Highlights

- The direct impact of recently proposed U.S. import tariffs on steel and aluminum is likely to be small, both for China and the world. In isolation, this development is not very relevant for investment strategy.

- However, the lessons learned from studying the game of Prisoner's Dilemma suggest that investors should be legitimately concerned about an iterative "tit-for-tat" exchange of retaliation between the U.S. and its major trade partners if the Trump administration continues to pursue aggressively protectionist trade policies.

- Recent data releases show that the ongoing economic slowdown continues. While the Caixin manufacturing PMI is a bright spot, it is not likely heralding a major turning point for the Chinese economy.

- Investors should closely watch three bellwethers to judge the likelihood of a full-blown global trade war. Barring a major deterioration on this front, or a sharp further slowdown in Chinese economic growth, investors should stay overweight Chinese ex-tech stocks vs global.

Feature

The looming threat of U.S. protectionism came into full force over the past week, as President Trump stated that sweeping tariffs on all U.S. imports of steel and aluminum would soon be formalized.

The tariff situation continues to evolve as we go to press, but the facts as they currently stand are the following:

- The proposed tariffs would be 25% on steel, and 10% on aluminum imports

- No exceptions are planned for any country, although statements from U.S. leadership on Monday suggested that Canada and Mexico may be exempt if NAFTA is renegotiated in the U.S.' favor

- Key European Union leaders threatened to retaliate against the U.S.' proposed tariffs, and the U.S. threatened to counter-retaliate

- China has taken a more cautious stance on the issue of retaliation, and is strongly seeking to negotiate with the Trump administration

Minimal Direct Impact

The developments over the past week raise two questions about China's economy that matter for investment strategy:

- What is the direct impact of the tariffs on China's exports likely to be?

- What is the implication for global growth?

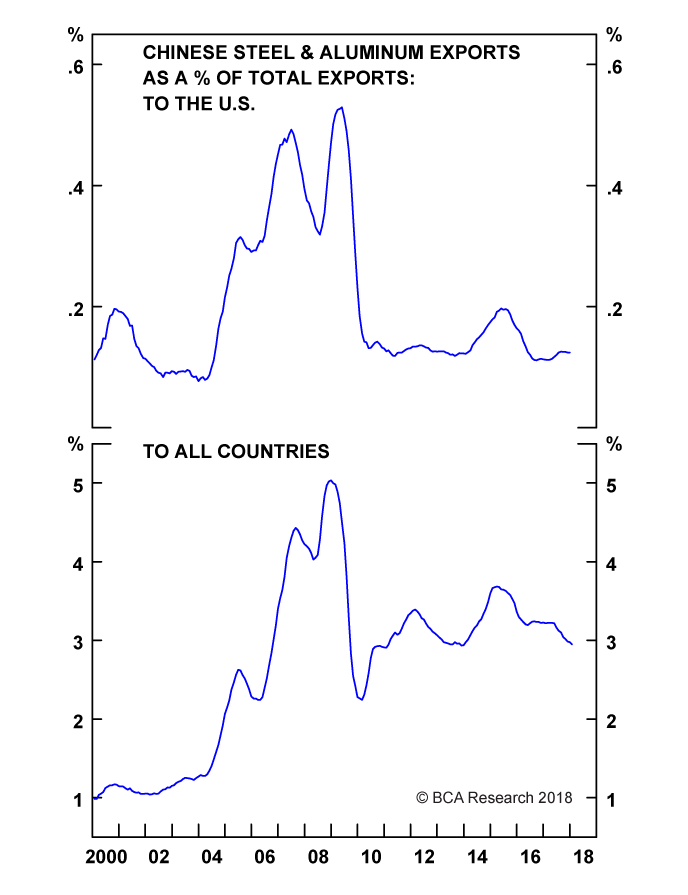

On the first question, the answer is fairly clear that the direct impact is likely to be small. The proposed tariffs do not disproportionately target China, and Chinese exports of steel and aluminum to the U.S. account for less than 0.2% of total exports (Chart 1). Exports of these products to all countries as a share of total exports is still quite small (panel 2).

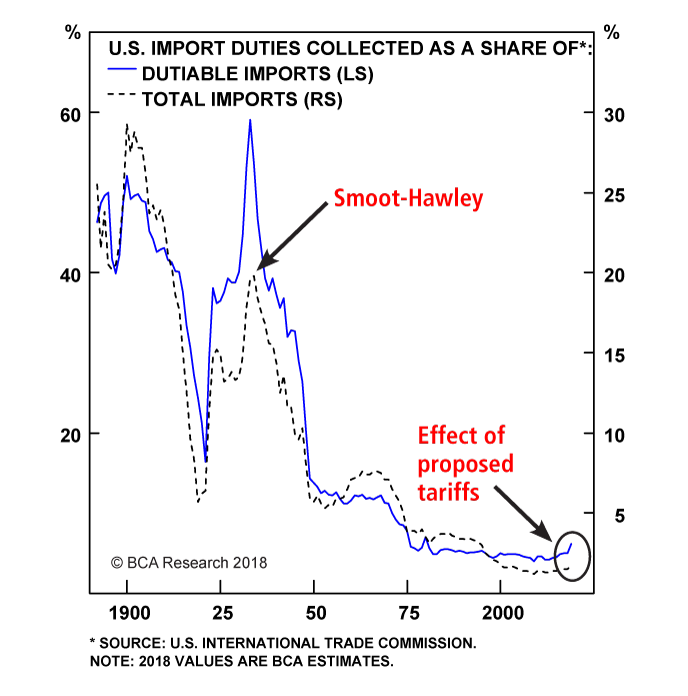

The second question is much more difficult to answer, and it has wide implications for both the Chinese economy and for investment strategy. When approaching the question, it is first important to note that the threat to the global economy from the imposition of the proposed tariffs comes from the potential for a series of retaliations from major trading partners, not the tariffs themselves. U.S. imports of steel and aluminum make up less than 1% of global goods exports, and Chart 2 presents a long-term history of average U.S. tariff rates along with our estimate of the impact of the U.S.' proposal. While the imposition of the announced tariffs would certainly change the trend that has been in place for some time, the rise is not very significant. Critically, even after the tariffs are imposed, U.S. tariffs rates will still be fractional when compared with those that prevailed during the early-1930s, when the Smoot-Hawley Tariff Act materially exacerbated the Great Depression.

Chart 1

Chinese Steel And Aluminum Exports

Are Not Significant

Fullscreen Fullscreen |  BAN BAN |

Chart 2

We're A Long, Long Way Away

From Smoot-Hawley

Fullscreen Fullscreen |  BAN BAN |

China's cautious stance towards retaliation is, at first blush, an encouraging development, but it may not be as hopeful of a sign as it seems. First, despite a general feeling among investors that China was the intended target of the U.S.' proposed tariffs, a global tariff on steel and aluminum is likely to disproportionately affect developed countries rather than China. It is therefore not surprising that China has signaled a somewhat conciliatory stance. In our view, the likelihood of Chinese retaliation is considerably higher if further tariffs are announced on goods that make up a larger share of their exports.

In addition, as we noted above, the European Union has already highlighted some U.S. goods that may be subject to higher retaliatory tariffs in response to the news (which already elicited a threat of counter-retaliation from the U.S.), and both Canada and Mexico have also threatened retaliation if they are not granted an exemption from the proposed tariffs. In our view, these threats should be treated seriously, especially after revisiting the lessons of one of the most famous experiments in game theory.

Bottom Line: The direct impact of proposed U.S. import tariffs on steel and aluminum is likely to be small, both for China and the world.

Retaliation Risk And The Prisoner's Dilemma

The dynamics of trade renegotiations can be examined, at least conceptually, through the lens of game theory. It is difficult to model these dynamics precisely because of the complexity of the relationship between trade and potential growth, but it is worth revisiting the lessons learned by the repeated playing of Prisoner's Dilemma, one of the most well-known examples of the application of game theory.

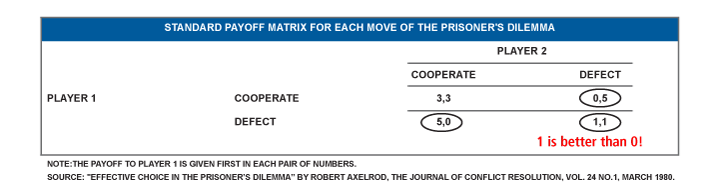

To summarize, the Prisoner's Dilemma scenario describes two criminals who have been arrested, and whose statement to the authorities affects the manner in which punishment (if any) is distributed between the two of them. The standard payoff structure of the game is set up such that one prisoner is able to largely avoid punishment if (s)he accuses the other of the crime and the other prisoner remains silent, but that both prisoners receive a punishment if they both accuse each other that is greater than the punishment received if they both remain silent (Table 1). Given that tariffs and other forms of trade protectionism can only durably succeed at improving net domestic economic outcomes if they do not result in retaliation, from the perspective of trade renegotiation, accusing the other player in the game of Prisoner's Dilemma is tantamount to restricting trade, and remaining silent is equivalent to allowing existing trade relationships to persist.

Table1

In The Prisoner's Dilemma, It's Better To Return Defection With Defection

Fullscreen Fullscreen |

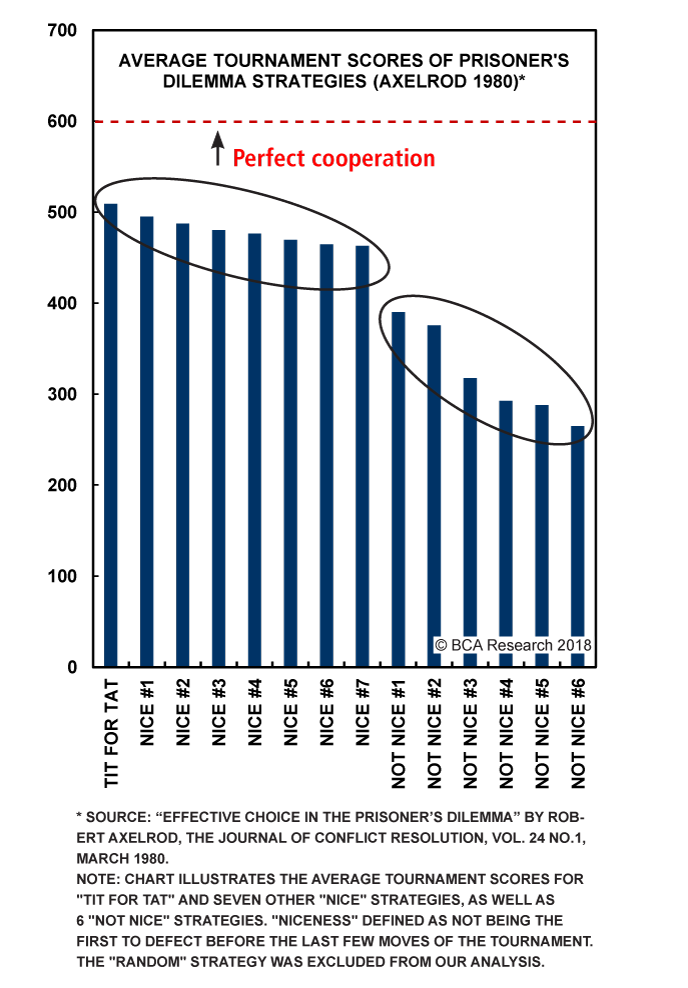

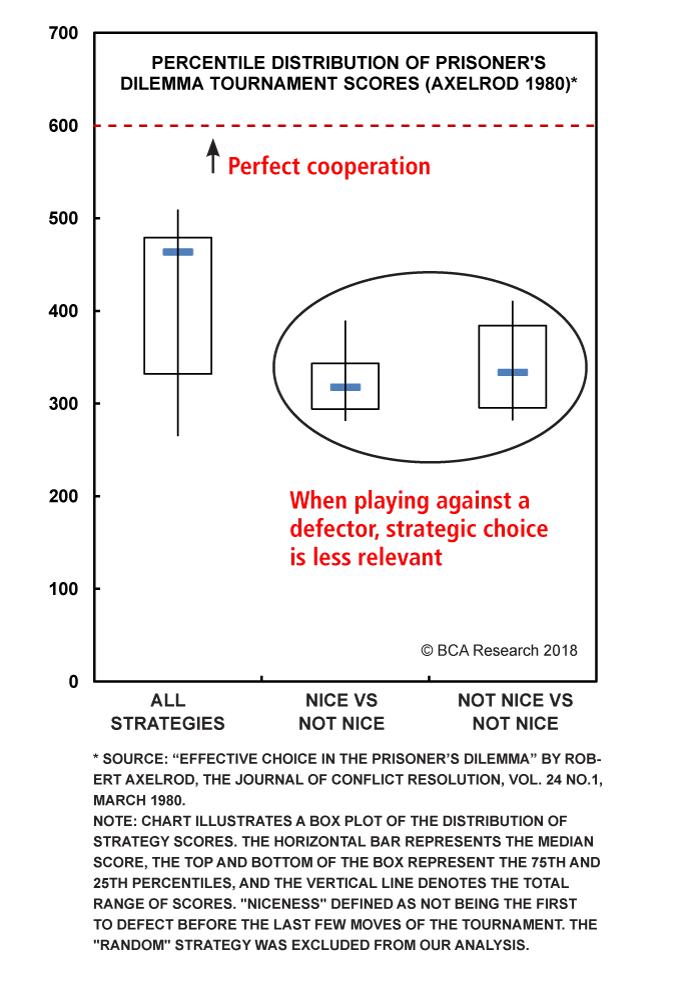

The success of strategies employed in repeated games of Prisoner's Dilemma was studied most famously by Robert Axelrod in 1980.1 The winning strategy (in both of Axelrod's tournaments) was "Tit for Tat", which follows two very simple rules: cooperate initially, and thereafter copy the other player's decision in the previous round. This strategy has three attributes that Axelrod showed to be highly successful when playing repeated games of Prisoner's Dilemma: niceness (not being the first player to accuse/defect/renege), being provocable (responding to defections with in-kind retaliation), and forgiveness (not allowing one-time defections to impact future choices beyond a one-time retaliation).

Chart 3 illustrates the performance of the "Tit for Tat" strategy in the first Axelrod tournament, along with the average scores of several other strategies. The most important lesson from both tournaments is summarized nicely in the chart: the average score of a series of "nice" strategies was considerably higher than those that were not nice. But Chart 4 also highlights that niceness is only a relatively successful strategy because of its ability to produce an optimal outcome with other nice strategies: all strategies, nice or not, tend to generate poor outcomes when played against strategies that are not nice. This is because the payoff structure of Prisoner's Dilemma is such that, compared with defection, co-operation makes a player worse off if their opponent defects.

Chart 3

In Repeated Games Of Prisoner's Dilemma,

"Nice" Strategies Pay Off...

Fullscreen Fullscreen |

Chart 4

...But Only Because They Do Well Against

Other "Nice" Strategies

Fullscreen Fullscreen |

In the context of global trade, this can be seen as the likelihood of outsized job losses (or the lack of job gains in a protected industry) from a failure to retaliate. The key point for investors is that the most basic lesson of the Prisoner's Dilemma suggests that market participants should be legitimately concerned about retaliation from the U.S.' trade partners (and subsequent counter-retaliation) if it continues to pursue a protectionist agenda, because it can be a rational response for an individual country even if it leads to poor outcomes for everyone involved.

In addition, three assumptions of the Prisoner's Dilemma game are not valid in the real world (or the current environment), which in two of these cases further increases the risk of an iterative exchange of retaliation:

Chart 5

The U.S. Has A Trade Deficit

With Many Trading Partners

Fullscreen Fullscreen |  BAN BAN |

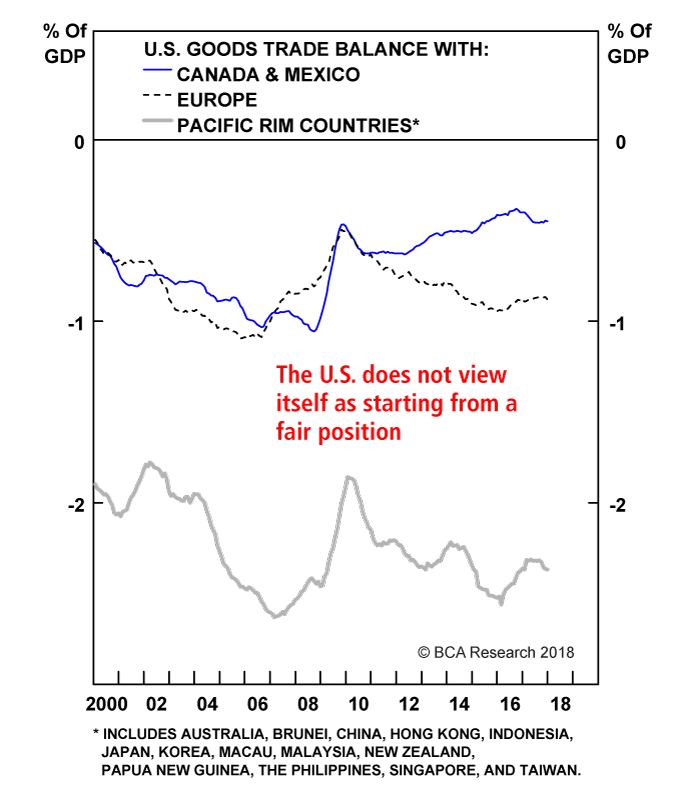

- In terms of the payoffs associated with the game, Prisoner's Dilemma assumes an equal starting position (of zero "points") on both sides, which is not the case in the current environment. The U.S. has a sizeable trade deficit with the world (Chart 5), and several important trading partners with the U.S. (especially China) maintain significant non-tariffs barriers to trade. Regardless of whether this inequity has been caused by an unfair trading relationship, in the parlance of Axelrod's tournaments, this implies that the U.S. strategy is likely to be not nice due to the perception on the part of the Trump administration of an unequal starting position. The implication is that the odds of an escalation of the imposition of relatively small tariffs into a full-blown trade war are higher than would normally be the case.

- Prisoner's Dilemma has clear and symmetric payoffs, which is also not the case in the current environment. The Trump administration apparently feels that the payoff to the U.S. of certain trade restrictions is a net positive even assuming retaliation, which raises the possibility of a negative outcome for the global economy. Worryingly, in our view the chances are high that calculations of the net benefit of any trade restriction are being done on a political basis, rather than an economic one.

- Prisoner's Dilemma assumes that the participants are unable to communicate, which is a limitation that does not exist in a real-world trade negotiation scenario. This lowers the probability that the U.S. and its major trading partners will engage in a spiraling tit-for-tat trade war relative to what the game of Prisoner's Dilemma would imply, even if the recently announced tariffs on steel and aluminum stand and major partners do retaliate.

Bottom Line: The lessons learned from studying the game of Prisoner's Dilemma suggest that investors should be legitimately concerned about an iterative "tit-for-tat" exchange of retaliation between the U.S. and its major trade partners if the Trump administration continues to pursue aggressively protectionist trade policies.

No Help From The Domestic Economy

A protectionist agenda from the U.S. is also coming at an inconvenient time for Chinese policymakers, even if they were not blindsided by the move. Policymakers already have to contend with managing the impact of renewed reforms on economy's financial and industrial sectors, and the potential addition of the external sector to this list of problems needing attention is unwelcome.

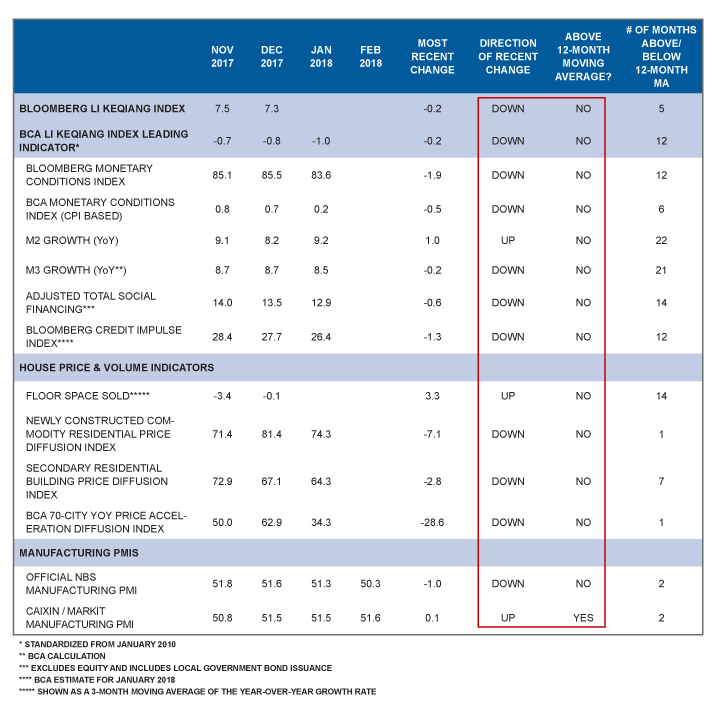

While a cooling of the economy was an inevitable result from the government's deleveraging campaign and shadow banking crackdown, Table 2 highlights how broadly leading economic indicators have decelerated. The table presents recent data points for several series that we identified in November Special Report as having leading properties for the Chinese business cycle,2 as well as the most recent month-over-month change, an indication of whether the series is currently above its 12-month moving average, how long this has been the case.

Table 2

No Convincing Signs Of An Impending Upturn In China's Economy

Fullscreen Fullscreen |

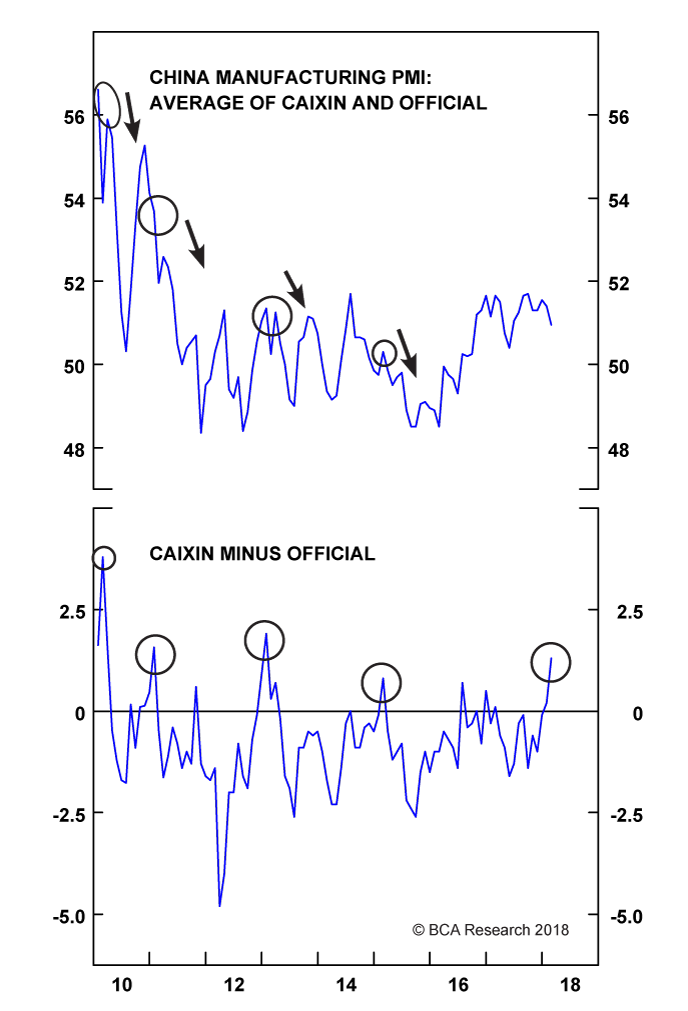

Among the components of the BCA Li Keqiang Leading Indicator (an index designed to lead turning points in the Li Keqiang index), all six series are in a downtrend and 5 out of these 6 fell in January (the growth in M2 was the exception). A similar story is borne out in the housing price data, with a variety of diffusion indexes having also fallen in January.3 The Caixin Manufacturing PMI remains the one bright spot, having recently risen above its 12-month moving average and having risen in January, in stark contrast to the official PMI (which fell a full point).

But as Chart 6 highlights, following the last four episodes when the Caixin PMI exceeded the official PMI by this magnitude, the subsequent trend in the average of the two was down in every case. The implication is that the outlier nature of the current Caixin PMI shown in Table 2 is just that, and not a heralding a major upturn in China's economy.

Chart 6

The Caixin PMI Is Probably The Noise, Not The Signal

Fullscreen Fullscreen |  BAN BAN |

Bottom Line: Recent data releases show that the ongoing economic slowdown continues. While the Caixin manufacturing PMI is a bright spot, it is not likely heralding a major turning point for the Chinese economy.

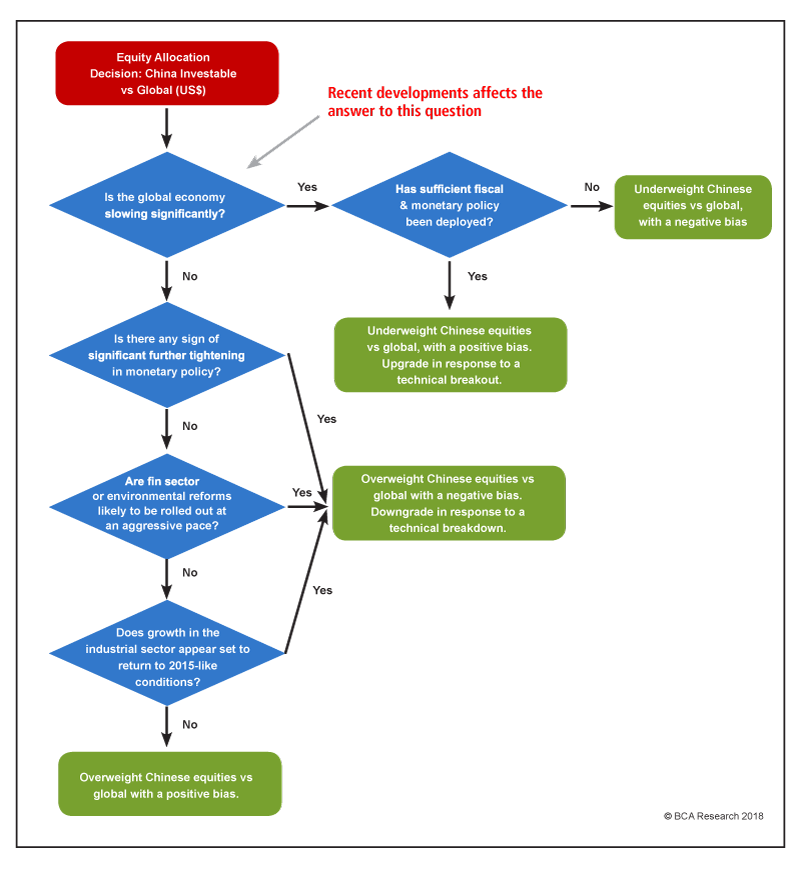

Conclusions For Investment Strategy

Chart 7 illustrates the decision tree for Chinese stocks that we presented in our first report of the year. While there has been a modest further deterioration in the industrial sector, the pace of the decline is still consistent with the controlled slowdown scenario that we outlined in an October Weekly Report.4 As such, the recent softness in the data is not significant enough to cause us to change our recommended investment strategy.

The key change over the past week has been the threat posed by U.S. protectionism to the global economy, which is the very first question to answer in our decision tree. The now high-beta nature of the Chinese stock market underscores that U.S. protectionism can significantly (negatively) impact the relative performance of Chinese equities if it destabilizes the global stock market, even if Chinese exports were to emerge from the exchange relatively unscathed.

For now, we judge the likelihood of a full-blown tit-for-tat trade war to be a risk, and thus not a probable event. For now, market participants seem to agree: U.S. and global equities rebounded earlier this week in response to a feeling that the negative repercussions for global growth are likely to be minimal.

Nonetheless, this is a risk that needs to be monitored closely, and to facilitate this our Geopolitical Strategy service has highlighted the following three bellwethers that they will be watching in order to judge the likelihood of a major escalation:5

Chart 7

The Chinese Equity "Decision Tree"

Fullscreen Fullscreen |

- Tariff exceptions for allies: Given the national security basis for the steel and aluminum tariffs, it is likely that exceptions will be made for allies such as Canada and Europe. If yes, then the measure is unlikely to be part of a truly "America First" mercantilist strategy and is instead a veiled swipe at China to satisfy Trump's base ahead of the midterm elections

- NAFTA: Our geopolitical team has argued that the probability of NAFTA abrogation is around 50%.6 If the administration continues the negotiations in light of tariff announcements, however, it suggests that the revealed preference of the White House is less protectionist than it appears.

- Chinese intellectual property (IP) theft: The Trump administration is investigating Chinese technology transfer and IP theft under Section 301 of the Trade Act of 1974. If China is found to have acted unfairly, penalties would likely include a combination of tariffs and restrictions on Chinese investment in the U.S. This might include an indemnity for cumulative losses from past violations, which would be rare, if not unprecedented, and which China would reject outright. This could produce across-the-board tariffs of a sort that the U.S. has not imposed since the Nixon shock.

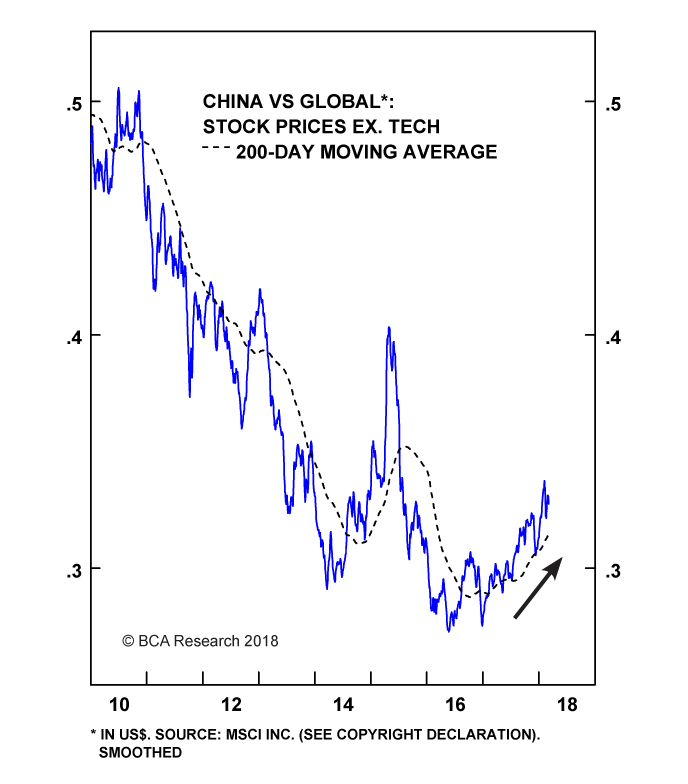

Chart 8

China Is Outperforming Global In Ex-Tech Terms

Fullscreen Fullscreen |  BAN BAN |

In the meantime, Chart 8 highlights that investable Chinese ex-technology stocks (proxied by the MSCI China Index ex-technology) remain in an uptrend versus their global peers, which underscores that investors should have a high threshold for reducing exposure to China. This underscores that investors should have a high threshold for reducing exposure to China. While the ongoing slowdown in China's economy is likely to cause earnings growth to decelerate over the coming year, the continued likelihood of decently positive earnings growth coupled with a sizeable valuation discount relative to global signals that Chinese ex-tech stocks are remain attractive on a risk/reward basis. Investors should stay overweight.

Bottom Line: Investors should closely watch three bellwethers to judge the likelihood of a full-blown global trade war. Barring a major deterioration on this front, or a sharp further slowdown in Chinese economic growth, investors should stay overweight Chinese ex-tech stocks vs global.

Jonathan LaBerge, CFA, Vice President

Special Reports

jonathanl@bcaresearch.com

- 1 "Effective Choice in the Prisoner's Dilemma" and "More Effective Choice in the Prisoner's Dilemma" by Robert Axelrod, The Journal of Conflict Resolution, Vol. 24 Nos.1 and 3, March and September 1980.

- 2 Please see China Investment Strategy Special Report, "The Data Lab: Testing The Predictability Of The Chinese Business Cycle", dated November 30, 2017, available at cis.bcaresearch.com.

- 3 However, as discussed in our February 8 Weekly Report, we are keeping an eye on residential floor space sold given its history of leading China's housing market cycles.

- 4 Please see China Investment Strategy Weekly Report, "Tracking The End Of China's Mini-Cycle", dated October 12, 2017, available at cis.bcaresearch.com.

- 5 Please see Geopolitical Strategy Special Report, "Market Reprices Odds Of A Global Trade War", dated March 6, 2018, available at gps.bcaresearch.com.

- 6 Please see BCA Geopolitical Strategy Special Report, "NAFTA - Populism Vs. Pluto Populism", dated November 10, 2017, available at gps.bcaresearch.com.

Cyclical Investment Stance

| COUNTRY /SECTOR RECOMMENDATIONS | INITIATE DATE/ LINK TO REPORTS | TOTAL RETURN | NOTE |

| SHORT HONG KONG 10-YEAR GOVERNMENT BOND/US 10-YEAR TREASURY | 15-JAN-14 | 0% | Total return of Hong Kong 10-Year government bond versus U.S. 10-Year Treasury. |

| LONG MSCI CHINA FREE / SHORT MSCI TAIWAN | 2-FEB-17 | 20% | MSCI China Free US$ Index versus MSCI Taiwan US$ Index (times 100), currently 23.5. |

| LONG CHINA ONSHORE CORPORATE BONDS | 22-JUN-17 | 2.1% | A basket of 5 year AAA and 5 year AA- rated corporate bonds from June 22, 2017 to January 25, 2018; ChinaBond Corporate Credit Bond Total Return Index after January 25, 2018. |

| LONG INVESTABLE CONSUMER STAPLES / SHORT INVESTABLE CONSUMER DISCRETIONARY | 16-NOV-17 | 8.5% | MSCI China investable consumer staples index versus MSCI China investable consumer discretionary index (times 10), initiated at 38, currently 40.8. |

| LONG INVESTABLE ESG LEADERS / SHORT INVESTABLE BENCHMARK | 16-NOV-17 | 2.1% | MSCI China investable ESG leaders index versus MSCI China investable index initiated at 20, currently 20.4. |

| LONG MSCI CHINA INVESTABLE EX-TECHNOLOGY / SHORT MSCI ALL COUNTRY WORLD EX-TECHNOLOGY | 15-FEB-18 | -0.2% | MSCI China investable ex-tech index versus MSCI ACW ex-tech index (times 100), initiated at 32, currently 31.9. |

| LONG MSCI CHINA INVESTABLE VALUE / SHORT ALL COUNTRY WORLD VALUE | 15-FEB-18 | -0.5% | MSCI China investable value index versus short MSCI ACW value index (times 10), initiated at 11.9, currently 11.8. |

You are reading a complimentary report. To find out more about our services,

You are reading a complimentary report. To find out more about our services,