Chart Of The Week November 14 2023

Soft US Inflation Cements The Fed's Pause

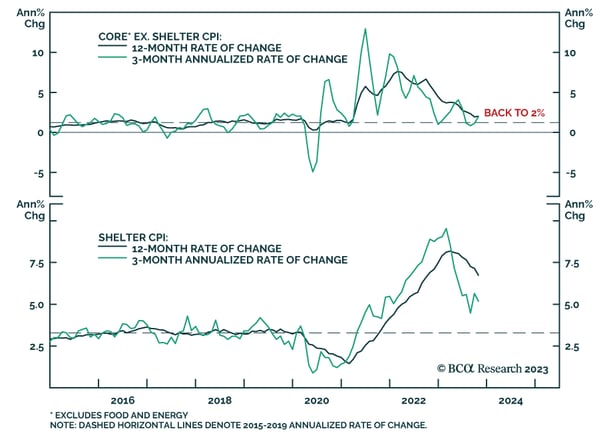

US Treasury yields fell sharply following yesterday’s soft October CPI report, and investors have now officially priced out all remaining rate hikes from the yield curve. In fact, the fed funds futures curve is priced for a 25 basis point rate cut by next June and for 50 bps of easing by next July. While there’s room to quibble about what the actual timing and pace of rate cuts will be in 2024, it does look increasingly likely that rate hikes are in the rearview mirror.This is not without good reason. While 12-month core CPI is still running at 4%, 12-month core CPI excluding shelter is down to 2%, right on top of its pre-pandemic average. This means that shelter is the only thing keeping core inflation above target, and trends in market rents point to a rapid deceleration in shelter inflation during the next 6-12 months.