Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Insight

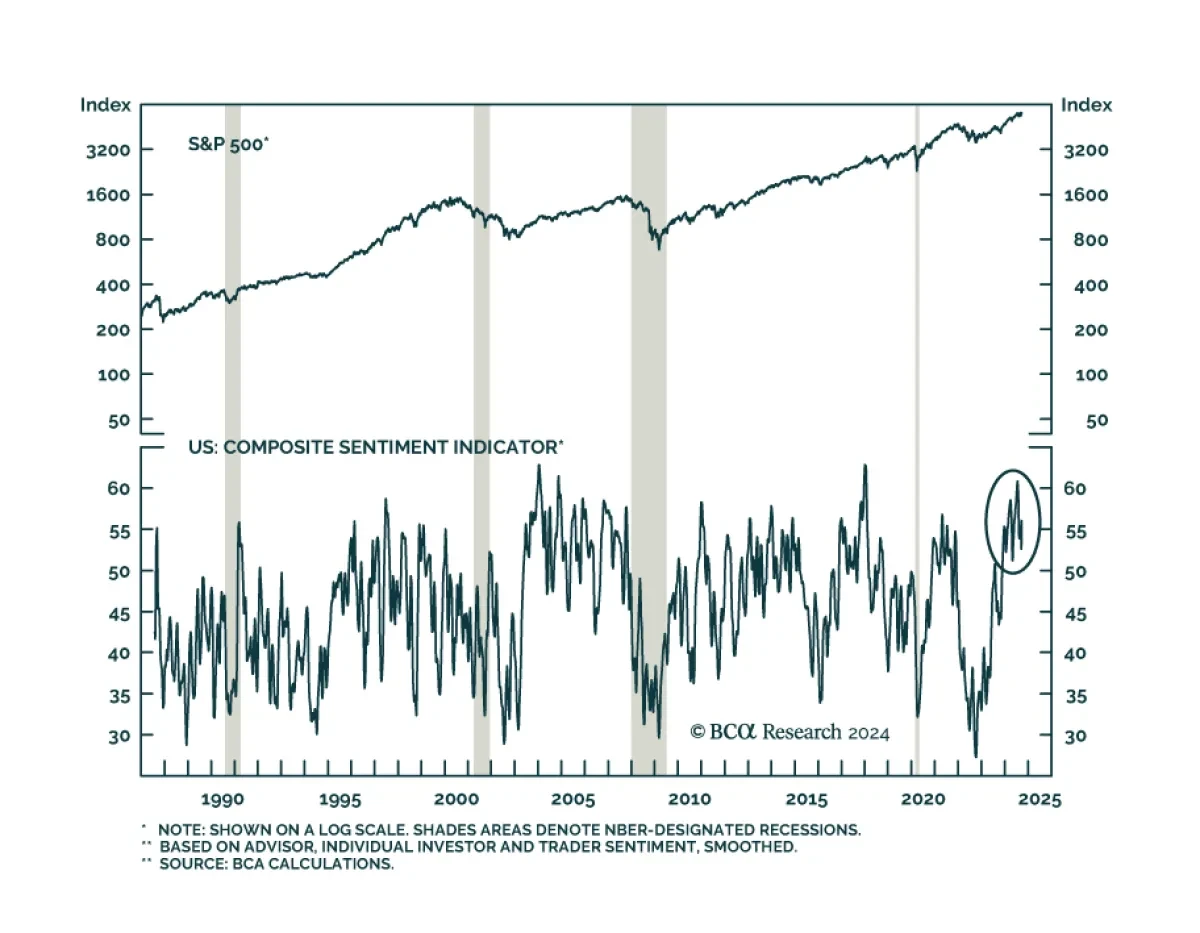

One key takeaway from Wednesday’s post-FOMC press conference is the Fed’s unshaken conviction that it can avoid a recession. A risk-on mood dominated markets on Thursday, with the S&P 500 breaching new all-time highs while the 10-year Treasury yield rose 3.5 basis points (see Indicator Spotlight...

Read more

Insight

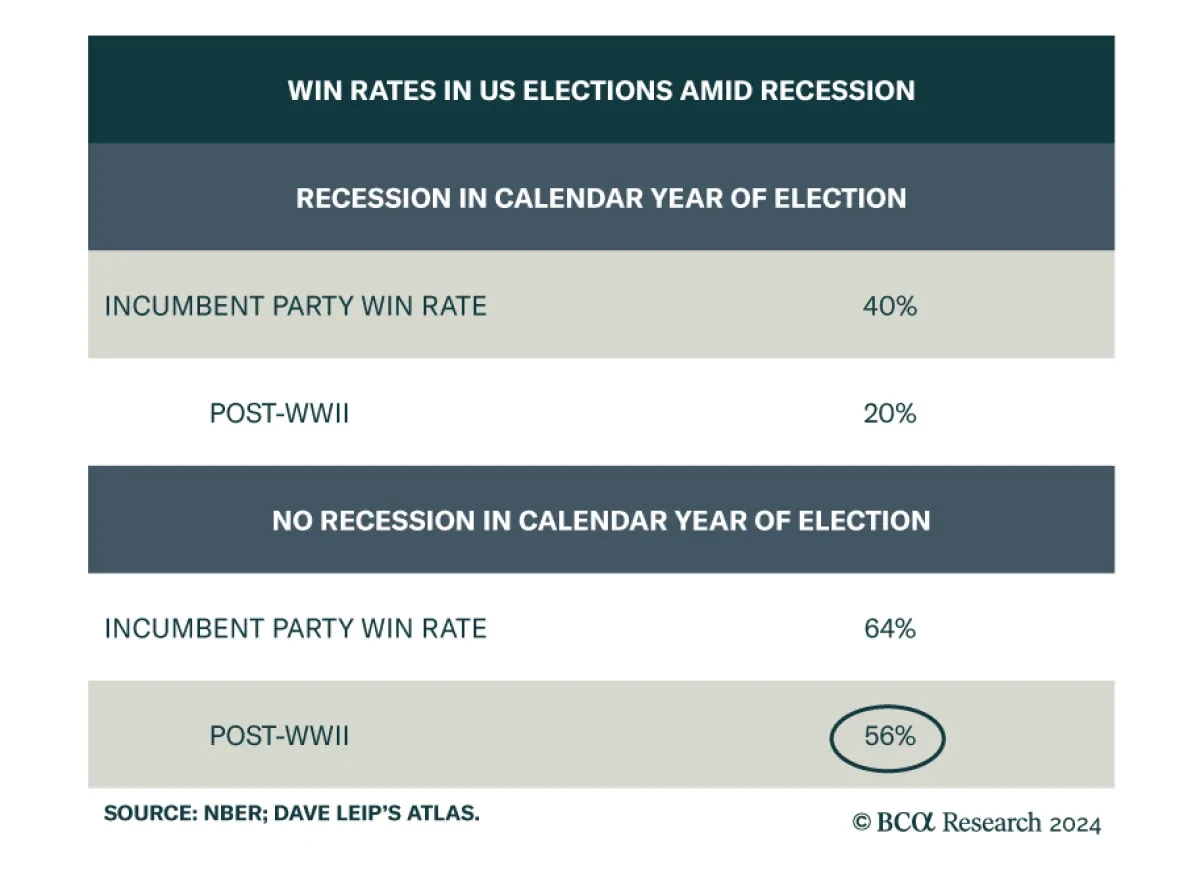

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran.Iran is still highly likely to retaliate against Israel. The Biden administr...

Read more

Insight

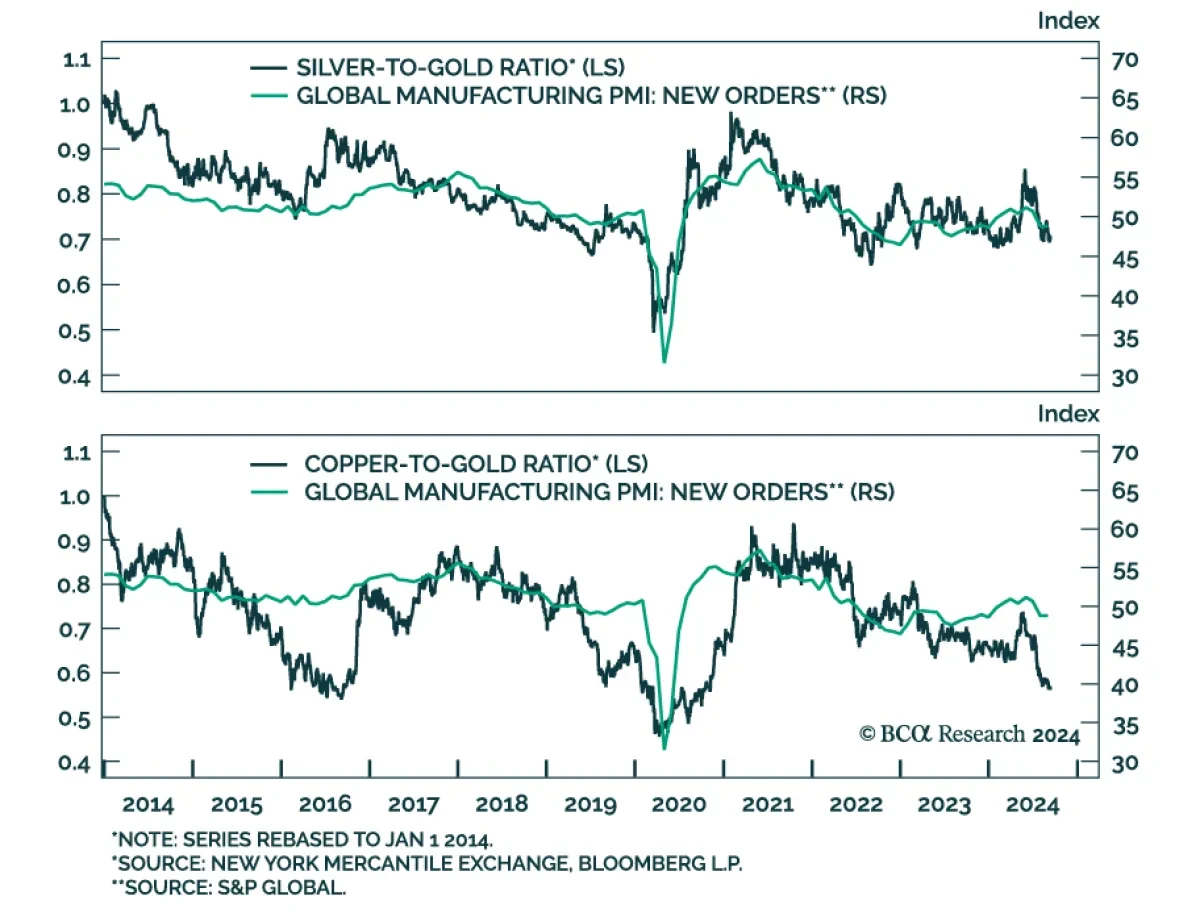

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that industrial applications account for roughly half of silver demand.The ...

Read more

Insight

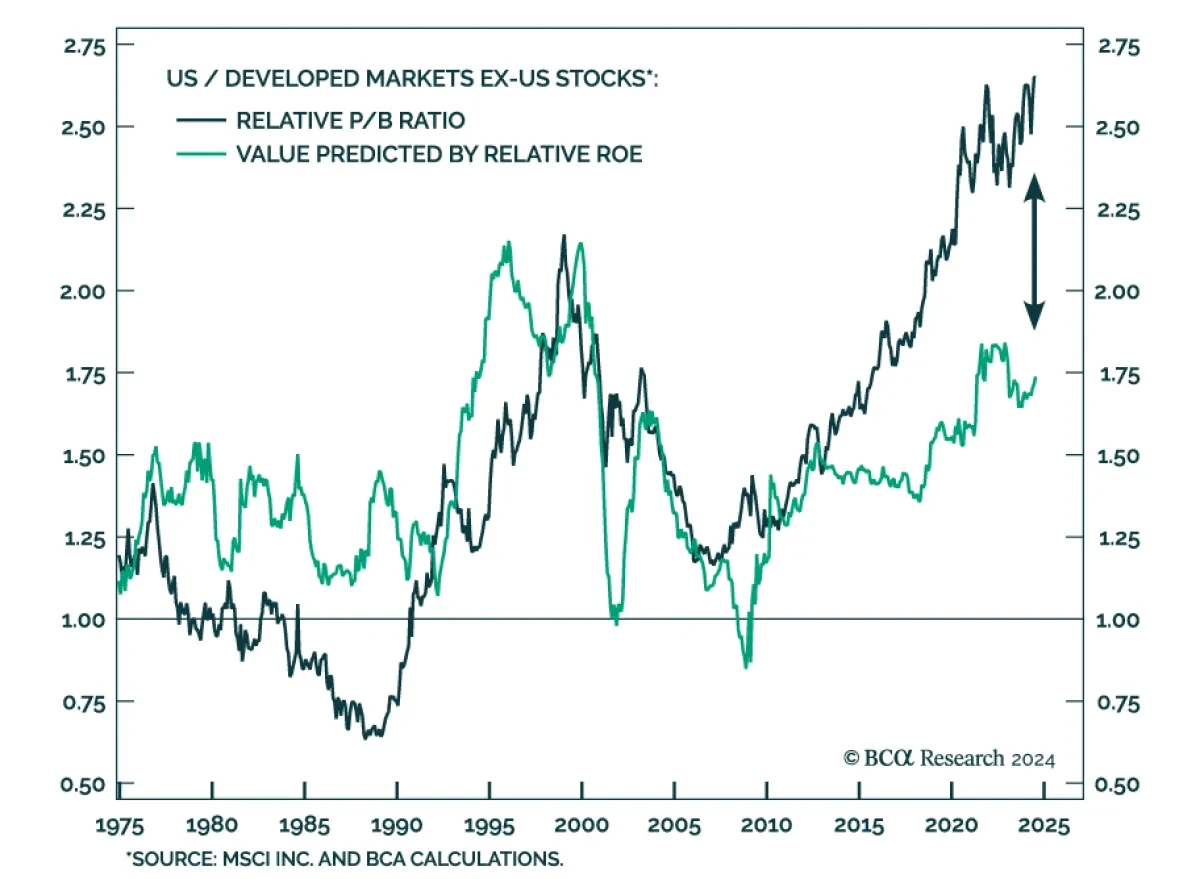

According to our Bank Credit Analyst service, an inflection point in the relative performance of US stocks is not likely to occur over the coming 6-12 months. A recession favors US equities in common currency terms barring substantially less global ex-US earnings weakness than has historically occur...

Read more

Insight

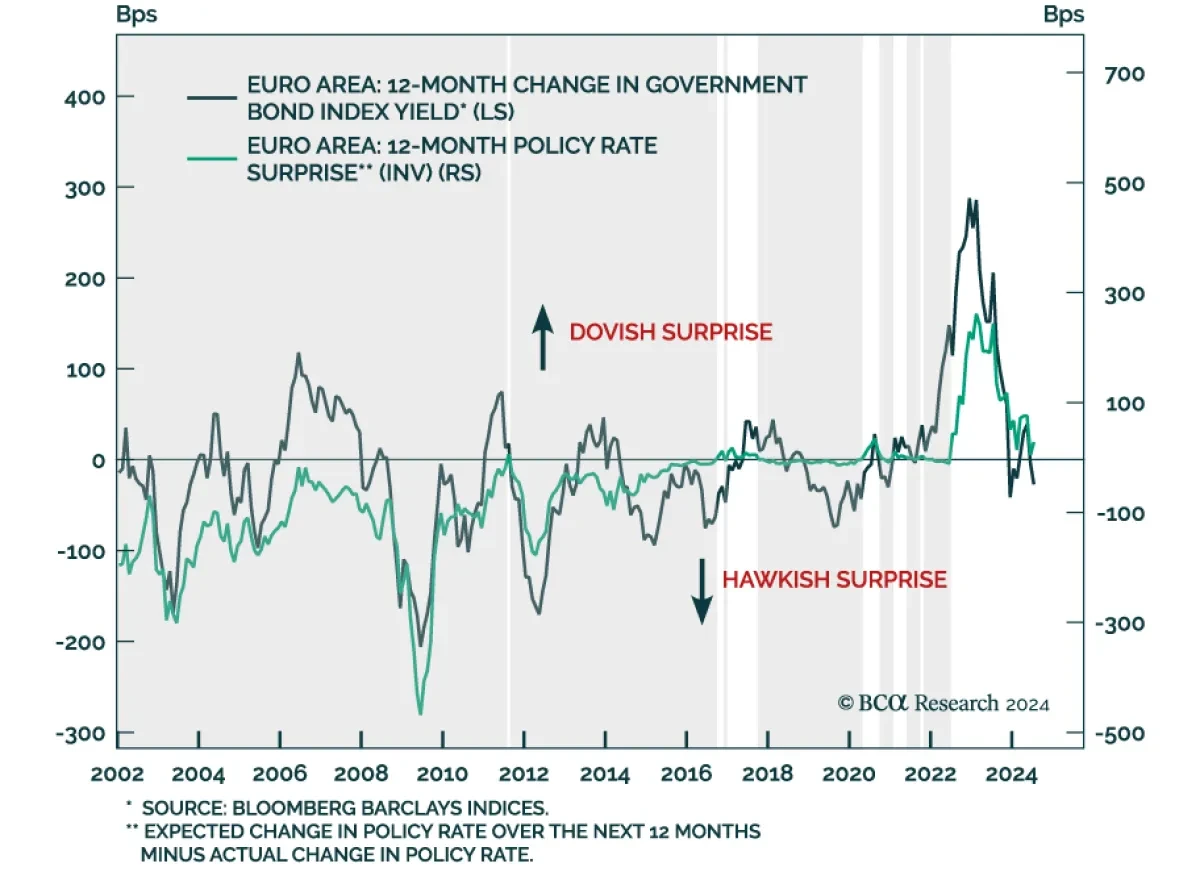

After surprising to the upside in July on higher energy costs, Eurozone CPI resumed its deceleration in August. Headline and core CPI declined from 2.6% y/y to 2.2% and from 2.9% to 2.8%, respectively.Energy prices contracted 0.3% y/y from July’s 1.2% increase, however services inflation, which is m...

Read more

Insight

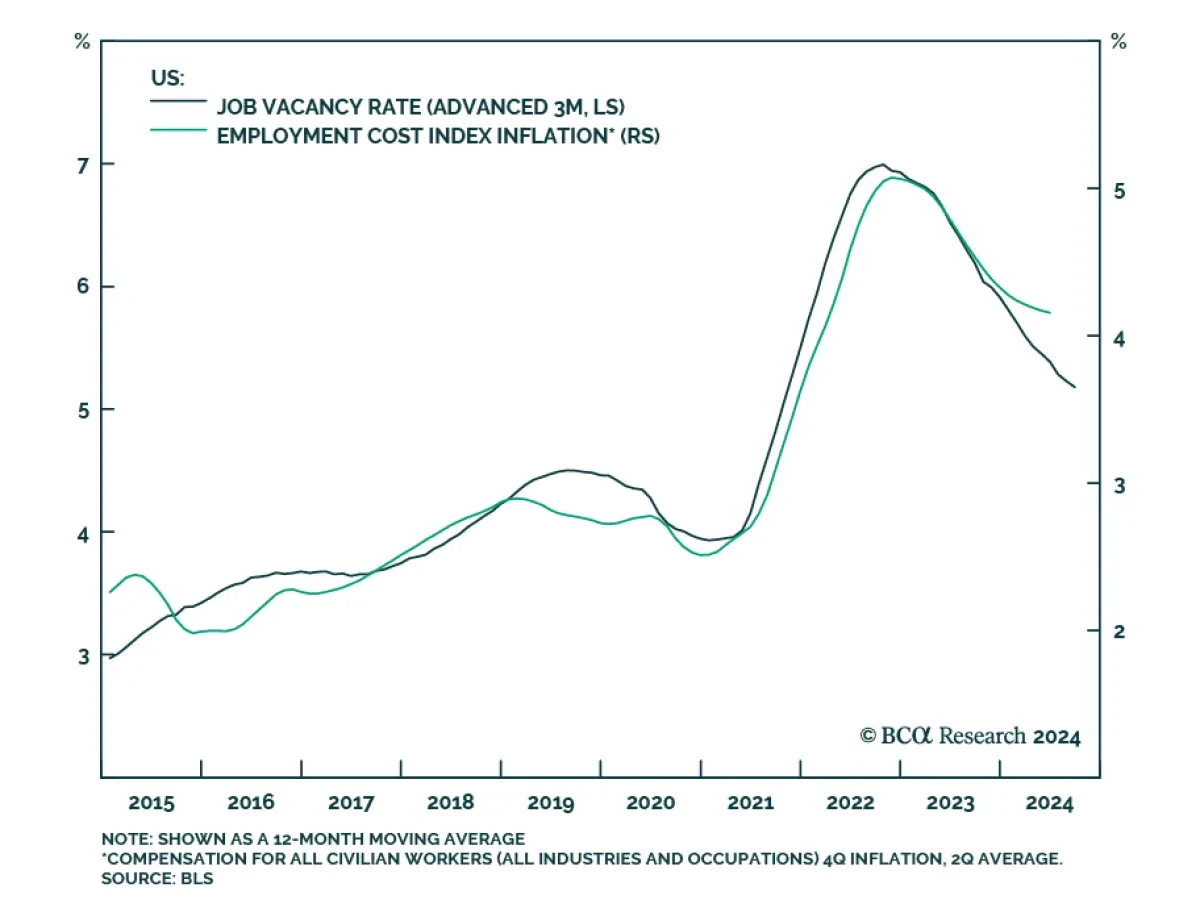

According to BCA Research’s Counterpoint Strategy service, the post-pandemic US economy has inverted from its usual ‘demand-constrained’ state to a highly unusual ‘supply-constrained’ state. This inversion is still a ways from normalizing, with labor demand still exceeding supply by 2.2 million jobs...

Read more

Insight

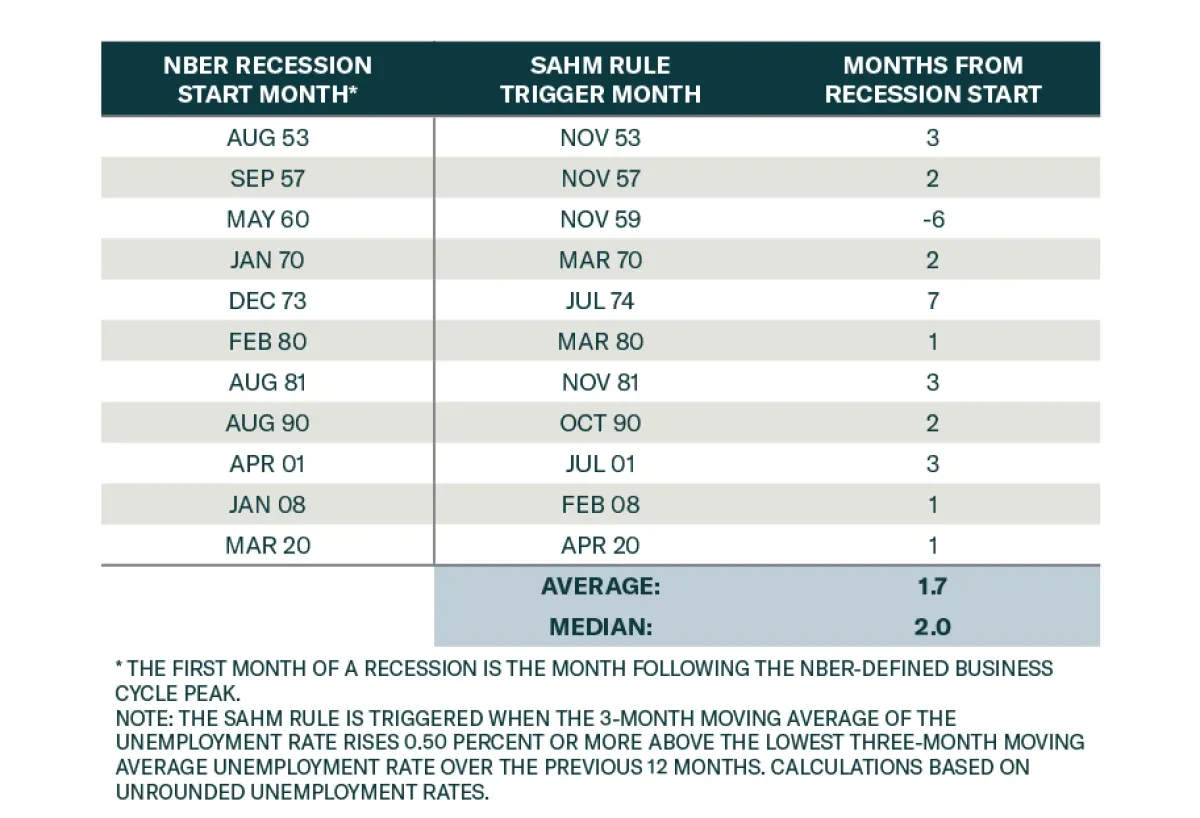

Market and economic observers have devoted a lot of attention to the Sahm Rule following July’s employment report, and whether or not it has been triggered. BCA’s analysis has highlighted that the overall direction of the labor market is far more important than the rounding conventions one applies t...

Read more

Insight

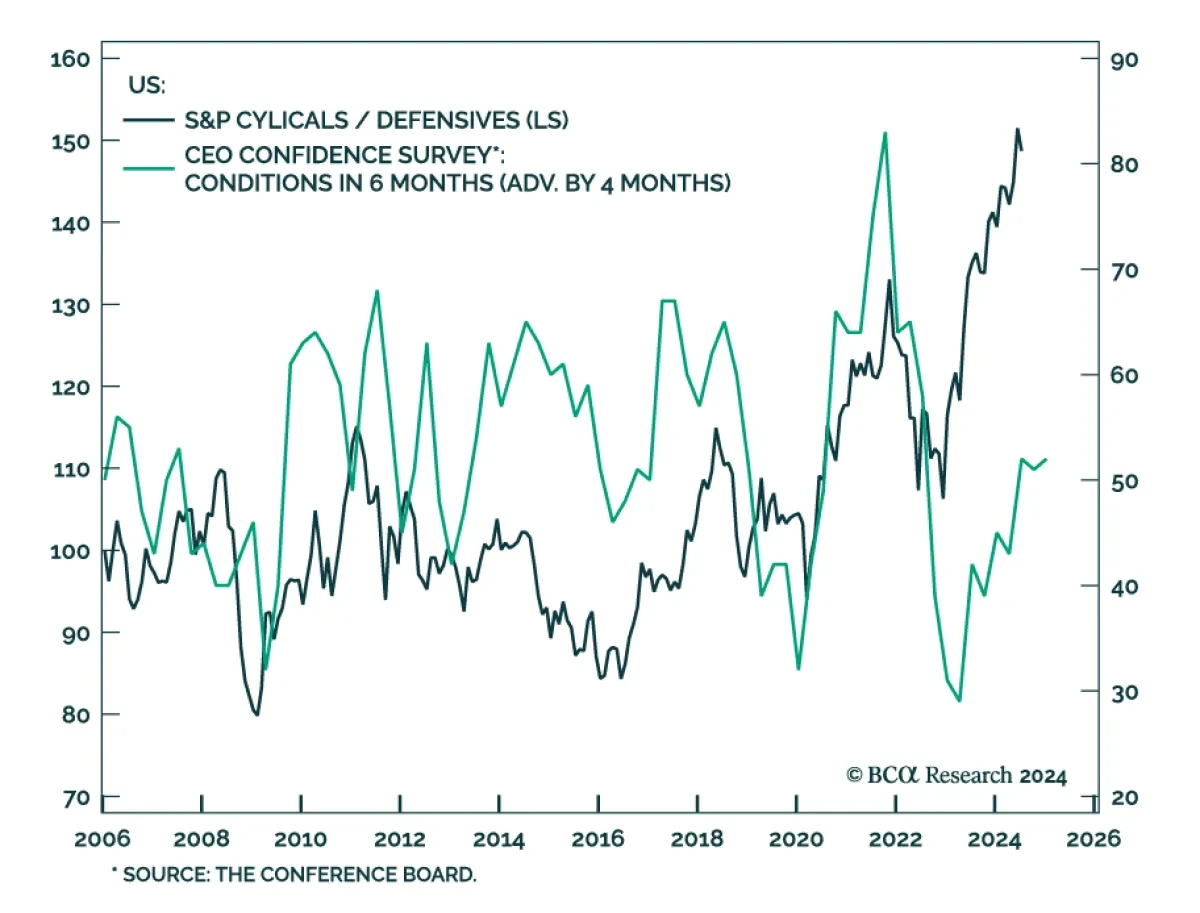

The Conference Board measure of CEO Confidence declined in Q3, from 54 to 52, its lowest level so far this year. Still, a reading above 50 indicates that optimistic perceptions of business conditions outweigh pessimistic assessments. The Q3 survey marks a decline in CEO optimism, which ha...

Read more

Insight

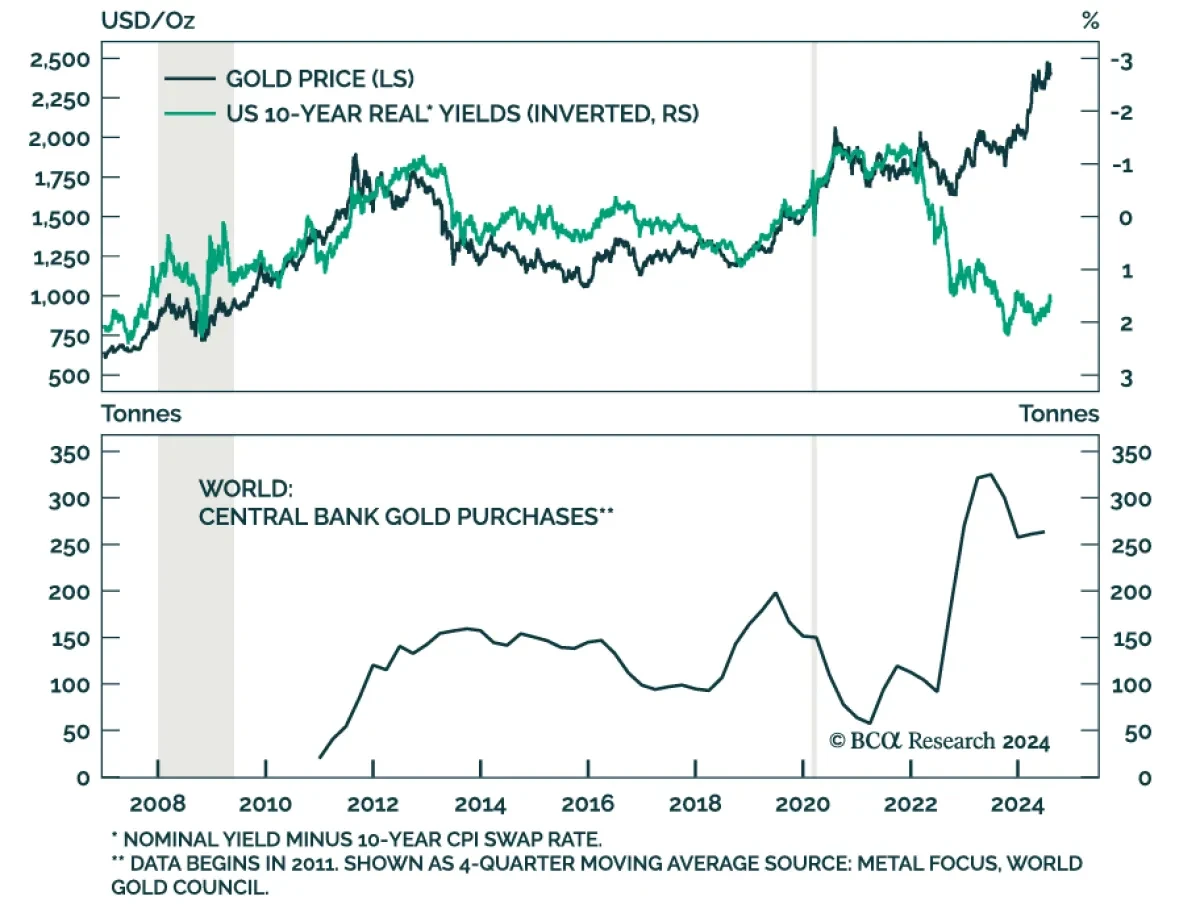

Despite the recent market rout, gold’s performance has maintained its leadership position. Global equities are up 7.5% in 2024YTD, global bonds are up 2.6% over the same period while gold prices have rallied by a solid 17%. Given our high conviction that the US economy will tip into recession by ear...

Read more

Insight

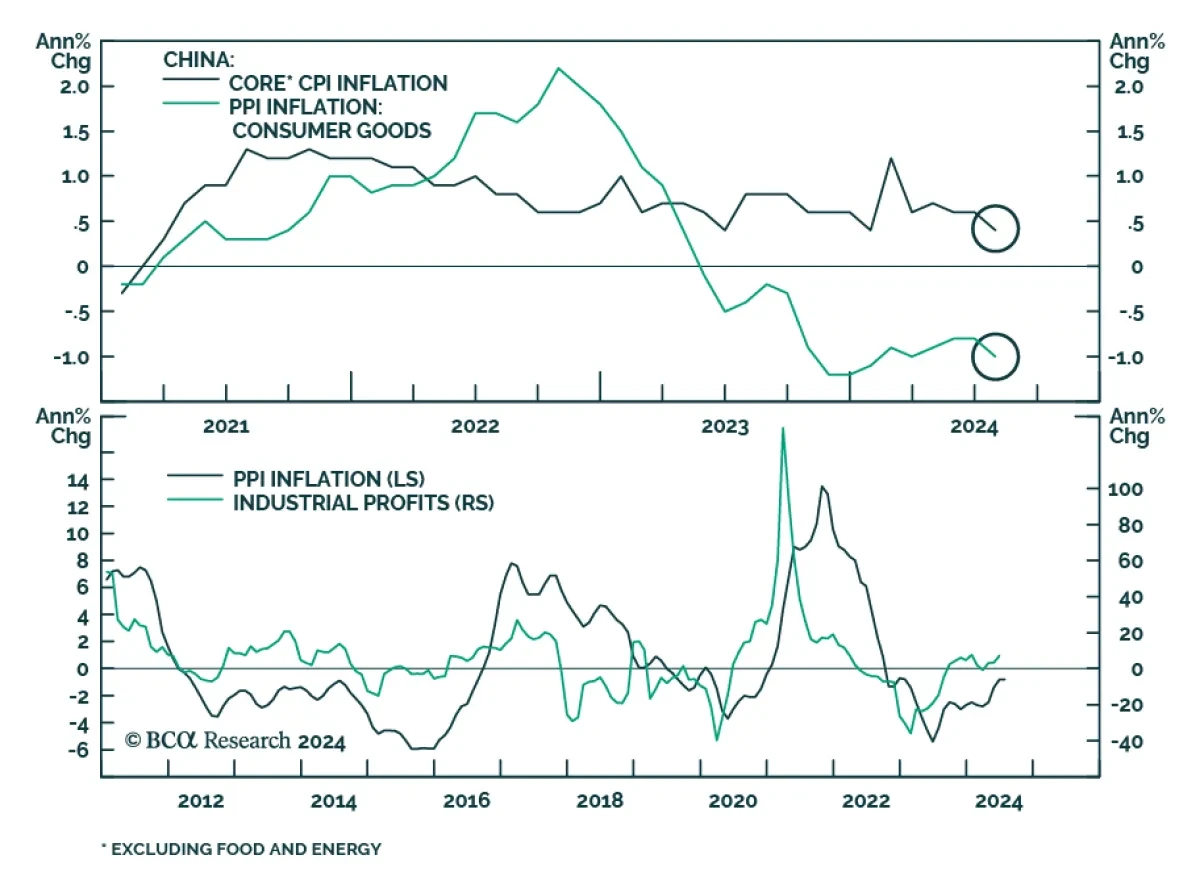

China’s CPI and PPI prints surprised to the upside on Friday. Producer prices contracted -0.8%y/y, unchanged from June, compared to expectations of a -0.9% contraction. Consumer prices increased 0.5%y/y, above 0.3% expectations.The consumer price index hit its highest rate of change since February, ...

Read more