Multi Asset: Global

Global Investment Strategy

BCA Research’s Global Investment Strategy provides asset allocation advice and timely forecasts to shape clients’ conviction as they make investment decisions.

Tools to forge your own views

- Our weekly reports consist of updates of our strategy and recommended portfolio mix, complete with the performance of our trade recommendations, while keeping clients abreast of any important shifts in the macroeconomic landscape

- Our special reports focus on original investment ideas or timely topics, drilling down into relevant issues affecting the macroeconomic outlook and markets

- We offer quarterly strategy outlooks, which highlight developing investment themes, identify opportunities and risks, recommend strategy, and review performance

- Client receive ad-hoc special alerts signaling major shifts in investment service

MacroQuant 2.0 Model

The Global Investment Strategy (GIS) service has recently launched their exciting, next-generation MacroQuant 2.0 model, a state-of-the-art forecasting tool covering all the major financial markets. Powered by an innovative learning algorithm and access to thousands of data series – including proprietary indicators developed by BCA Research – this new platform aims to forecast the direction of equities, fixed income, currencies, and commodities across different time horizons. It also provides equity recommendations down to the sector and regional levels. With great efforts put in to reduce the look-ahead biases that typically plague other models, MacroQuant 2.0 significantly outperformed a buy-and-hold portfolio in backtests. The Global Investment Strategy service uses this new model as an input into its investment recommendations. In fact, it has already made use of MacroQuant 2.0 to inform the view to remain positive on stocks over the course of 2023, as well as to go long the TLT ETF in late September 2023.

“At Global Investment Strategy, we combine our knowledge of macroeconomics with deep analysis of financial markets in order to help our clients generate alpha.”

Peter Berezin Chief Strategist,

Global Investment Strategy

How we do it

- Our discussion of key economic and investment themes is designed to assist clients in understanding the underlying forces that are shaping the economic and financial market outlook in both the developed and emerging worlds

- Our unique approach results in timely and actionable recommendations, which allow clients to capitalize on profit opportunities as well as preserve capital

- Our analysis draws on the breadth and depth of BCA Research’s research offerings, and is based on a mix of macroeconomic developments and how they impact all financial markets spanning the globe

- The GIS team utilizes unique models and indicators that give investors an edge in forecasting market trends. Some of these models were pioneered at BCA Research decades ago and have stood the test of time. Others, such as MacroQuant, offer innovative, cutting-edge tools that are not available anywhere else in the investment community

Challenge your investment conviction with insights from Global Investment Strategy

Some of what we've called

2023: Immaculate Disinflation

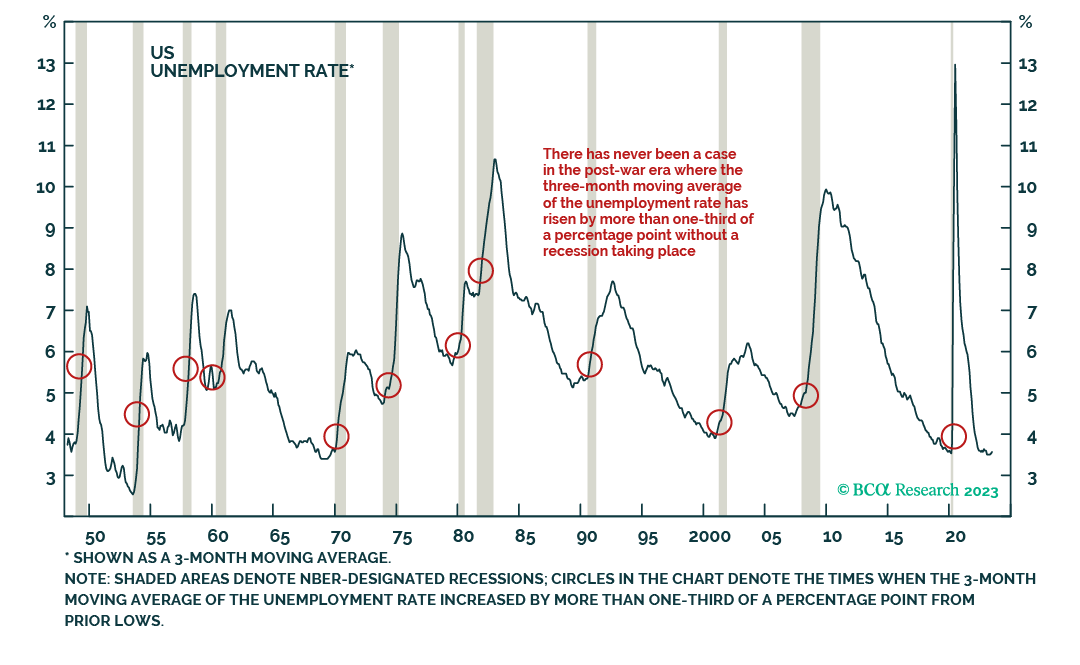

Going into 2023, our Global Investment Strategy service predicted that 2023 would be a year of immaculate disinflation.

2021: Trading Big Swings In Bond Yields

Our Global Investment Strategy service initiated a short 10-year Treasury trade at a yield of 1.45% in June 2021, a trade which was closed in October 2022 for a double-digit gain. When GIS closed that trade, the service went tactically long the iShares 20+ Year Treasury Bond ETF (TLT), closing it in less than two months for another double-digit gain.

2020: Pandemic Calls

In February 2020, our Global Investment Strategy (GIS) service warned that investors were too complacent about the pandemic. After stocks crashed, GIS turned bullish and argued for a V-shaped recovery.

2018: Stocks before and during the pandemic

GIS downgraded global equities in June 2018 based on the prospects of slowing global growth and an increasingly hawkish Fed. We repeatedly cautioned clients against “buying the dip” as stocks began to plunge in October. The GIS service turned bullish on equities in late 2018 and this upgrade proved timely, with global equities engaging on a good run in 2019. We forewarned that investors were too complacent about the coronavirus at the end of February of 2020. As the market crash was unfolding, we argued in March 2020 that the year would end up looking more like 1998 than a 1918 Spanish flu-type scenario. We also laid out the thesis that the pandemic could lead to higher stock prices in April 2020, one that was regarded with much skepticism at the time.

2016: End of the Bond Bull Market

After being in the “deflationary” camp for many years, GIS shifted its view on bonds towards a more bearish stance in July 2016. Our note entitled “End Of The 35-Year Bond Bull Market” came out on the same day the US 10-year Treasury yield reached a pre-Covid closing low of 1.37%. We argued correctly at the time that both cyclical and structural forces would conspire to put in a bottom for yields. This view was upended by the pandemic, but it also gave us another chance to play the upside in yields. We initiated a short 10-year Treasury trade at a yield of 1.45% in June 2021 which we closed in October 2022 for a double-digit gain.

2015: Populist Wave

We began discussing the new age of populism quite early on. GIS predicted that Donald Trump would become president. In early June 2016, GIS began flagging that the Brexit vote was too close to call. In an aptly titled report “Worry About Brexit, Not Payrolls,” GIS warned that investors were greatly understating the risks that on June 23rd, the British population would reject the European establishment by voting in favor of Brexit, an event which ultimately came to pass.

2014: Long Dollar

The Global Investment Strategy instated a long US dollar (DXY) position in late-2014, with nuances added along the way. Staying with this position until April 2019 was a profitable course of action, as it generated a double-digit positive return.

2011: Peak Commodity

Identifying turning points of secular trends in financial assets is a critical part of what the Global Investment Strategy (GIS) service can deliver to its client base. In May 2011, Peter Berezin presented a speech entitled “The Coming Commodity Bust” at a conference in Saudi Arabia. As one of the only bearish voices on the stage, he argued that the fundamentals underpinning the commodity boom had broken down and that it was time to turn more cautious on oil and metals.

Peter Berezin

Chief Strategist

Peter is currently BCA Research’s Chief Global Strategist and Research Director. Since joining BCA Research in 2010, he has served as Managing Editor of The Bank Credit Analyst as well as helping to develop and launch BCA Research’s Equity Analyzer Service. Peter focuses on analyzing global economic and financial market trends. Prior to BCA Research, Peter worked as a Senior Global Economist with Goldman Sachs. Peter has also spent time in the research department of the International Monetary Fund. Peter has a Bachelor of Arts in Economics from McMaster University, a Master of Science from the London School of Economics, and a PhD in Economics from the University of Toronto.

Examples of our work

Our client website is updated daily and available whenever and wherever you are

Access our research on your desktop or apps for your tablet and smartphone.