Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Insight

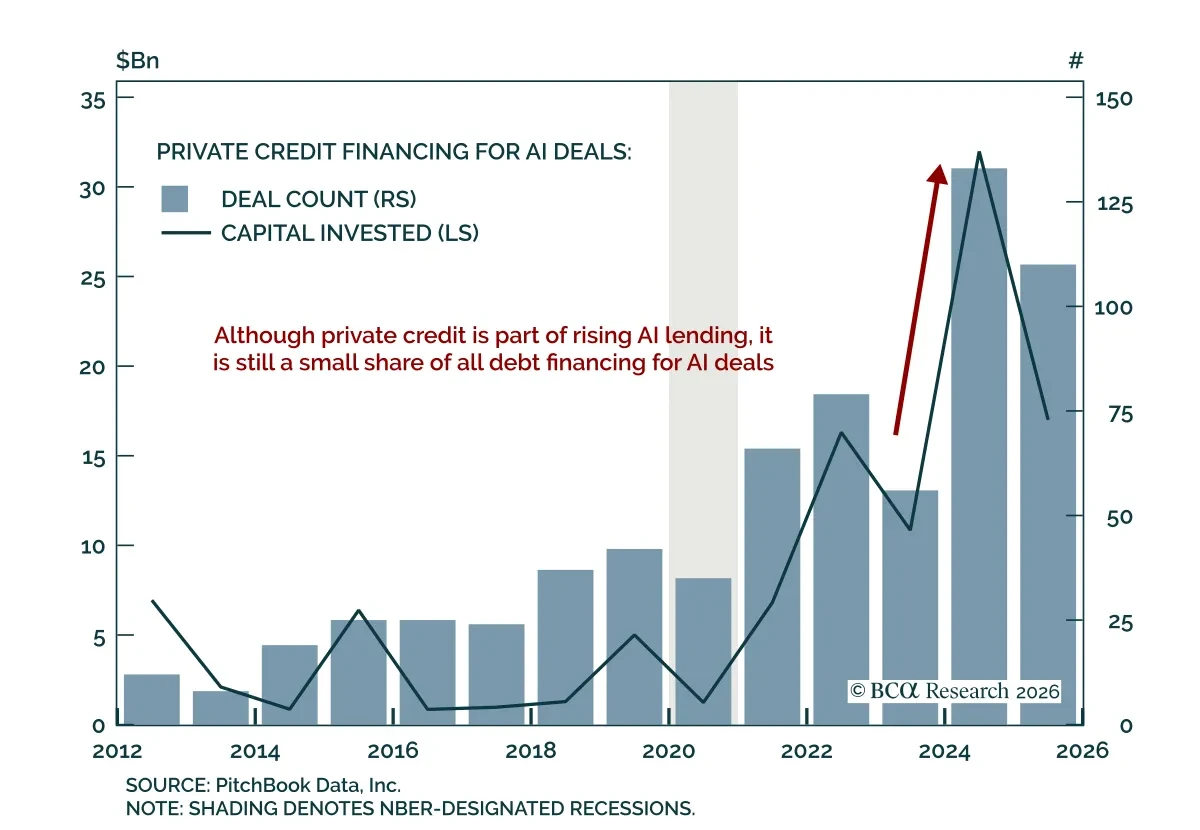

Private Credit’s role in financing AI is growing, but remains small and concentrated. Our Chart Of The Week comes from Brian Payne, Chief Strategist for our Private Markets & Alternatives (PMA) service. Both private and public market investors are asking how much AI exposure is embedded in ...

Read more

Insight

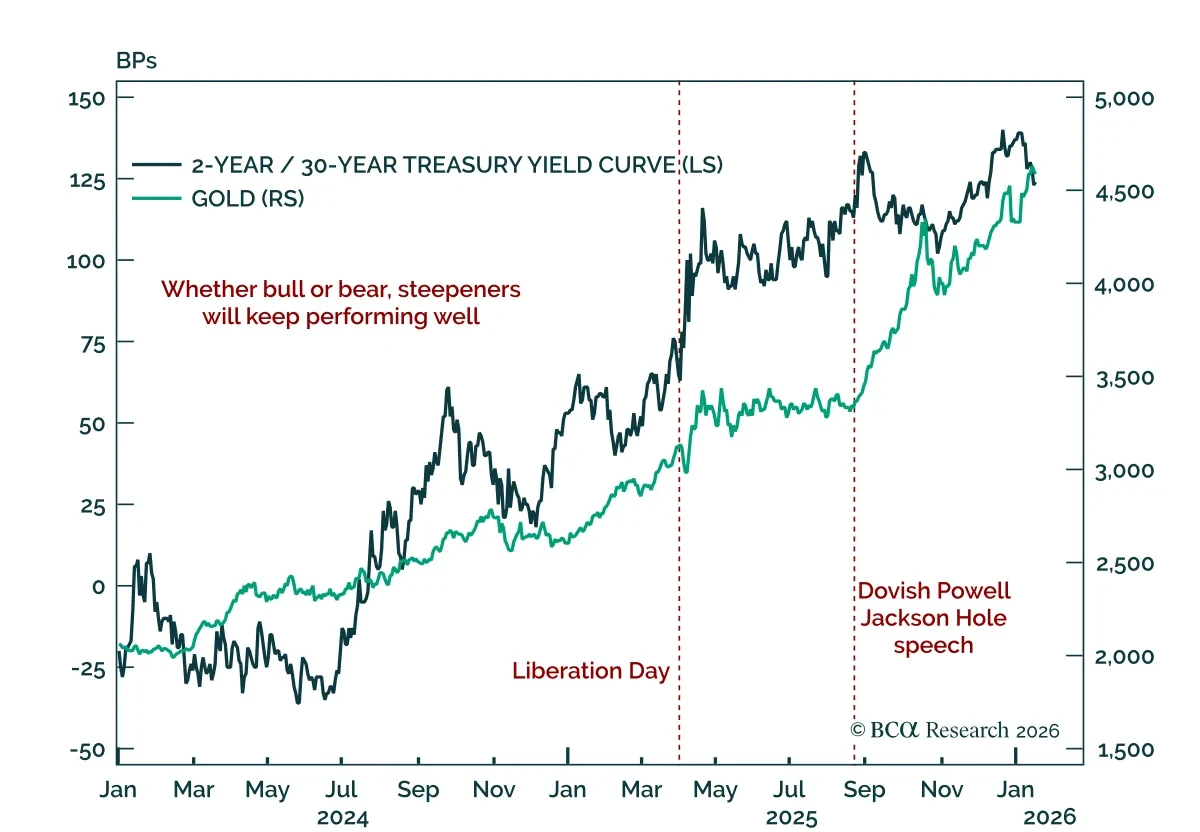

Favor curve steepeners and gold as recent price action highlights rising term premia and diversification away from US assets. With markets closed on Monday for the MLK holiday, Tuesday’s session saw price action reminiscent of last year’s “Sell America” trade amid escalating tensions between the US ...

Read more

Insight

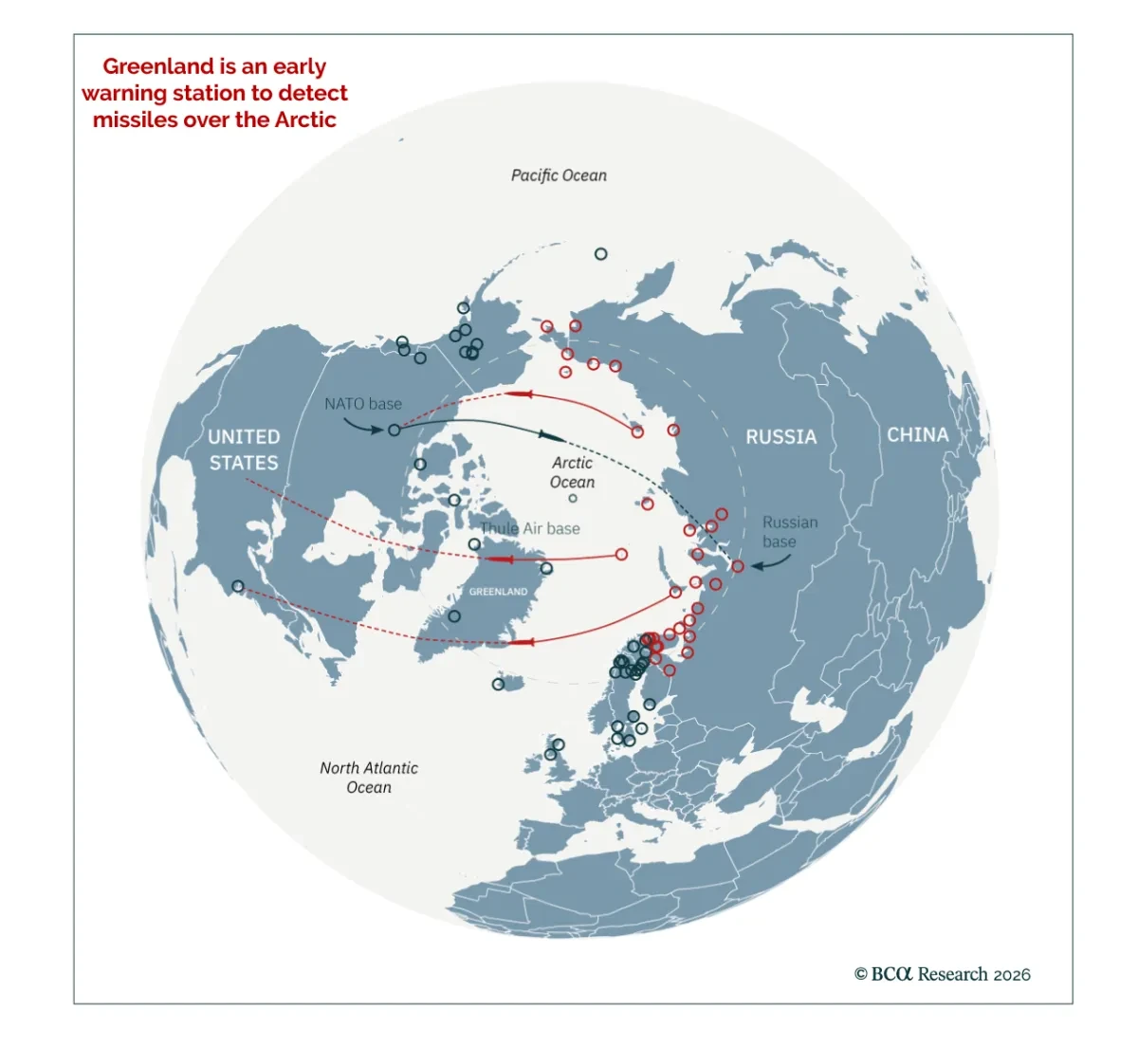

Stay constructive on European defense stocks and increase strategic exposure to industrial metals as geopolitical priorities reassert themselves. Following the capture of Venezuelan President Maduro, top US officials seem to confirm that President Trump is exploring ways to buy Greenland. While the ...

Read more

Insight

Our Global Investment strategists expect 2026 to follow a two-stage pattern: a “Great Rotation” from tech to non-tech equities in H1, followed by a broader market selloff in H2 as US economic momentum fades. Much like the 2000 cycle, the initial phase of sector rotation may mask deeper fragilities i...

Read more

Insight

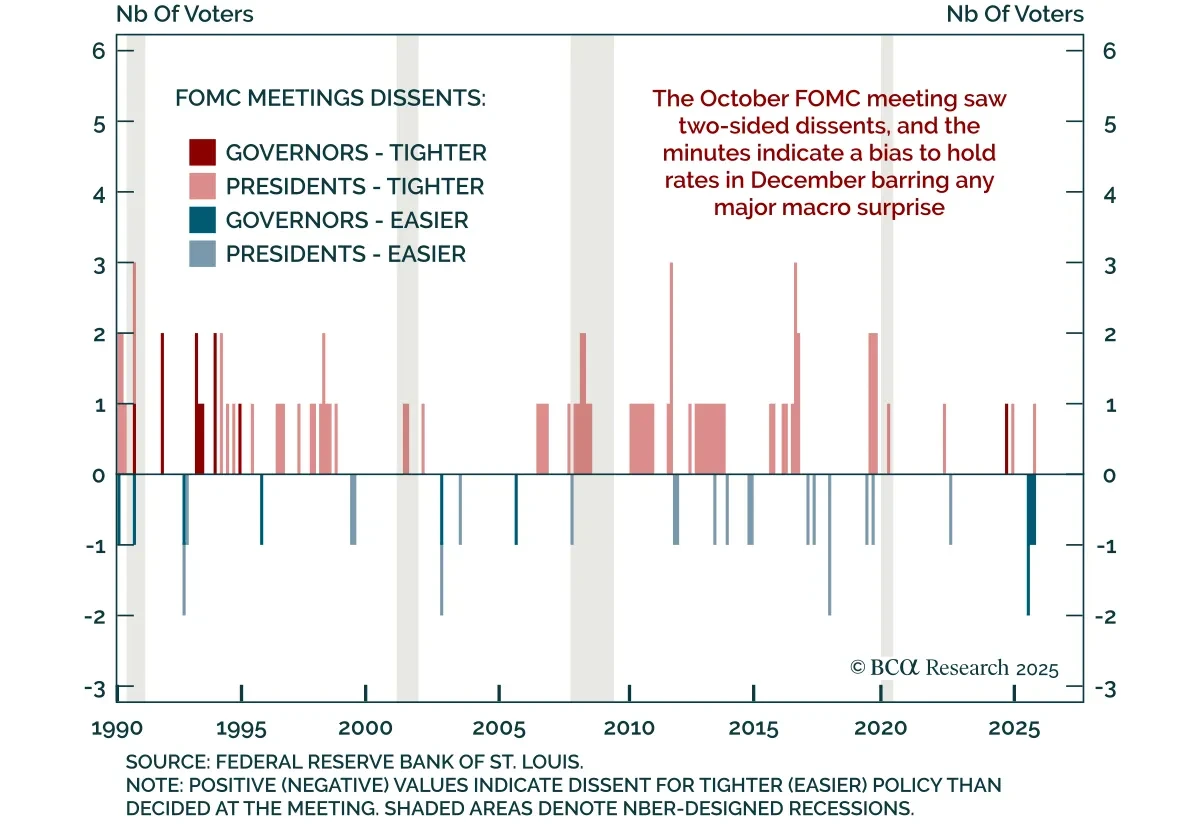

The October FOMC minutes underscored deep divisions over the Fed’s next move, reinforcing expectations for a December hold but keeping the easing bias intact. The 10–2 vote for a 25 bps cut included dissents on both sides (Governor Miran for a 50 bps move and Kansas City Fed President Schmid for no ...

Read more

Insight

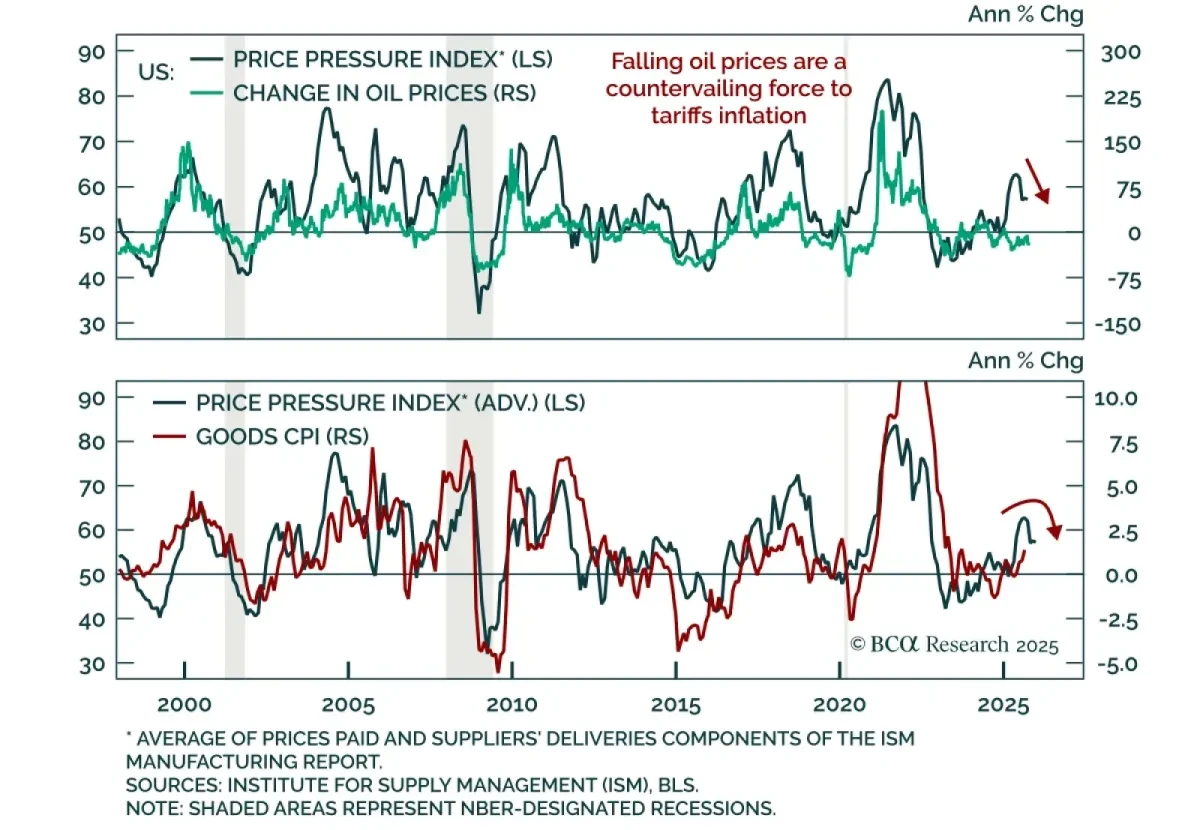

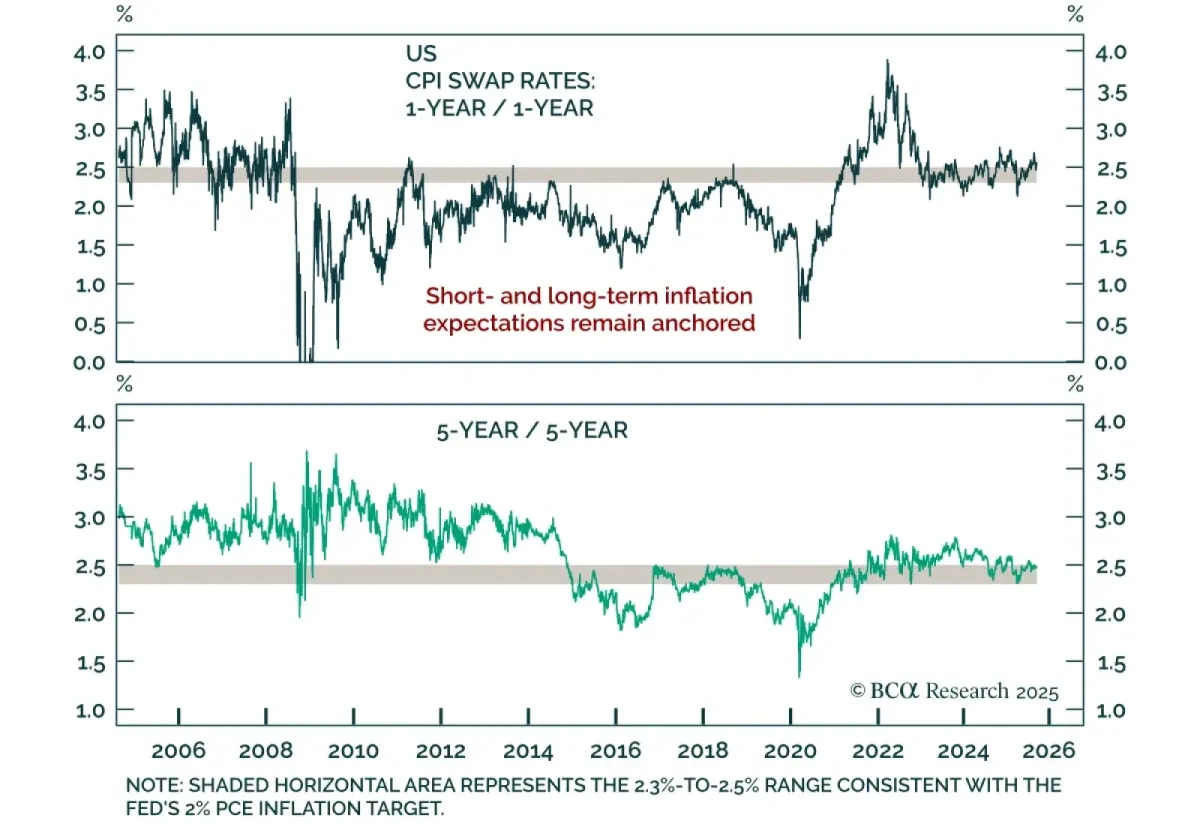

Falling oil prices are countering tariff-driven inflation which, along with a weakening labor market, is reinforcing a long duration stance. Brent crude broke below the $65/bbl support level held since June and WTI is now down 16% from a year ago. Falling oil prices are significant at this stage of ...

Read more

Insight

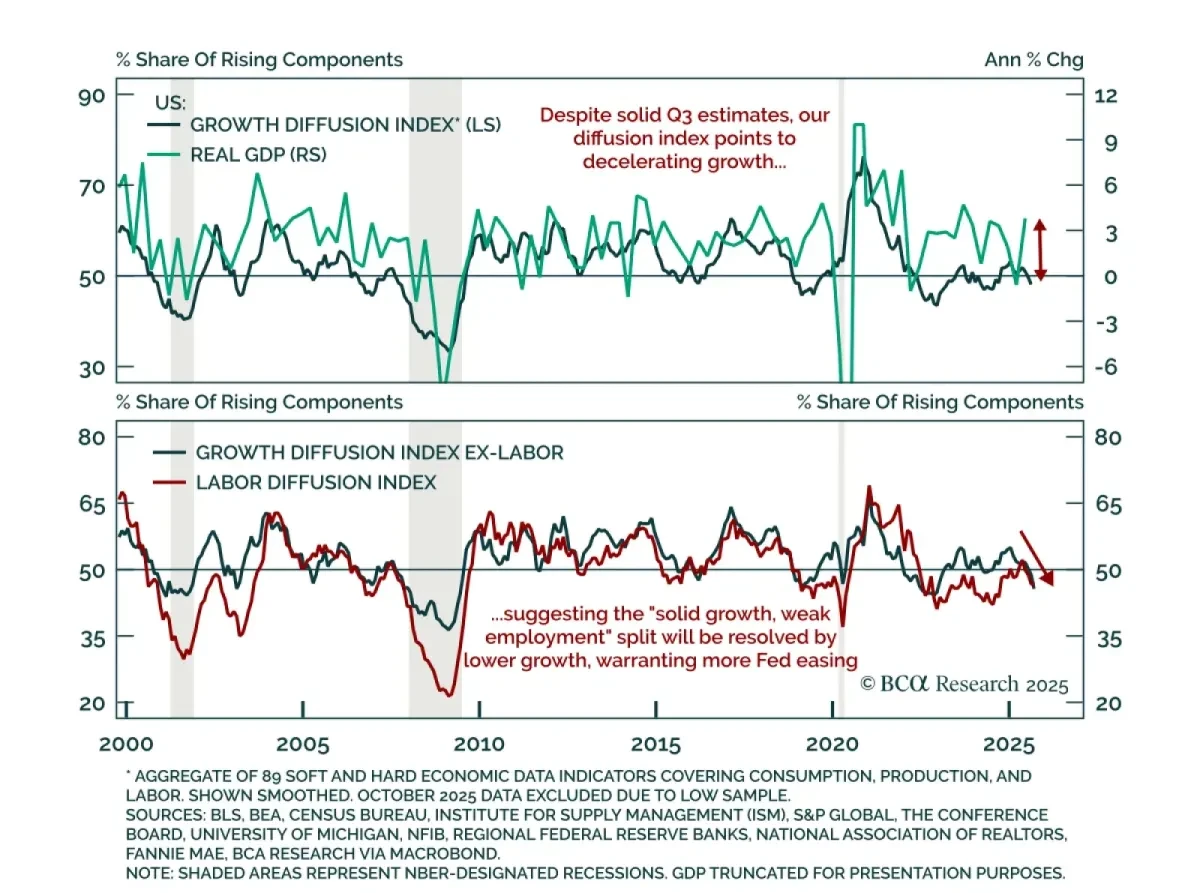

We expect the divergence between resilient growth and weakening employment to be resolved by lower growth estimates, supporting long duration and steepeners. Economic activity and employment usually move together in a circular relationship: spending drives income and jobs, with income driving subseq...

Read more

Insight

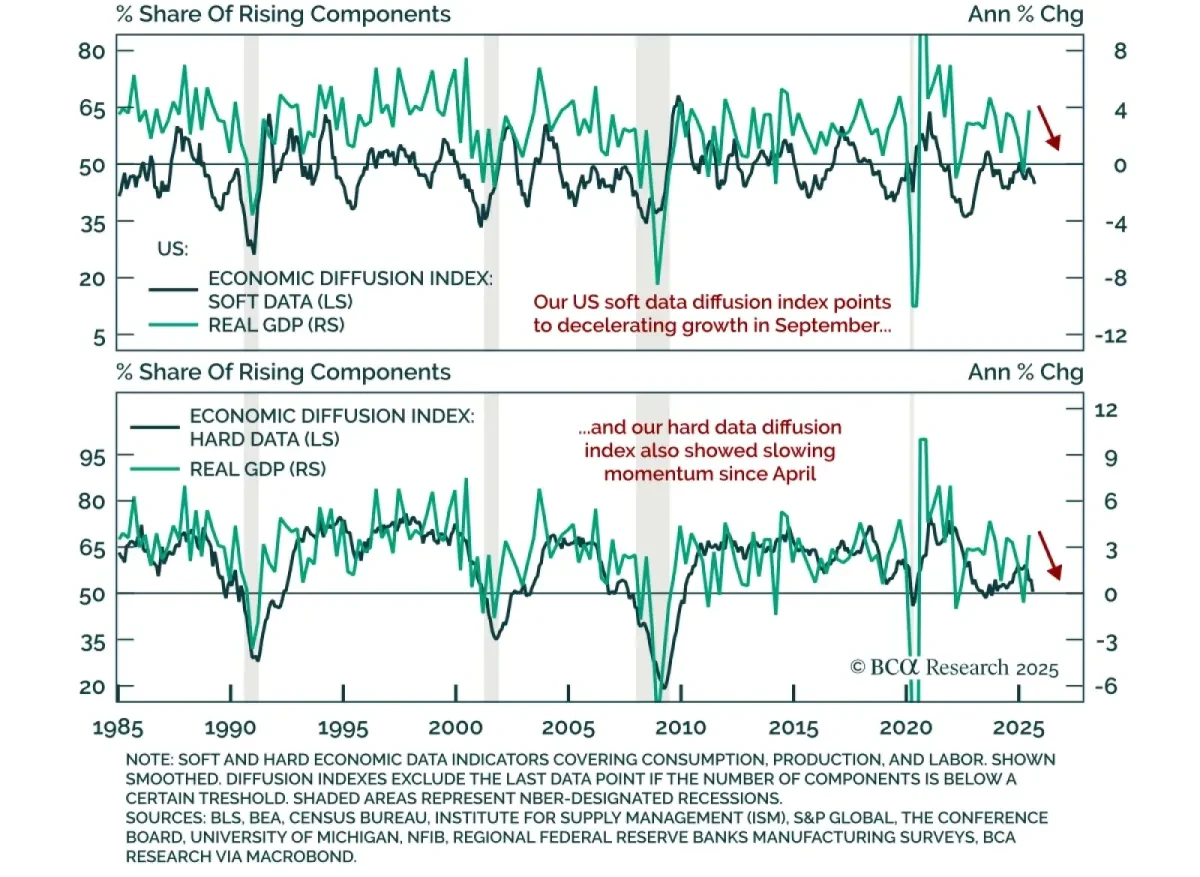

Survey-based data available for September show weakening US growth momentum, supporting modest defensiveness. While the government shutdown may delay official releases, soft data provide a timely view. Our US economic diffusion index, combining more than 80 indicators, points to slowing momentum. Of...

Read more

Insight

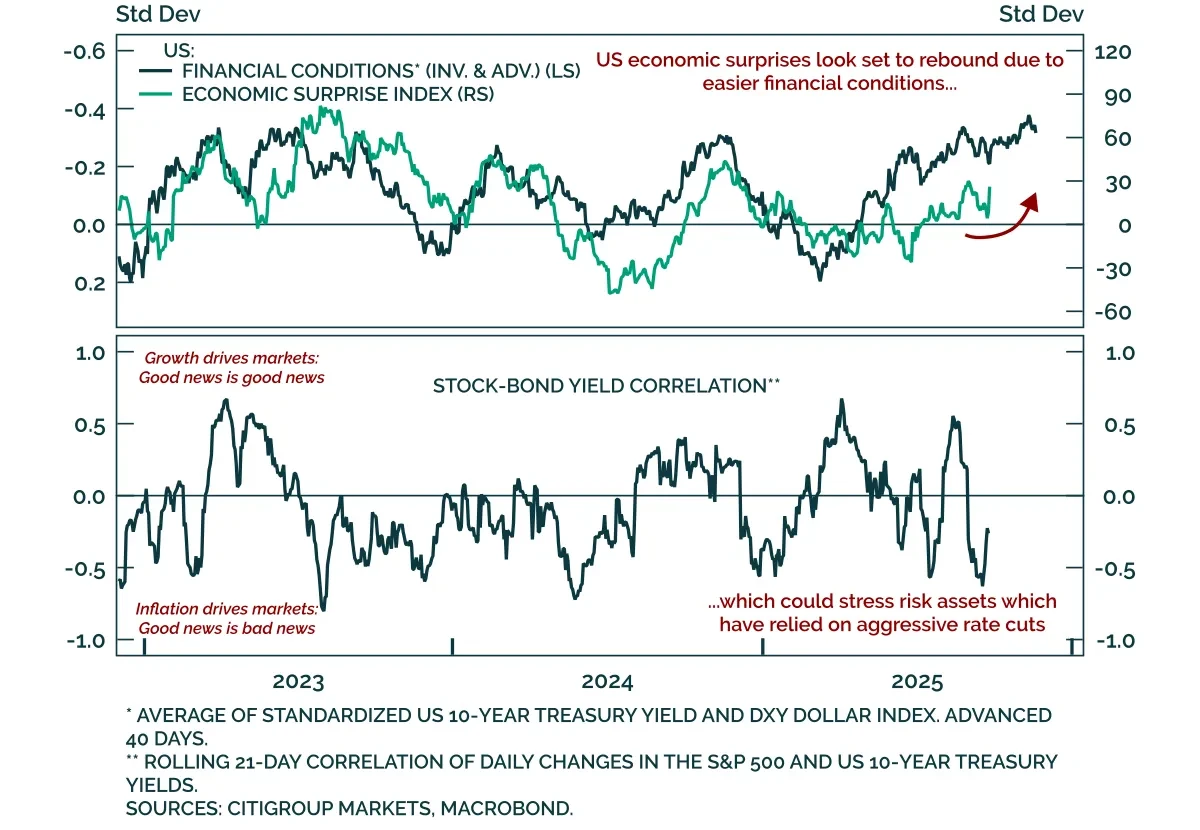

Our tactical framework, which tracks the reflexive loop between financial conditions and economic surprises, points to stronger near-term growth, leaving equities vulnerable if inflation re-accelerates. Data surprises move markets, while bond yields and the USD in turn shape growth outcomes through ...

Read more

Insight

Powell’s “risk management cut” underscores the Fed’s shift toward growth risks, reinforcing long duration with steepeners. Risk management is central to monetary policy. It determines how policymakers balance uncertainty and decide which mistake is less costly: Cutting too soon and risking infl...

Read more