Single Asset

US Bond Strategy

BCA Research’s US Bond Strategy provides asset allocation recommendations to optimize your US bond portfolio given the different macro environments effecting interest rates and bond yields.

Tools to forge your own views

- Recommendations on all major USD-denominated fixed income sectors

- Detailed weekly coverage of major topics related to the US economy and Federal Reserve policy

- An effective and replicable framework guides our portfolio duration and yield curve recommendations. One that you can be apply to your own portfolio, whether or not you agree with BCA Research’s macro outlook

- Timely updates on a suite of top-down credit cycle indicators to help you get out of corporate bonds before the defaults kick in

- Report published on a weekly basis. These consist of Weekly Reports that discuss the most pressing issues for US bond portfolios, a monthly Portfolio Allocation Summary that provides a snapshot of how we would position amongst the major US fixed income sectors, and occasional Special Reports that are deeper dives into specific topics of interest

“There is too much data out there. Our job is to filter out the noise and bring bond investors only the most relevant info.”

Ryan Swift Strategist,

US Bond Strategy

How we do it

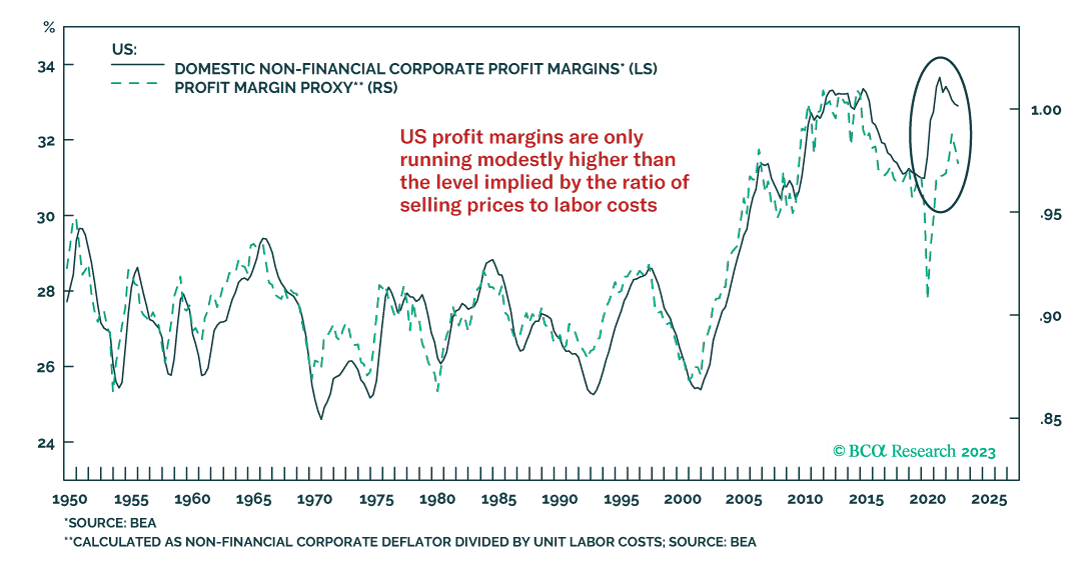

- Our recommendations for bond portfolio duration are guided by a simple, repeatable methodology that focuses on the outlook for US economic growth and the Federal Reserve’s reaction function

- When it comes to corporate bonds, we recognize that maintaining a healthy allocation to the sector is typically a winning strategy for bond funds managers. We focus on identifying those periods when that is not the case, and warning investors ahead of time

- We work closely with BCA Research’s other services and constantly stress test our views against those of other BCA Research strategists

Challenge your investment conviction with insights from US Bond Strategy

Some of what we have called

2016 Portfolio Duration

Reduced portfolio duration to below-benchmark in July 2016, just after the cyclical trough in Treasury yields.

2008 Overweight Corporate Bonds

Moved to overweight investment grade corporate bonds versus Treasuries in December 2008, near the cyclical peak in spreads.

2019 Overweight Corporate Credit

Turned more cautious on corporate credit in June 2018, and then reverted to an overweight recommendation in January 2019 after the back-up in spreads.

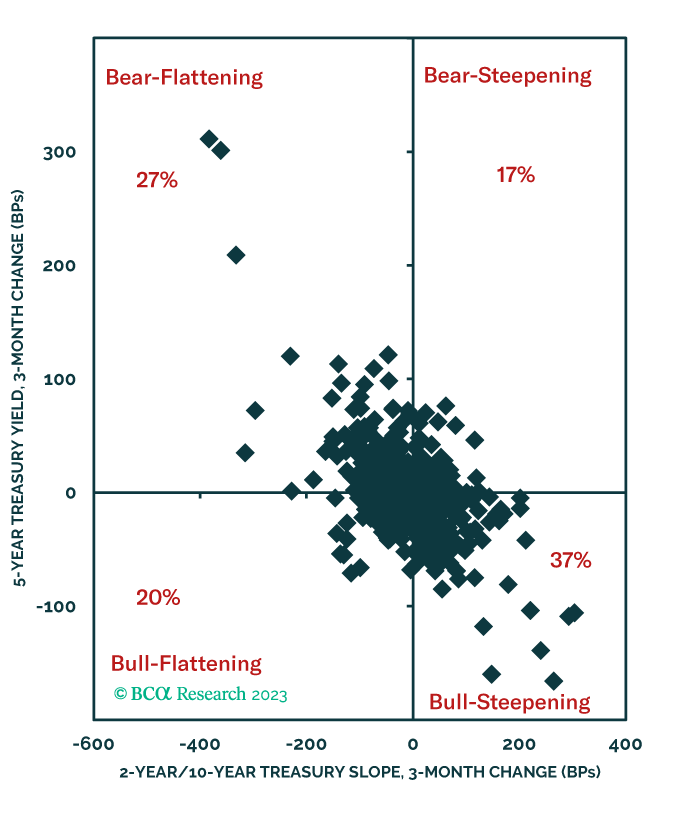

2018 Treasury Curve Belly

Favored the belly of the Treasury curve (7-year) versus the wings (1-year & 20-year) in duration-neutral terms between May 14 2018 and November 6 2018. During that time, the 7-year yield fell 21 bps more than the duration-equivalent 1/20 barbell, for unlevered gains of roughly 1%.

Ryan Swift

Strategist

Ryan is currently BCA Research’s Strategist, US Bond Strategy. Since joining BCA Research in 2010 he has held the position as a fixed income strategist. Prior to BCA Research he completed his studies in finance. Ryan holds an MSc in finance from Concordia University and a BCom from McGill University.

Examples of our work

Our client website is updated daily and available whenever and wherever you are

Access our research on your desktop or apps for your tablet and smartphone.