Who we are

BCA Research is the leading independent provider of global investment research. Since 1949, BCA Research's mission has been to shape the level of conviction with which our clients make investment decisions, through the delivery of leading-edge analysis and forecasts of all the major asset classes and economies. The firm maintains a head office in Montreal, with local offices in London, New York, Hong Kong, Sydney, Singapore and Shanghai.

Tools to forge your own views

Analysis & Forecasts for all Asset Classes & Economies

BCA Research covers every corner of the globe through its Global, US, European, Emerging Markets, and China strategy services. Asset class coverage includes equities, fixed income, FX, commodities and energy - as well as the geopolitical issues affecting the investment climate.

Over 57 Research Staff Globally Including 16 Chief Strategists

We have tremendous continuity amongst our team of strategists; nine have been with the firm for more than a decade. BCA Research strategists are supported with an environment conducive to independent thought.

Proprietary Models and Leading Indicators

With over 215,000 data series, BCA Research controls a vast treasure of historical data, including countless proprietary leading indicators and predictive economic models.

Dedicated Account Management and Client Service

BCA Research has a dedicated Client Relationship Team for quick response and efficient fulfillment of client requests. The team is also available to assist with the provision of chartbooks and in the interaction between clients and BCA Research's research strategists.

“BCA Research strategists are supported with an environment conducive to independent thought.”

Our history

- BCA Research was founded in Montreal in 1949 by A. Hamilton Bolton, who pioneered the concept that national economies and their capital markets are led by shifts in financial liquidity, money supply and credit.

- Mr. Bolton's innovative and highly successful approach to forecasting trends in the economy and financial markets ensured that BCA Research gained a wide following among financial institutions, corporations, individual investors and academics. His approach was outlined in his book Money and Investment Profits, published in 1967, just before his untimely death. He was honored posthumously 20 years later by the Financial Analysts Federation, the predecessor to the CFA Institute, with the prestigious Nicholas Molodovsky Award in recognition of his achievements and contributions to the field of financial market analysis.

- BCA Research's reputation as the foremost provider of leading-edge and accurate analysis continued to grow under the direction of J. Anthony Boeckh, who led the company from 1968 to 2001. Dr. Boeckh dramatically expanded the firm's research capabilities and global coverage by building a large team of experienced economists and researchers. Today, BCA Research's operations have grown worldwide with offices in many major cities across the globe.

Client Services

BCA Research in the news

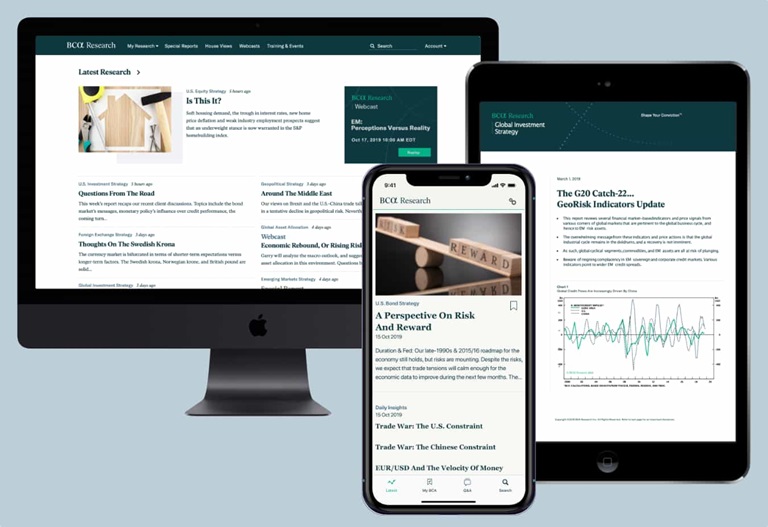

Our client website is updated daily and available whenever and wherever you are

Access our research on your desktop or apps for your tablet and smartphone.