Multi Asset: Regional

China Investment Strategy

BCA Research’s China-focused strategy service, oriented around an assessment of the cyclical trajectory of China’s economy and the accompanying investment strategy conclusions for the Greater China Region.

Tools to forge your own views

- The integration of top-down macro analysis and portfolio/investment strategy for several China-related assets

- A weekly assessment of significant economic and financial market developments in China, and whether they are consistent with our recommended investment strategy

- Ad hoc Special Reports focused on the medium-to long-term themes for China

- A combination of the most salient Chinese macro data into a focused set of proprietary indicators

- “End-to-end” service: From macro insight, to analysis, to forecast, to investment conclusions

“China has grown to become one of the three core pillars of the global economy. If you want to understand, predict, and profit from shifts in the trajectory of Chinese economic activity, CIS is a must-have strategy service.”

Jing Sima Strategist,

China Investment Strategy

How we do it

- We strongly focus on identifying and tracking leading indicators for China’s investment-relevant economic activity, in order to predict its likely cyclical trajectory and the attendant implications for global growth

- This outlook for growth is then filtered through the lens of policy, which is informed heavily by BCA Research’s constraint-based approach to analyzing likely policy outcomes

- A joint assessment of the global economic environment and Chinese growth, policy, and financial conditions inform our fundamental view for key China-related assets

- Our view on asset fundamentals is married with both analytical and judgmental assessments of investor sentiment in order to generate specific asset allocation recommendations over a tactical, cyclical, and strategic time horizon

Challenge your investment conviction with insights from China Investment Strategy

Some of what we've called

Long H-Shares

Long H-Shares and Short Industrial Commodities, initiated in March 2016; closed January 2018 with a 16% annualized return.

Long MSCI China

Long MSCI China and Short MSCI Taiwan, initiated February 2017; closed June 2018; 15% annualized return.

Long MSCI China Consumer Staples

Long MSCI China Consumer Staples and Short Consumer Discretionary, initiated in November 2017, closed September 2018; 48% return.

Long China Onshore Corporate Bonds

Long China Onshore Corporate Bonds, initiated June 2017; currently open; 9.4% return since initiation.

Jing Sima

Strategist

Jing Sima is currently BCA Research’s Strategist, China Investment Strategy. Before joining BCA, she worked as a Consultant at CS Global Strategies, helping clients navigate China’s economic and industry policy landscape. Prior to that, she was a Senior Economist overseeing the Emerging Markets Research Program at The Conference Board, where she developed the firm’s flagship product and a variety of frameworks predicting turning points in China’s business cycles. Jing received her MBA in Finance and Investment from Baruch College, City University of New York, and her BA in Economics from the Capital University of Economics and Business in Beijing.

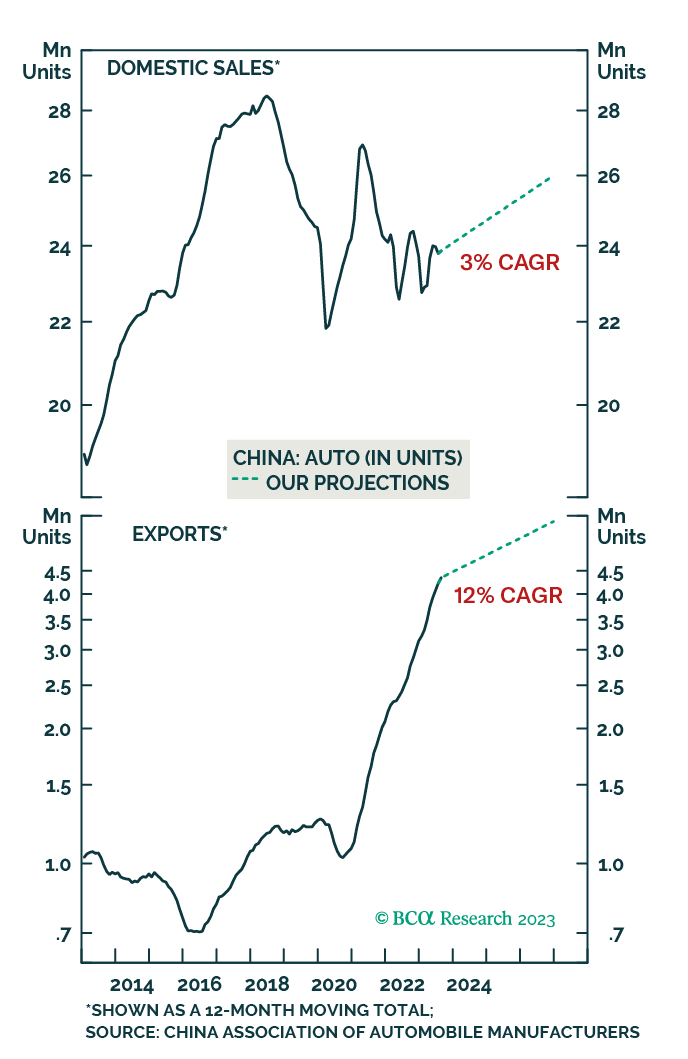

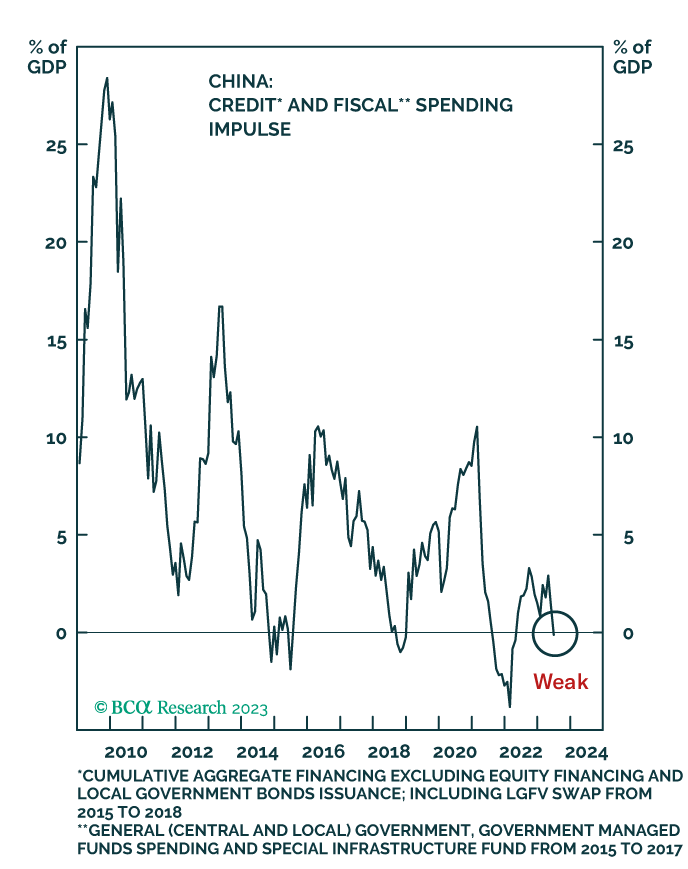

Examples of our work

Our client website is updated daily and available whenever and wherever you are

Access our research on your desktop or apps for your tablet and smartphone.