The March credit release shows that an upturn in China’s credit cycle is real, and that a recovery in economic activity over the coming several months is highly likely.

Fullscreen Fullscreen |  Interactive Chart Interactive Chart |

Overnight data out of China came out stronger than expected, significantly increasing the odds of a looming rebound in growth.

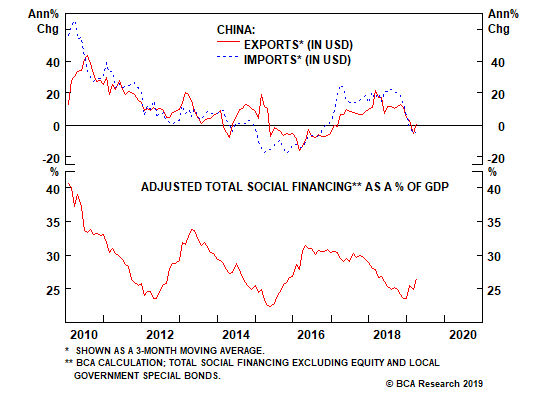

- Export growth came in at 14.2% year-on-year for the month of March, versus -20.8% for the previous month. Compositionally, the increase was broad-based across both the European Union and Asia. However, exports to the U.S. were more modest at 3.7%.

- Imports were weaker than expected at -7.6% year-on-year. However, it is rare that imports and exports diverge for long, suggesting an imminent pickup. The potential of a trade war with the U.S. probably led to some restocking last year, so it is possible those inventories are being currently run down. On a smoothed basis, import growth in March was flat.

- Credit growth in March easily topped consensus expectations. New Yuan loans came in at 1.7 trillion RMB versus 885.8 billion RMB the previous month, aggregate financing increased from 703 billion RMB to 2.86 trillion RMB and M2 growth accelerated from 8.0% to 8.6%.

The March credit data has clearly pushed a key leading indicator for China’s economy higher (see chart), substantially raising the odds of a reacceleration in economic activity. While broad money and total import growth remain relatively weak, we expect them to meaningfully improve over the coming several months. The bottom line for investors is that today’s data warrants meaningfully higher confidence that China’s contribution to global growth will rise over the coming year.

You are reading a complimentary report. To find out more about our services,

You are reading a complimentary report. To find out more about our services,