Watch Out For… Good News?

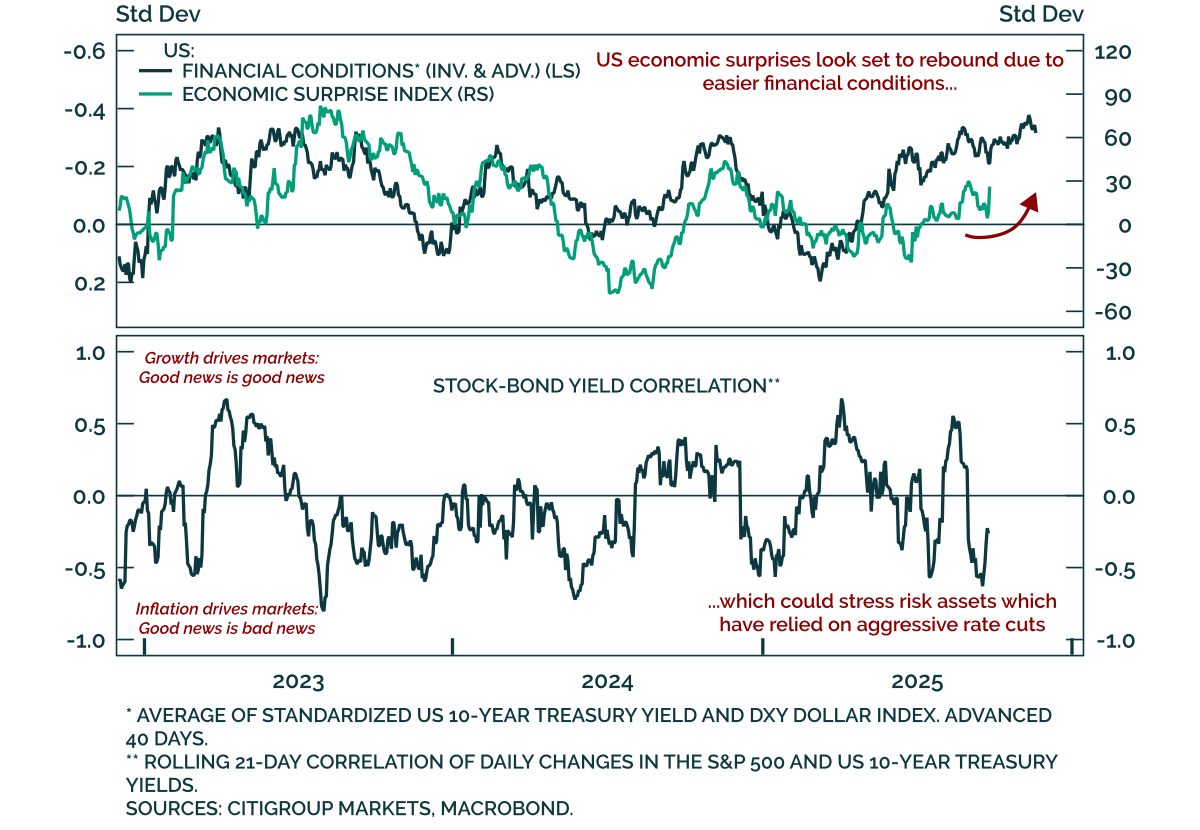

Our tactical framework, which tracks the reflexive loop between financial conditions and economic surprises, points to stronger near-term growth, leaving equities vulnerable if inflation re-accelerates. Data surprises move markets, while bond yields and the USD in turn shape growth outcomes through financial conditions. Strong economic data tightens financial conditions, eventually weighing on growth. This loop means robust growth often plants the seeds of its own reversal, and vice versa.

US data has weakened in recent months, especially after labor revisions left the macro picture weaker than first thought. This has pushed the Fed to re-evaluate its balance of risks toward unemployment rather than inflation, a shift that was well anticipated and helped ease financial conditions. Since May, conditions have loosened; first through a weaker USD, then through lower bond yields since July. These easier conditions should create a short-term growth impulse and buoy economic surprises.

The cross-asset implications are clear. Yields may stay rangebound: Not a tailwind for equities anymore, but not a headwind unless inflation re-accelerates. Broadly rising inflation would reverse aggressive Fed cut pricing, spike rates volatility, and trigger an equity pullback. While not our base case, this “inflation scare” remains the main tactical risk. The danger is greater as the stock-bond yield correlation remains negative, creating an environment where good macro news would be bad news. For now, our macro data tracking shows steady momentum loss in both hard and soft data, pointing to below-potential growth in the coming quarters.