Commodities As A Late-Cycle Investment

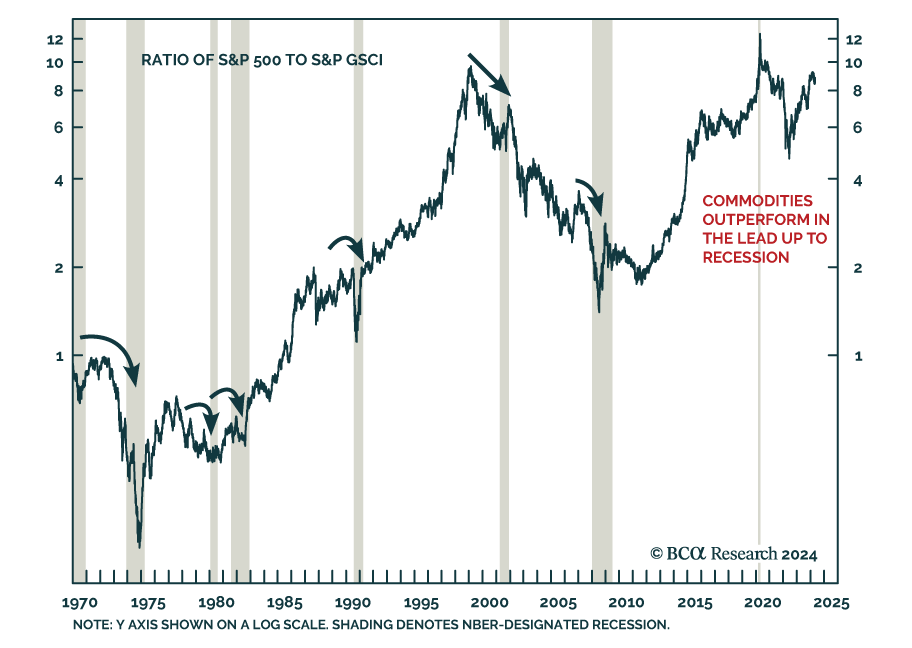

According to BCA Research’s Commodity & Energy Strategy service, commodity prices typically rally toward the end of the business cycle.

In the past six recessions, the S&P 500 peaked before commodity prices. While there is significant variability across recessions, on average, the S&P GSCI topped out two months after the onset of a recession while the S&P 500 peaked five months before it began. The peak in commodity prices only preceded the recession in two instances (2001 and 2020). Conversely, the S&P 500 index has historically topped out ahead of recessions.

The implication is that investors should not rely on commodity markets to provide a leading signal for other risk assets that an economic downturn is looming. Rather, equity market dynamics help inform the outlook for commodity markets whereby – in the absence of a supply shock – a decisive peak in the equity market would signal that the commodity rally is in its latter stages.

To be clear, we cannot say if the March 28 top in the S&P 500 marked a cyclical peak. Yet if and when equities decisively roll over and the hard-landing scenario becomes the dominant driver of financial market dynamics, it would signal that the demand headwind is intensifying.

Alternatively, the other two plausible outcomes for the economy – soft landing or no landing – are both favorable for commodity prices. In the soft-landing scenario, resilient demand-side growth would provide a tailwind for both commodity prices and equities. A no-landing scenario – which has been gaining traction among the investment community so far this year – would entail increased interest in commodities as an inflation hedge.

In the lead up to recessions, stocks have historically peaked prior to commodities. Therefore, a decisive top in the equity market would provide an early warning for commodity investors. That said, supply-side dynamics could prolong the commodity rally well into a recession.