Multi Asset: Global

Global Asset Allocation

BCA Research's portfolio construction service, advising CIOs and asset allocation teams on the optimum way to structure a global multi-asset portfolio.

Tools to forge your own views

- Recommendations on all major assets

- A "one-stop shop" for BCA Research's across-the-board views, with inputs from all our specialists, from energy to US fixed income, from China to geopolitics

- Regular conference calls with the GAA team to stress-test your views and get new insights and a comprehensive discussion of the macro data

- GAA can become part of your investment process. We often call into clients' investment committees, trustee meetings, or the allocation team's monthly discussion

- Quants models supporting the equity country and sector recommendations

“GAA understands that every investor is different. We can become part of a client's asset allocation process to help identify where best to take risk to achieve the required portfolio return.”

Garry Evans Chief Strategist,

Global Asset Allocation

How we do it

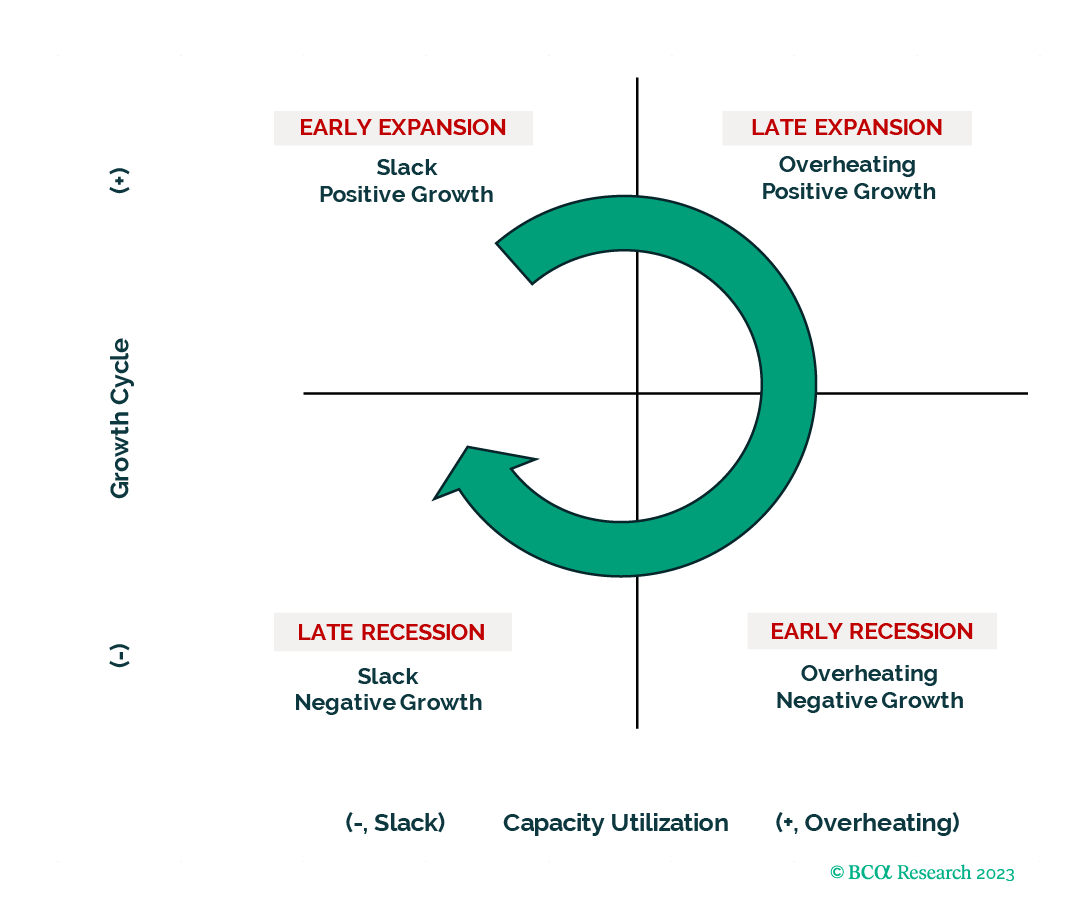

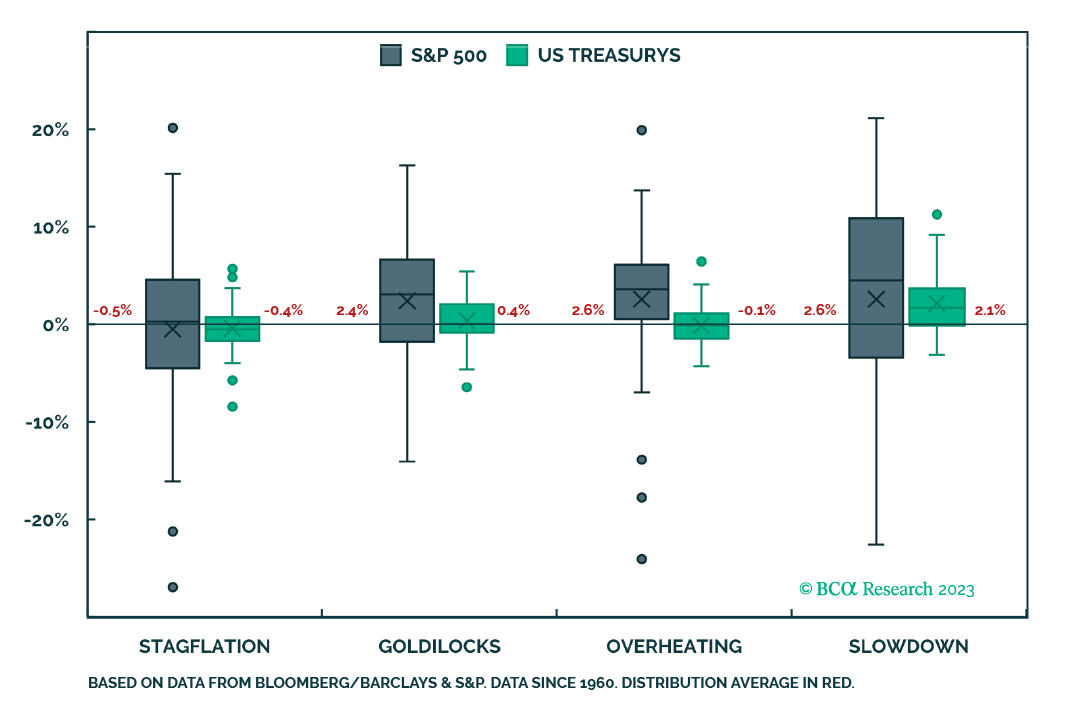

- The GAA team works closely with BCA Research's asset-class and regional experts to come up with recommendations on 1) bonds v equities v cash, 2) equity country and sector tilts, 3) bond classes, 4) currencies, and 5) illiquid assets

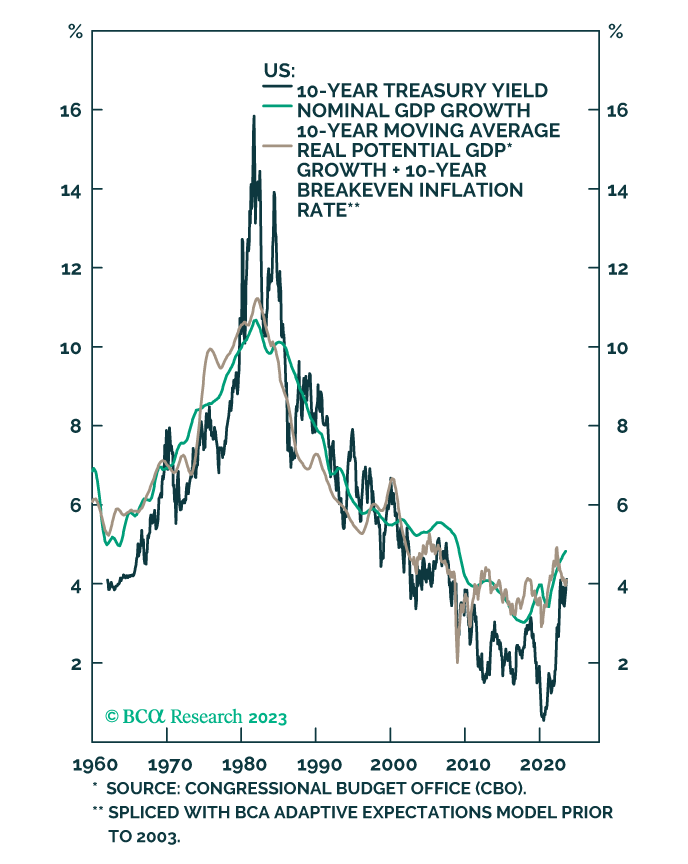

- Our recommendations are centered on 12-month tactical tilts. But we also analyze long-term themes such as inflation risk, long-run asset returns, technology and commodity cycles, and the risk/reward characteristics of more esoteric alt investments

- Our publication schedule is centered around a detailed Quarterly, with views on all asset classes. This is backed up by a Monthly update, and some 10 Special Reports a year on themes of key importance to asset allocators

- GAA also incorporates a tailored service, with quarterly or monthly conference calls, analysis of a client's specific portfolio, and bespoke requests

Challenge your investment conviction with insights from Global Asset Allocation

Some of what we've called

2015 Credit Proof

Went overweight credit in December 2015. Over the following 12 months, US junk bonds returned 17%.

2018 Cash & Equities

Equities went overweight cash and lowered equities to neutral in July 2018. Excess return at the asset-class level over the following six months: 430 basis points.

2017 REITs

Recommended becoming more cautious on US REITs in October 2017. Since then, REITs have underperformed US equities by 300 basis points.

2018 Global Equities

Went overweight global equities and lowered cash to neutral in late December 2018. This recommendation has returned 8% so far.

Garry Evans

Chief Strategist

Garry is currently BCA Research’s Chief Strategist, Global Asset Allocation. Since joining BCA Research in 2015, Garry has headed the Global Asset Allocation Service as well as being involved in Emerging Market Sector Strategy. Prior to BCA Research, Garry was the Managing Director and Global Head of Equity Strategy at HSBC, and Editor of Euromoney Magazine. Garry has a Masters in Asian Studies from Cambridge University, and undertook postgraduate studies in economics at Kyoto University.

Examples of our work

Our client website is updated daily and available whenever and wherever you are

Access our research on your desktop or apps for your tablet and smartphone.