensation growth remains the main driver of spending and credit performance. Lending standards will thus adjust to continued labor market deterioration.

The Q2 editions of the Senior Loan Officer Survey and the New York Fed report on household debt and credit are not yet available, but a sharp rise in transition into serious delinquency (along with weaker demand for loans and tighter bank lending standards across the board) had marked Q1. Given that economic conditions have been relatively stable since then, we do not expect any significant change in credit performance in Q2.