China’s Surprise Rate Cut Unlikely To Move the Needle

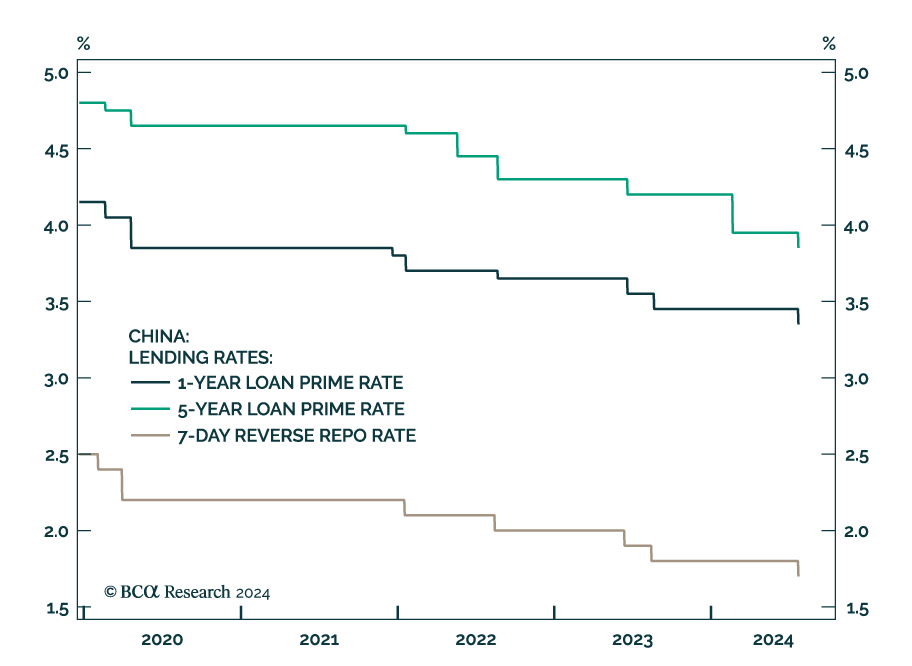

The PBoC lowered the 7-day reverse repo rate from 1.80% to 1.70% on Monday. The 5-year and 1-year loan prime rates declined by 10 basis points (bps) to 3.85% and 3.35%, respectively.

However, this 10-bps cut is unlikely to have any meaningful stimulative effect on the overall economy. Not only is the magnitude of the rate cut modest, but it will also merely help lower the debt servicing burden of households and corporations at the margin. Investors should thus not expect any significant demand revival from this new development in the PBoC’s string of muted stimulus efforts.

Our China Investment strategist highlighted in Monday’s BCA Live & Unfiltered meeting that this rate cut was more symbolic in nature and mostly already priced in. Although the challenges facing the economy warrant further rate cuts and stimulus on a 6-to-12 month horizon, the authorities are likely to tread carefully to avoid triggering a rapid yuan devaluation which could trigger panic in financial markets, undermine consumer and business confidence, and delay economic recovery.

All in all, neither the Third Plenum nor the PBoC’s 10-bps rate cut delivered the big-bang stimulus that global investors are hoping for, and there is little scope for further efforts to be sufficiently large to move the needle on China’s growth outlook.

Investors should continue to underweight Chinese equities within a global portfolio.