Chart Of The Week March 01 2023

How To Spot An Equity Market Bottom

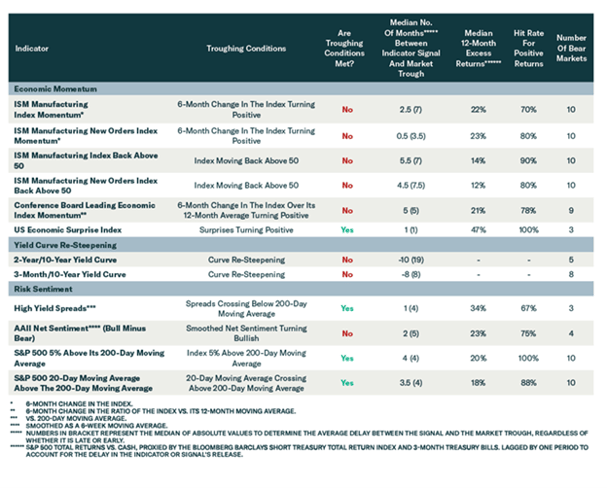

This has been a difficult 12 months for investors: After the huge sell-off last year, risk assets have rebounded since October. So, is that the beginning of a new bull market, or just another bear market rally? How can investors tell the difference?