Multi Asset: Global

Geopolitical Strategy

BCA Research’s Geopolitical Strategy service provides market-relevant, data-driven, non-partisan, macroeconomic research with geopolitical risk analysis resulting in discretionary trade recommendations for global investors.

Competitive Advantage

- Investment Relevance - The financial industry’s premier geopolitical research service. With a stellar 11-year record of forecasting and analysis built on seven decades of macroeconomic expertise, no provider of geopolitical analysis has a firmer grounding in investment research.

- Reliable Analytical Framework - Emphasizes structural limitations that nations and economies face. Analyzes what politicians want and need to achieve. Identifies geopolitical opportunities and risks, and aims to reveal when markets are overrating or underrating geopolitical narratives.

- Non-Partisanship - Responds to our clients’ interests, not partisan biases. Coverage is politically neutral, centered on financial markets, and global in range

“Geopolitical Strategy is not about predicting inherently unpredictable events. It is about getting global policy settings right, improving scenario analysis and probabilities, and thus capitalizing on geopolitical risks and opportunities.”

Matt Gertken, PhD Chief Strategist,

Geopolitical Strategy

Deliverables

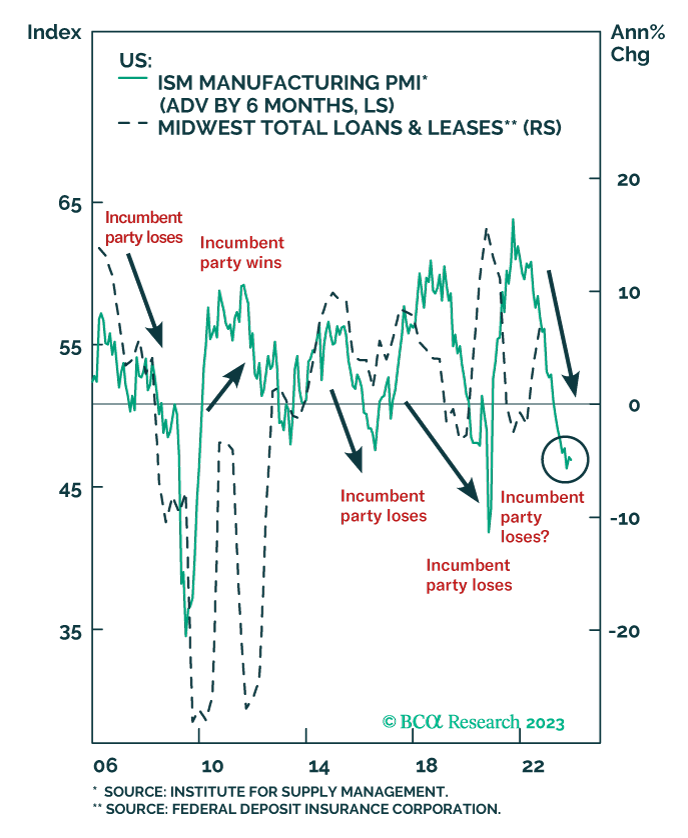

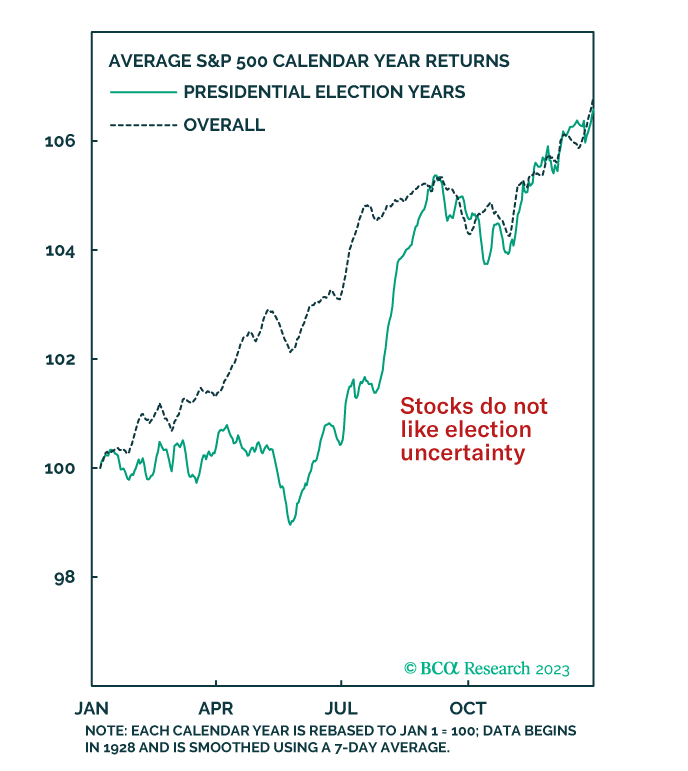

- Bi-Weekly Strategy Reports - Big-picture analysis of policy issues affecting global regions and asset classes.

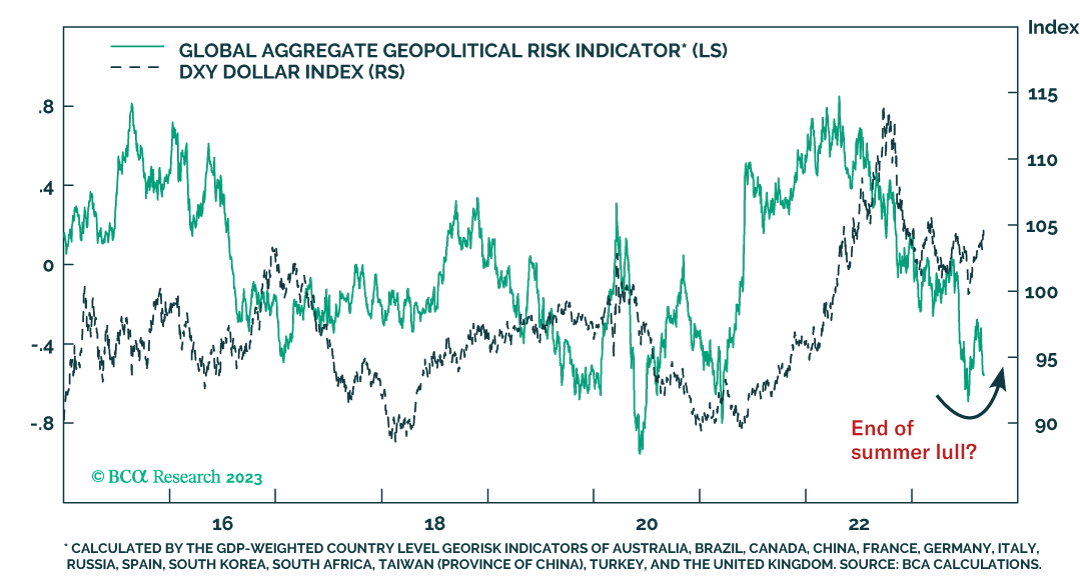

- Special Reports - In-depth views of country risks, forward-looking themes and views, and updates of our quantitative GeoRisk Indicators.

- Strategy Insights - Short and sweet comments on breaking news or market moves.

- BCA Direct - Conference calls, client meetings, and email correspondence to answer critical questions.

- BCA Talks - Webcasts and round tables to discuss the latest research with lively Q&A.

- Geopolitical Calendars - A handy look ahead each month

Challenge your investment conviction with insights from Geopolitical Strategy

Some of what we've called

June 2022: Predicted that China would reopen and reboot its economy after the 20th party congress in Oct. 2022. Confirmed in November when China shed Covid social restrictions and released plans to stimulate the property sector. Trade: Long Southeast Asian equities

April 29, 2022: Predicted Russia would cut off EU’s energy and doubled down on that call, e.g. on June 1 and July 15, 2022. Confirmed when Russia cut off gas to Germany on June 15 and again on July 25. Trade: Long defensives / cyclicals, long large caps over small caps, long US stocks versus ROW

April 14, 2022: Predicted Italy would hold an early election and elect right-wing populist coalition. Confirmed in election Sept. 25. Trade: Long US stocks versus ROW

March 30, 2022: Predicted US Congress would pass semiconductor bill and FY2022 reconciliation bill in reports dated March 30, June 2, and July 8, 2022. Both bills passed (Aug. 9, Aug. 16) Trade: Long DXY; long renewable energy, long healthcare, long biotech, long defense

Feb. 4, 2022: Predicted China would under-stimulate its economy, depreciate the renminbi, and face major social unrest in reports dated Feb. 4 and April 8, 2022. Confirmed with currency depreciation in September and mortgage boycotts. Trade: Short CNY

Jan. 27, 2022: Predicted Ukraine war. Turned defensive in annual outlook Dec 15, 2021 and stayed bearish all of 2022. Confirmed when Russia invaded Ukraine on February 24. Trade: Long defensives / cyclicals; large caps over small caps

Jan. 7, 2022: Predicted a “fourth Taiwan Strait crisis,” albeit not yet a full-scale war. Predicted in April 2021 that the Taiwan crisis would happen within 12-24 months. See also Jan 2016. Confirmed with House Speaker Pelosi’s visit Aug 2 and China’s military drills blockading Taiwan’s ports plus economic sanctions. Trade: Short Taiwanese and Chinese

currency and assets

Sept. 3, 2021: Predicted Iran would reach nuclear breakout and US-Iran deal would fail in reports dated Sept. 3, 2021, Jan. 10 and March 11, 2022. Confirmed Aug 1 and Aug 24. Trade: Long oil volatility.

Matt Gertken, PhD

Chief Strategist

Matt is BCA Research’s Chief Strategist, Geopolitical Strategy and US Political Strategy. He oversees the firm’s coverage of market-relevant policy developments across the world. He has 16 years’ experience in the field and appears frequently in global news media. Prior to joining BCA in 2015, Matt worked as a Senior Analyst at STRATFOR (Strategic Forecasting) and in a range of academic and publishing roles. Matt holds an MPhil from the University of Cambridge and a PhD from the University of Texas at Austin.

Examples of our work

Our client website is updated daily and available whenever and wherever you are

Access our research on your desktop or apps for your tablet and smartphone.