Feature

It is too early to determine whether Iran and its client Hezbollah helped plan and execute Hamas’s attacks on Israel over the weekend, as media reports declaim.1 However, given the long-standing relationships of these parties, this is not unlikely.

It remains to be seen whether the attacks will undermine ongoing negotiations being brokered by the US between the Kingdom of Saudi Arabia (KSA) and Israel, which are aimed at normalizing relations between the two erstwhile foes in return for greater security guarantees and weapons from the US.

To us, Hamas’s attack suggests Iran aims to scupper such a deal. Prior to the attacks over the weekend, KSA reportedly expressed a willingness to increase oil supplies in the event of higher prices next year, to build goodwill in the US Congress in return for the mutual defense and weapons deal.2

Following Hamas’s attacks, the US, which is allied with Israel and KSA, immediately deployed the USS Gerald R. Ford carrier strike group to the eastern Mediterranean over the weekend.3

Chart 1

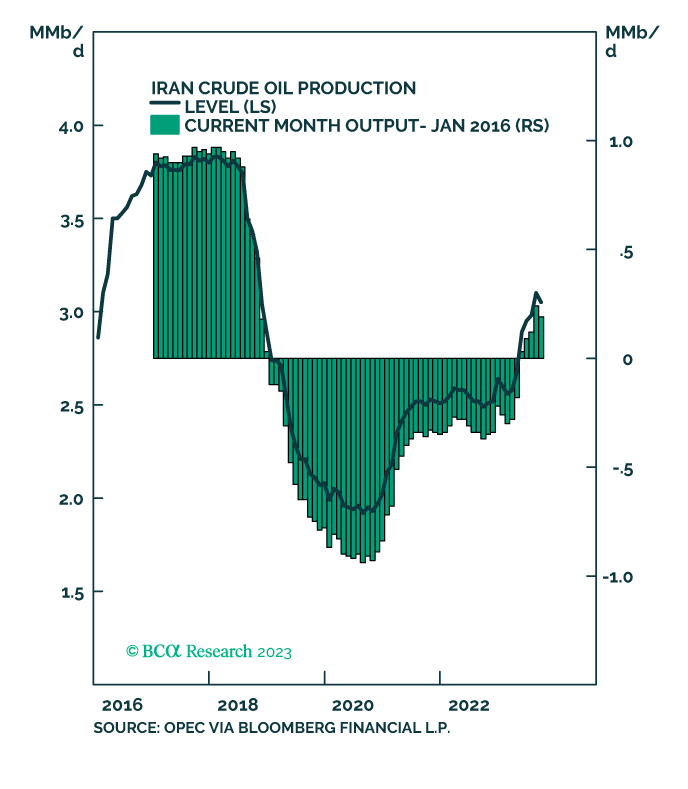

Iranian Output Surge At Risk

Fullscreen Fullscreen |  Interactive Chart Interactive Chart |

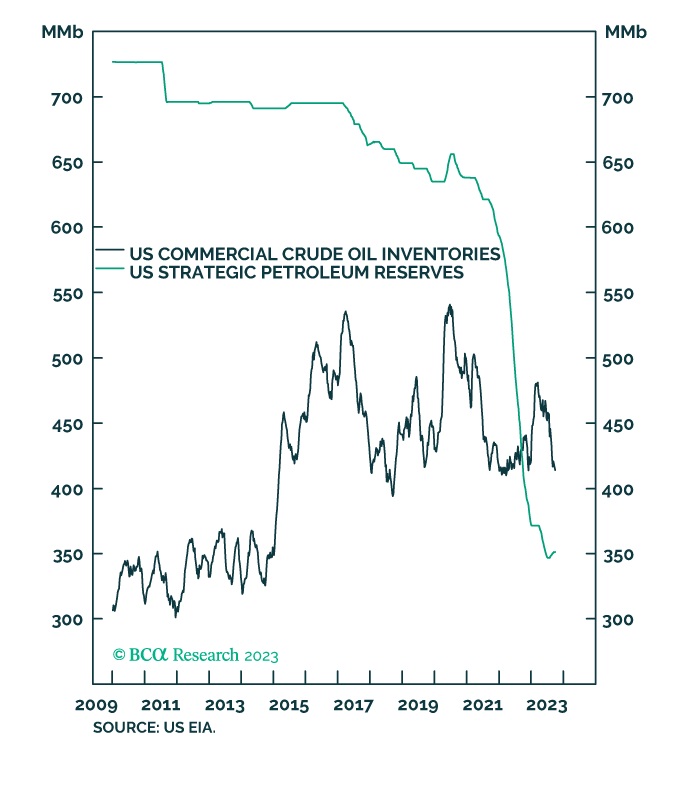

Normalizing KSA-Israel relations and providing greater military support for KSA most likely is seen as a stratagem aimed directly at Iran. If the US were to move vigorously to enforce the sanctions it imposed against Iran’s oil trade after walking away from the 2015 Joint Comprehensive Plan of Action – the so-called Iran nuclear deal – this would be an inescapable conclusion. Such action would reduce Iranian oil revenues by pushing production back below its recent increase (Chart 1).

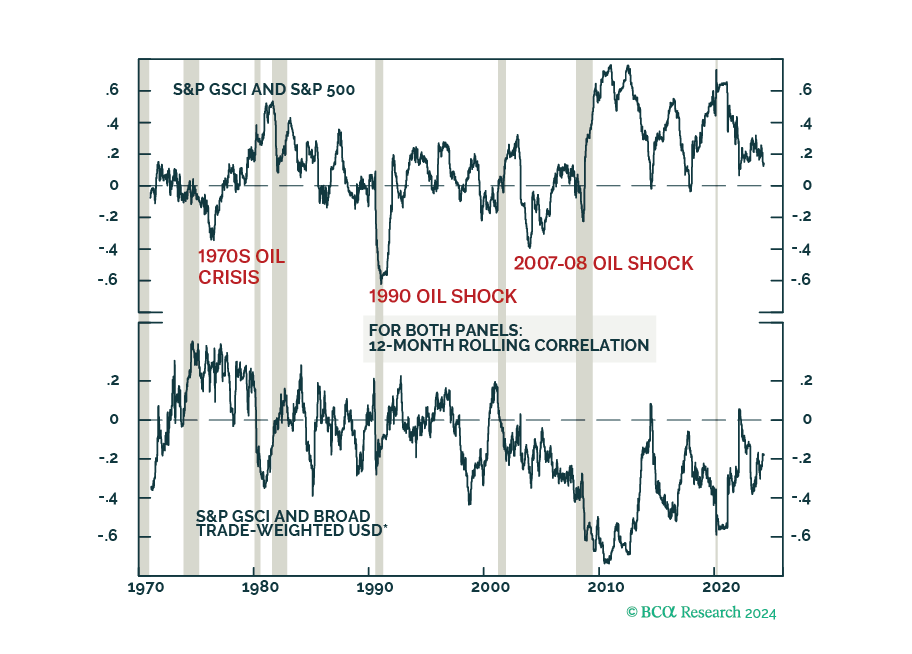

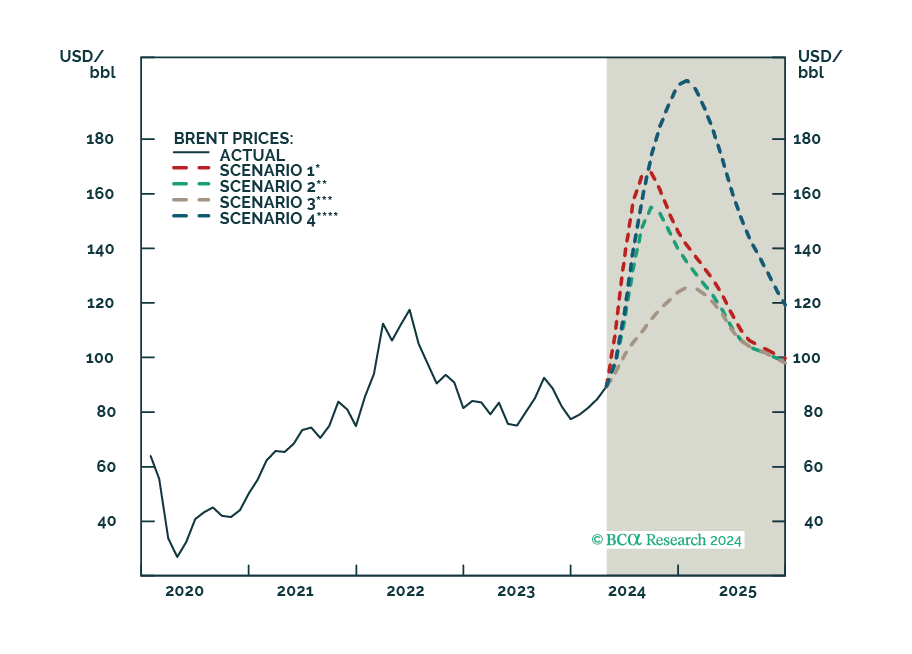

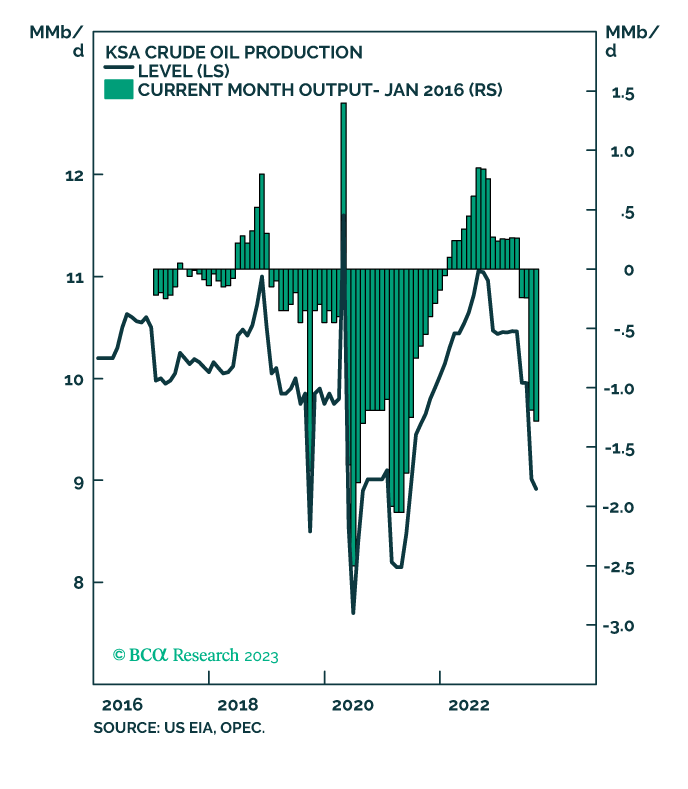

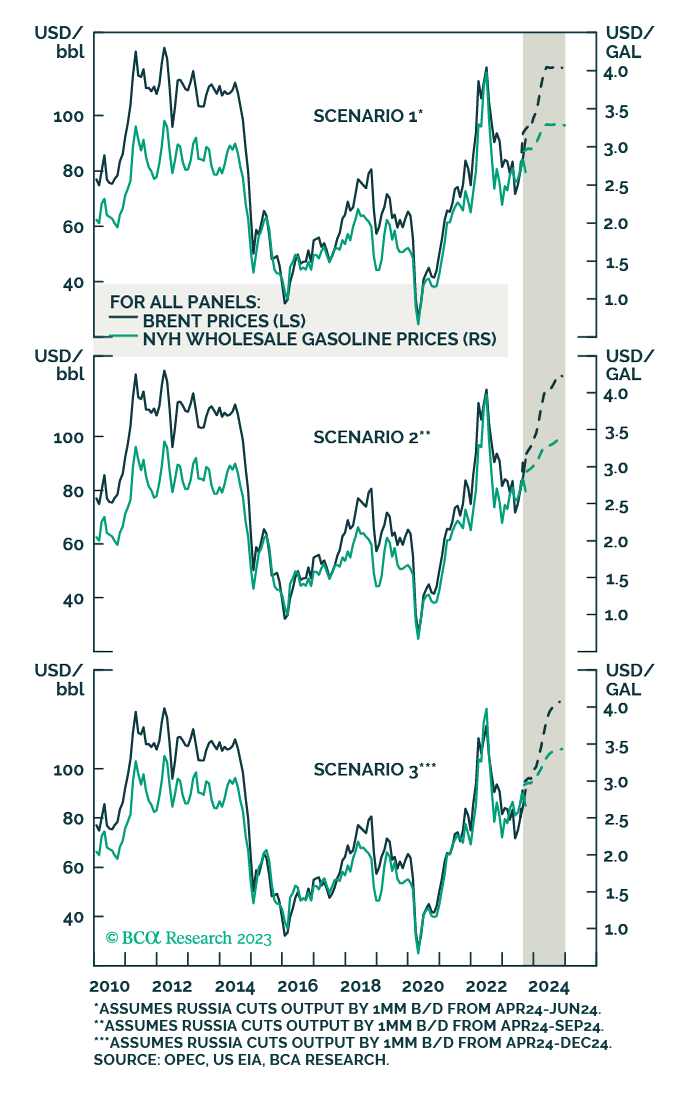

KSA holds the bulk of spare capacity in OPEC 2.0. It would have to flex output to make up for lost supplies from Iran or, as we assume in our forecast, Russia. KSA could quickly restore ~ 2mm b/d of output and bring on another 1mm b/d after that, in the event of another supply shock. Such a response from KSA would be needed to balance markets so as to keep prices from escalating sharply above our $118/bbl forecast for next year (Chart 2).4 Indeed, given the sharp draw-down of the US Strategic Petroleum Reserve (SPR), additional output from KSA would be critical to maintaining orderly oil markets in the event of a Russian or Iranian supply cut-off (Chart 3).

Chart 2

KSA Surge Could Be Required

Fullscreen Fullscreen |  Interactive Chart Interactive Chart |

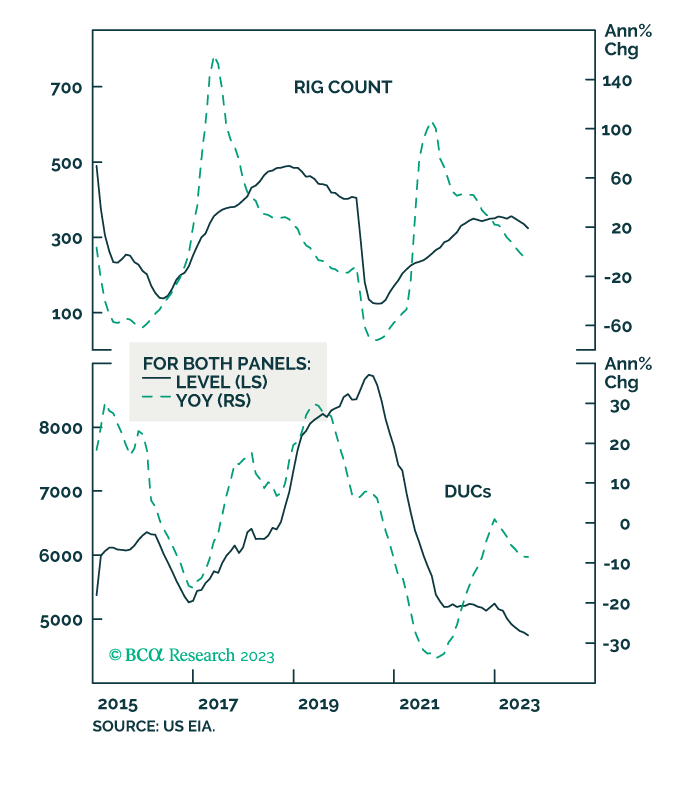

It is not clear the US shale-oil patch will be able to surge production quickly enough to make up for lost output, in the event of a supply cutoff next year. This is because the inventory of drilled-but-uncompleted wells (DUCs) – a form of spare capacity in the US – has been steadily depleted (Chart 4).

Surging production by KSA would alter Russia’s oil-price calculus, by lowering the odds of sharply higher prices meant to undermine the re-election of President Biden in next year’s US general elections (Chart 5).

Chart 4

US Spare Capacity Depleted

Fullscreen Fullscreen |  Interactive Chart Interactive Chart |

Chart 5

KSA Could Dampen Supply Shock

Fullscreen Fullscreen |  Interactive Chart Interactive Chart |

We will be updating our oil balances and forecasts next week. For now, we continue to expect oil to trade just above $100/bbl in 4Q23 and to average $118/bbl next year.

Investment Implications

Hamas’s attack on Israel raises the odds of a wider conflict in the Gulf, which would lead to higher oil prices. Given the response of oil prices Monday, markets appear to be relatively restrained in their assessment of a sharp escalation in prices. However, this is early days in a strategy that is just revealing itself.

We remain long 1Q24 Brent futures vs. short 1Q25 Brent futures, expecting higher prices and lower inventories in the short run; December 2024 $100/bbl Brent calls; the COMT and XOP ETFs to retain exposure to commodity prices and backwardation, and oil and gas producers’ equity, respectively.

Robert P. Ryan

Chief Commodity & Energy Strategist

rryan@bcaresearch.com

Footnotes

- 1 Please see Iran Helped Plot Attack on Israel Over Several Weeks published by The Wall Street Journal 8 October 2023.

- 2 Please see Saudi Arabia Willing to Raise Oil Output to Help Secure Israel Deal published by The Wall Street Journal 6 October 2023.

- 3 Please see USS Gerald R. Ford Moving Closer to Israel in Response to Hamas Attack published by USNI News 8 October 2023.

- 4 Please see Russian Oil Embargo?, a Special Report we published with BCA’s Geopolitical Strategy 3 August 2023.

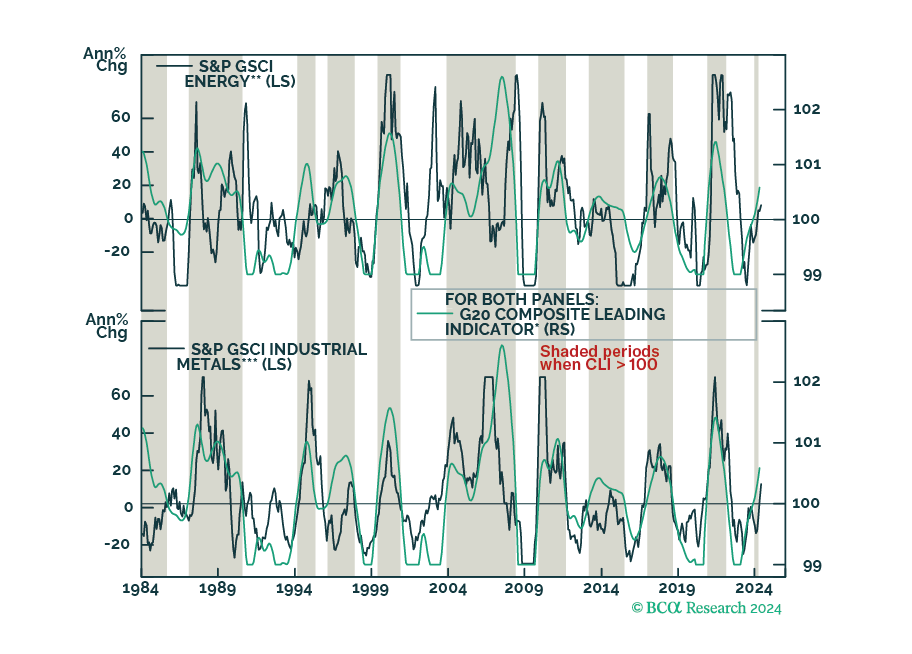

Mapping The Performance Of Commodities Across The Business Cycle

Mapping The Performance Of Commodities Across The Business CycleVarying degrees of exposure to certain economic sectors and regions can help explain differences…

You are reading a complimentary report. To find out more about our services,

You are reading a complimentary report. To find out more about our services,