Multi Asset: Global

Private Markets & Alternatives

BCA Research’s Private Markets & Alternatives service provides empirical analysis and practitioner advice across the most opaque of all asset classes to improve clients’ portfolio construction and management decisions.

Our competitive advantage

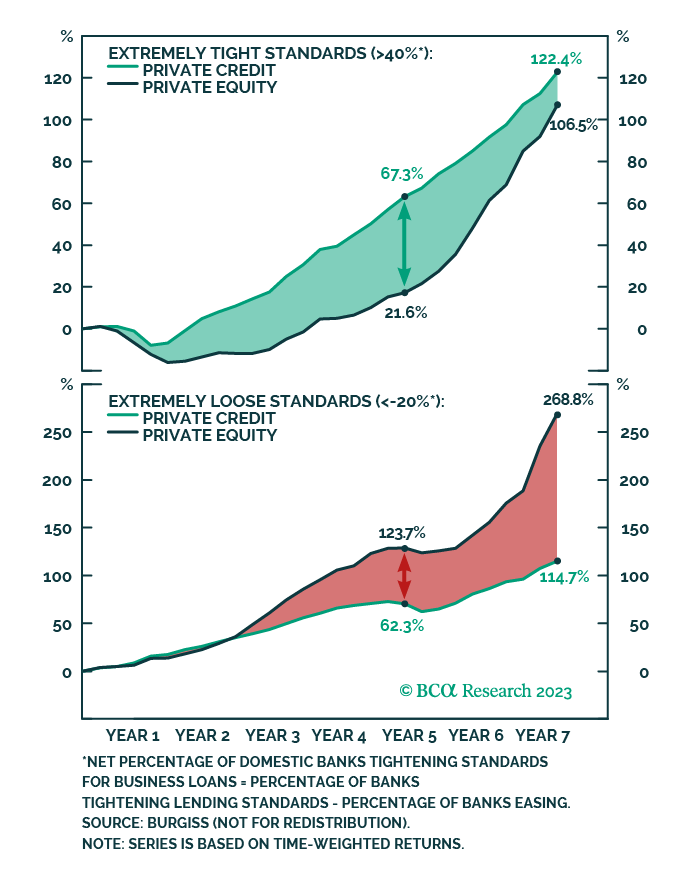

- Runs comprehensive and unbiased data analysis and establishes forward-looking expectations across the entire spectrum of private markets & alternatives — Private Equity, Private Credit, Hedge Funds and Real Estate.

- Provides prescriptive, actionable advice from a practitioner’s perspective. “Where should the marginal dollar go?”

- Offers outlooks and projections for each sub-asset class and asset class through the combination of top-down and bottom-up analysis.

- Weighs opportunity costs within and across asset classes to provide a holistic assessment to portfolio managers.

“Our approach to private markets and alternatives is unbiased, comprehensive, predictive and portfolio management-focused. We understand how heterogeneous these markets are and how important it is to distill and provide analysis from a practitioner standpoint.”

Brian Payne Chief Strategist,

Private Markets & Alternatives

Coverage

- Geographies: North America, Europe, Asia, Rest of World

- Private Equity: Venture Capital, Buyout, Growth Equity

Stage: Seed, Early Stage, Late Stage

Size: Mega, Large, Mid, Small

Theme: Financial Services, Cyclical, Healthcare, Intangible Assets, Emerging Markets, Multi-Business, User- & Subscriber-Based

- Private Credit: Senior, Mezzanine, Distressed & Special Situations

Size: Upper, Middle, Lower Markets

Strategy: Direct Lending, Asset-Based Lending, Specialty Finance, Infrastructure Lending, Niche Strategies

- Hedge Funds: Directional/Equity-replacements, Diversifier/Absolute Return/FI-replacements, Hedge/Downside-focused

Strategy: Long-Short Equity, Activists, Event Driven, Market Neutral, Macro, Relative Value, Quant, Multi-Strategies, CTAs, Alt Risk Premia, Long Vol, Tail Risk

- Real Estate: Core/Core+, Value Added, Opportunistic

Sector: Residential, Commercial, Industrial, Office, Retail, Special Purpose, Real Assets, Infrastructure

Quality: A, B, C

Challenge your investment conviction with insights from Private Markets & Alternatives

Deliverables

- Quarterly and Special Reports: Unconstrained, extensive, unbiased data analyses and outlooks, with actionable portfolio management advice

- Webcasts and Podcasts: Topical sessions that cover the opportunity set

- 1:1 Client Meetings and Calls: Interactive sessions with the Chief Strategist

- Annual CMA/CAPM outputs and potentially bespoke modeling

Private Markets & Alternatives

Brian Payne

Chief Strategist

Brian is BCA Research’s Chief Strategist, Private Markets & Alternatives. Prior to BCA Research, he was an Investment Officer of the Teachers’ Retirement System of Illinois, where he restructured and oversaw a $5+ billion multi-asset portfolio consisting of hedge funds, private investments, and opportunistic strategies. Prior to Illinois, he was a buy-side researcher and trader at Potomac River Capital. Brian began his career in wealth management, where he researched and advised RIAs on alternative investments and asset allocation. He has a B.A. in Economics and Political Science from St. Mary’s College of Maryland. He is also a CFA and CAIA charter holder.

Our client website is updated daily and available whenever and wherever you are

Access our research on your desktop or apps for your tablet and smartphone.