Insights

Access expert research, timely insights, and exclusive webcasts to help you make confident, data-driven decisions.

Insight

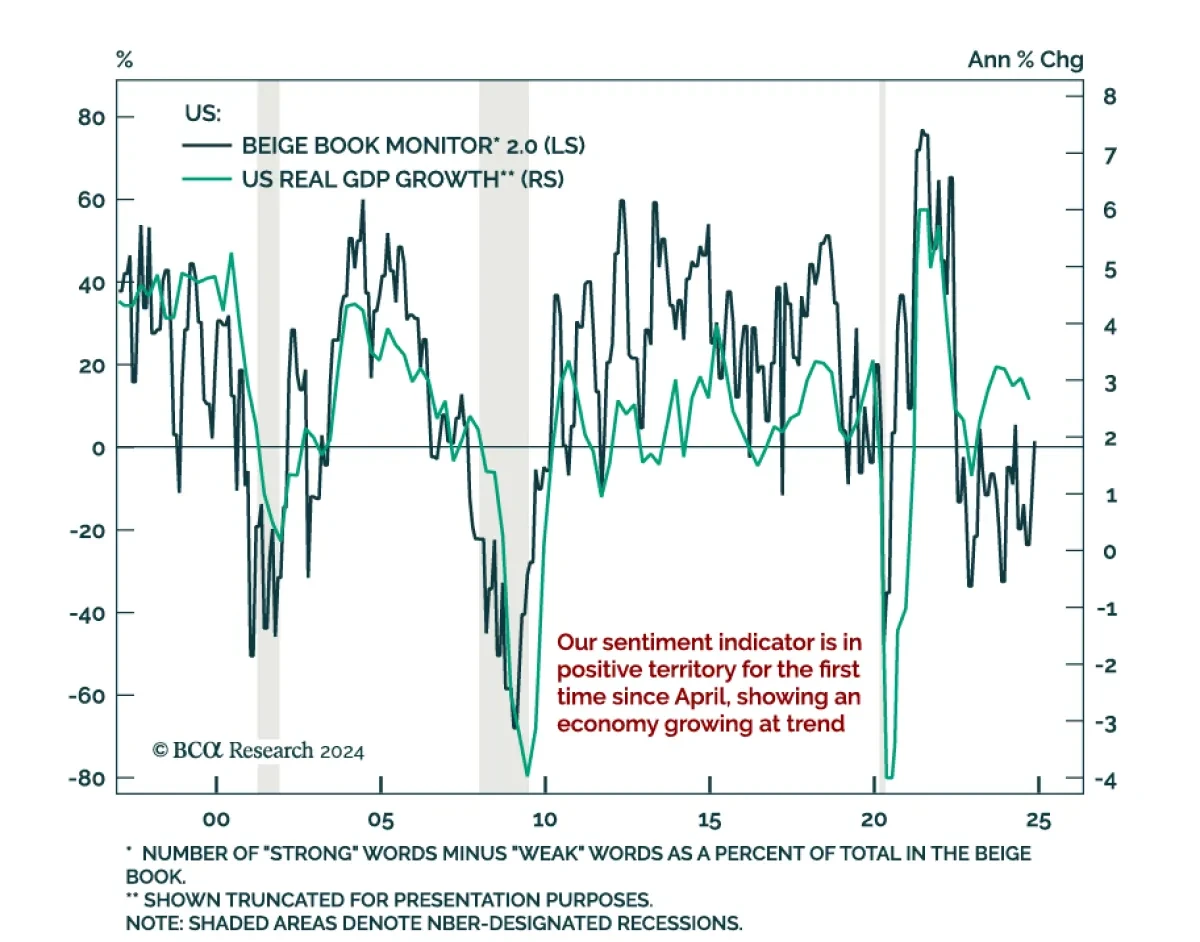

The Federal Reserve’s Beige Book shows a modestly growing economy imbued with post-election optimism, while highlighting some caution about employment. The latest Beige Book is in line with other sentiment indicators showing modest growth but increased post-election expectations. The pict...

Read more

Insight

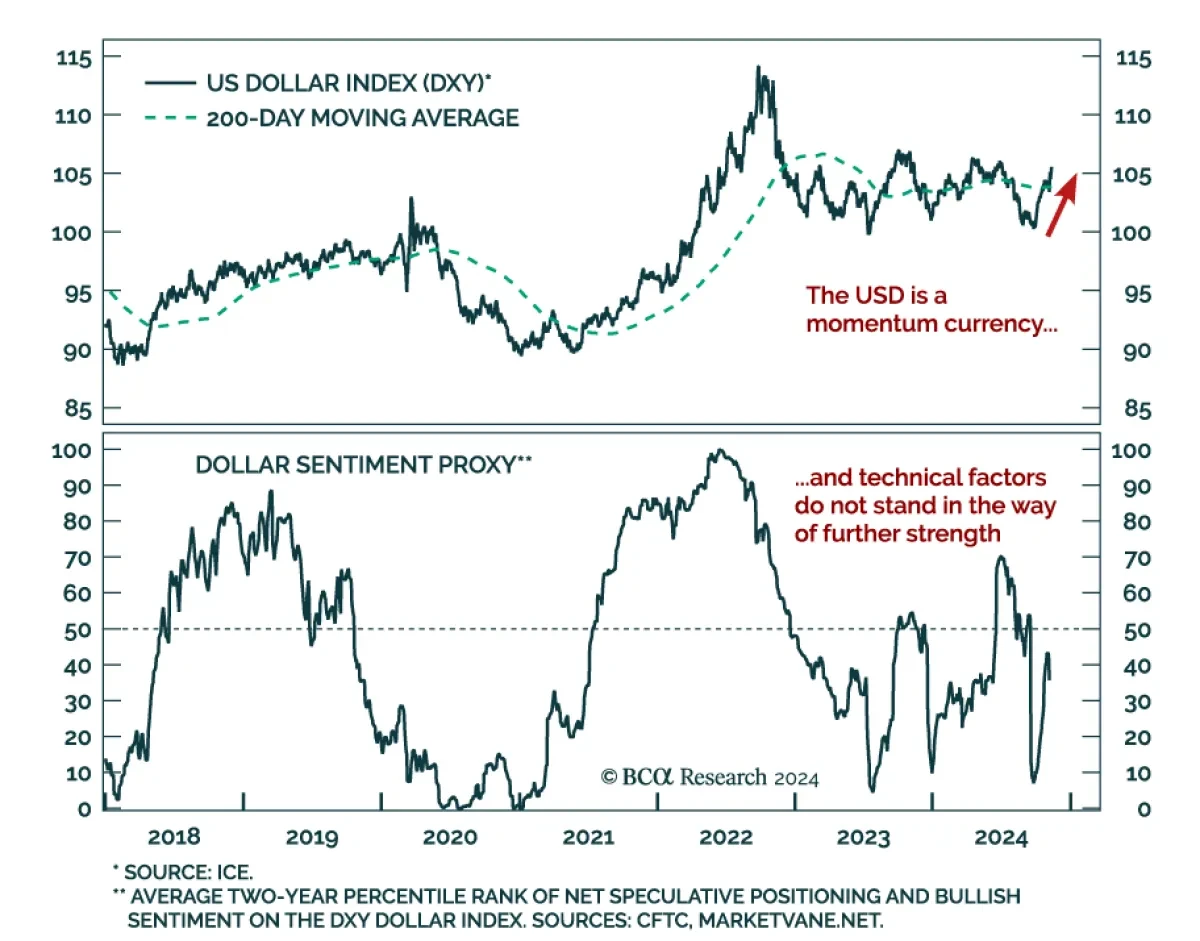

The US dollar steamrolled its peers since early October. After breaking out above its 200-day moving average, it is now fast approaching recent highs. Multiple factors drove this rally, among them are the stronger-than-expected US economic data, weaker data overseas, and Trump’s victory. ...

Read more

Insight

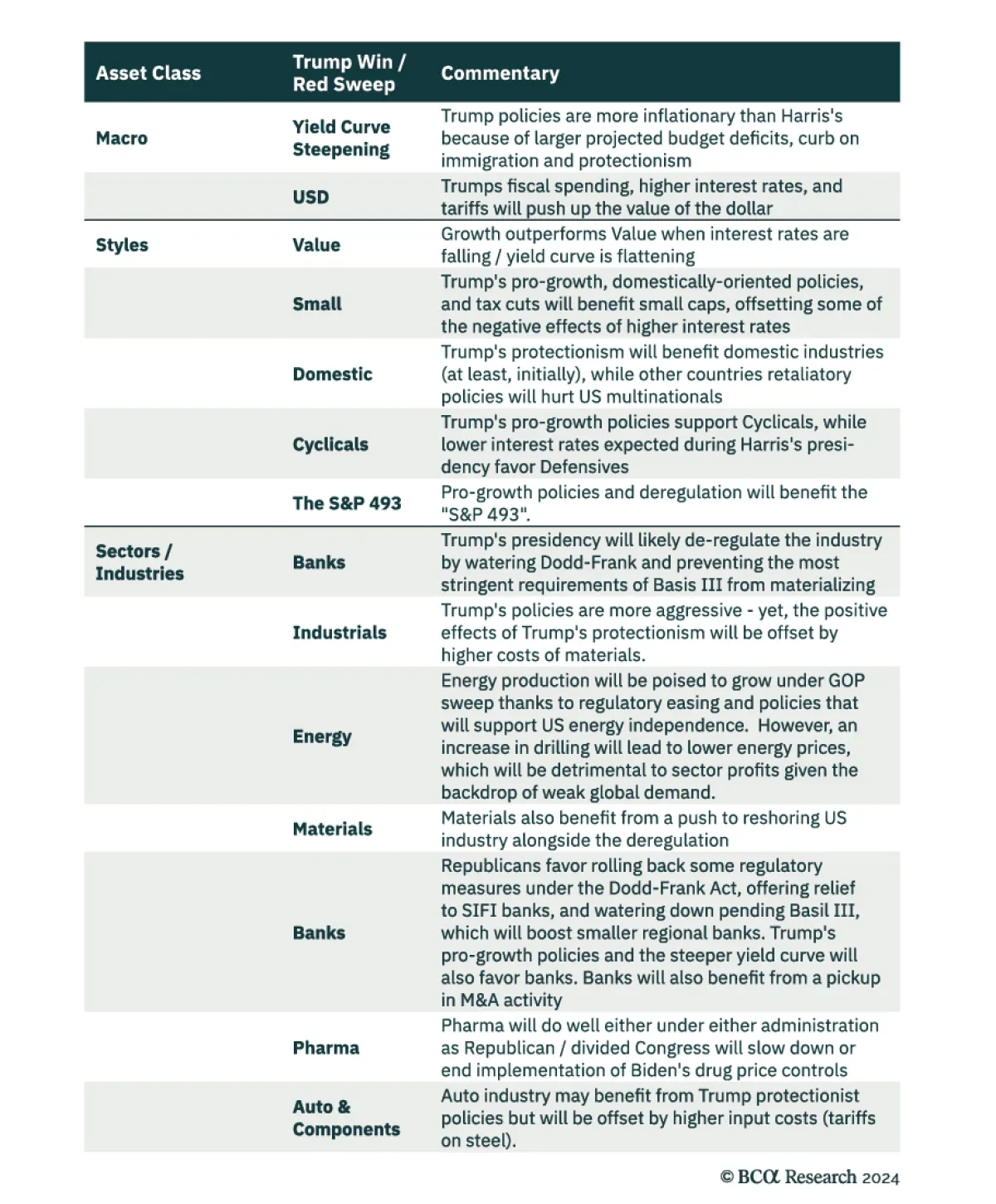

Our US Equity strategists prepared a Post-Election US Equity Cheat Sheet. Here are highlights of their recommended positioning for a US equity portfolio in a Red Sweep scenario. Our US Equity strategists prepared a Post-Election US Equity Cheat Sheet. Here are highlights of their recommen...

Read more

Insight

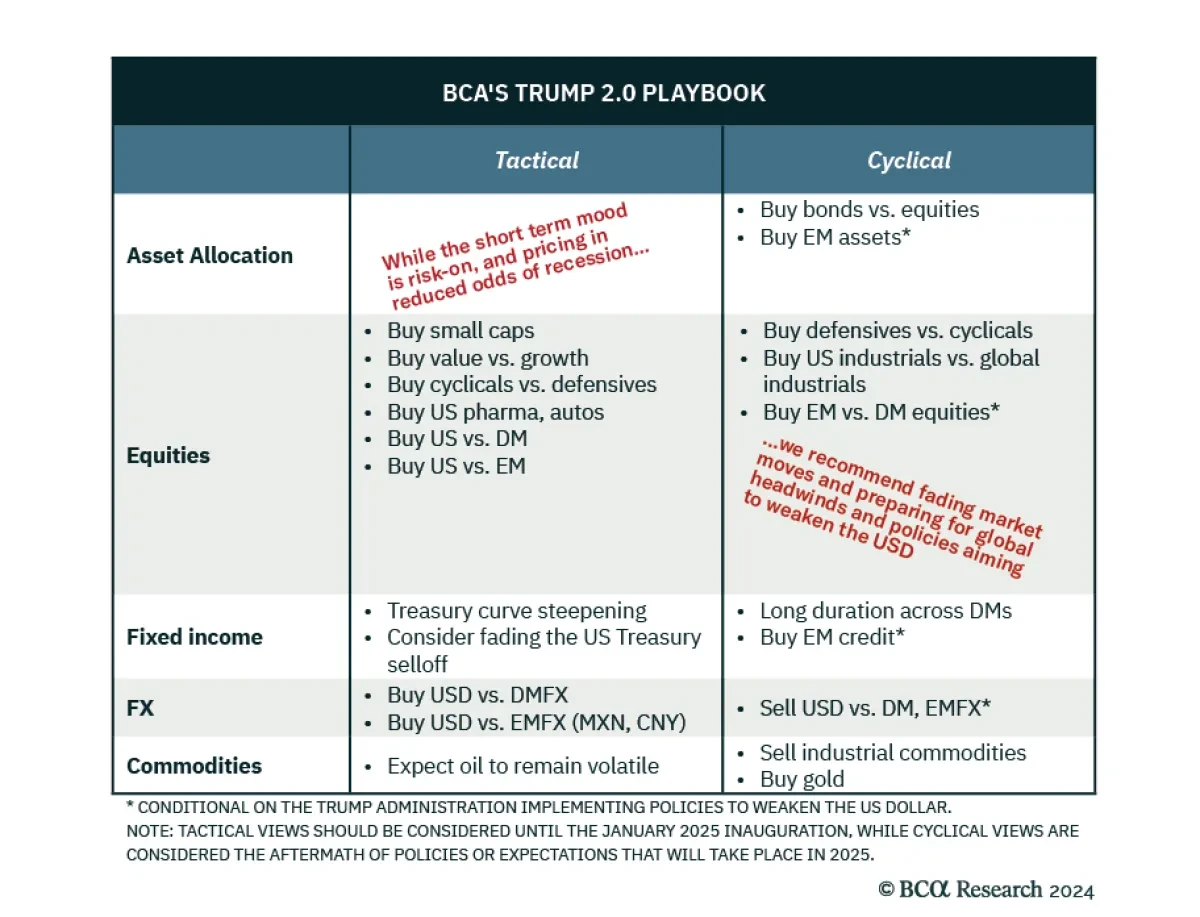

Although foreseen by our US & Geopolitical strategists, a “Red Sweep” now makes the macro environment more volatile. After convening for our BCA Live & Unfiltered meeting, we offer three main takeaways. First, 2024 is not 2016. To begin with, a Trump victory is less of a surprise....

Read more

Insight

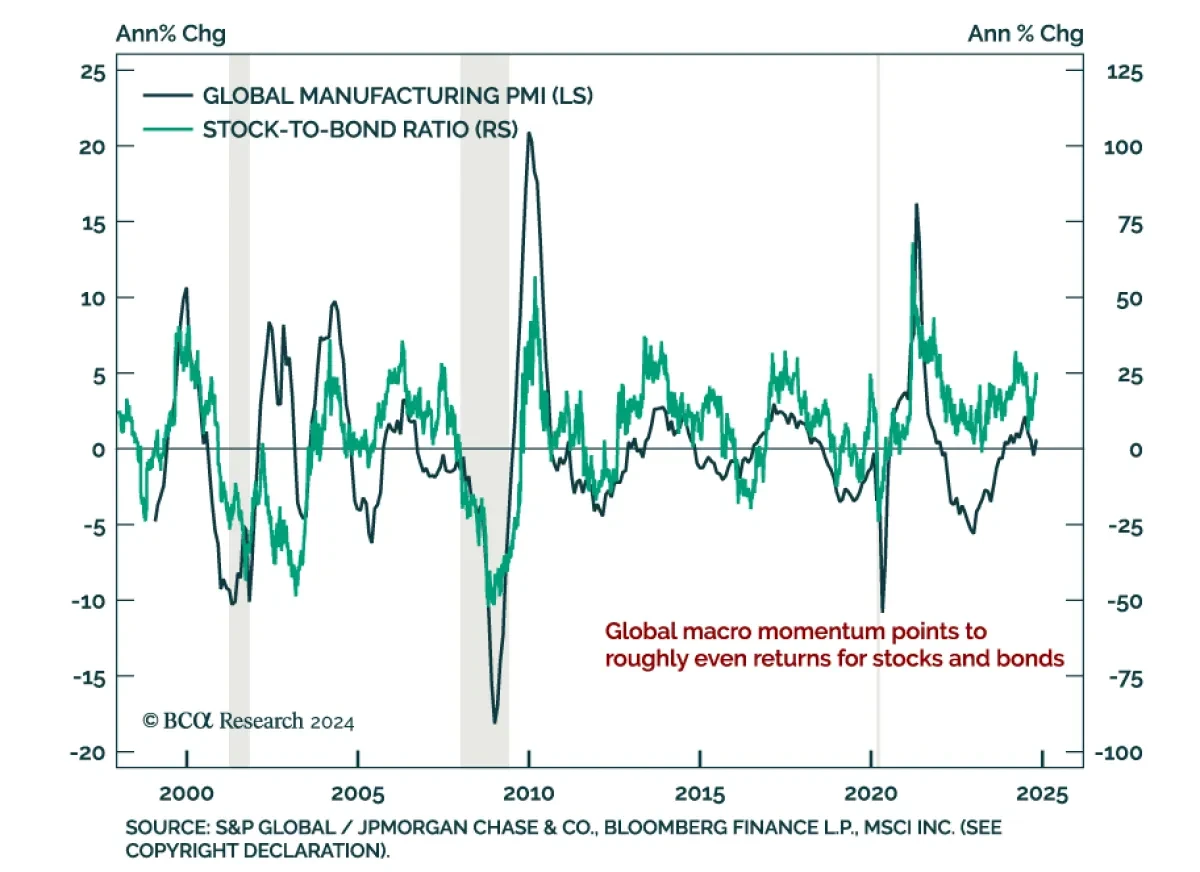

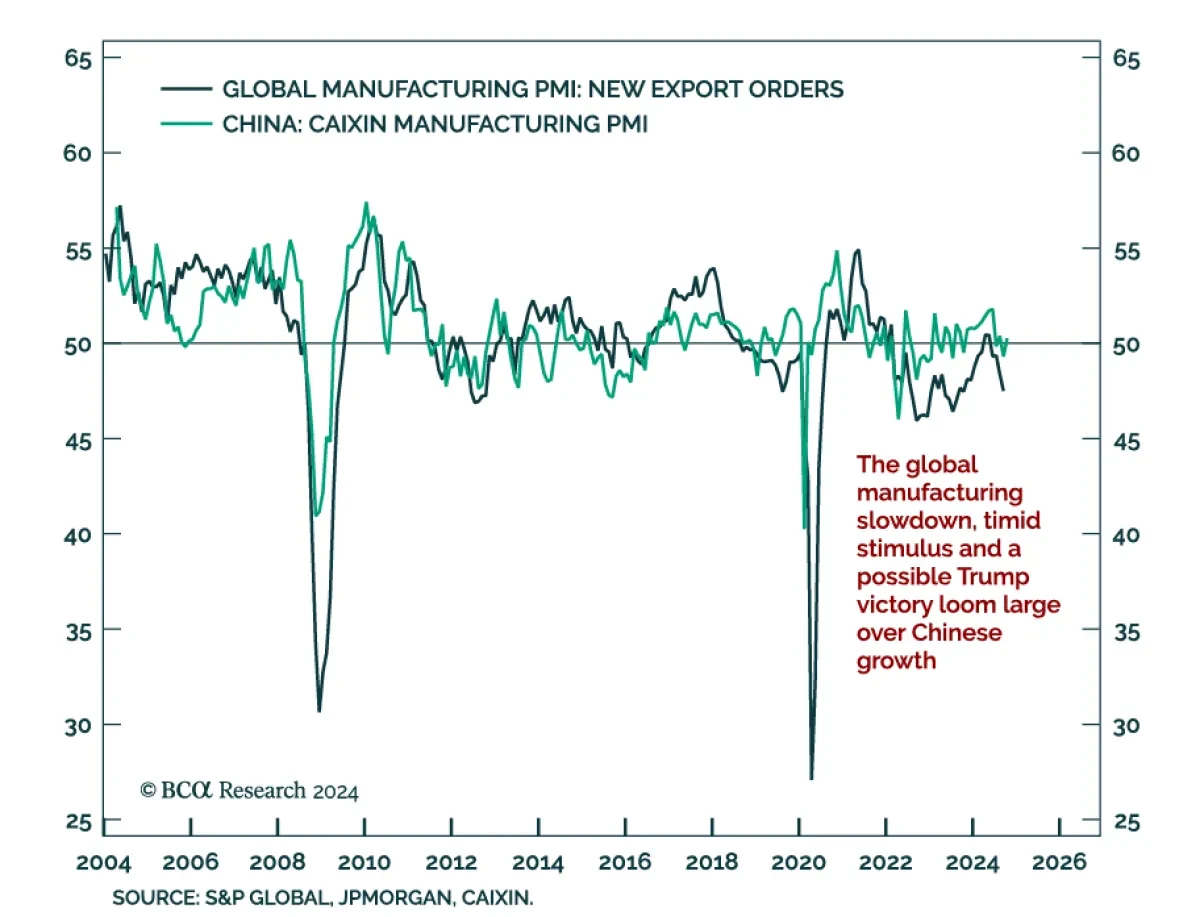

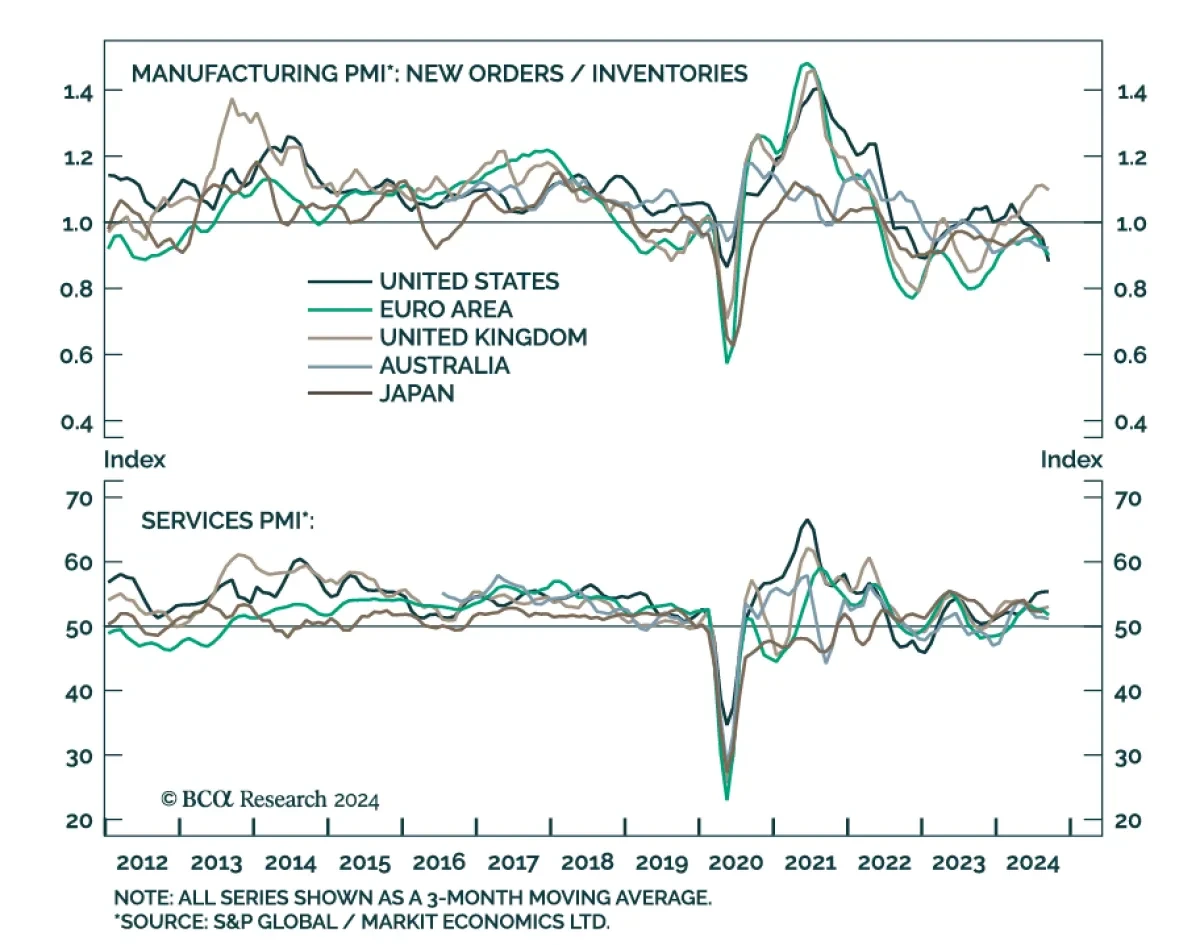

The October global manufacturing PMI printed at 49.4, up from 48.7 in September but still in contractionary territory. While output stabilized at 50.1, new orders (48.8) and new export orders (48.3) remain in contraction, as is the case for the new orders-to-inventories spread. This rebound is ...

Read more

Insight

China’s Caixin Manufacturing PMI rebounded one point in October to 50.3. This was in line with the NBS PMIs from earlier this week, which also showed a modest rebound. We are looking for a turning point in China as the government unrolls stimulus measures. This Caixin rebound is not that turnin...

Read more

Insight

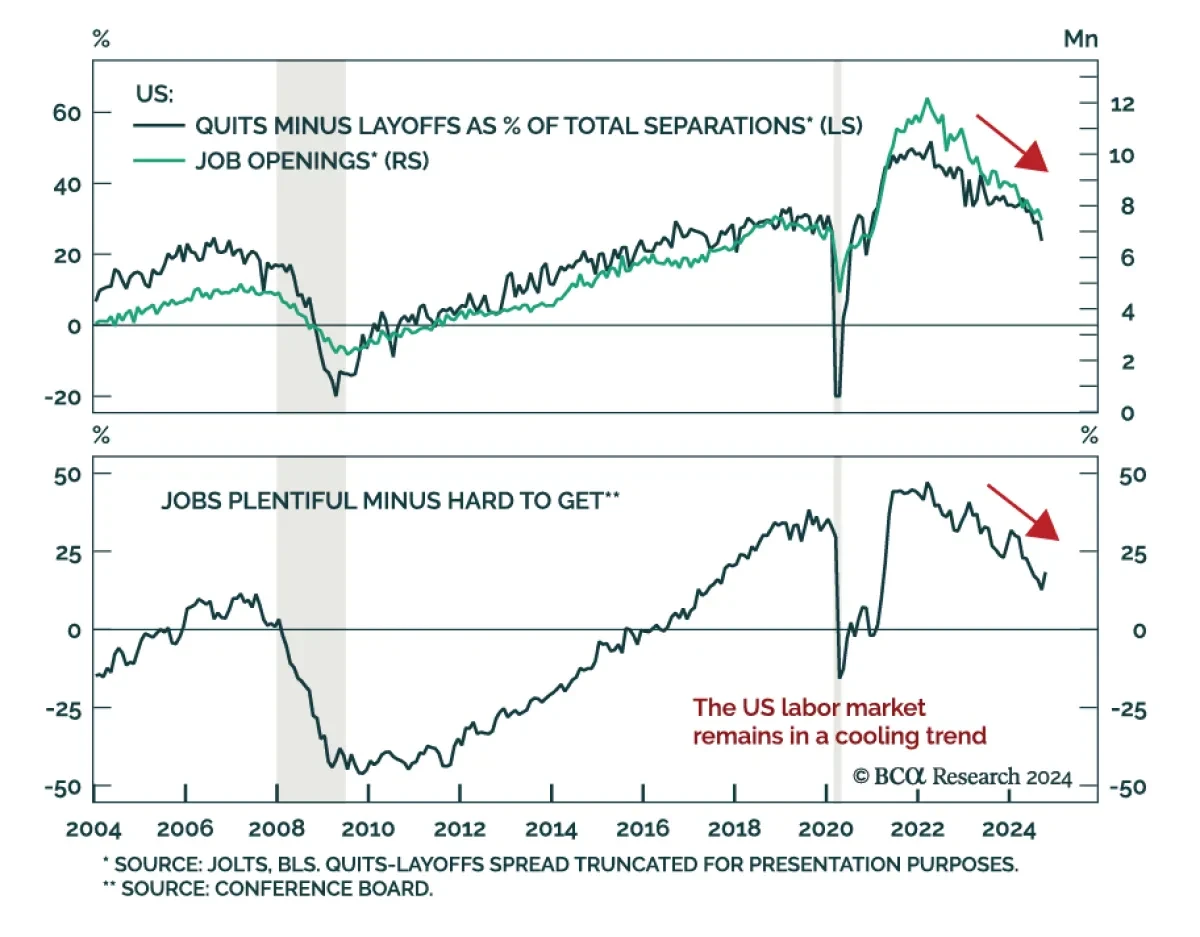

Job openings missed expectations at 7.44 million in September, a mild slowdown from August. The details of the JOLTS report were also negative, except for hirings which continue their June rebound. Meanwhile, consumer confidence for October data beat expectations. The Conference Board’s labor differ...

Read more

Insight

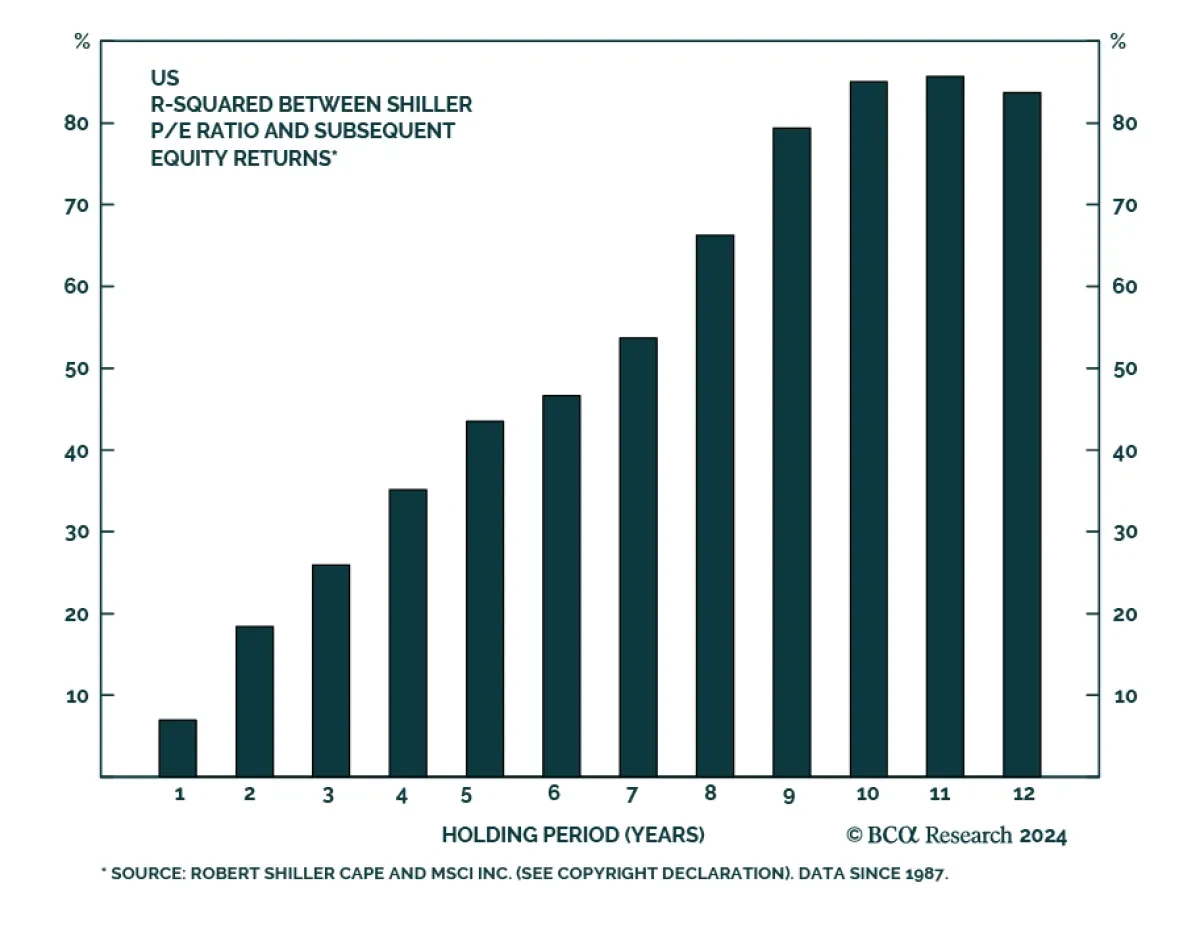

Elevated US equities valuations and their impact on returns are a hot topic right now. Valuations are not a tactical or cyclical timing tool, but they help predict long-term returns. Our Global Asset Allocation Strategy team publishes their multi-asset 10-to-15 years return assumptions annually, and...

Read more

Insight

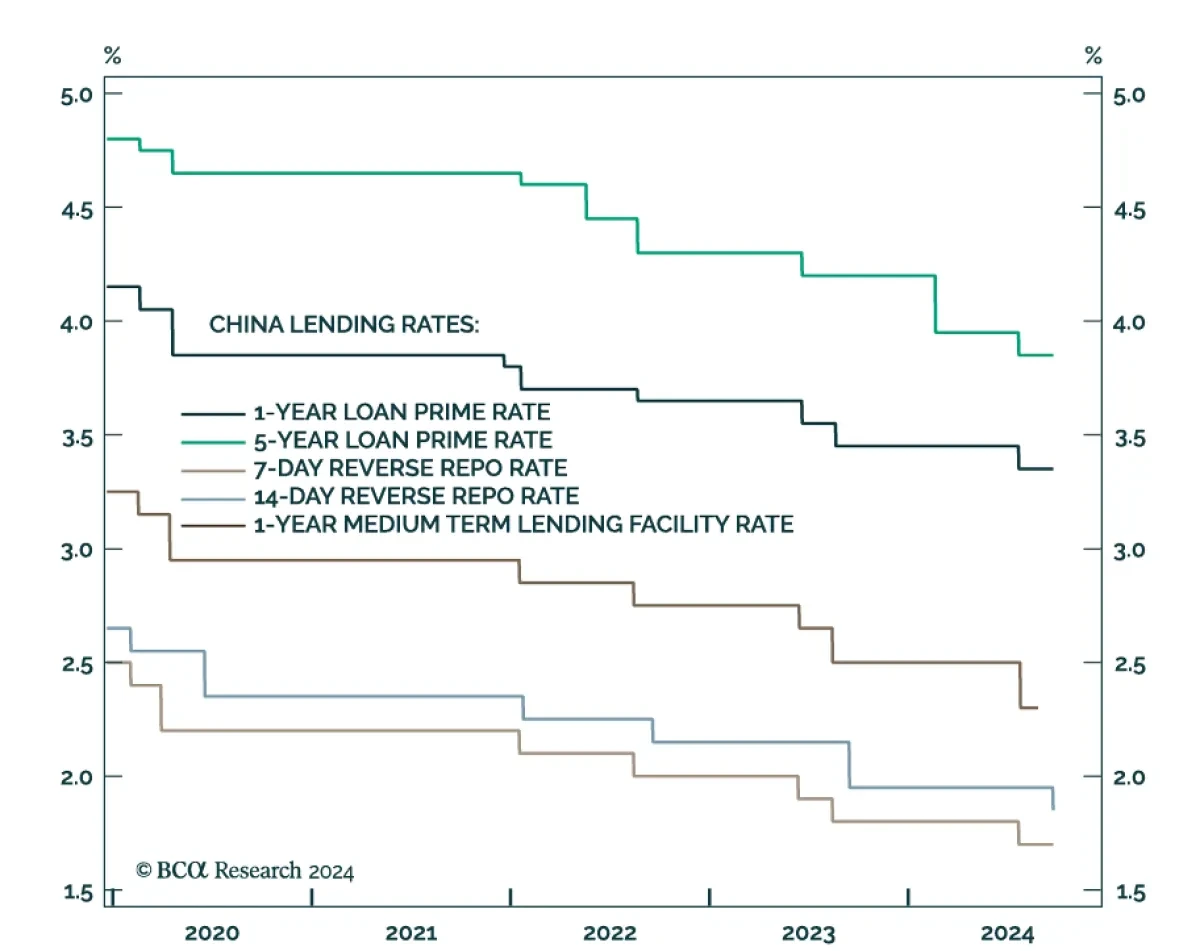

The PBoC lowered the 14-day reverse repo rate by 10 bps on Monday, a move that follows a string of easing measures in late July when the central bank lowered the 7-day reverse repo rate, several maturities of the loan prime rate and the 1-year medium-term lending facility rate.Our China Investment s...

Read more

Insight

Preliminary estimates suggest that activity continued to slow across DM economies in September.Manufacturing PMIs contracted at a faster pace in the US, Eurozone, Germany, France and Australia, and grew at a slower pace in the UK. Services PMIs continued to expand in most regions, though the pace of...

Read more