Multi Asset: Regional

US Investment Strategy

BCA Research’s US Investment Strategy analyzes the future direction of US financial markets and the US economy to set equity portfolio strategy and enhance returns for asset-allocators.

Tools to forge your own views

- Recommendations in all major asset classes

- Weekly reports updating our views and their interaction with ongoing data and news flow

- Special Reports conducting a deep dive into individual market or economic topics

- Continuously updated proprietary models and indicators

“US Investment Strategy blends an extensive study of cycles and BCA Research’s formidable institutional memory with hands-on money management experience to provide clients with actionable asset-allocation advice.”

Doug Peta Chief Strategist,

US Investment Strategy

How we do it

- The USIS team rigorously studies the business cycle, the credit cycle, the sentiment cycle, and the monetary policy cycle to anticipate market-moving inflection points

- We focus on only the elements of the economy that impact financial markets and are of interest to the vast majority of investors

- We make use of the entire archive of proprietary models and indicators from USIS’ 25-year history and BCA Research’s 70-year history

Challenge your investment conviction with insights from US Investment Strategy

Some of what we have called

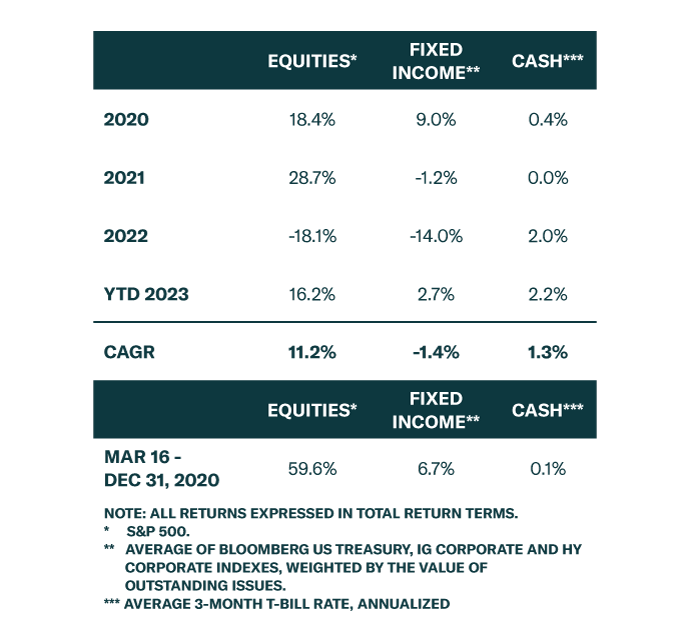

2013-14 Equities

Upgraded equities to overweight and downgraded Treasuries to underweight in our September 23, 2013 report. Between September 23, 2013 and September 12, 2014, when the next team took over USIS, the S&P 500 Total Return Index outperformed the Barclays US Treasury Index by 16.2%.

2013-14 Spread Product

Upgraded spread product to overweight in team’s inaugural August 12, 2013 report. Recommendation to overweight high-yield over investment-grade corporates delivered 3% of outperformance between August 12, 2013 and September 12, 2014, when the next team took over USIS.

Upgraded spread product to overweight in team’s inaugural August 12, 2013 report. Recommendation to overweight high-yield and investment-grade corporates over Treasuries delivered 7.6% and 4.6% of outperformance, respectively, between August 12, 2013 and September 12, 2014, when the next team took over USIS.

2013-14 Dividend Aristocrats

Recommended owning the S&P 500 Dividend Aristocrats Index in place of Treasuries and Investment-Grade Corporates in the August 19, 2013 report as a higher-returning alternative to “safe” debt. Between August 19, 2013 and September 12, 2014, when the next team took over USIS, the S&P 500 Dividend Aristocrats Total Return Index outperformed the Barclays US Treasury Index and the Barclays US Corporate Index by 15.3% and 9.9%, respectively.

2014 Property REITs

Recommended owning property REITS in place of Treasuries and Investment-Grade Corporates in the April 14, 2014 report as a higher-returning alternative to “safe” debt. Between April 14, 2014 and September 12, 2014, when the next team took over USIS, the S&P 500 REIT Total Return Index outperformed the Barclays U.S. Treasury Index and the Barclays U.S. Corporate Index by 6.8% and 6.1%, respectively.

Doug Peta

Chief Strategist

Doug is currently BCA Research’s Chief Strategist, US Investment Strategy. He joined BCA Research in 2010 and has also led the Global Asset Allocation service. Prior to BCA Research, he spent over 20 years as a strategist, analyst and trader. Doug holds an MBA with Honors in Finance and Economics from the University of Chicago and a B.S. in Accounting from the University of Virginia. He is a CFA charter holder.

Examples of our work

Our client website is updated daily and available whenever and wherever you are

Access our research on your desktop or apps for your tablet and smartphone.