Chart Of The Week February 22 2023

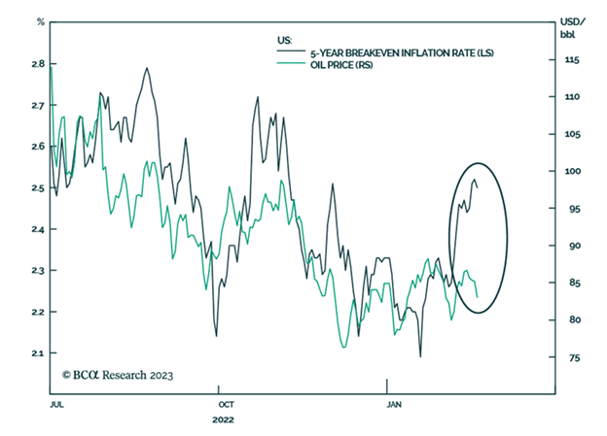

Will US Inflation Breakevens Decouple From Oil Prices?

US inflation expectations from the fixed-income market typically track crude oil prices. Recently, however, the 5-year TIPS breakeven inflation rate (inflation expectations) has risen despite tame crude prices. Are we witnessing a short-term aberration or the beginning of a lasting divergence between these two?