Chart Of The Week March 15 2023

More Large-Cap Bank Failures Are Unlikely

Since Silicon Valley Bank (SIVB) was seized by the FDIC last Friday, and Signature Bank (SBNY) was shuttered over the weekend, investors have been on pins and needles wondering how many more banks will fold.

Our US Investment Strategy service doesn’t sugarcoat the fact that all banks are subject to the forces that triggered SIVB’s securities losses. The remaining 15 S&P 500 banks’ portfolio maturity profiles necessarily resemble SIVB’s after successive refinancing waves stuffed agency mortgage-backed securities (MBS) to the gills with long-maturity, low-coupon loans. When the Fed’s rate hike campaign laid waste to prepayment activity, MBS durations soared faster than a holder could hedge them.

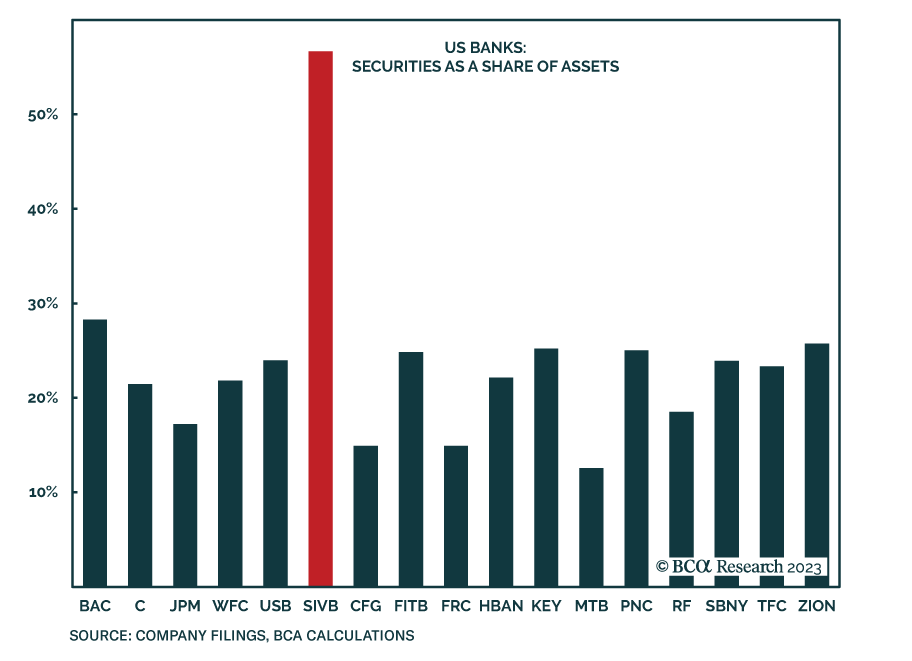

Fortunately for the rest of the banks, however, SIVB’s sensitivity to security values was uniquely high. Securities accounted for a whopping 57% of its assets, more than double the share of any of its regional bank peers.

SIVB’s concentrated deposit base made it an outlier from a funding perspective. No other bank relied on start-ups for deposits. When investment capital stopped flooding into these cash-burning companies after the Fed began hiking rates, SIVB found itself starved of funding. Banks with more diverse deposit bases will confront higher deposit costs, but they are not likely to be cut off the way SIVB was.

Now that the FDIC has stepped in to make SIVB and SBNY depositors whole, and the Fed has made it easy for banks to borrow against their securities holdings, a chain reaction of large-cap bank failures is unlikely.