Chart Of The Week March 08 2023

A Period Of Indigestion For The Euro

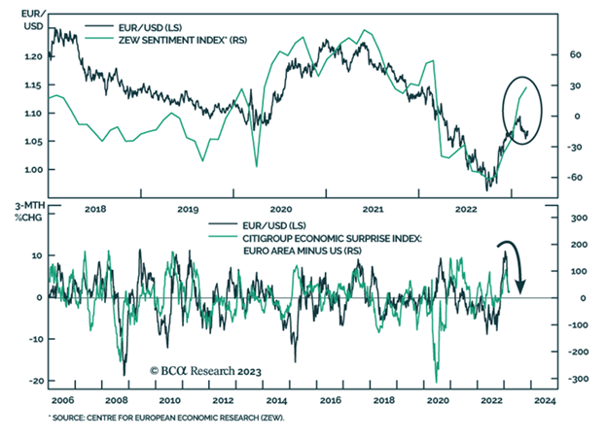

The euro has been giving back recent gains, despite the upbeat economic performance of the Eurozone. One of the most reliable trackers for the euro’s performance of late is the ZEW sentiment index. It surveys over 300 experts from banks, insurance companies, and financial departments of select corporations on the outlook for financial markets. Despite an increase in the Growth Expectations component to a one-year high of 29.7 in February, the euro collapsed, creating a rare divergence.